Beneficiary Deed Trust With Charitable

Description

How to fill out Arizona Beneficiary Deed From Husband And Wife To Trust?

Regardless of whether you often handle documentation or need to file a legal report from time to time, it is essential to find a source of information where all the examples are pertinent and current.

The initial step you should take when utilizing a Beneficiary Deed Trust With Charitable is to confirm that it is the latest version, as this determines its submitability.

If you desire to streamline your quest for the newest document samples, seek them on US Legal Forms.

To acquire a form without an account, follow these steps: Use the search bar to locate the form you need. Review the Beneficiary Deed Trust With Charitable preview and description to ensure it is precisely what you seek. After verifying the form, simply click Buy Now. Choose a subscription option that suits you. Create an account or Log In to your existing one. Use your credit card information or PayPal account to complete the purchase. Select the file format for download and confirm it. Eliminate the confusion of managing legal documents. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that encompasses nearly every sample you may need.

- Look for the forms you require, review their significance instantly, and learn more about their application.

- With US Legal Forms, you gain access to over 85,000 form templates across various sectors.

- Acquire the Beneficiary Deed Trust With Charitable examples in just a few clicks and keep them anytime in your account.

- A US Legal Forms account will enable you to access all the samples you need with added ease and less stress.

- One simply needs to click Log In in the site header and navigate to the My documents section containing all the forms you require in one place, saving you time on searching for the right template or verifying its authenticity.

Form popularity

FAQ

A charitable remainder trust allows donors to receive income for a specified time, after which the remaining assets go to charity. This setup provides immediate tax benefits and can support your financial goals while benefiting your chosen charity. However, the donor relinquishes control over the assets, which can be a drawback. Considering a beneficiary deed trust with charitable features might provide a different balance of control and support for charitable efforts.

Charitable trusts offer several advantages, including potential tax deductions and a structured way to manage charitable giving. They can provide ongoing support to designated organizations and generate income for the donor during their lifetime. A beneficiary deed trust with charitable components can enhance your estate planning by ensuring your contributions continue beyond your lifetime.

A charity is a nonprofit organization focused on philanthropic goals, while a charitable trust is a legal arrangement that holds assets to support charitable activities. Charitable trusts provide a structured way to manage and distribute assets, ensuring they are utilized effectively. You might find that setting up a beneficiary deed trust with charitable intent offers a more personal approach to supporting organizations you care about.

In a charitable trust, the beneficiary is typically a recognized charitable organization or purpose, rather than an individual. This means that the trust's assets are used to support charitable activities, benefiting the community or a specific cause. By using a beneficiary deed trust with charitable designations, individuals can ensure their legacy supports their chosen charities.

One con of a charitable lead trust is that it can be complicated to set up, often requiring professional assistance. Additionally, the funds set aside for charitable purposes cannot be accessed by the donor, which may limit personal financial flexibility. It is essential to weigh these factors against the benefits of using a beneficiary deed trust with charitable provisions.

To donate to charity on behalf of someone else, you can make a contribution in their name through a charity’s website or by sending a check. It is beneficial to inform the individual about your intentions, especially if you wish to include this in a beneficiary deed trust with charitable provisions. This gesture can support meaningful causes while honoring the individual you have in mind.

