This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Arizona Foreign Corporation Annual Report

Description

How to fill out Arizona Business Incorporation Package To Incorporate Corporation?

Individuals often connect legal documentation with intricacy that requires expert handling.

In a specific sense, this is accurate, as creating the Arizona Foreign Corporation Annual Report necessitates considerable expertise regarding relevant criteria, including state and local laws.

However, with US Legal Forms, everything has become easier: pre-prepared legal templates for any personal and business situation specific to state regulations are gathered in a single online database and are now accessible to everyone.

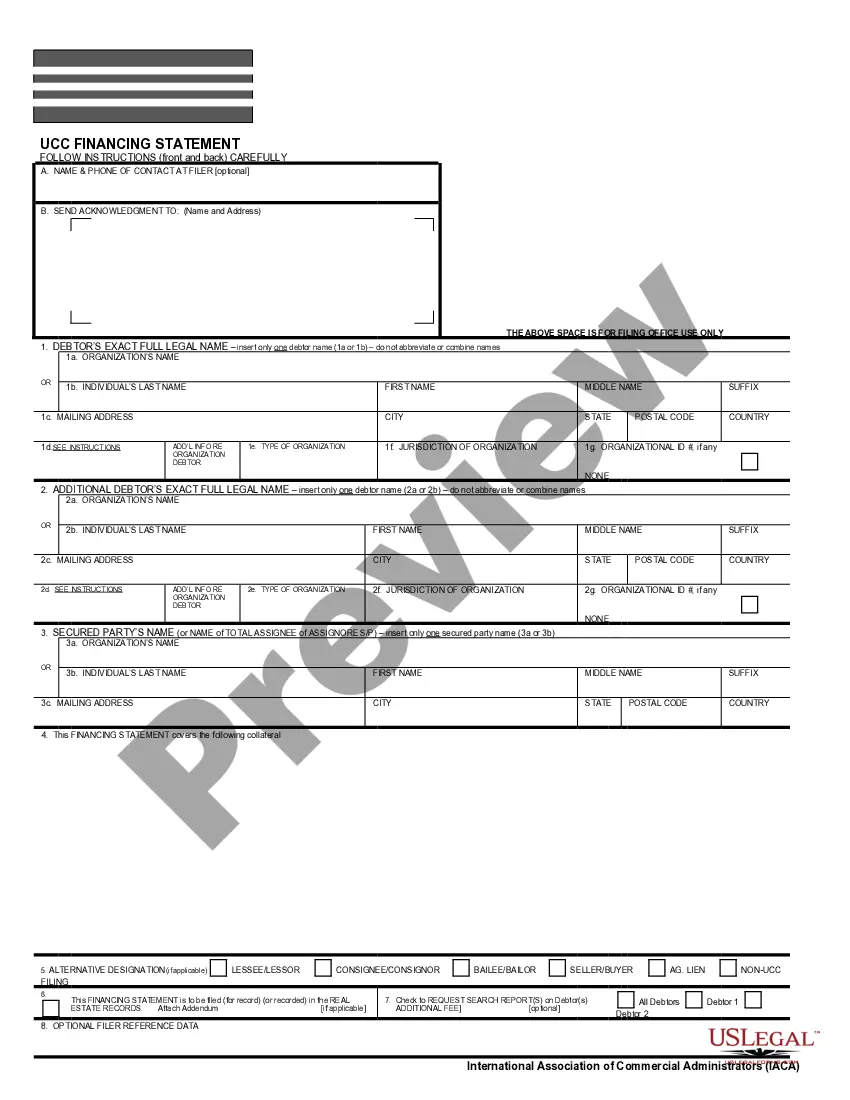

Select the file format and click Download. You can print your document or upload it to an online editor for quicker completion. All templates in our library are reusable: once acquired, they remain saved in your profile. You can access them anytime needed through the My documents section. Discover the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms categorized by state and usage area, making it quick to search for the Arizona Foreign Corporation Annual Report or any other particular template.

- Registered users with a valid subscription must Log In to their account and click Download to receive the form.

- New users to the platform must first sign up for an account and subscribe before downloading any documents.

- Here are the step-by-step instructions for obtaining the Arizona Foreign Corporation Annual Report.

- Carefully review the page content to ensure it meets your requirements.

- Read the form description or inspect it via the Preview option.

- If the initial template doesn't fit your needs, find another one using the Search bar in the header.

- Click Buy Now when you identify the correct Arizona Foreign Corporation Annual Report.

- Select a subscription plan that aligns with your needs and budget.

- Register for an account or Log In to proceed to the checkout page.

- Pay for your subscription using PayPal or your credit card.

Form popularity

FAQ

Creating an annual report for your Arizona foreign corporation involves gathering important financial and operational information about your business for the past year. You should outline your company’s activities, finances, and any major changes. Utilizing tools like US Legal Forms can simplify this process, guiding you through the necessary steps and making sure your Arizona foreign corporation annual report is compliant with state regulations.

Failing to file your Arizona foreign corporation annual report can lead to serious consequences for your business. The Arizona Corporation Commission may impose penalties, and your corporation might face administrative dissolution. Staying up to date with your annual report not only ensures your business remains in good standing, but it also helps you maintain active status with state authorities.

Yes, as an Arizona foreign corporation, you need to file an Arizona corporate tax return. This is required even if your corporation does not conduct business in the state. Maintaining compliance is crucial for your business to avoid penalties. Additionally, timely filing contributes to a smoother process for your Arizona foreign corporation annual report.

To look up a business in Arizona, you can utilize the Arizona Corporation Commission's online database. This resource allows you to search for business entities by name or license number. You can also find valuable information, like the Arizona foreign corporation annual report status, which helps you verify compliance with state regulations.

Filing an Arizona Corporation annual report is straightforward. You can file online through the Arizona Corporation Commission's website, where you will also find the required forms and guidelines. Ensure you gather all necessary information about your corporation before submission to complete the Arizona foreign corporation annual report successfully.

In Arizona, while you do not need to file an annual report for your LLC, you must file Articles of Organization to establish it. However, it's important to stay compliant with state laws, which may include filing specific tax documents. Keeping your LLC active in good standing requires meeting these obligations.

Yes, Arizona requires foreign corporations to file an annual report. This report helps maintain the corporation's active status within the state. Failing to submit the Arizona foreign corporation annual report on time may lead to penalties or administrative dissolution.

To obtain a company's annual report, you can visit the Arizona Corporation Commission's website. There, you can access public records, including the Arizona foreign corporation annual report. Simply search for the company name, and you'll find the necessary documents available for viewing or download.

Yes, Arizona requires foreign corporations to file an annual report. This obligation helps maintain your business's good standing in the state and keeps your information up to date. Failure to submit your Arizona foreign corporation annual report may result in penalties or even administrative dissolution. To simplify this process, consider using a platform like US Legal Forms to guide you through the necessary steps.

To file your Arizona foreign corporation annual report online, you should visit the Arizona Secretary of State's website. Look for the business services section, where you can access the online filing system. You'll need to provide your corporation's information, such as your entity name and registration number, along with the relevant details. Completing this process will ensure you meet Arizona's annual reporting requirements efficiently.