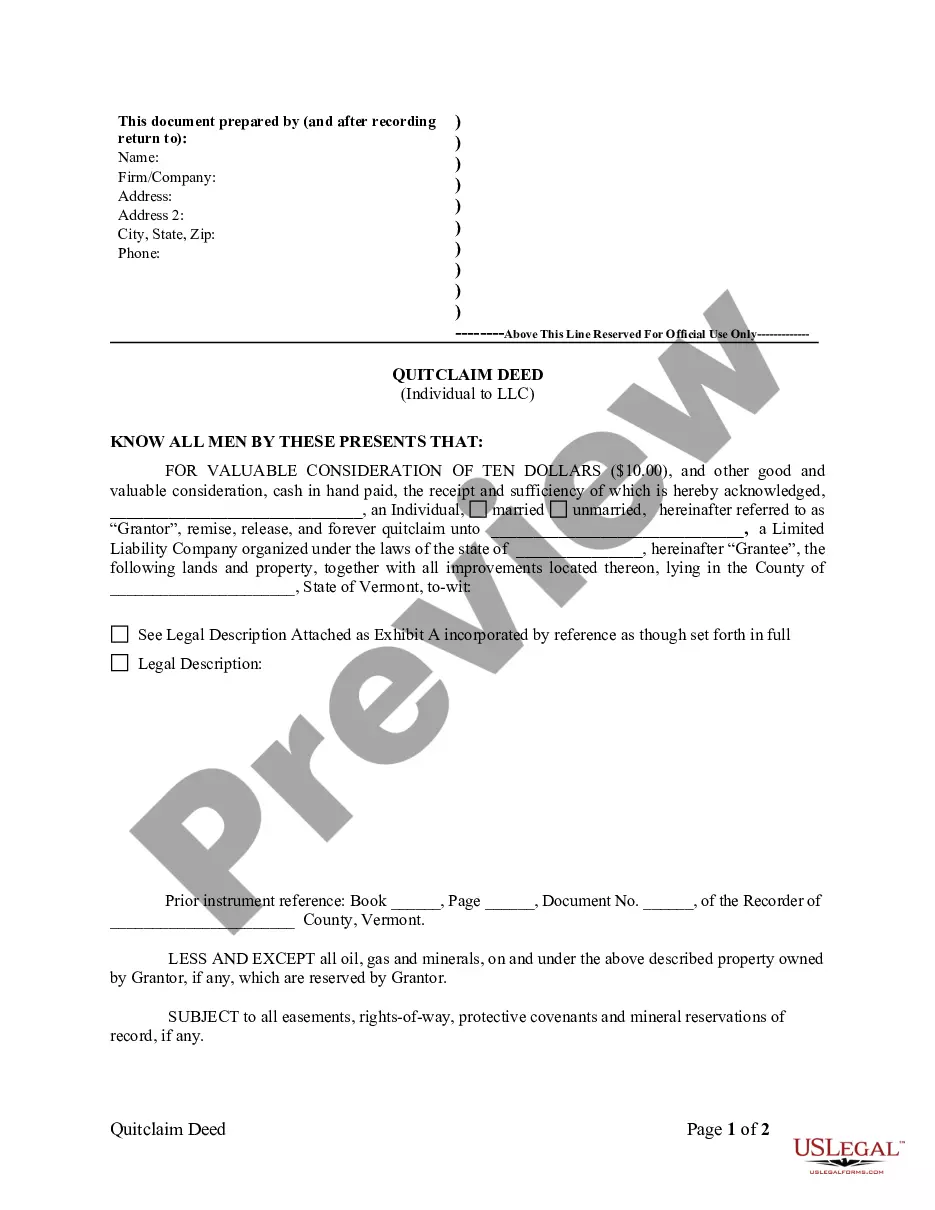

This form is a Transfer on Death Deed, or Beneficiary Deed, where the grantor is an individual and the grantees are four individuals. If one or more grantees fail to survive the grantor their interest goes to their estate or the surviving grantees. This transfer is revocable by Grantor until death and effective only if filed prior to grantor's death. This deed complies with all state statutory laws.

Transfer Death Beneficiary Form For A Family Member

Description

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For One Individual To Four Individuals?

