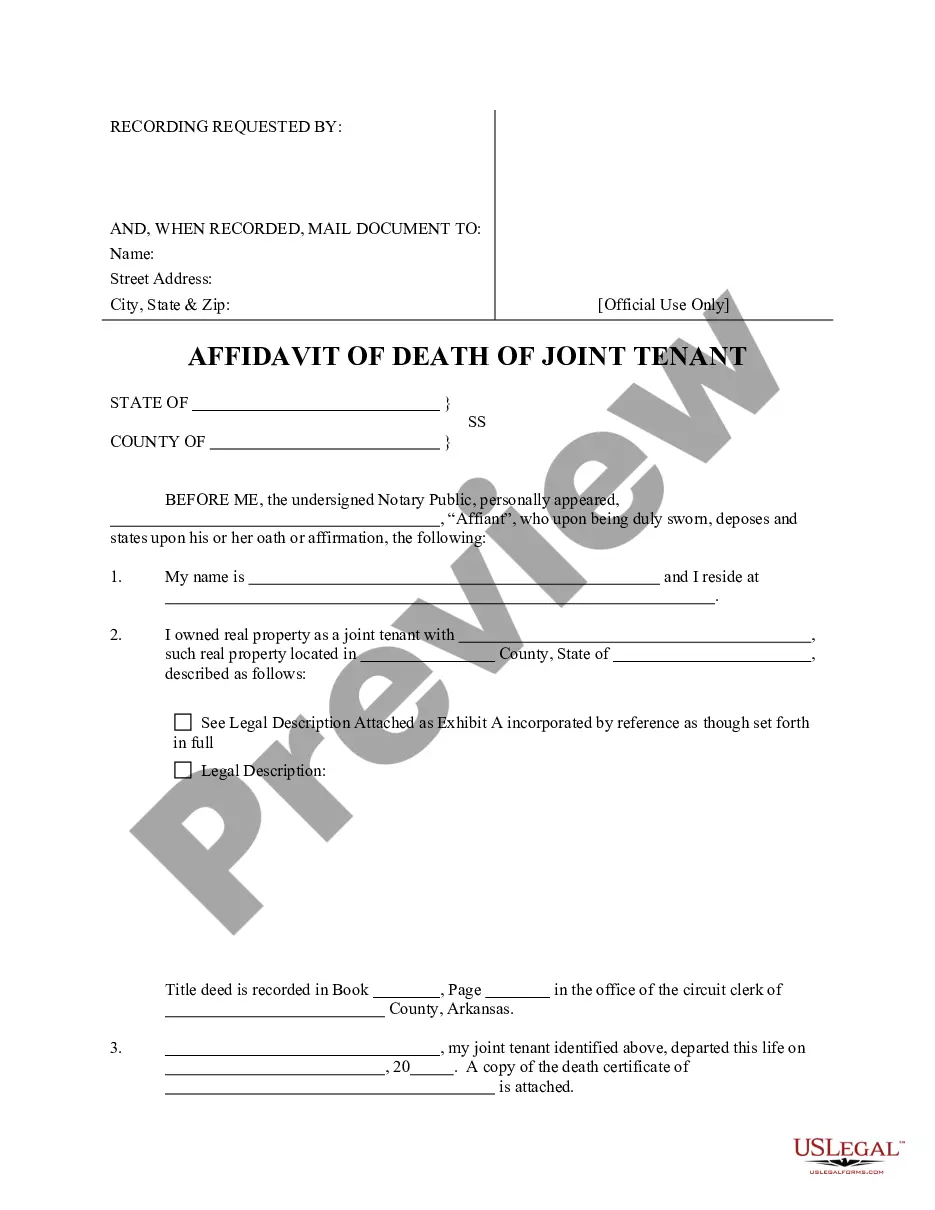

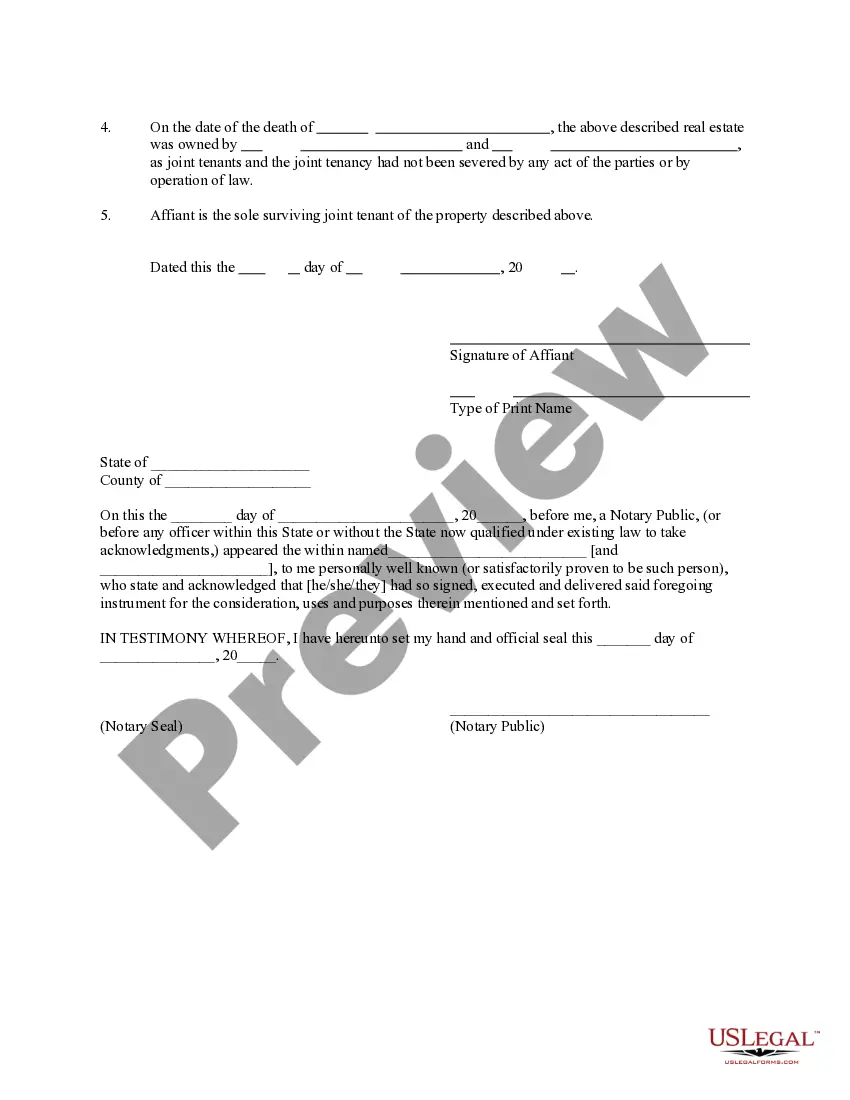

Affidavit Of Death Withdrawal Sample

Description

How to fill out Arkansas Affidavit Of Death Of Joint Tenant?

When you must complete the Affidavit Of Death Withdrawal Sample in accordance with your regional state's statutes and guidelines, there might be various alternatives to select from.

There's no justification to review every document to guarantee it fulfills all the legal requirements if you are a subscriber of US Legal Forms.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any topic.

Utilize Preview mode to view the form description if available.

- US Legal Forms is the largest online repository featuring a collection of over 85k ready-to-use documents for both business and personal legal needs.

- All templates are verified to comply with each state's statutes and regulations.

- Thus, when downloading the Affidavit Of Death Withdrawal Sample from our platform, you can rest assured that you retain a valid and contemporary document.

- Acquiring the required sample from our site is incredibly easy.

- If you already possess an account, simply Log In to the system, check that your subscription is active, and save the selected file.

- Later, you can access the My documents section in your profile and maintain access to the Affidavit Of Death Withdrawal Sample whenever needed.

- If it's your first time on our site, please follow the instructions below.

- Review the suggested page and verify it for alignment with your requirements.

Form popularity

FAQ

The surviving account holder will have to submit a written application informing about the death of account holder to the bank along with the copy of death certificate and copy of ID proof of the deceased. The copy of ID proof of the deceased account holder will be self-attested by the surviving account holder.

With reference to the above Current Account/ Savings Bank Account/ TDR Account I (Name and relationship to the Deceased) of Late Shri/Smt/Kum (name of the deceased) have to advise that I have no interest in the assets of

1. Mention name of the deceased and date of expiry. In case person is missing/not traceable (i.e., whereabouts of person is unknown for more than 7 years an order/certifffdcate of legal death/presumption of death may be issued by Court) mention date since missing.

Joint account with the deceased person Now, to remove the name of the deceased person from the joint account and nomination, a copy of the application and a photocopy of the death certificate should be presented to the bank branch. This will allow the bank to remove the deceased name from the bank account.

Withdrawing money from a bank account after death is illegal, if you are not a joint owner of the bank account.