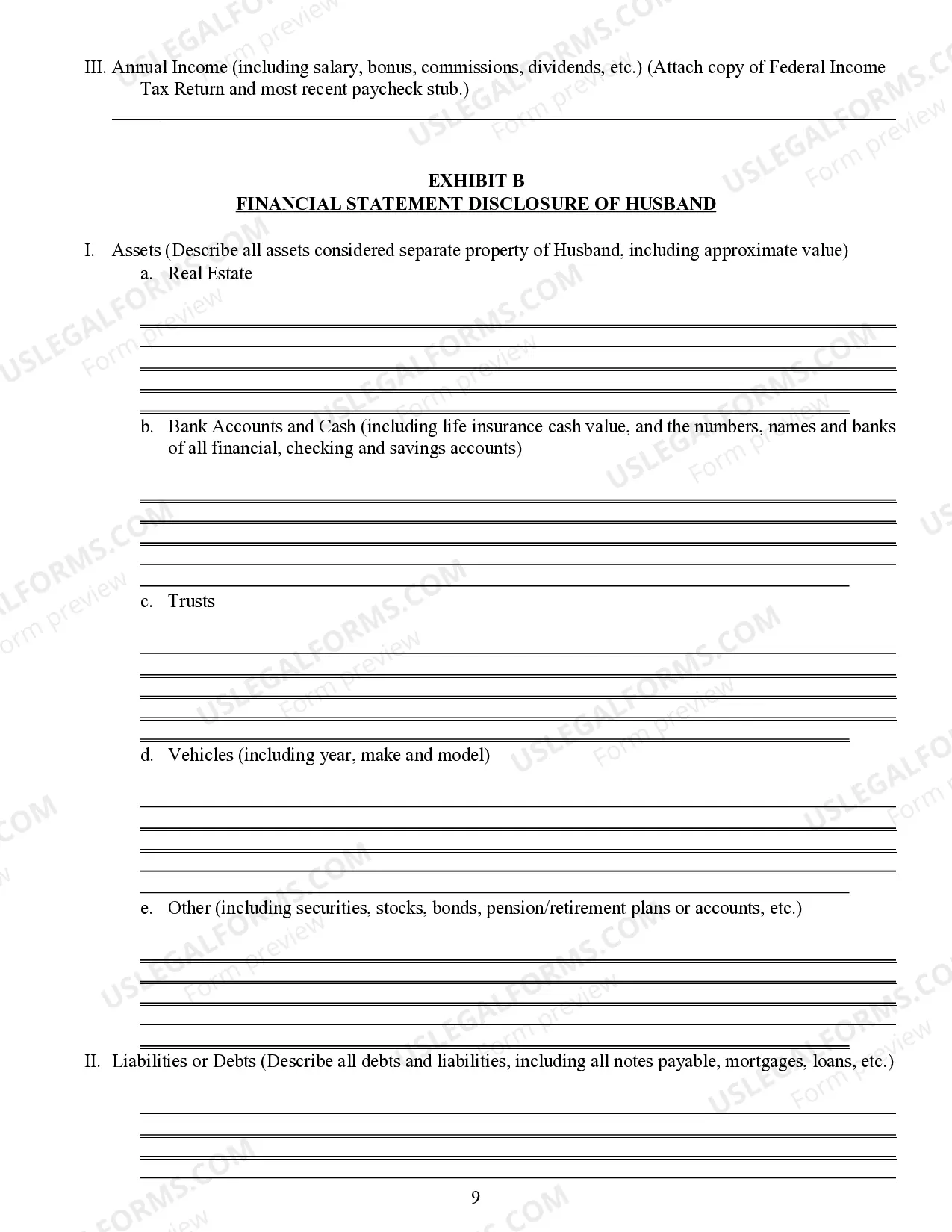

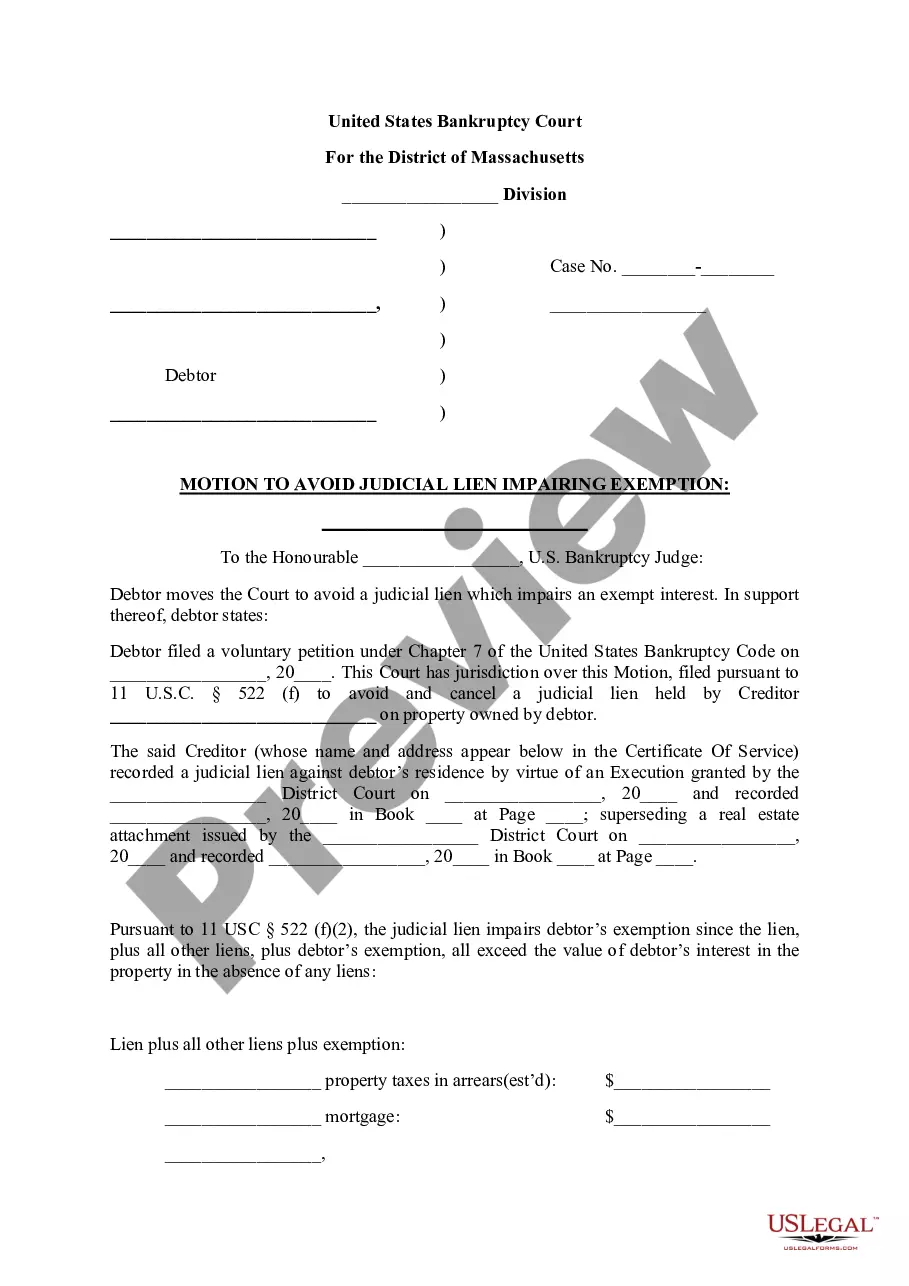

Arizona Property Code

Description

How to fill out Arizona Postnuptial Property Agreement?

The Arizona Property Code displayed on this page is an adaptable formal model crafted by skilled attorneys in accordance with national and local laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal practitioners with over 85,000 authenticated, state-specific documents for any commercial and personal circumstances. It’s the fastest, easiest, and most dependable method to obtain the paperwork you require, as the service assures the utmost level of data protection and anti-malware safeguards.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your fingertips.

- Search for the document you require and examine it.

- Navigate through the sample you queried and view it or assess the form description to confirm it meets your needs. If it does not, use the search bar to locate the accurate one. Click Buy Now when you have identified the template you want.

- Choose a subscription plan and sign in.

- Select the payment option that best fits you and create an account. Use PayPal or a credit card for a swift transaction. If you possess an account already, Log In and check your subscription to proceed.

- Download the editable template.

- Pick the format you desire for your Arizona Property Code (PDF, Word, RTF) and save the sample on your device.

- Complete and authenticate the document.

- Print the template to fill it out by hand. Alternatively, use an online multi-functional PDF editor to quickly and correctly complete and sign your form with an electronic signature.

- Download your paperwork once more.

