Absolute Assignment Form Lic

Description

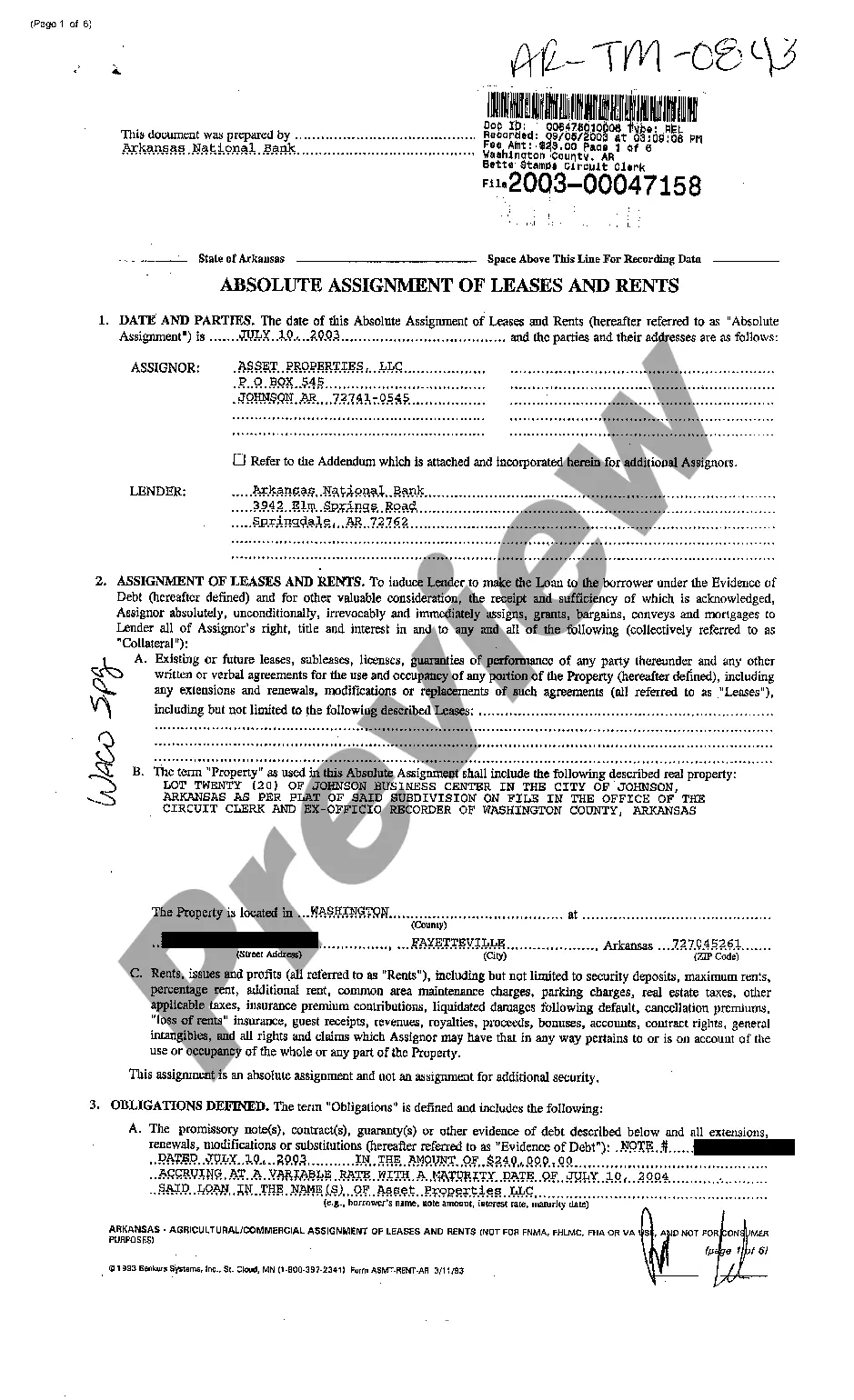

How to fill out Arkansas Absolute Assignment Of Lease And Rents?

There's no longer any justification to squander hours searching for legal documents to adhere to your local state rules.

US Legal Forms has gathered all of them in one location and made them easier to access.

Our platform offers over 85,000 templates for any business and personal legal matters categorized by state and area of application.

Completing legal documents under federal and state laws and regulations is quick and easy with our platform. Try US Legal Forms now to keep your paperwork organized!

- All forms are expertly prepared and verified for authenticity, so you can have confidence in acquiring a current Absolute Assignment Form Lic.

- If you are acquainted with our service and possess an account, you must confirm that your subscription is active before retrieving any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time needed by accessing the My documents tab in your profile.

- If you have not used our service before, the process will require a few more steps to finalize.

- Here's how new users can locate the Absolute Assignment Form Lic in our repository.

- Examine the page content thoroughly to confirm it includes the sample you require.

- To do so, make use of the form description and preview options if available.

