Quitclaim Deed On Property With Mortgage

Description

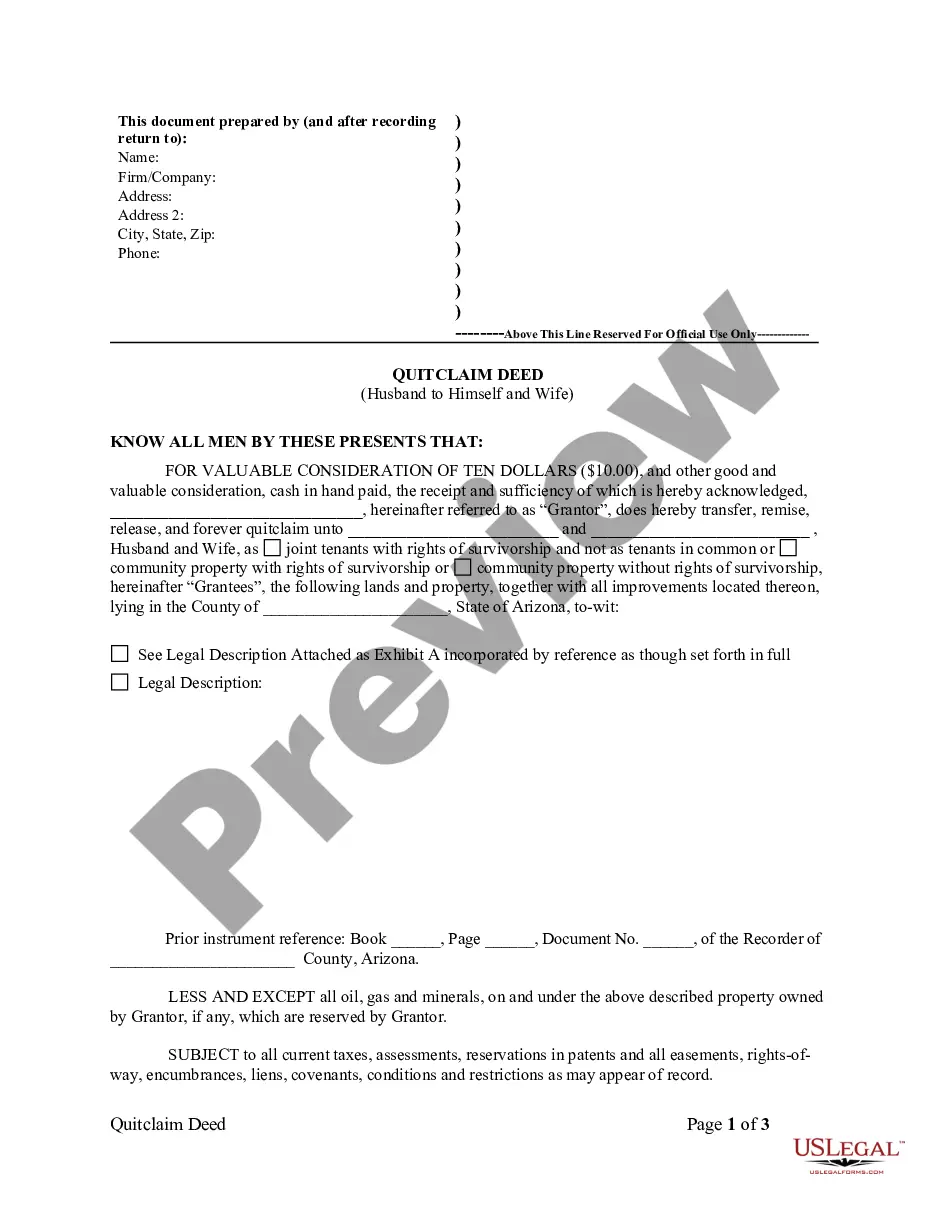

How to fill out Arizona Quitclaim Deed From Husband To Himself And Wife?

- If you're a returning user, log in to your account and download the quitclaim deed template you need by clicking the Download button. Ensure your subscription is active; renew it if necessary.

- For first-time users, begin by exploring the Preview mode and detailed form description. Confirm that you've selected the correct quitclaim deed that aligns with your local jurisdiction's requirements.

- If adjustments are needed, utilize the Search tab to find alternative templates. Once you pinpoint the suitable document, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting a subscription plan that fits your needs. You will need to create an account to access the full library.

- Complete the payment process using your credit card or PayPal account to secure your subscription.

- Lastly, download your form to save it on your device. You can revisit it anytime via the My Forms menu in your profile.

US Legal Forms stands out with an extensive collection of over 85,000 fillable and editable legal templates. Their robust library not only outnumbers competitors but also ensures you have the right tools for accurate and legally binding documents.