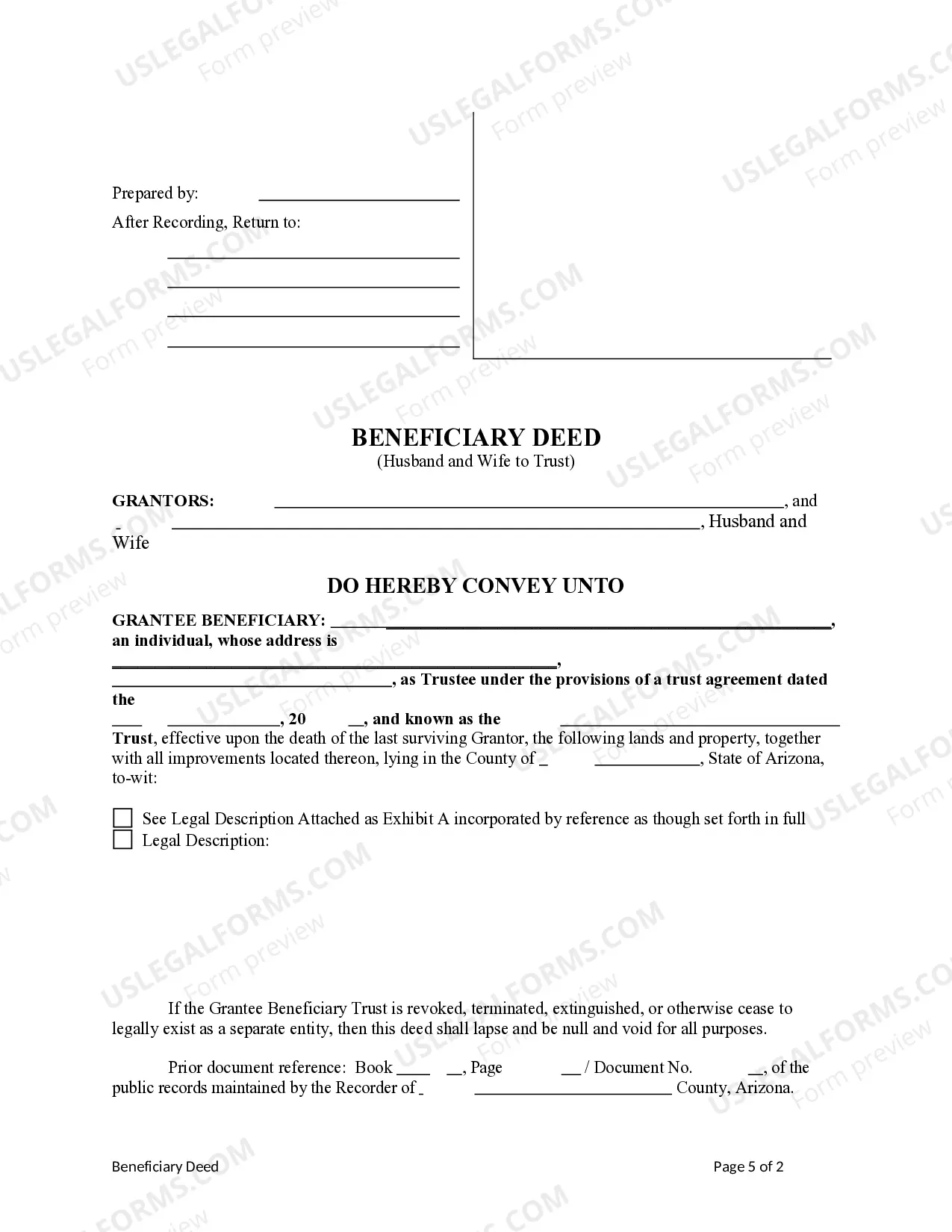

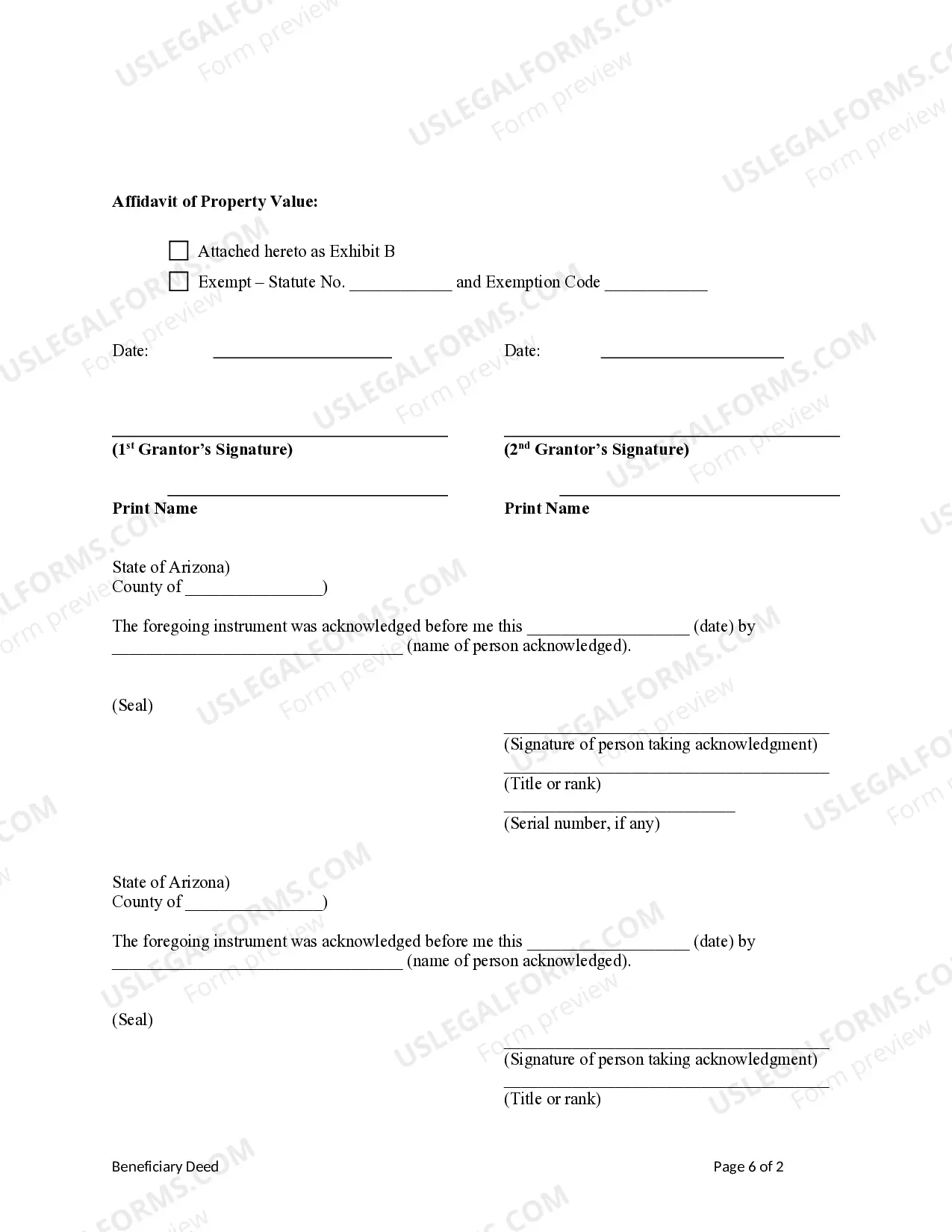

Filling out a beneficiary designation form requires careful attention to detail. Begin by listing your primary and secondary beneficiaries, ensuring you include their full names and any relevant identification numbers. With a beneficiary deed trust with charitable provisions, it's critical to follow legal guidelines to ensure the intended beneficiaries receive their assets correctly.

