Certificate Of Trust Form Within One Year

Description

Form popularity

FAQ

Yes, it is possible to file a short year tax return for a trust. This situation may arise if the trust is newly established or if it terminates within the year. It’s essential to calculate the income and deductions accurately for that period. Properly managing your tax responsibilities ensures compliance, especially when preparing your certificate of trust form within one year.

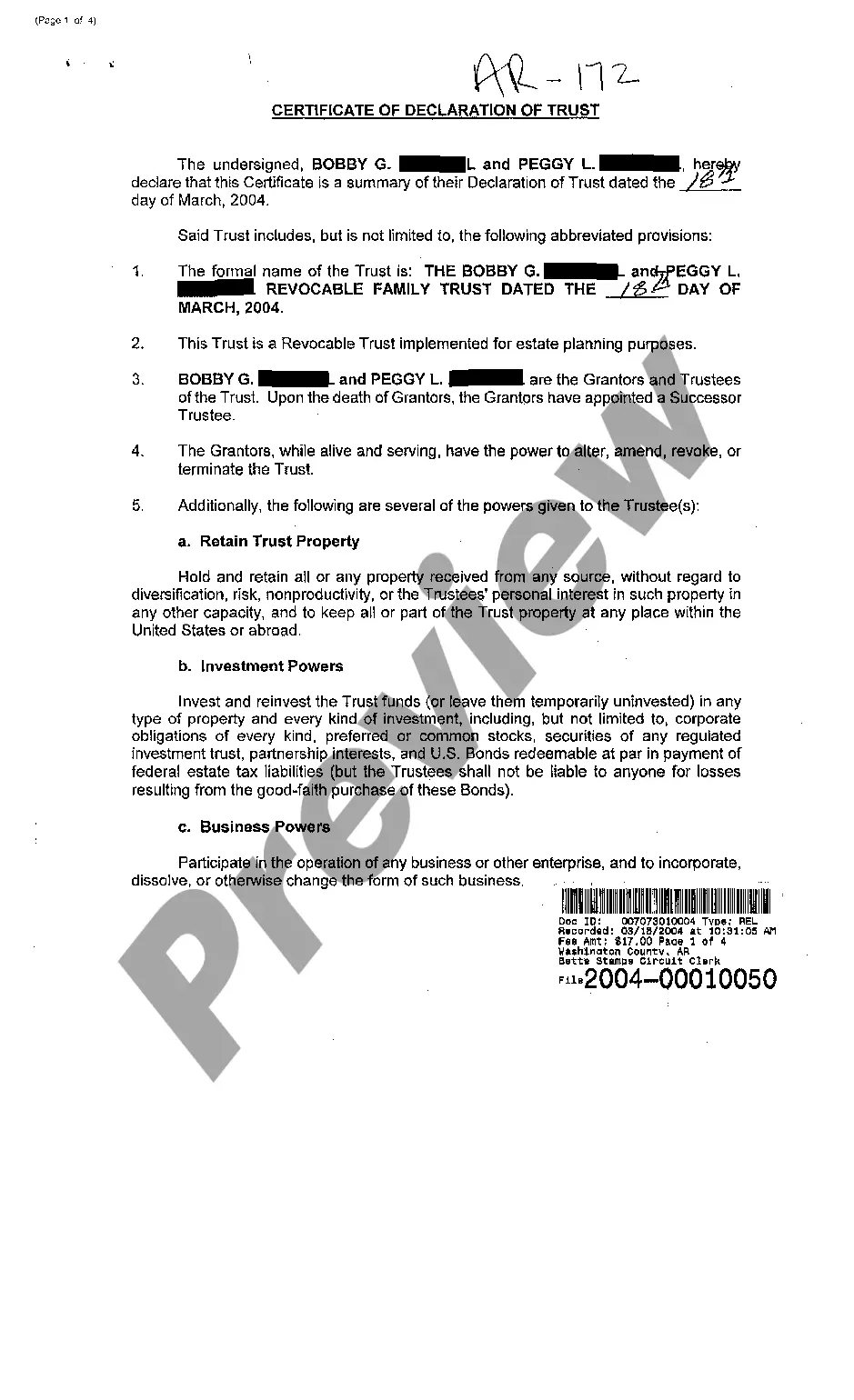

Recording a certificate of trust involves several steps, such as drafting the document with accurate information about the trust. You may need to visit your local county clerk or office to file it. Ensure you complete all required documentation before submission. This process can protect your interests, especially if you create a certificate of trust form within one year.

To record a certificate of trust, start by preparing the document according to state guidelines. It typically requires signatures from the trustee and possibly notarization. Submit the completed form to the appropriate state or county office. Recording your certificate of trust form within one year helps secure the trust's validity and informs others of its existence.

Bookkeeping for a trust involves maintaining organized financial records to track income, expenses, and distributions. Start by keeping separate bank accounts for the trust and documenting all transactions related to it. Regularly review financial statements and ensure all records align with the terms of the trust. Effective bookkeeping ensures you comply with tax obligations and helps you prepare your certificate of trust form within one year.

In Texas, a certificate of trust does not need to be recorded in the same way as a will or deed. However, you may want to keep it on file to clarify the trust's details and provisions to relevant parties. If you plan to engage in transactions involving real estate or other significant assets, consider recording it to provide transparency. Remember, understanding the requirements for your certificate of trust form within one year is essential to ensure compliance.

While trust funds can be beneficial, some drawbacks include potential tax implications and the complexity of managing the fund. Beneficiaries may also become overly reliant on the trust fund, leading to a lack of financial independence. Thus, using a well-organized Certificate of trust form within one year is vital for outlining conditions that promote responsible use of trust fund assets.

Deciding whether your parents should put assets in a trust largely depends on their estate planning goals. A trust can provide asset protection, reduce probate costs, and offer greater control over asset distribution. It is advantageous to discuss these options and, when needed, refer to a Certificate of trust form within one year to effectively implement their estate plan.

Some pitfalls of setting up a trust include misunderstanding the trust's purpose and misalignment with financial goals. Additionally, if the trust documents lack clarity, it can lead to disputes later on. Utilizing a well-crafted Certificate of trust form within one year can help avoid these common issues by ensuring all aspects of the trust are properly outlined and transparent.

One downside of a family trust is the potential for family conflict, especially if beneficiaries disagree on management or distribution of assets. Additionally, there may be costs involved, such as setting up the trust and ongoing administrative fees. To minimize challenges, it is wise to use a clear Certificate of trust form within one year that outlines the terms and expectations for all parties.

Yes, you can create your own certificate of trust, but it is essential to follow legal guidelines to ensure its validity. You should include key details about the trust, such as the name, purpose, and trustee information, to make it effective. Consider using a structured Certificate of trust form within one year to help you easily capture necessary information and meet legal standards.