In conclusion, utilizing US Legal Forms for procuring a quitclaim deed on property with a mortgage streamlines the process, making it easier for individuals and attorneys alike. Don’t hesitate to explore our platform today and discover the ease of managing your legal documentation.

Form popularity

FAQ

The negatives of a quitclaim deed on property with a mortgage often relate to the lack of protection for the grantee. Unlike other deed types, it provides no warranties about the property’s condition or title, which means hidden issues could arise post-transfer. Moreover, in the case of debts tied to the property, you might still face financial obligations even if you no longer hold ownership. To navigate these pitfalls, USLegalForms can provide resources and support tailored to your situation.

A quitclaim deed on property with a mortgage may lead to potential challenges. One key disadvantage is that it transfers the ownership without guaranteeing that the title is clear; this can expose you to liabilities. Additionally, if the property has a mortgage, you may still be responsible for the debt even after transferring your interest. For further guidance, consider using USLegalForms to ensure you understand all implications involved.

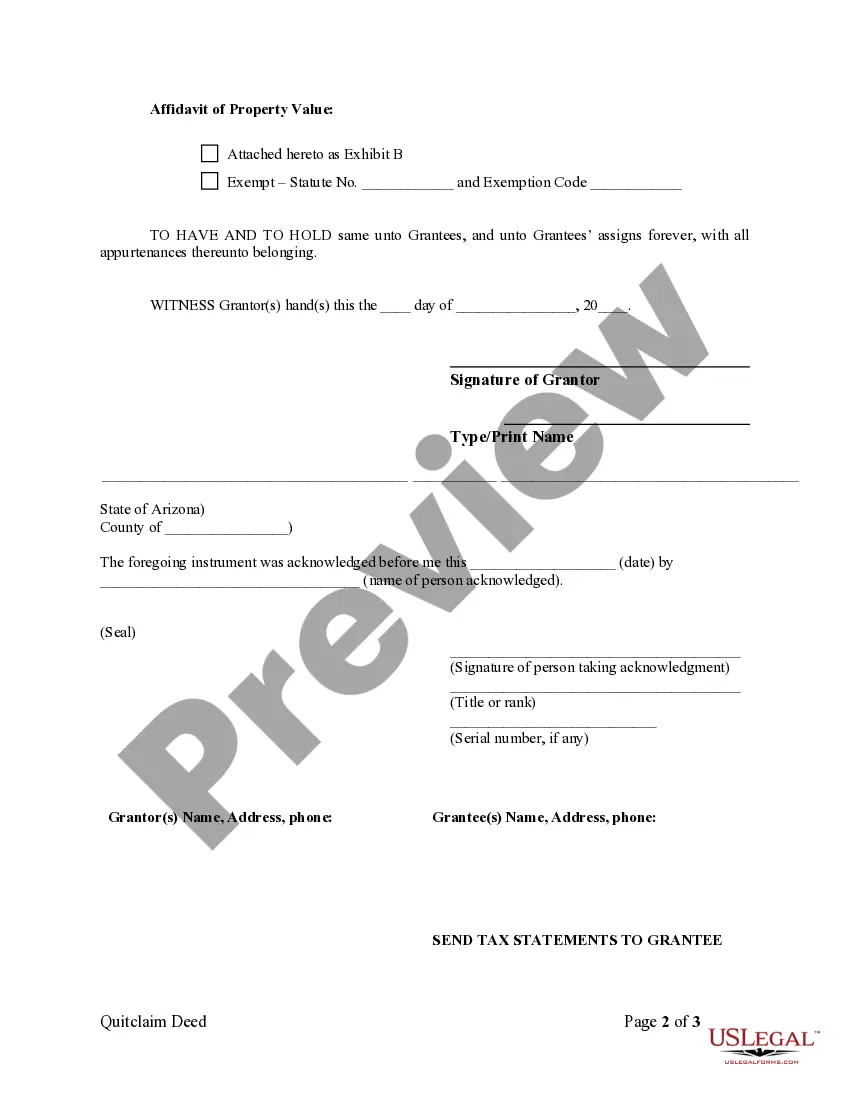

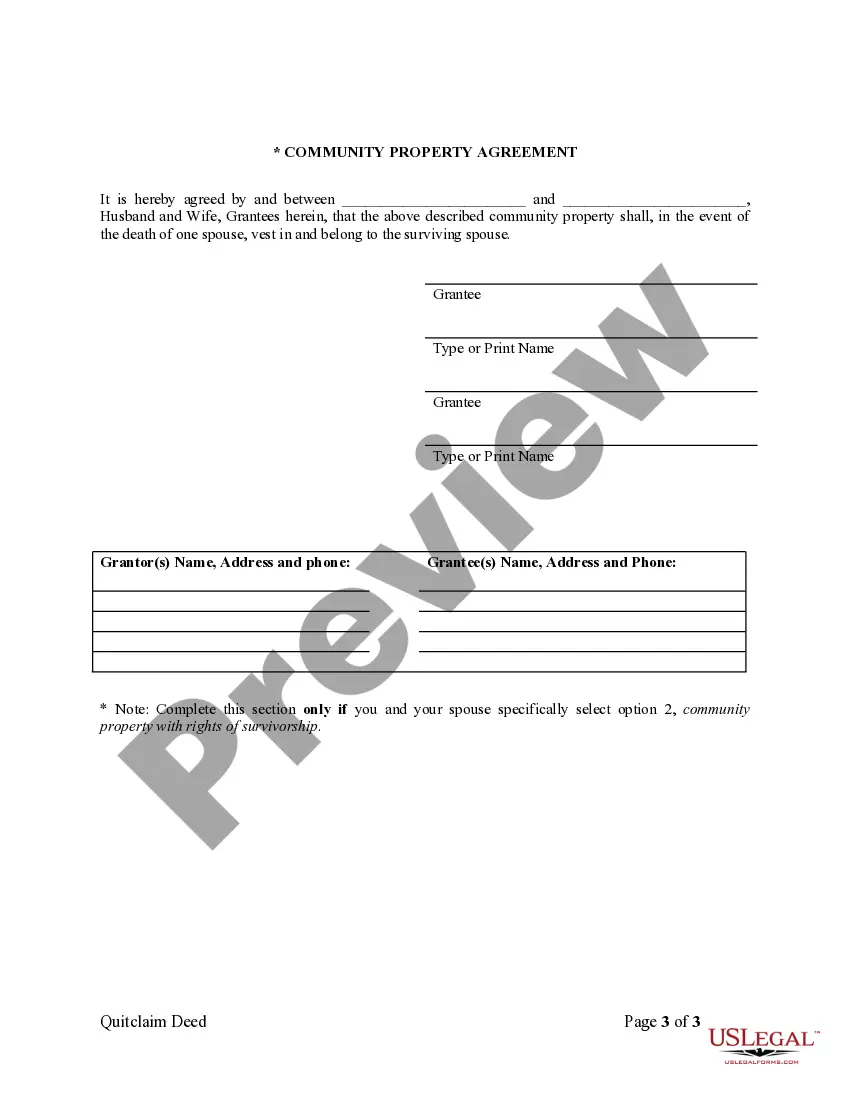

Filling out a quitclaim deed requires specific information like the parties involved, property description, and signatures. Start by clearly identifying the grantor and grantee and provide a thorough description of the property. If you have a mortgage, be aware of any obligations to your lender as you complete the quitclaim deed on property with a mortgage. For an easy process, consider using US Legal Forms, which guides you through the necessary steps.

Yes, you can add someone to your deed even if you have a mortgage. However, you should notify your lender about the change. Adding someone may affect your mortgage agreement, so it’s wise to consult the bank before proceeding with a quitclaim deed on property with a mortgage. This helps you avoid potential complications down the line.

