Deed Tod Beneficiary With Distribution

Description

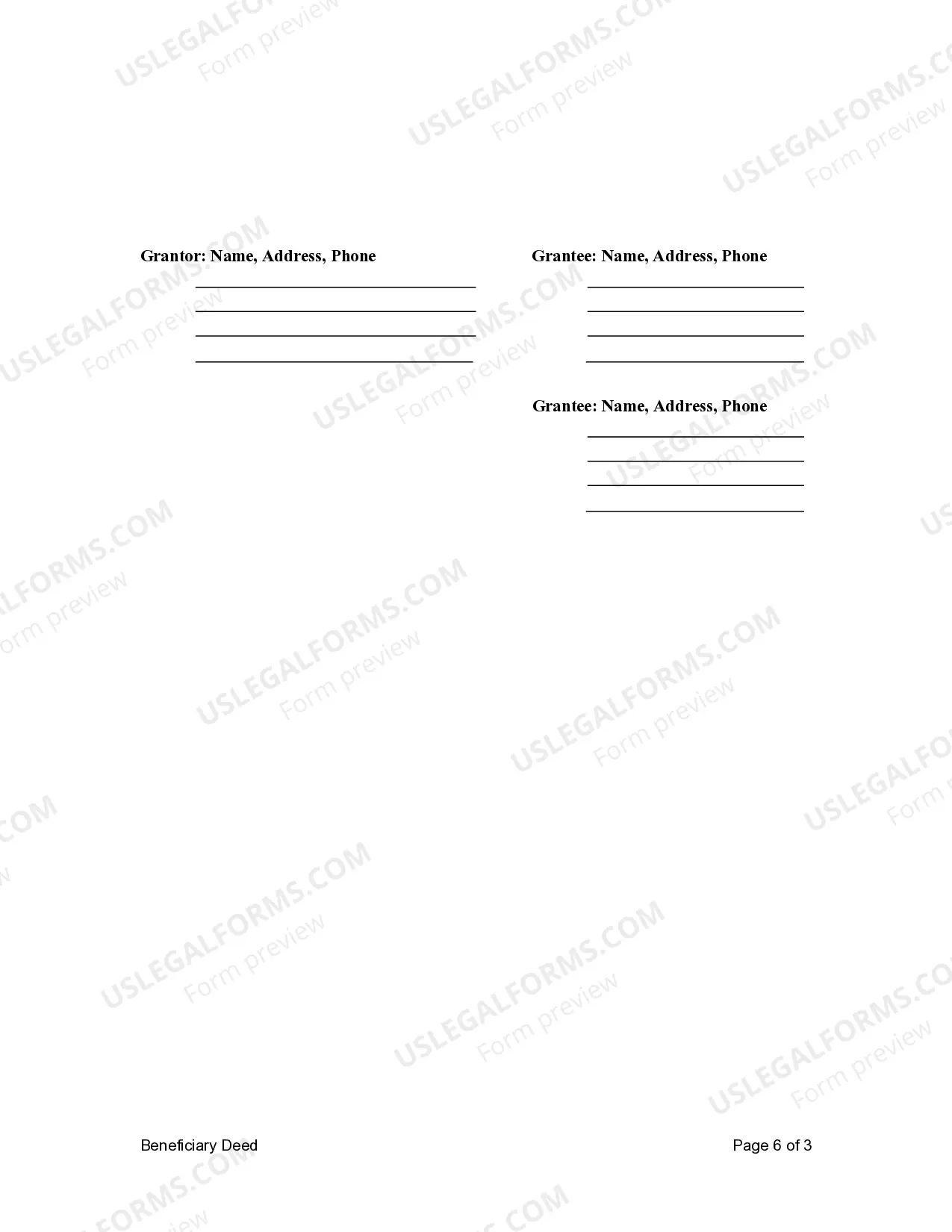

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For One Individual To Two Individuals?

Managing legal documents can be exasperating, even for experienced experts. When you seek a Deed Tod Beneficiary With Distribution and don’t have the opportunity to invest time in finding the correct and updated version, the processes can be challenging.

An effective web form repository can revolutionize the approach of anyone wanting to handle these matters efficiently. US Legal Forms is a frontrunner in online legal documents, offering over 85,000 state-specific legal forms accessible to you at any time.

Conserve time and effort searching for the documents you require, and leverage US Legal Forms’ advanced search and Preview feature to find Deed Tod Beneficiary With Distribution and obtain it. If you possess a membership, Log In to your US Legal Forms account, look for the form, and acquire it.

Check the My documents section to view the documents you have previously downloaded and to organize your folders as desired.

Experience the US Legal Forms online repository, supported by 25 years of knowledge and reliability. Change your routine document management into a seamless and user-friendly process today.

- Confirm it is the right form by previewing it and reviewing its details.

- Make sure the template is valid in your state or county.

- Select Buy Now when you are prepared.

- Choose a monthly subscription plan.

- Select the format you wish, and Download, complete, sign, print, and dispatch your documents.

- Obtain state- or county-specific legal and business documents. US Legal Forms addresses any needs you might have, from personal to corporate paperwork, all in one location.

- Utilize sophisticated tools to fill out and manage your Deed Tod Beneficiary With Distribution.

- Access a valuable resource hub of articles, manuals, and materials highly pertinent to your circumstances and requirements.

Form popularity

FAQ

While a transfer on death designation can help avoid the probate process, the assets are still subject to applicable estate taxes, capital gains taxes, and inheritance taxes.

The most important benefit of a TOD account is simplicity. Estate planning can help minimize the legal mess left after you die. Without it, the probate system can take over the distribution of your assets. It can also name an executor of your estate and pay off your remaining debts with your assets.

TOD accounts are also subject to inheritance tax and capital gains tax, as well as taxes on withdrawals from pre-tax investments including IRAs and 401(k) plans.

Invalidation and Probate The transfer on the death deed is rendered ineffective if the designated recipient passes away before the property owner. This could cause the property to enter probate without adequate planning or execution, negating the goal of using a transfer on the death deed to avoid probate.

There are various components to the titling of assets: One is using a transfer on death (TOD) designation, generally used for investment accounts, or a payable on death (POD) designation, used for bank accounts, which act as beneficiary designations, stating to whom account assets are to pass when the owner dies.