Arizona Business Registration Fee

Description

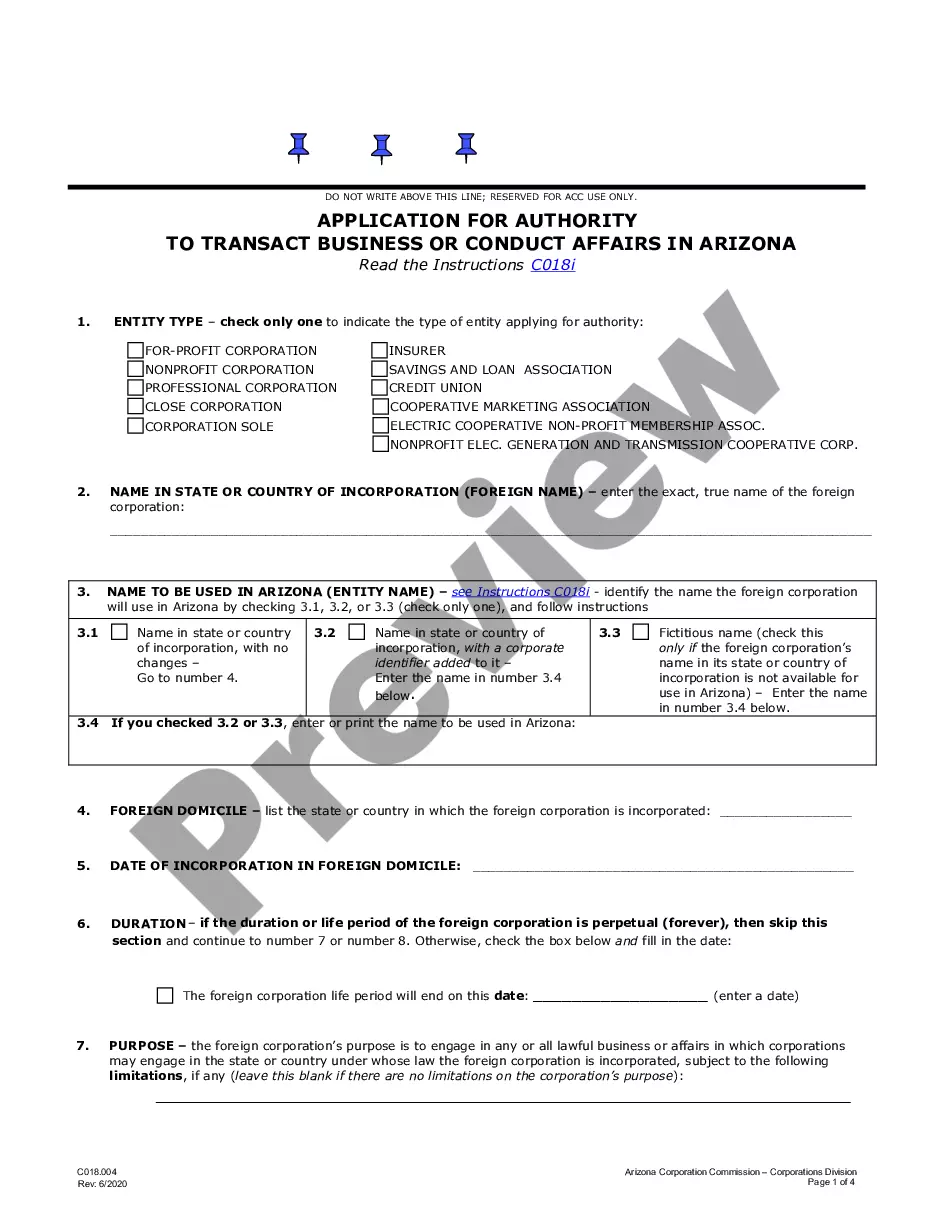

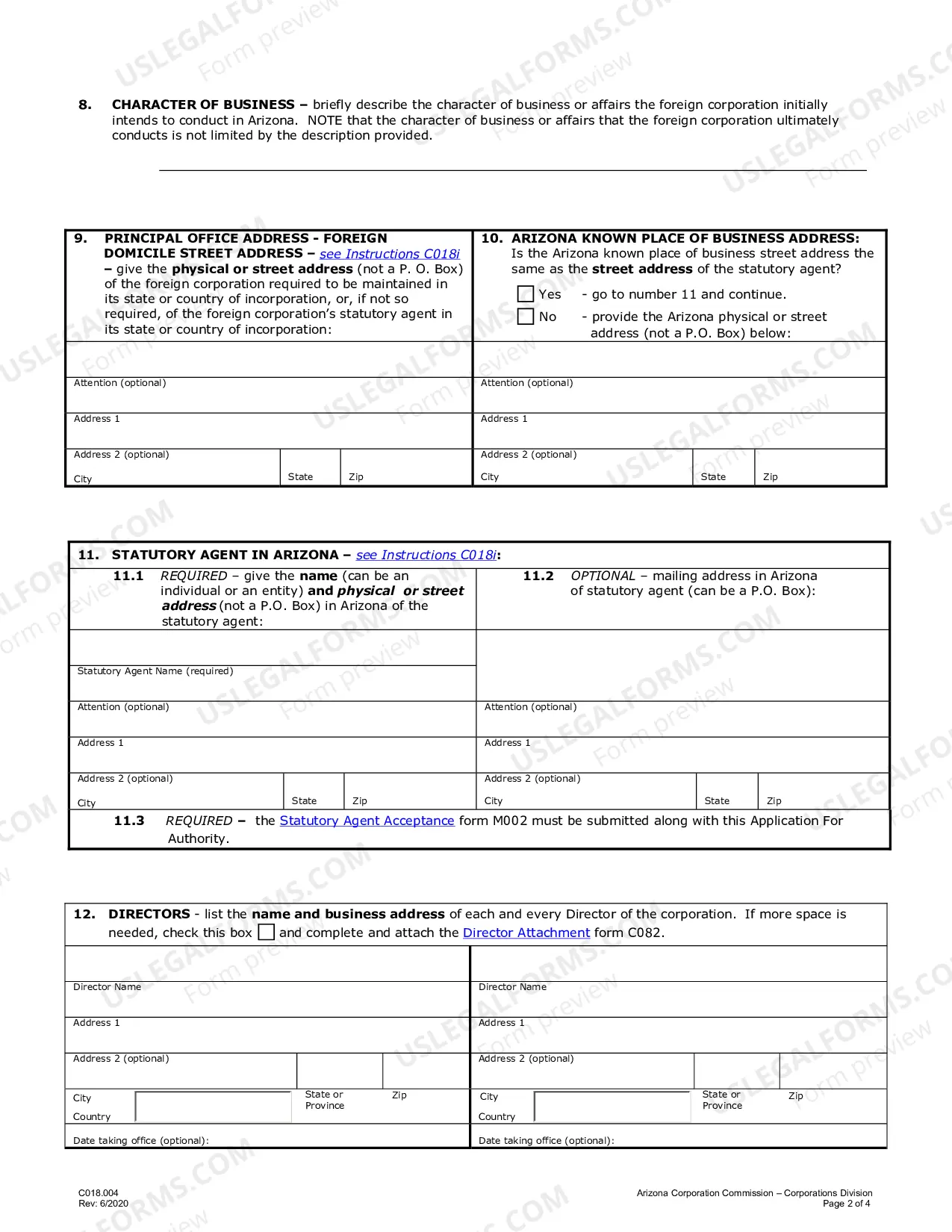

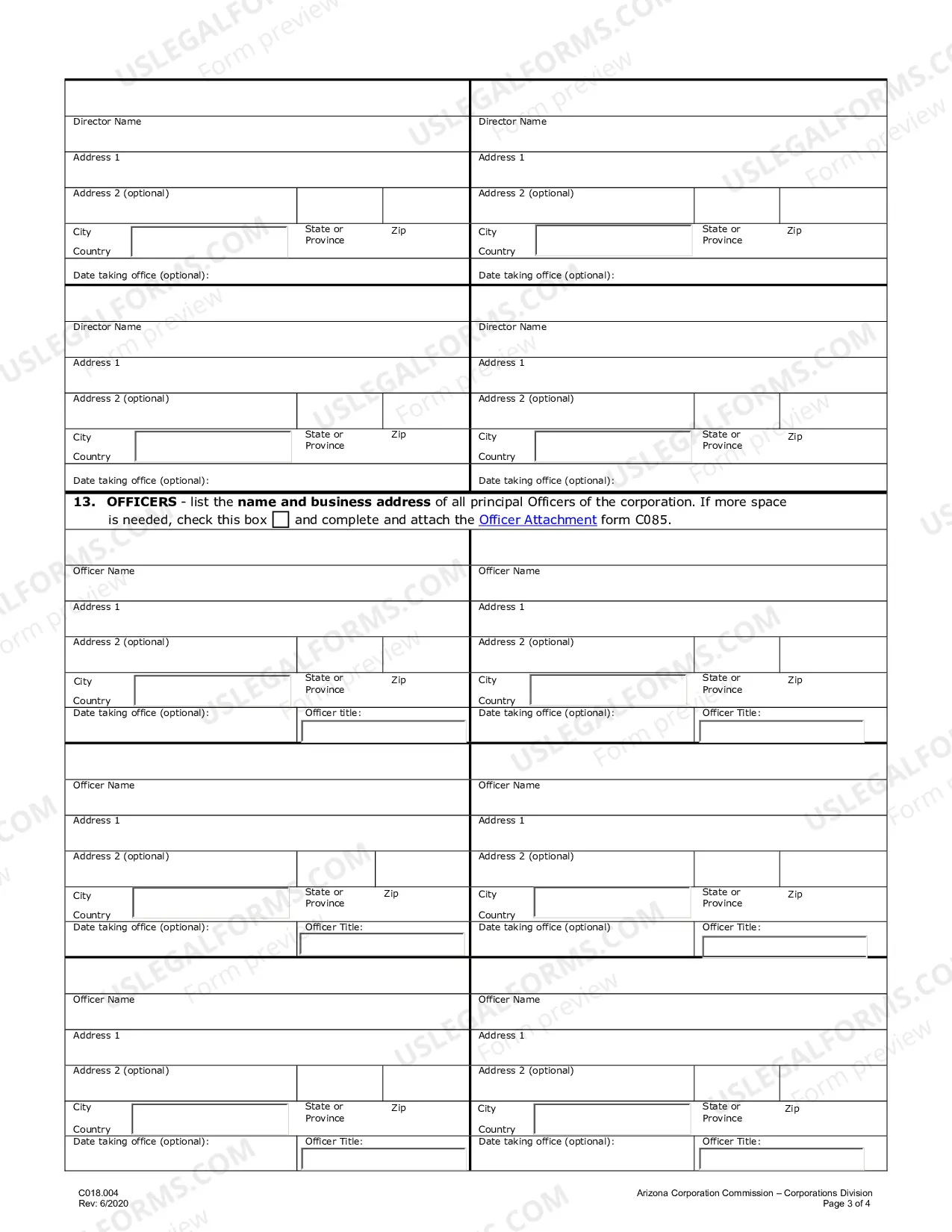

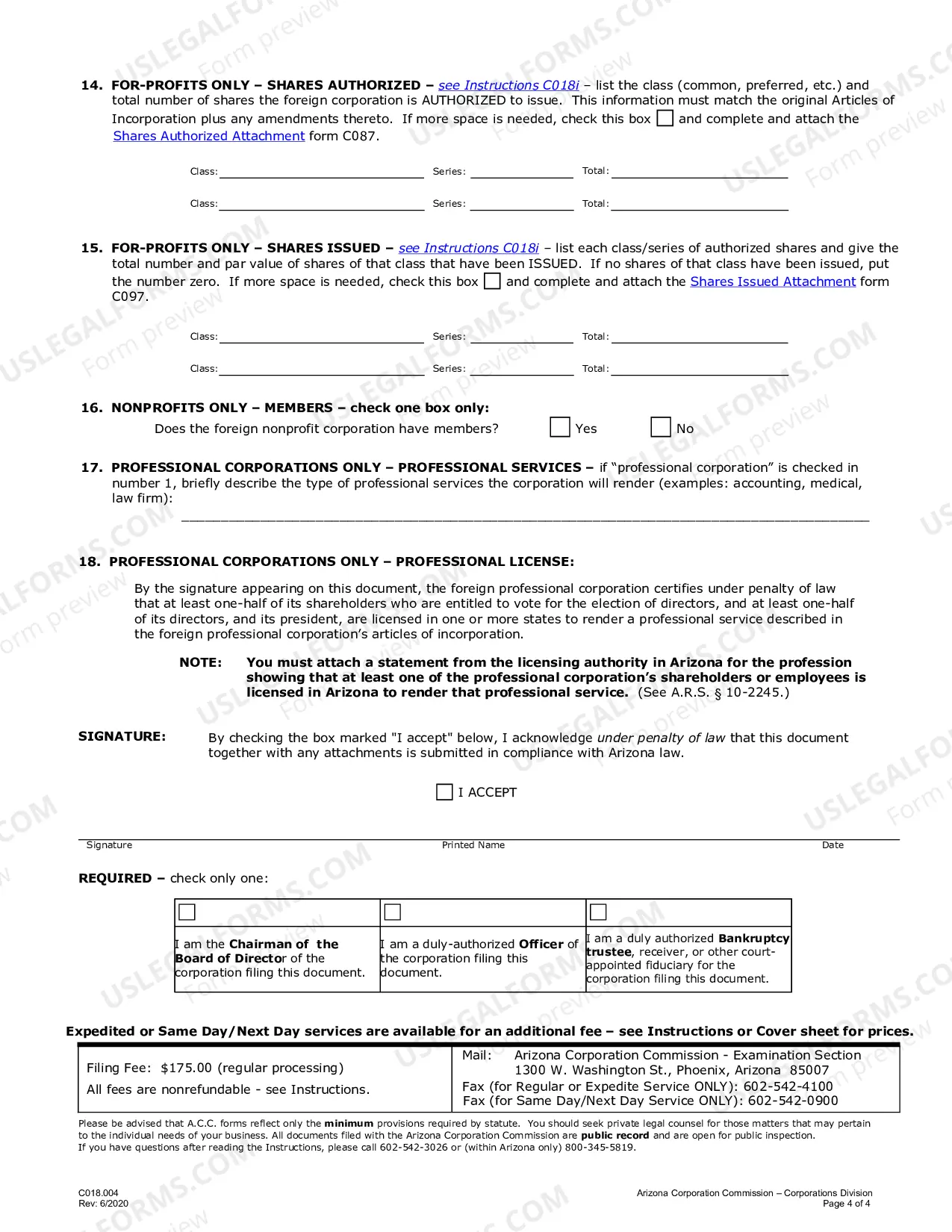

How to fill out Arizona Registration Of Foreign Corporation?

Dealing with legal documents and procedures can be a labor-intensive addition to your day.

Arizona Business Registration Fee and similar forms typically necessitate that you search for them and comprehend how to fill them out efficiently.

Consequently, whether you are managing financial, legal, or personal issues, having a comprehensive and functional online directory of forms readily available will significantly help.

US Legal Forms is the premier online service for legal templates, providing over 85,000 state-specific forms and various tools that will aid you in completing your documents with ease.