When you have a mortgage, the bank does not technically hold the deed to your property. Instead, the bank holds a lien against it. This means that while you retain ownership through the deed, the bank has a legal claim until you fully repay your mortgage. If you plan to use a quitclaim deed on property with a mortgage, ensure you understand your obligations to the lender.

Yes, if you are on the deed of a property that has a mortgage attached, you may be responsible for the mortgage. Holding a quitclaim deed on property with a mortgage typically means you have ownership rights, but it also comes with financial obligations. In many cases, lenders hold all parties on the deed accountable for the debt. If you need guidance on dealing with mortgages and quitclaim deeds, consider using the resources available at US Legal Forms to navigate these complexities.

A common reason for using a quitclaim deed on property with mortgage is to clear up ownership issues among family members or in divorce situations. It allows one party to relinquish their interest in the property without lengthy legal processes. Always remember to check the implications of using a quitclaim deed to ensure you're making an informed decision.

If you have a mortgage, the lender holds the deed of trust or mortgage agreement, which secures their interest in the property. However, you still retain ownership of the home, and your name appears on the deed unless it changes through legal means like a quitclaim deed. Understanding this relationship is crucial when considering any type of deed transfer.

The primary beneficiaries of a quitclaim deed on property with mortgage are typically those looking for a quick transfer of ownership, such as family members or friends in informal arrangements. These agreements allow individuals to navigate property transfers without extensive legal proceedings. However, both parties should understand the potential risks and implications involved.

Quitclaim deeds are often viewed with skepticism because they lack the protections and assurances found in other types of property transfers. For instance, the absence of warranties means buyers cannot easily defend against claims or title disputes. Many legal experts advocate for the use of more secure deed options to safeguard all parties involved.