Grantor Corporation Forever For The Right

Description

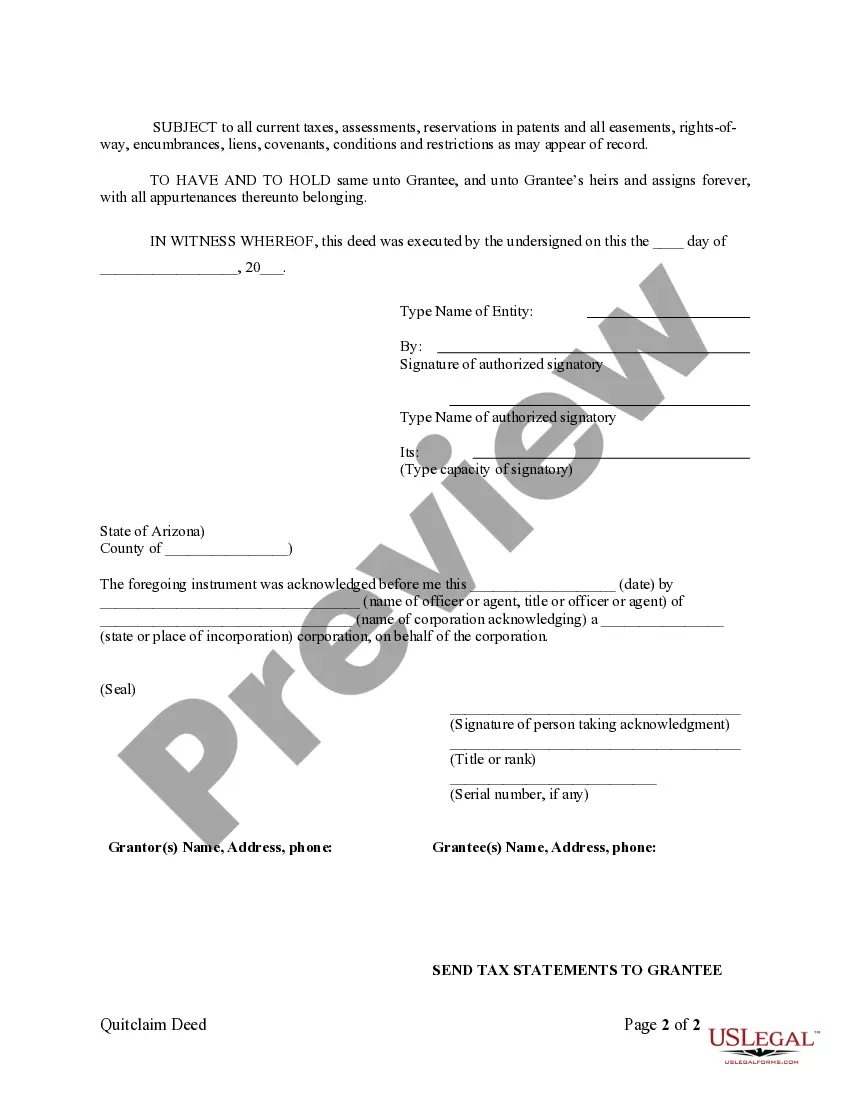

How to fill out Arizona Quitclaim Deed From Corporation To Corporation?

- If you're a returning user, log in to your account and download your required form template by clicking the Download button, ensuring your subscription is active. If it's not, renew it according to your payment plan.

- For first-time users, begin by reviewing the Preview mode and form description to ensure you've selected the correct document that meets your local jurisdiction requirements.

- Should you need a different template, utilize the Search tab above to find the right one if any inconsistencies arise.

- Once you find your desired document, click the Buy Now button and select your preferred subscription plan. You’ll need to register an account for access to the extensive library.

- Complete your purchase by entering your credit card information or utilizing your PayPal account to pay for the subscription.

- Finally, download your form and save it to your device. You can access it later in the My Forms section of your profile.

By following these steps, you'll have quick access to reliable legal forms tailored to your needs.

Don't hesitate—start your legal journey with US Legal Forms today and ensure your documents are precisely what you need!

Form popularity

FAQ

Determining the residency of a trust primarily depends on where the trustee resides and where the trust is administered. The governing law usually describes the trust's residency, impacting how it may be taxed. To gain a clearer understanding of residency matters, consulting uslegalforms can provide valuable insights into navigating grantor corporations forever for the right.

The responsible party when applying for an EIN for an irrevocable trust is generally the trustee. The trustee manages the trust's assets and is accountable for its tax filings. It's important to choose a qualified trustee, and for assistance, consider uslegalforms as a trusted resource to ensure your grantor corporation forever for the right remains compliant.

Reporting income from an irrevocable grantor trust typically involves the trust's fiduciary filing an income tax return on behalf of the trust. Income is taxed at the trust level, and beneficiaries may also have tax responsibilities. Understanding these reporting requirements can be complex; thus, utilizing uslegalforms can help clarify issues surrounding grantor corporations forever for the right.

An irrevocable grantor trust generally requires an EIN once the grantor passes away, as it becomes a separate taxable entity. This helps in reporting income and fulfilling tax obligations. To simplify the process of applying for an EIN, consider exploring resources offered by uslegalforms, which align with grantor corporations forever for the right.

Setting up a grantor trust involves creating a trust document that names the grantor and specifies the terms of the trust. You can draft this document yourself or seek the assistance of a legal professional to ensure compliance with your state's laws. Using platforms like uslegalforms can facilitate the setup process, emphasizing the concept of grantor corporations forever for the right.

When a revocable trust transitions to an irrevocable trust, it usually does not require a new EIN as long as the grantor is still living. However, once the grantor dies and the trust remains irrevocable, a new EIN may be necessary. For a deeper understanding, looking into uslegalforms can help clarify details about grantor corporations forever for the right.

An irrevocable grantor trust typically does not need to file a separate tax return as long as the income is reported on the grantor's personal tax return. However, once the grantor passes away, the trust might need to file its own tax return. It's essential to understand these obligations, so consider using resources from uslegalforms to navigate the complexities of grantor corporations forever for the right.

When the grantor of a grantor trust passes away, the trust may require a new Employer Identification Number (EIN). This need arises because the tax status of the trust changes after the grantor's death. To ensure compliance, it's advisable to consult with a tax professional familiar with grantor corporations forever for the right.

Trusts that are not classified as grantor trusts must file Form 1041. This includes irrevocable trusts and certain complex trusts, as they are treated as separate tax entities. Understanding which trusts have this obligation is crucial for compliance. If you're uncertain about your specific situation, consider USLegalForms for assistance.

The grantor of a grantor trust reports the income generated by the trust on their personal tax return. This approach ensures that all income is accounted for within the grantor's taxable income. Effectively managing this reporting can help prevent any future tax complications. Explore USLegalForms to access valuable resources for trust income reporting.