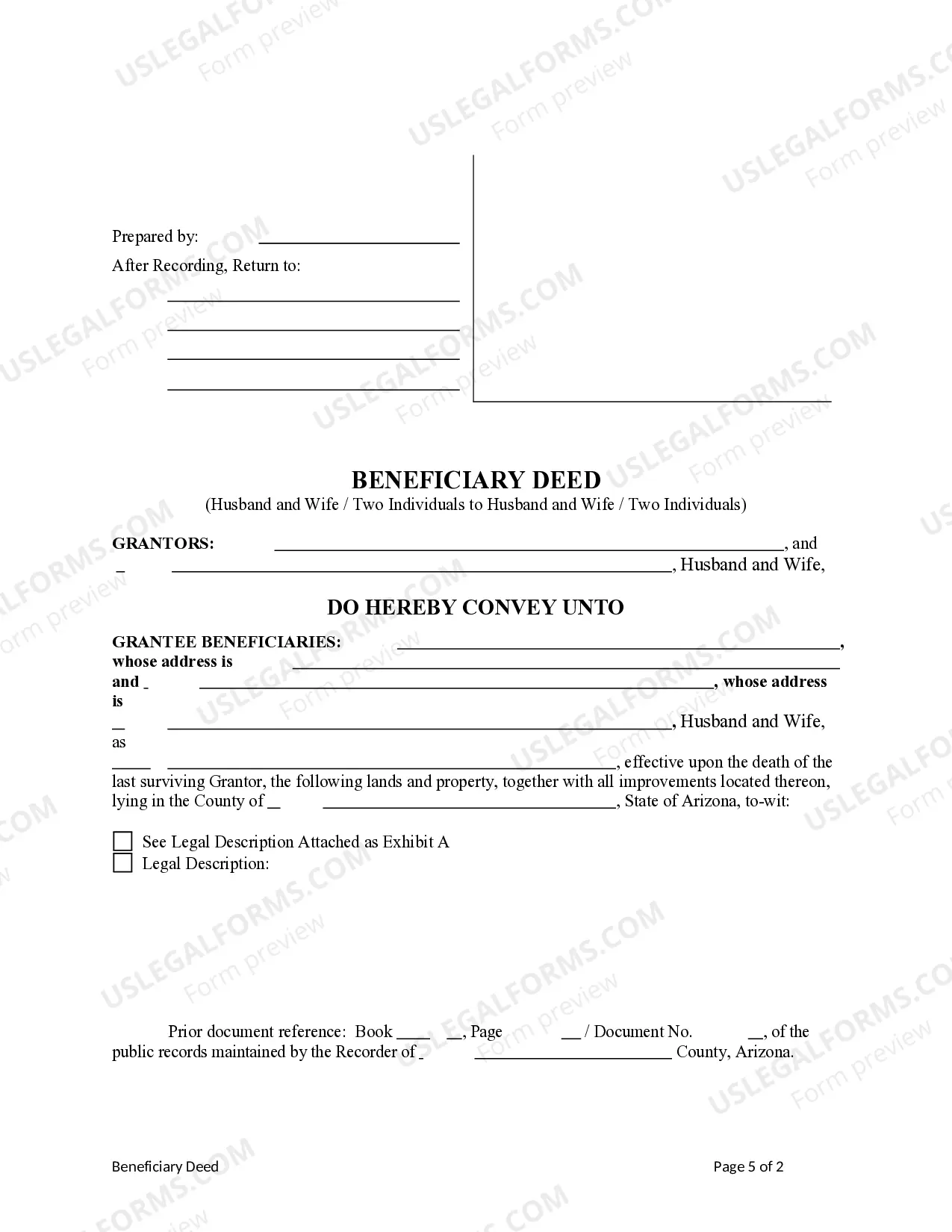

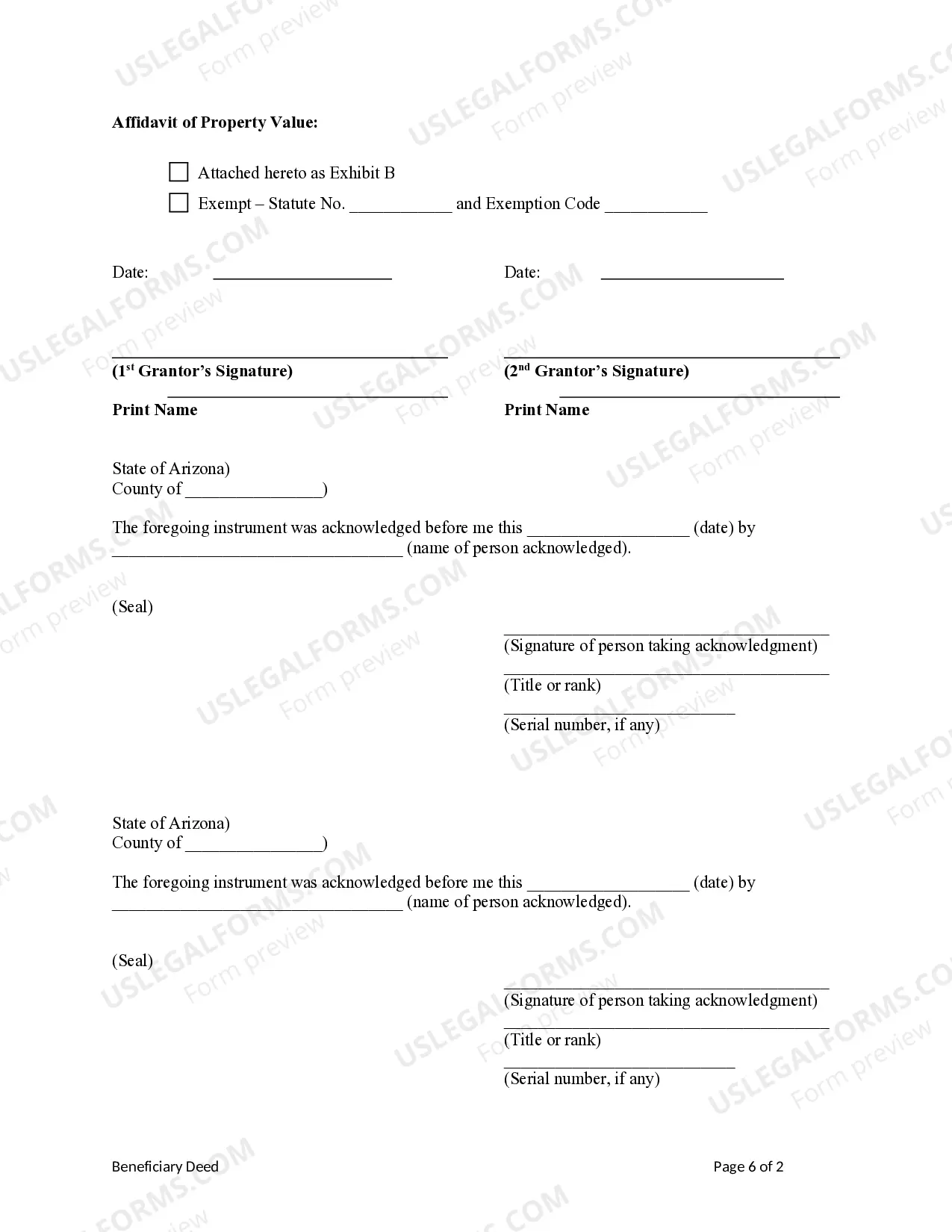

This form is a Transfer on Death Deed where the Grantors are husband and wife / two individuals and the Grantees are husband and wife / two individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. This deed complies with all state statutory laws.

Goes Dies Survivorship With Beneficiary

Description

How to fill out Arizona Beneficiary Or Transfer Of Death (TOD) Deed - Husband And Wife / Two Individuals To Husband And Wife / Two Individuals?

