Llc Operating Agreement Arizona With Preferred Return

Description

How to fill out Arizona Limited Liability Company LLC Operating Agreement?

Managing legal documents and processes can be a lengthy addition to your day.

Llc Operating Agreement Arizona With Preferred Return and similar forms usually necessitate that you search for them and find the best way to complete them correctly.

As a result, whether you are handling financial, legal, or personal affairs, having a comprehensive and user-friendly online directory of forms readily available will greatly assist you.

US Legal Forms is the premier online platform for legal templates, providing over 85,000 state-specific forms along with various tools to help you complete your documents easily.

Is it your first time using US Legal Forms? Register and set up your account in a matter of minutes, and you'll gain access to the form directory and Llc Operating Agreement Arizona With Preferred Return. Then, follow the steps outlined below to complete your form.

- Browse the collection of relevant documents accessible to you with just a single click.

- US Legal Forms offers state- and county-specific forms available for download anytime.

- Protect your document management processes with high-quality support that enables you to prepare any form in minutes without any additional or concealed fees.

- Simply Log In to your account, locate Llc Operating Agreement Arizona With Preferred Return and download it directly from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

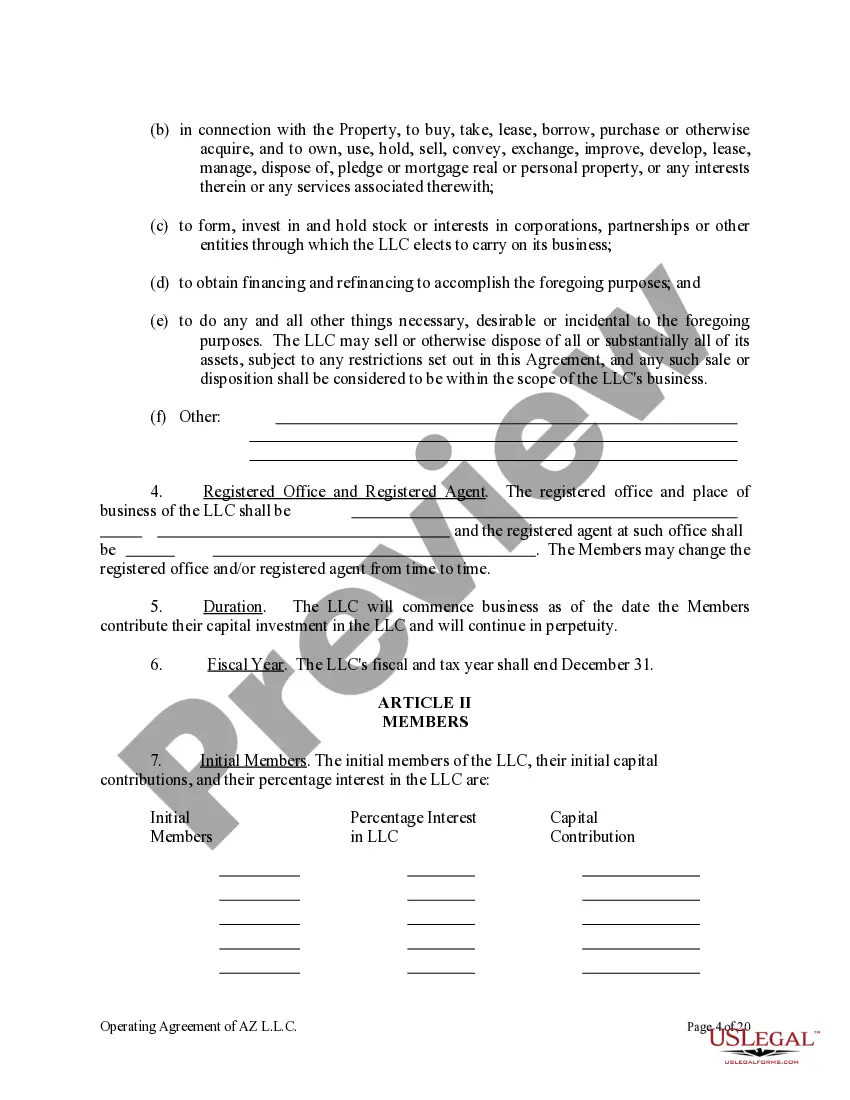

Although Arizona does not legally require LLCs to have an operating agreement, it is highly recommended to draft one. An operating agreement helps define internal processes and protects your personal assets in case of disputes. By establishing clear rules and guidelines through an LLC operating agreement Arizona with preferred return, you foster better management and accountability within your business.

To write a simple operating agreement for your LLC, start by clearly stating the business name and purpose. Next, outline the management structure, including member responsibilities and voting rights. Include financial provisions like profit distributions, especially if you want to specify a preferred return. Tools like USLegalForms can provide you with straightforward templates to simplify your writing process.

Filling out an LLC operating agreement involves gathering essential information about your business, such as member names, roles, and ownership percentages. You will also need to decide on financial matters, like profit distribution and the preferred return format. Follow the template closely, ensuring you tailor it to reflect the unique aspects of your LLC. If needed, consider using USLegalForms to streamline this process.

Ideally, the members of the LLC should collaborate to draft the operating agreement. However, if you're unsure about the legal language or structure, you can seek assistance from a legal professional experienced in Arizona LLC laws. Online platforms, such as USLegalForms, provide templates and resources to help you create a comprehensive LLC operating agreement Arizona with preferred return.

Yes, an LLC should have an operating agreement. This important document outlines the management structure and operational guidelines for your business. It also helps protect your limited liability status by demonstrating that your LLC is a separate entity. Having an LLC operating agreement Arizona with preferred return can also clarify profit distribution and member responsibilities.

In Arizona, an LLC is generally considered a pass-through entity for tax purposes, meaning it doesn't file a separate tax return. Instead, the members report profits and losses on their personal tax returns. However, if your LLC elects to be taxed as a corporation, it will need to file a different type of return. Understanding tax obligations in your LLC operating agreement for Arizona with preferred return is essential, and consulting a tax professional can provide personalized guidance.

Yes, you can add an operating agreement to an existing LLC in Arizona. This process allows you to establish clear guidelines for your business operations and member responsibilities. Creating an LLC operating agreement in Arizona with a preferred return can help define profit distributions and decision-making processes. Utilizing a platform like USLegalForms simplifies this task, offering templates that meet Arizona laws and requirements.

If your LLC lacks an operating agreement, the state’s default rules will govern how your business operates, which might not align with your intentions. Without this crucial document, you risk confusion and potential disputes among members regarding management decisions and profit distributions. To avoid these issues, consider creating an LLC operating agreement in Arizona with a preferred return to clearly outline your expectations and protect your interests.

No, Arizona does not legally require an LLC to have an operating agreement. However, having one is advantageous for your business operations. An LLC operating agreement in Arizona with a preferred return establishes clear guidelines for how the business will function, which can save you time and stress if any disputes arise between members.

An operating agreement is not legally required for an LLC in Arizona, but it is highly recommended. This document serves as a foundational blueprint for your business, detailing the management structure and member responsibilities. By drafting an LLC operating agreement in Arizona with a preferred return, you can protect your interests and prevent potential conflicts among members as your business grows.