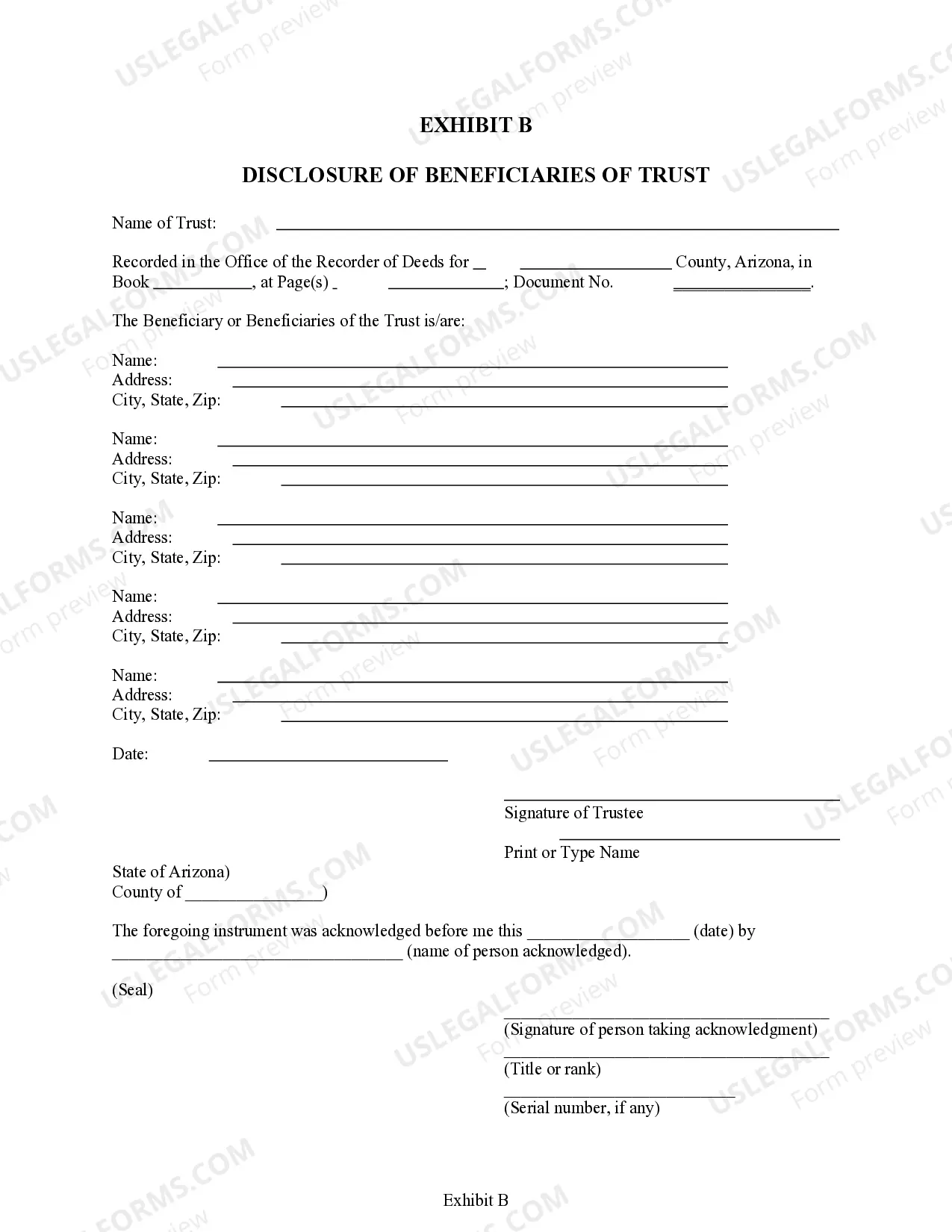

Listing a trust as a beneficiary involves specifying the trust in your beneficiary deed trust documents. Include the trust's full name, tax identification number, and sometimes even its purpose. This ensures clarity regarding which trust will receive the assets, allowing for seamless transfer upon your passing.

Yes, you can name an organization as a beneficiary within a beneficiary deed trust with charitable provisions. This approach allows you to direct your assets to causes you care about, ensuring they are used for philanthropic purposes. It is important to have accurate details about the organization to avoid any confusion in the future.

To add a charity as a beneficiary, you must identify the charity and gather necessary information, including its legal name and tax identification number. Next, update your beneficiary deed trust with charitable designations using the appropriate documentation. Using a platform like USLegalForms can simplify this process, guiding you through the necessary forms and requirements.