- If you are a returning user, log into your account and ensure your subscription is active to access and download the necessary form template.

- For first-time users, start by checking the Preview mode and form description to confirm that the chosen document is suitable for your needs and adheres to local jurisdiction requirements.

- If the selected document does not meet your needs, utilize the Search tab to find a more appropriate template.

- Once you find the right document, click the Buy Now button to select your desired subscription plan and create an account for library access.

- Proceed with payment by entering your credit card details or using your PayPal account to complete the purchase.

- After your transaction is confirmed, download the form to your device and access it anytime from the My Forms section of your profile.

By following these straightforward steps, you'll be able to effectively utilize US Legal Forms, which boasts an extensive library of over 85,000 editable legal documents.

Start your journey to organized legal documentation today with US Legal Forms—empower yourself with the tools you need for precise and legally sound document preparation!

Form popularity

FAQ

Avoid naming individuals who may create complications in the future, such as minors or individuals with financial issues. Additionally, steer clear of individuals who may not respect your wishes or those who may not benefit from your estate. It can be helpful to consult resources about goes dies survivorship with beneficiary to make informed choices. Using a legal platform like US Legal Forms can guide you in identifying the best beneficiaries.

Filling out a beneficiary designation involves collecting essential information about yourself and your chosen beneficiaries. After entering your identification details, clearly state each beneficiary's name, relationship, and the percentage of assets they will receive. With tools from US Legal Forms, you can ensure that your designation aligns with the goes dies survivorship with beneficiary concept, securing your intentions.

Determining whether your child should be a primary or contingent beneficiary depends on your family situation. If you wish for your child to inherit directly, naming them as a primary beneficiary is wise. However, if you have a spouse or partner, they may take priority, making your child a contingent beneficiary. Always consider how goes dies survivorship with beneficiary affects your decisions.

Beneficiary designations come in various forms, including life insurance policies, retirement accounts, and trusts. For instance, naming your spouse as the primary beneficiary of your life insurance ensures they receive the proceeds in the event of your passing. It’s essential to understand how these designations align with the principle of goes dies survivorship with beneficiary, to ensure proper distribution.

To fill out a beneficiary designation form, start by providing your personal information, such as your name and address. Next, identify the beneficiaries you want to include, specifying their names and relationship to you. Finally, review the form for accuracy, sign it, and submit it according to the instructions. Using a platform like US Legal Forms can simplify this process with user-friendly templates.

