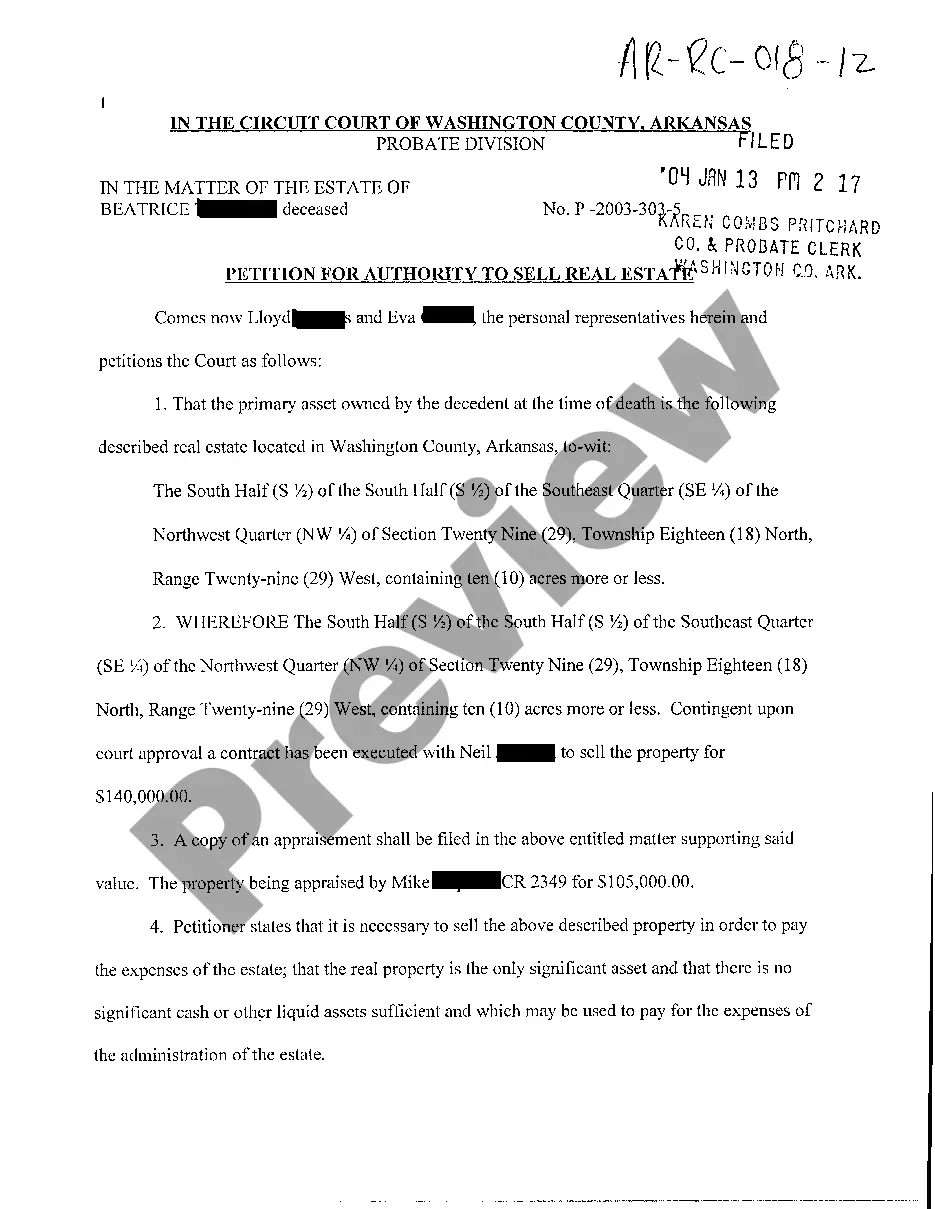

Authority To Sell Sample Format

Description

How to fill out Arkansas Petition For Authority To Sell Real Estate?

It’s well-known that you can’t become a legal authority instantly, nor can you quickly understand how to create an Authority To Sell Sample Format without having specific expertise.

Assembling legal documents is a lengthy endeavor that necessitates particular training and abilities. Therefore, why not entrust the drafting of the Authority To Sell Sample Format to the experts.

With US Legal Forms, one of the most extensive legal template repositories, you can discover everything from court documents to in-office communication templates. We recognize how crucial compliance and adherence to federal and local regulations are. That’s why, on our site, all templates are tailored to specific locations and are current.

Select Buy now. Once the payment is processed, you can obtain the Authority To Sell Sample Format, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

You can revisit your documents from the My documents section at any moment. If you’re an existing customer, you can easily Log In, and locate and download the template from the same section. No matter the reason for your forms—whether it’s financial and legal, or personal—our website is here to assist you. Experience US Legal Forms today!

- Begin by visiting our website and obtain the form you require in just a few moments.

- Locate the form you need by utilizing the search bar at the top of the webpage.

- Review it (if this option is available) and examine the accompanying description to determine if the Authority To Sell Sample Format is what you seek.

- If you require any other form, restart your search.

- Establish a free account and choose a subscription plan to purchase the template.

Form popularity

FAQ

A personal loan sanction letter is an official document issued by the lender to the applicant of the personal loan stating the approval of the application submitted by the borrower. The sanction letter contains all the relevant information about the personal loan for the borrowers to review the terms.

How to Draft a Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Do you need to notarize a Loan Agreement? First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

Consider including: Names and addresses of the parties to the agreement. Loan amount (principal). Interest rate. Repayment terms, including dates, and any late fees or penalties. Signature lines.