Form popularity

FAQ

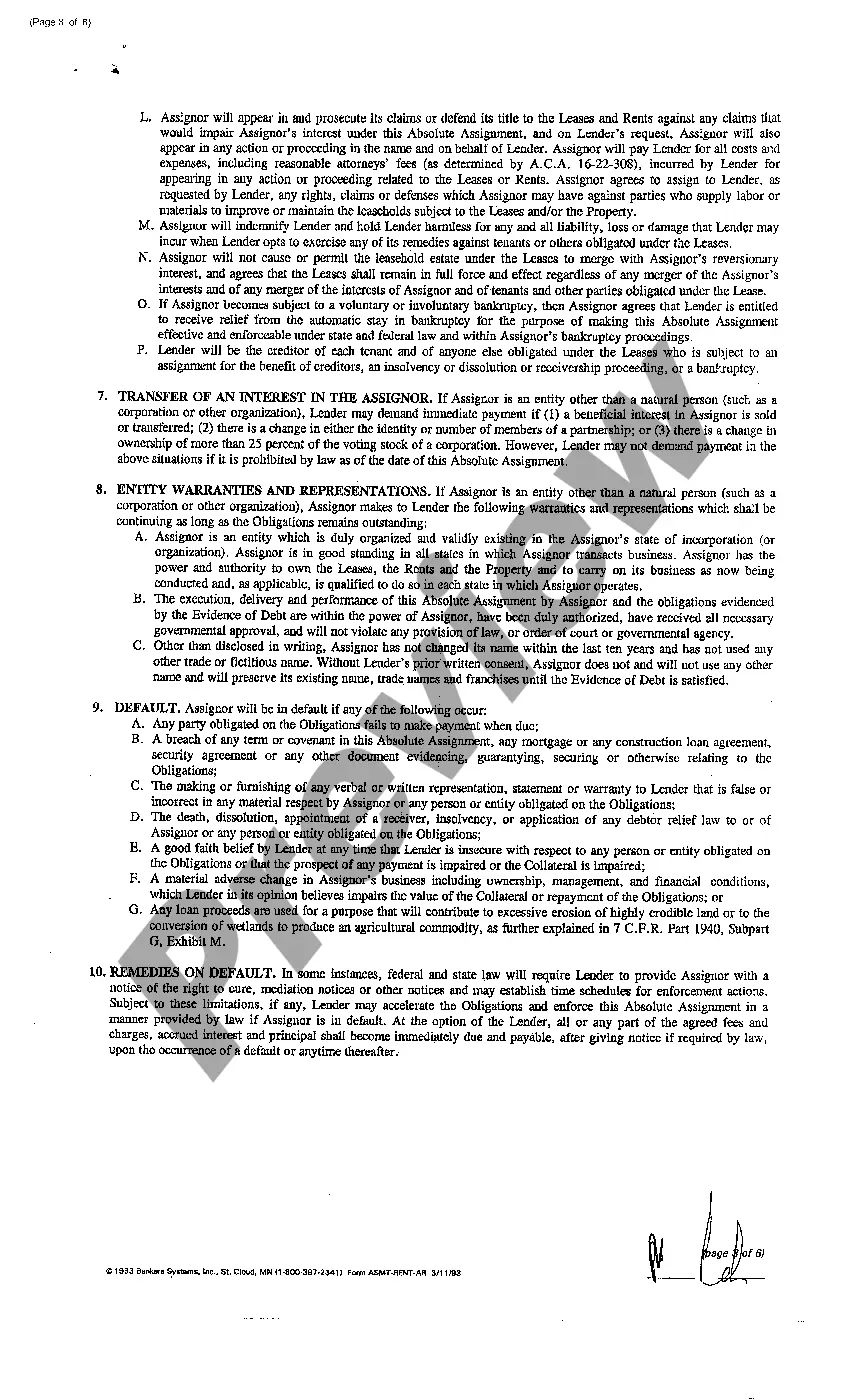

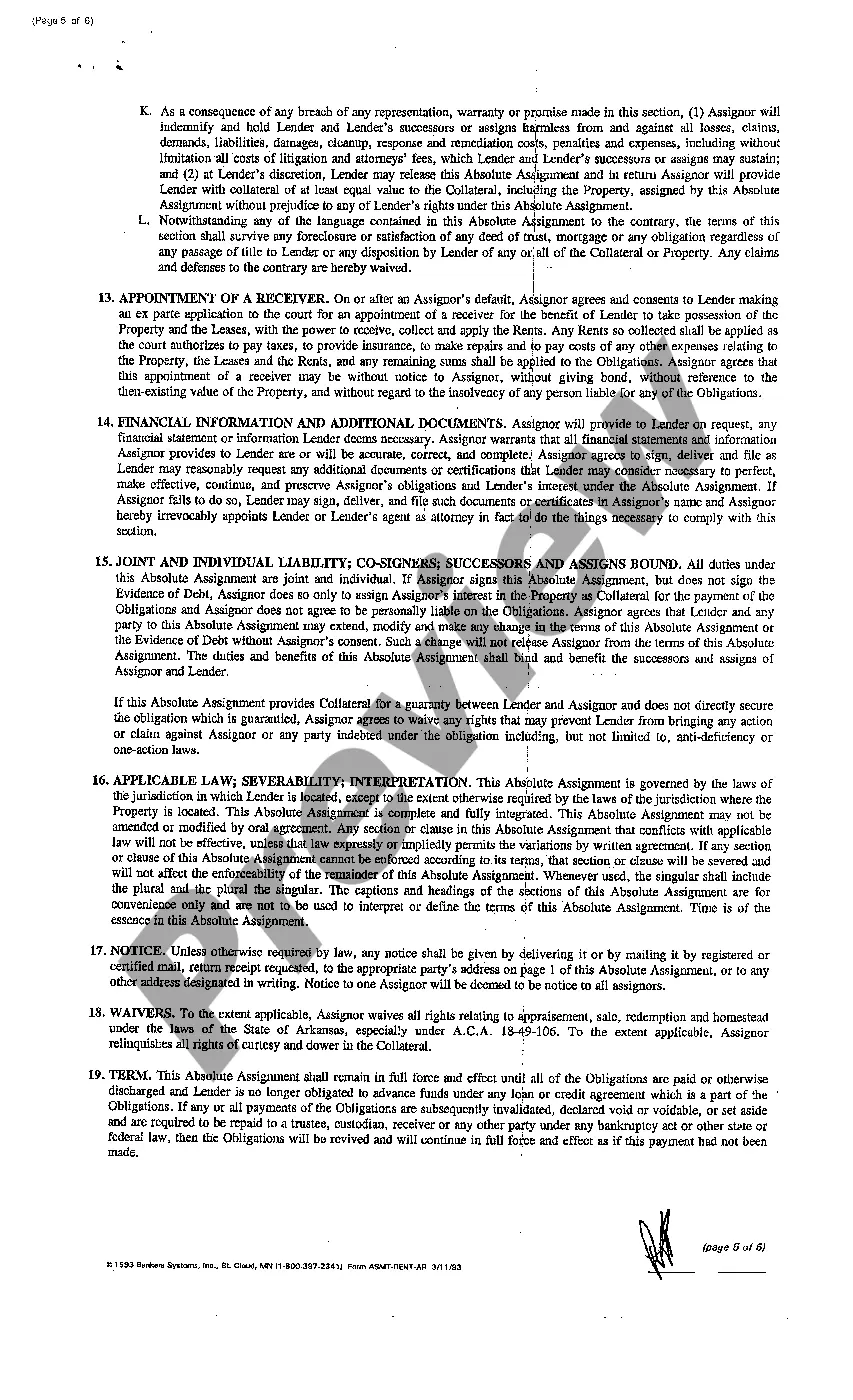

An absolute assignment form is a legal document that facilitates the transfer of ownership of a life insurance policy. Specifically, the absolute assignment form LIC captures essential details about the assignor, assignee, and the policy itself. Completing this form correctly is crucial to ensure a smooth transition of rights and responsibilities, providing clarity for all parties involved.

An absolute assignment in life insurance is a complete transfer of rights and benefits from the policyholder to another party. Once this assignment is executed, the assignee gains full control over the policy, including benefits upon maturity or in the event of the policyholder's death. To formalize this transfer, the absolute assignment form LIC must be properly filled and submitted.

The assignment of a LIC policy involves transferring ownership rights from the original policyholder to another individual or entity. This process allows the new owner to receive benefits such as the policy's maturity or death benefits. Using the absolute assignment form LIC simplifies this process, ensuring all legal requirements are met during the transfer.

LIC form 3762 is specifically designed for the purpose of assigning a life insurance policy. This form serves as a legal document that formalizes the transfer of rights from the policyholder to another party, known as the assignee. In order to complete the absolute assignment form LIC, ensure you fill out this form accurately for a smooth assignment process.

The LIC assignment process starts with gathering necessary details for the Absolute Assignment Form LIC. After you fill the form accurately, present it to your LIC office to initiate the assignment. Once the assignment is processed, your new assignee will gain complete control of the policy, ensuring a smooth transition.

