Dissolve Irrevocable Trust With Retained Income Interest

Description

Form popularity

FAQ

The 5 year rule in an irrevocable trust refers to a guideline that impacts Medicaid eligibility and asset transfers. Generally, it means that any assets transferred to the trust must not be accessible by the grantor for at least five years to avoid penalties. If you're looking to dissolve an irrevocable trust with retained income interest, be aware of this rule as it may affect your trust's status. Consulting UsLegalForms can help clarify these complex regulations and ensure compliance.

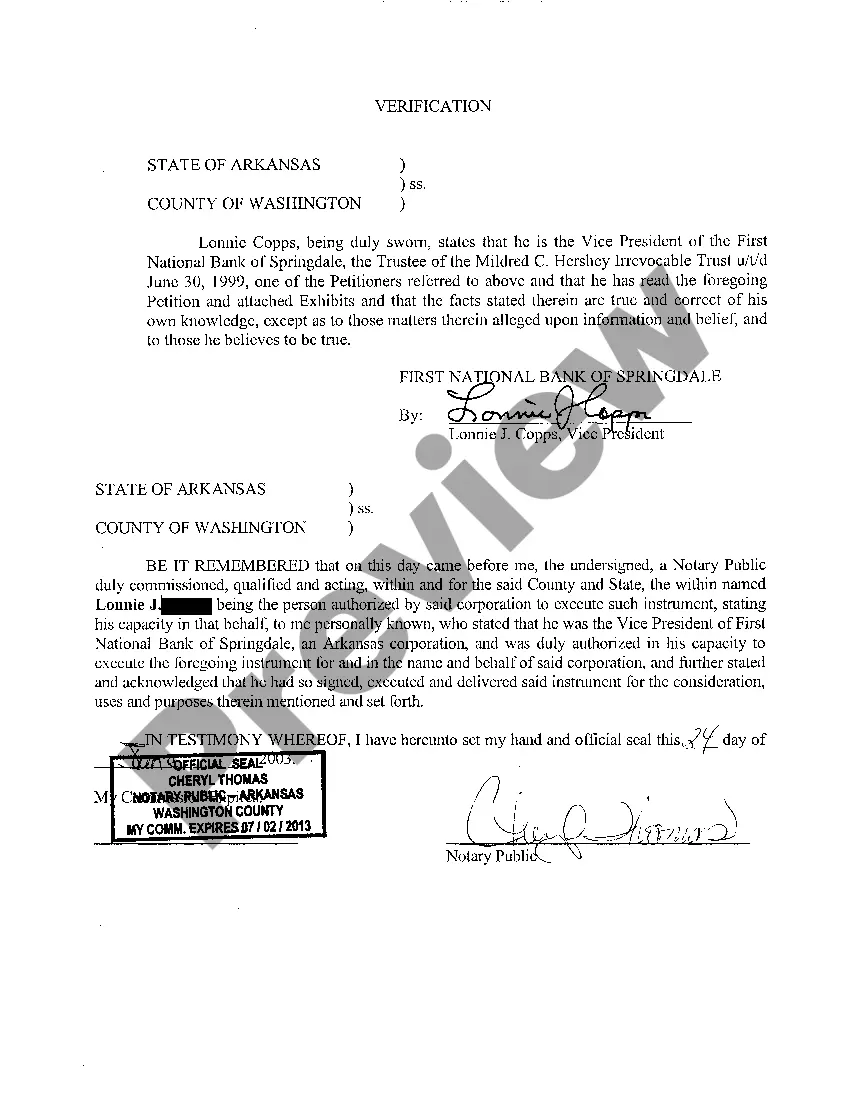

An irrevocable trust with retained income interest is a legal arrangement where the grantor transfers assets into a trust, retaining the right to receive income generated by those assets. This type of trust cannot be altered or dissolved by the grantor without the consent of the beneficiaries. If you're considering how to dissolve an irrevocable trust with retained income interest, understanding your rights and obligations is essential. UsLegalForms can provide valuable guidance during this process.

