Arizona Joint Tenancy With Right Of Survivorship Form For Trust

Description

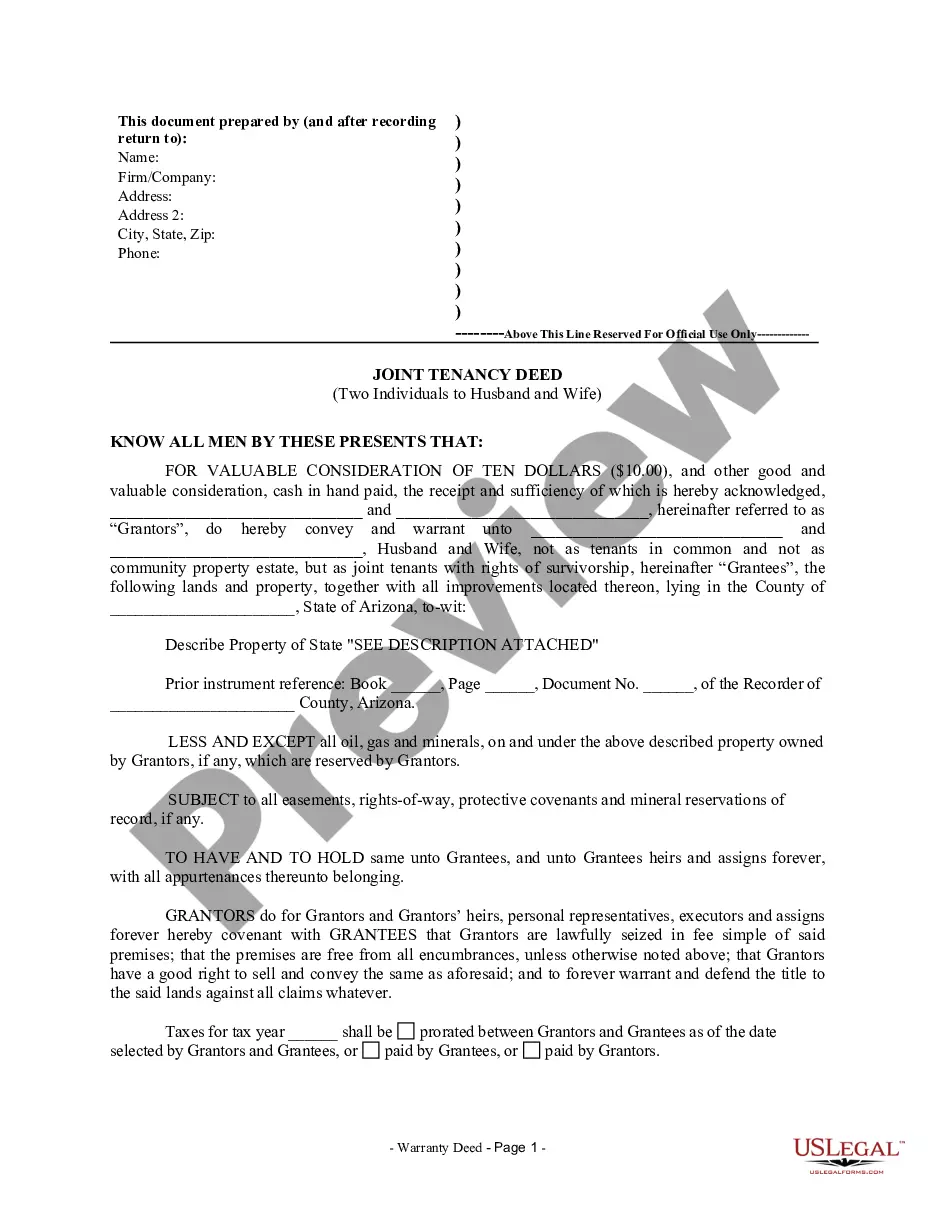

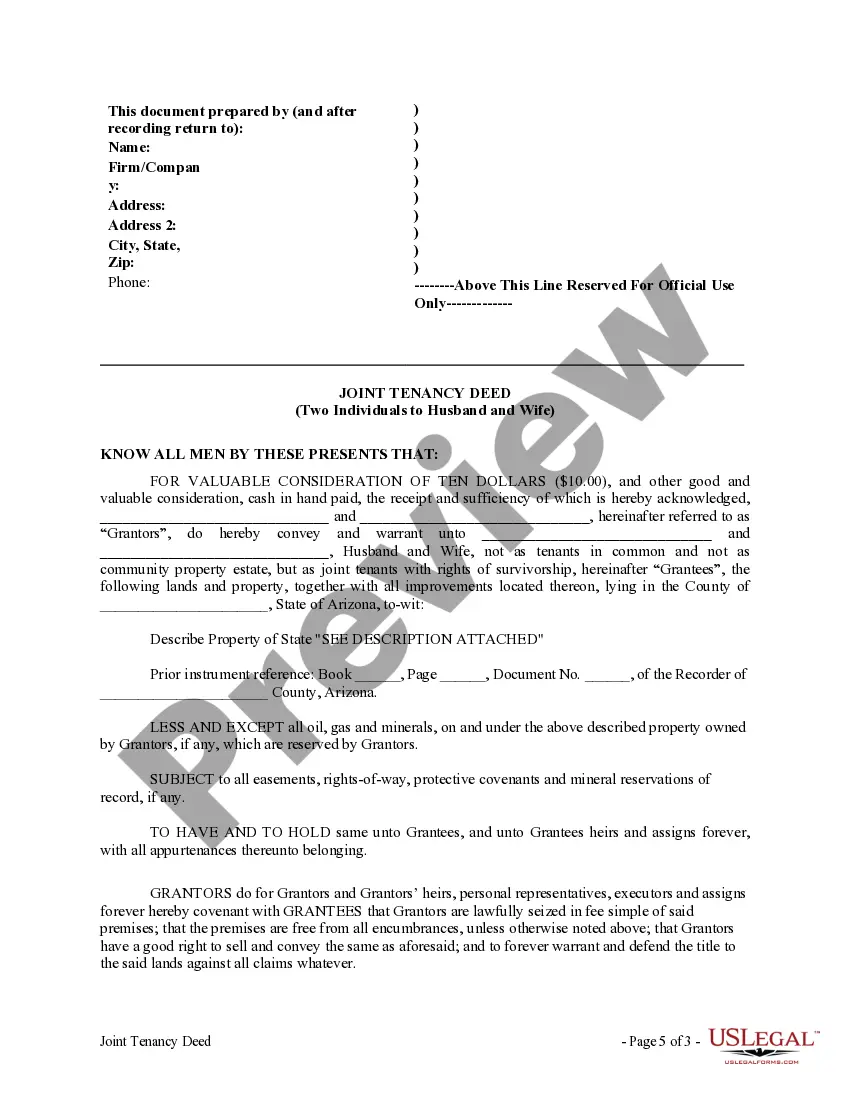

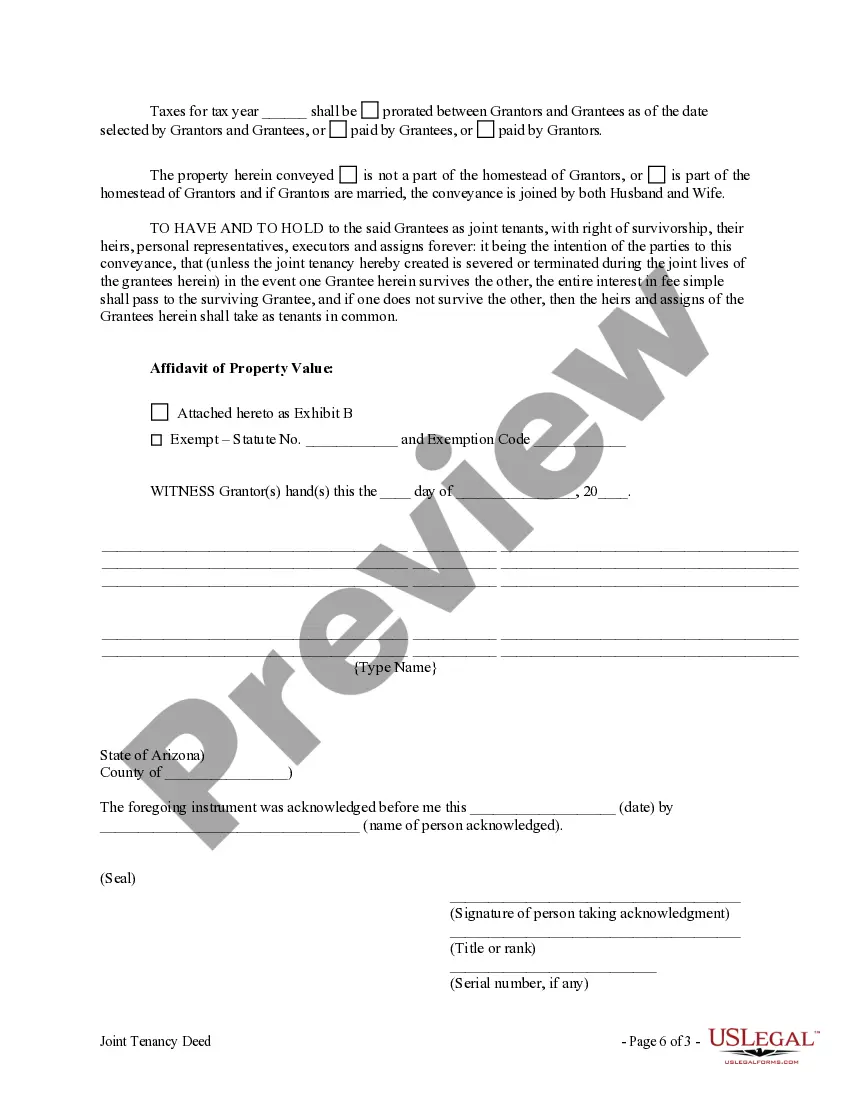

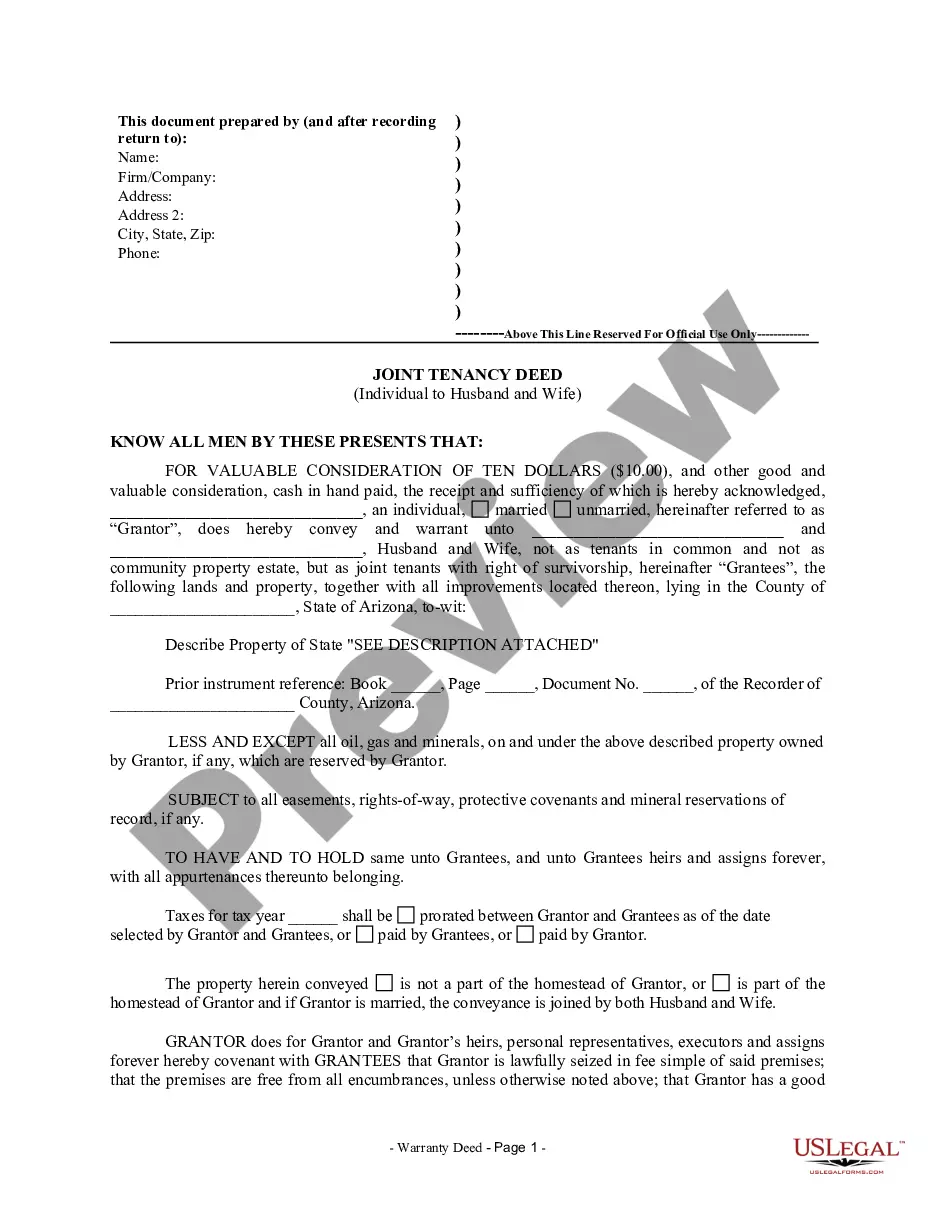

How to fill out Arizona Joint Tenancy Deed - Two Individuals To Husband And Wife?

Creating legal documents from the ground up can occasionally feel a bit daunting.

Certain situations may require extensive investigation and substantial financial expenditure.

If you're looking for a simpler and more cost-effective method to generate the Arizona Joint Tenancy With Right Of Survivorship Form For Trust or any other documentation without complications, US Legal Forms is always accessible.

Our online inventory of over 85,000 current legal templates encompasses nearly every facet of your financial, legal, and personal concerns. With just a few clicks, you can swiftly access state- and county-specific forms meticulously prepared by our legal professionals.