- Log in to your US Legal Forms account if you are an existing user or sign up to create a new account.

- Navigate to the preview section and review the descriptions to select the accurate beneficiary form suited for your jurisdiction.

- If needed, search for alternative templates using the search bar to find a form that exactly matches your requirements.

- Once you find the correct document, click the Buy Now button and select your preferred subscription plan.

- Complete your purchase by entering your payment details, choosing from credit card or PayPal options.

- Download the completed form directly to your device, and access it anytime through the My Forms section of your profile.

In conclusion, using US Legal Forms provides a reliable and comprehensive solution for managing legal documents. Their extensive library and premium support ensure you can easily create accurate paperwork.

Start your legal document management journey today with US Legal Forms and experience the ease of accessing a wide range of legal forms tailored to your needs.

Form popularity

FAQ

A beneficiary is an individual or entity designated to receive assets from an estate, while transfer on death (TOD) is a legal mechanism that facilitates this transfer outside of probate. The transfer death beneficiary form for a family member outlines your wishes clearly, ensuring that assets like bank accounts or real estate transfer directly to the designated beneficiary upon your passing. This method is advantageous because it streamlines the process, reduces delays, and maintains privacy compared to traditional probate procedures.

Using a transfer on death designation does not inherently avoid inheritance tax; this tax depends on your state's laws and the total value of the estate. However, the transfer death beneficiary form for a family member can help minimize tax implications because it allows assets to pass directly to the beneficiary without going through probate. Understanding your state's regulations can be beneficial, so consider consulting with a tax professional or legal advisor for clarity. Platforms like USLegalForms can help navigate these complexities efficiently.

A transfer on death (TOD) can provide a more straightforward solution than a will when designating a transfer death beneficiary form for a family member. Unlike a will, a TOD allows assets to bypass probate, making the transfer process quicker and often less costly. This means that your loved ones can receive their inheritance without going through lengthy legal proceedings. Many people find this simplicity appealing, especially when they want to ensure their family members have immediate access to necessary assets.

A beneficiary is an individual named to receive assets from an account or estate, while transfer on death (Tod) is a legal designation that allows beneficiaries to receive assets automatically upon your death. The transfer death beneficiary form for a family member is an important document that facilitates this process. By understanding these distinctions, you can ensure a smoother transfer of your assets to your loved ones.

Another name for a transfer on death (Tod) is a death beneficiary designation. This term describes the same process where you designate a beneficiary to receive your assets upon your death. It's crucial to complete the transfer death beneficiary form for a family member to ensure your assets are transferred according to your wishes. Understanding these terms can help you make informed decisions about your estate planning.

A transfer on death (Tod) account may come with some disadvantages, such as limited control over the assets during your lifetime. The beneficiary may not have access to the funds until you pass away. Additionally, if you do not properly complete the transfer death beneficiary form for a family member, it can lead to disputes among heirs after your death. It's essential to weigh these factors before deciding on this type of account.

To set up a transfer on death (Tod) account, you should first contact your bank or financial institution for their specific requirements. Generally, you will need to fill out a transfer death beneficiary form for a family member. This form allows you to name a beneficiary who will receive the assets in the account upon your passing. It’s important to ensure that all documentation is accurate to avoid any issues later.

A transfer on death (TOD) is a method to transfer assets directly to a beneficiary upon death, but it is not the same as a general beneficiary designation. While both serve to designate who receives property after you pass, a TOD specifically applies to real estate. To ensure that your wishes are clear, you may need a transfer death beneficiary form for a family member for each applicable asset.

Determining whether a transfer on death (TOD) or a beneficiary designation is better depends on your personal situation. A TOD allows property to pass directly to your chosen beneficiary without going through probate. In contrast, a beneficiary designation may apply to different types of assets, such as life insurance or retirement accounts. It is essential to consider your entire estate when making this choice.

One disadvantage of a transfer on death (TOD) designation is that it may not address all aspects of your estate. For instance, if there are debts or taxes owed, the beneficiary may be responsible for those. Additionally, a transfer death beneficiary form for a family member does not replace a will, which means that other assets may not be distributed according to your wishes. Thus, a TOD should be part of a broader estate plan.