Is this your first experience with US Legal Forms? Register and create a free account in just a few minutes to gain access to the form directory and Arizona Business Registration Fee. Then, follow the steps below to complete your document: Ensure you have located the correct form using the Review feature and examining the form details. Click Buy Now when ready, and choose the subscription plan that best fits your needs. Click Download, then fill out, eSign, and print the form. US Legal Forms has twenty-five years of experience helping clients manage their legal documents. Find the form you need today and streamline any process effortlessly.

- Browse the collection of relevant documents accessible to you with just one click.

- US Legal Forms offers state- and county-specific documents available for download at any time.

- Protect your document management processes with a high-quality service that allows you to prepare any form in minutes without incurring additional or concealed fees.

- Simply Log In to your profile, locate Arizona Business Registration Fee, and download it instantly within the My documents section.

- You can also access forms that you have previously saved.

Form popularity

FAQ

Any license(s) you need to be in business could be - and often is - generically referred to as a "business" license, however, there are basically three different types of "business" licenses in Arizona: Transaction Privilege (Sales) Tax (TPT), Business, and Regulatory (professional/special).

The price of a business license or permit can vary depending on the type of license, business location, processing fees and recurring fees. Phoenix charges an application fee from $24 up to $1,665 and a license/permit fee between $10 and $360, depending on the type of business.

Great news, the Arizona Corporation Commission (AZCC) doesn't require an Annual Report (or fee) for an Arizona LLC. Although most states have annual reports and fees, Arizona is one of the few states that doesn't require LLCs to file (or pay) an Annual Report. This doesn't mean that Arizona LLCs don't pay taxes though.

Corporations may use AZTaxes.gov or ACH Credit to make EFT payments. International businesses without a US bank can make electronic payments through ACH credit for routine payments, extension payments, and estimated payments. If you wish to use the ACH Debit option, please register at .AZTaxes.gov.

However, an EIN is for federal withholding tax, excise tax, business information returns, and other IRS-related tax issues. An Arizona tax ID number is the number you use on returns that you file with the Arizona Department of Revenue.