Ensure that the selected form aligns with the statutes and regulations of your state and county. Select the most appropriate subscription plan to purchase the Arizona Joint Tenancy With Right Of Survivorship Form For Trust. Download the file. Then complete, sign, and print it out. US Legal Forms enjoys a solid reputation and over 25 years of experience. Join us today and make document completion a straightforward and efficient process!

- Utilize our platform whenever you require dependable services to swiftly locate and download the Arizona Joint Tenancy With Right Of Survivorship Form For Trust.

- If you’re familiar with our website and have previously registered an account, simply Log In, choose the form, and download it immediately or re-download it later in the My documents section.

- Don't have an account? Not an issue. It takes minimal time to register and browse the catalog.

- Before diving straight into downloading the Arizona Joint Tenancy With Right Of Survivorship Form For Trust, please adhere to these suggestions.

- Review the document preview and descriptions to confirm that you are on the correct form.

Form popularity

FAQ

To take someone's name off a deed, a new deed must be prepared to transfer the property from all of the current owners to all of the remaining owners.

Get Your Deed Online Deeds and most other documents kept by the Land Records Department are available through mdlandrec.net. This website is free to use but you must create an account using your name and email address. Search for your deed by first selecting the county where the property is located.

Laws & Requirements Signing Requirements: Maryland Code, Real Property, § 4-101: The grantor must sign a quitclaim deed in Maryland before a notary public. Recording Requirements: Maryland Code, Real Property, § 3-104: You must file Maryland quitclaim deeds with the Clerk of the Circuit Court in the property's county.

If you wish to change your name or remove a name on your property record, due to marriage, divorce, death of an owner, etc., a new deed must be filed with the local Land Records office where the property is located. You can not change a deed to a property through the Assessment office.

Although not defined in the statutes, Maryland accepts quitclaim deeds to transfer the rights, title, and interest in real estate, if any, from the grantor (owner) to the grantee (buyer), with no protections for the grantee.

If you wish to change your name or remove a name on your property record, due to marriage, divorce, death of an owner, etc., a new deed must be filed with the local Land Records office where the property is located. You can not change a deed to a property through the Assessment office.

Maryland law requires all deeds to include the names of the grantor (the seller) and grantee (the buyer), a description of the property, and the interest that you intend to convey. All deeds must be recorded with the Department of Land Records in the county where the property is located.

Maryland law requires all deeds to include the names of the grantor (the seller) and grantee (the buyer), a description of the property, and the interest that you intend to convey. All deeds must be recorded with the Department of Land Records in the county where the property is located.