- Reutilize the same document whenever needed. Access the My documents section in your profile to redownload any previously acquired forms.

Form popularity

FAQ

Under the terms of a debt management plan, while you may receive more favorable interest rates or relief from fees, you still repay the entire principal amount owed.

About Form 1099-C, Cancellation of Debt | Internal Revenue Service.

Bankruptcy is your best option for getting rid of debt without paying.

Use a balance transfer credit card. One smart way to get out of debt is to complete a balance transfer. ... Consolidate debt with a personal loan. ... Borrow money from family or friends. ... Pay off high-interest debt first. ... Pay off the smallest balance first.

If you're talking about credit card debt, all you need to do is make minimum monthly payments. At a minimum payment of $200 a month at current interest rates, it will end up costing you $22,644.95 (in addition to the original $20,000!) to pay off all the debt, and it'll take you about 10 years to do it.

National Debt Relief assists with many types of unsecured debt, including credit cards, medical bills and some student loans. National Debt Relief charges no upfront fees. Free consultations are offered. Many types of debt qualify for help.

The snowball method is a debt-repayment strategy that focuses on paying down the account with the lowest balance first. As you direct your larger payments toward that balance, you continue to make the minimum payments on your other accounts so you don't end up paying late fees, hurting your credit or even defaulting.

Here are a few of the best ways to get out of the red. Find a payment strategy (or two) ... Consider debt consolidation. ... Negotiate with your creditors. ... Seek third party help. ... Open a balance transfer credit card.