To assign your LIC policy, you need to complete the Absolute Assignment Form LIC. After filling out the required information, submit it to your LIC branch for processing. Once approved, the assignment will be recorded, and the new owner will receive notifications regarding their rights.

Assignment and nomination serve different purposes in life insurance. Assignment involves transferring ownership rights, while nomination allows you to designate a beneficiary to receive the policy's benefits upon your passing. When considering an Absolute Assignment Form LIC, it's essential to understand this distinction to make informed decisions.

The assignment process in life insurance involves transferring policy rights from the original owner to another party. You must fill out an Absolute Assignment Form LIC, submit it to your insurance provider, and ensure they acknowledge the change. Once approved, the assignee has control over the policy and its benefits.

An absolute assignment occurs when you transfer all ownership rights of your life insurance policy to another person or entity. This means the assignee gains full control over the policy, including the ability to change beneficiaries and receive benefits. To formalize this process, you typically need to complete an Absolute Assignment Form LIC, which legally documents the transfer of rights.

Filling out the LIC policy assignment form requires specific information about both parties involved. Start by entering your policy number and details about the current owner and the new assignee. Clearly state the terms of the assignment and review all entries carefully to avoid mistakes. Using the Absolute assignment form lic simplifies this process, ensuring all critical details are covered for a smooth transition.