Dissolving an irrevocable trust can have significant tax consequences, including potential capital gains taxes and income tax on distributions. It's crucial to consult with a tax advisor to understand how these implications may affect you. When considering how to dissolve an irrevocable trust with retained income interest, being aware of these consequences can help you plan effectively.

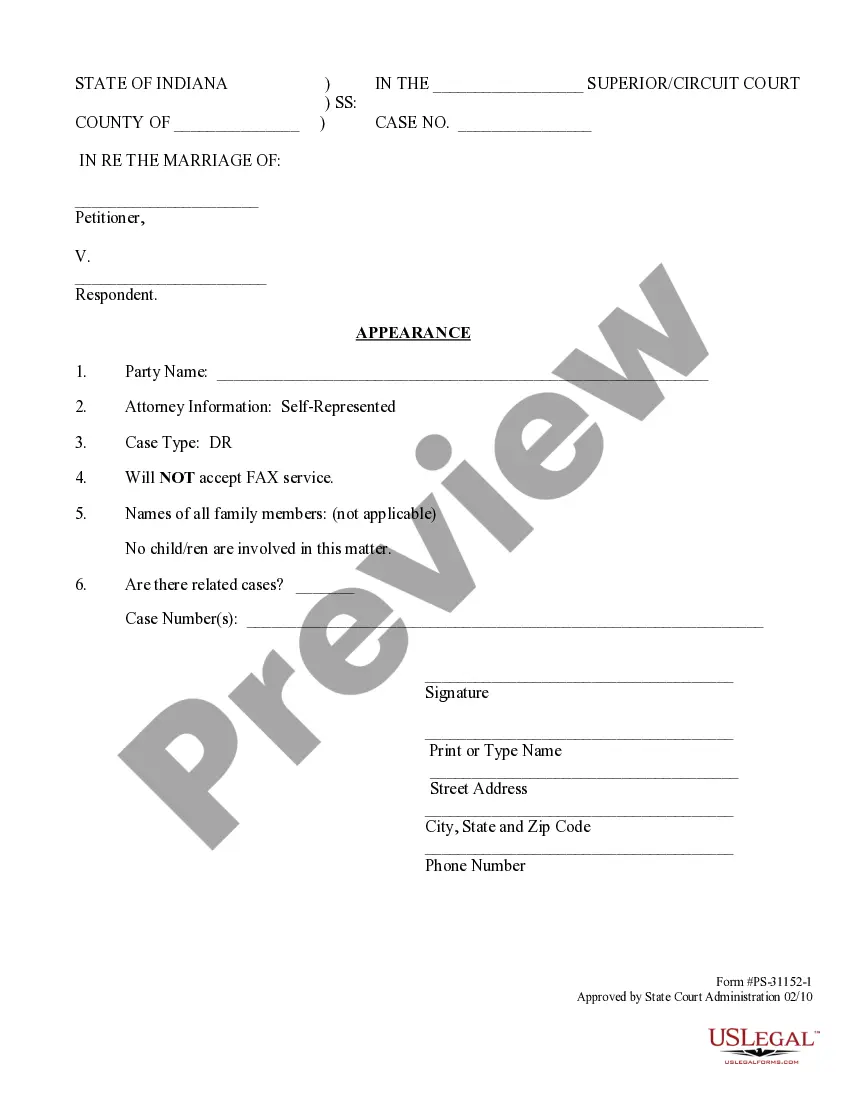

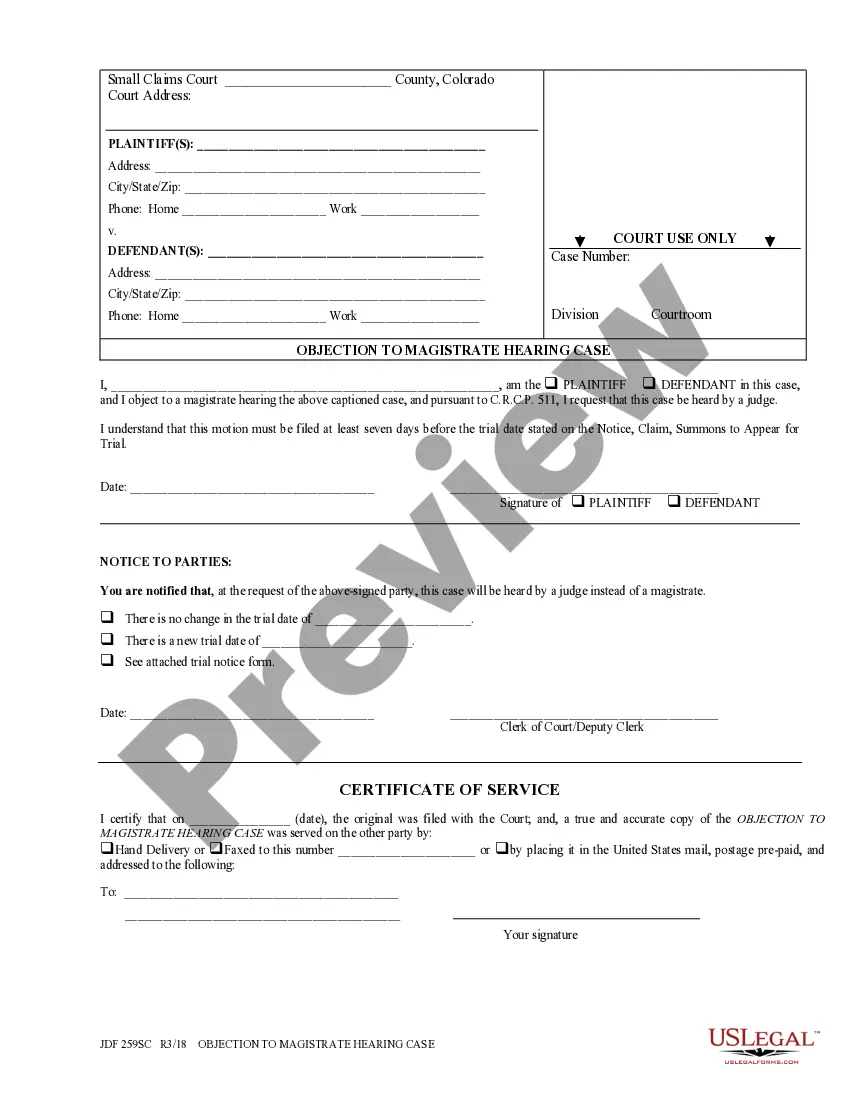

To dissolve an irrevocable trust, you generally need to follow procedures outlined in the trust agreement. This may involve gathering consent from beneficiaries and executing specific legal documents. If you're looking to dissolve an irrevocable trust with retained income interest, platforms like US Legal Forms can provide the necessary templates and guidance to streamline this process.

An irrevocable trust can be dissolved under certain circumstances, usually according to the trust's terms or state laws. Generally, the process involves the agreement of all beneficiaries and the trustee. If you plan to dissolve an irrevocable trust with retained income interest, it's important to approach this with careful consideration and support from legal professionals.

Yes, you can retain an income interest in an irrevocable trust if the trust document allows for it. This means you may receive benefits or distributions from the income generated by the trust's assets. If you're looking to dissolve an irrevocable trust with retained income interest, knowing your rights can help you navigate the process effectively.

Removing assets from an irrevocable trust can be a complex process. Generally, you will need permission from the trustee and sometimes the beneficiaries, depending on the trust's terms. If you're considering how to dissolve an irrevocable trust with retained income interest, it may be helpful to consult a legal professional for guidance.

Yes, an irrevocable trust account can earn interest. The income generated by the trust assets may accumulate within the trust, providing a steady income stream for beneficiaries. Understanding how to manage these earnings is essential if you wish to dissolve an irrevocable trust with retained income interest in the future.