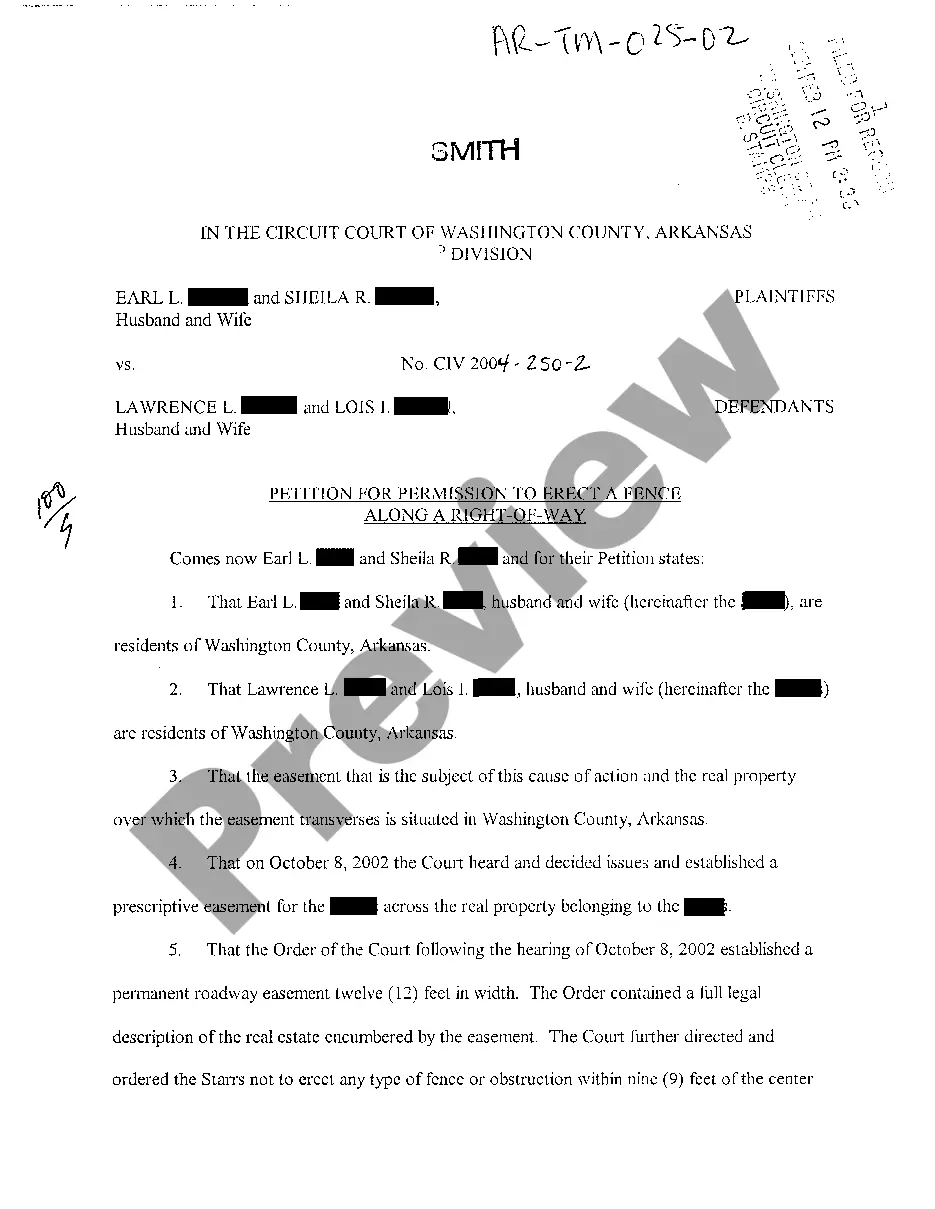

The survivorship rule, commonly related to goes dies survivorship with beneficiary, ensures that when one joint tenant passes away, the surviving tenant automatically inherits their share of the property. This rule simplifies the transition of ownership, avoiding lengthy probate processes. Understanding this rule is essential for effective estate planning. Resources from uSlegalforms can aid you in recognizing how these rules apply to your specific situation.

To prove goes dies survivorship with beneficiary, you need to establish the ownership structure of the asset, typically through legal documents. Joint tenancy agreements or titles often clarify the intention of the parties involved, demonstrating that survivors receive the asset directly. Additionally, presenting death certificates may be necessary to finalize the transfer of ownership. Always consider consulting professionals for accurate guidance on documentation.

Yes, the principle of goes dies survivorship with beneficiary typically supersedes a will. When a property is held in joint tenancy with rights of survivorship, it passes directly to the surviving owner upon death, regardless of any directives in a will. Thus, it's crucial to understand how survivorship interests interact with your estate planning. For those needing clarity, uSlegalforms can provide valuable resources to help you navigate these complex issues.

You would use a survivorship clause when you want to clarify how assets should be distributed if one of your beneficiaries passes away before you do. This clause is particularly useful in families with multiple beneficiaries or complex relationships, as it prevents potential disputes over the estate. By incorporating goes dies survivorship with beneficiary, you ensure your assets pass directly to your remaining beneficiaries, providing a smoother transition in times of grief.

If there is no survivorship clause in place after death, distribution may become problematic for the deceased's estate. The asset may pass to the deceased beneficiary’s estate instead of the remaining beneficiaries, leading to delays and potential disputes. To avoid this scenario, including goes dies survivorship with beneficiary in your estate planning provides clarity and directs assets to your intended beneficiaries, streamlining the process.