Trust Deed With Assignment Of Rents

Description

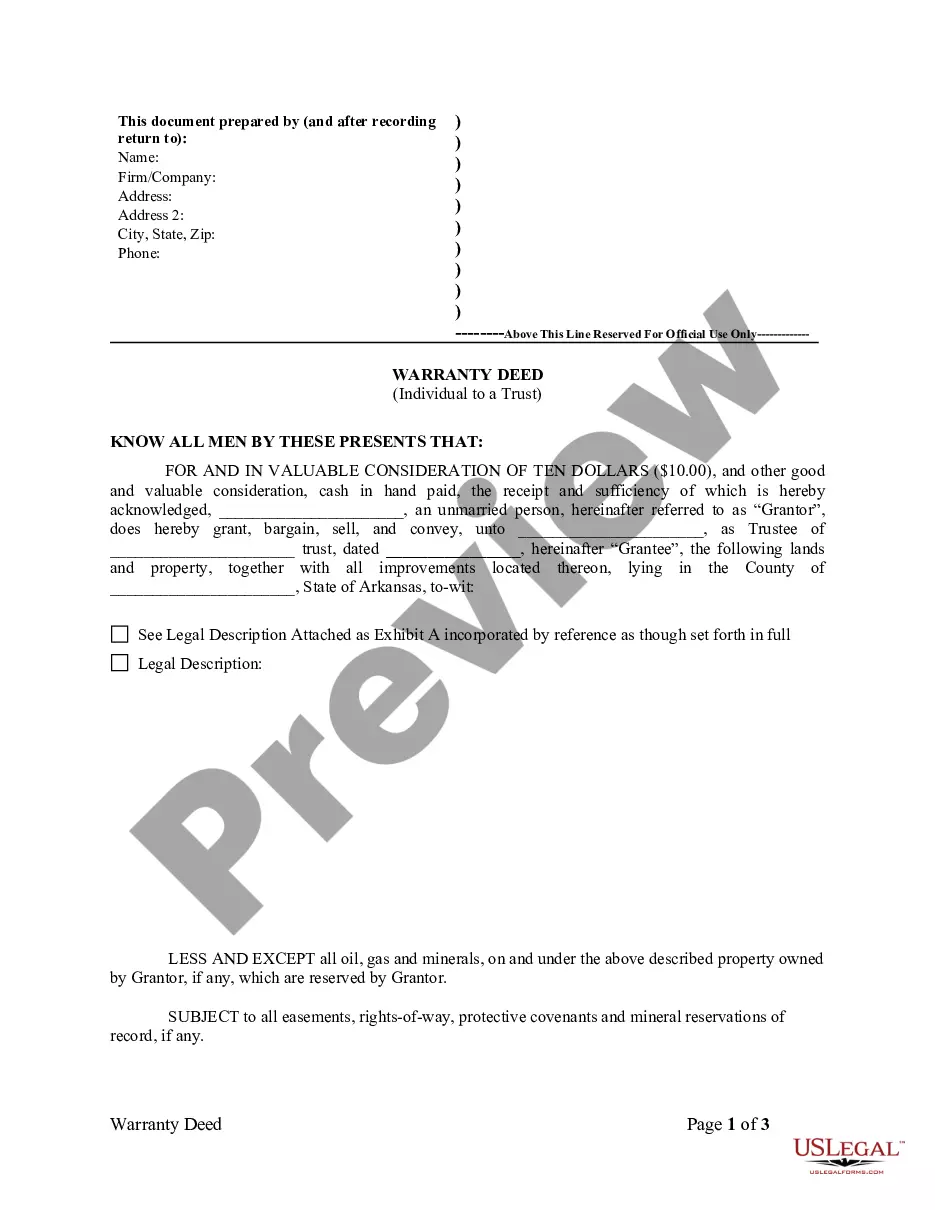

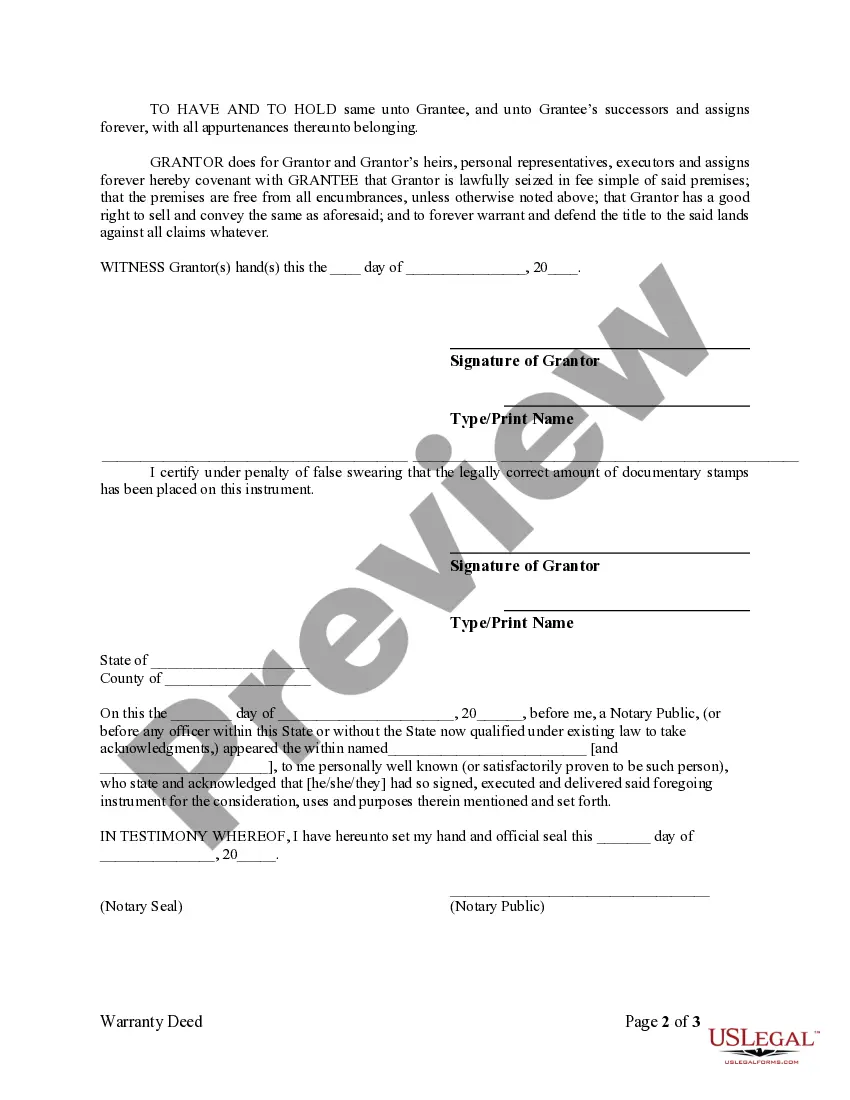

How to fill out Arkansas Warranty Deed From Individual To A Trust?

- To begin, access your US Legal Forms account. If you're a returning user, simply log in to download your desired template.

- If you are new to the service, review the form descriptions in Preview mode to find the trust deed with assignment of rents that suits your needs and complies with your local jurisdiction.

- Should you require a different template, utilize the Search tab to explore additional options until you find the correct document.

- Proceed to purchase the form by clicking the Buy Now button and selecting a subscription plan that fits your requirements. Registration for an account is necessary to access all resources.

- Finalize your acquisition by entering your payment information or opting for PayPal to complete the subscription process.

- Download your form and save it to your device. You can also access it anytime in the My Forms section.

US Legal Forms empowers users by providing a robust collection of over 85,000 editable legal documents. With access to premium experts for assistance, you can ensure your submissions are accurate and valid.

Don't delay in securing the legal forms you need. Visit US Legal Forms today to streamline your documentation process!

Form popularity

FAQ

The primary purpose of an assignment of rents is to secure the lender's interest in rental income stemming from a property. By incorporating an assignment of rents into your trust deed with assignment of rents, lenders can effectively mitigate risks associated with borrower defaults. This arrangement not only protects the lender's capital but also allows for a smoother financial transaction process, benefitting everyone involved.

An assignment of deed of trust transfers the lender's rights to a third party, which can include the power to collect payments from the borrower. When you enter into a trust deed with assignment of rents, this ensures that the lender can access rental income directly if the borrower fails to meet their obligations. This process aids in streamlining the relationship between borrowers and lenders, ensuring a level of security for all parties involved.

An assignment of rents is a legal provision in a trust deed that allows a lender to collect rental income from a property if the borrower defaults. This means that if you finance a property through a trust deed with assignment of rents, your lender has the right to take control of the rental income to cover unpaid debts. Understanding this concept is crucial for both lenders and borrowers, as it protects the lender's investment while providing borrowers with necessary flexibility.

The assignment of trust refers to the transfer of rights and obligations under a trust agreement. This process allows another party to take over responsibilities or benefits previously held. Understanding the assignment of trust is vital, especially when it aligns with a trust deed with assignment of rents, to secure financial transactions related to property rental.

An assignment deed of trust refers to the transfer of rights under a trust deed from one party to another. This can occur to streamline the management or sale of the property. When you utilize a trust deed with assignment of rents, the new holder may gain rights to collect rental income, ensuring smoother operations and potential investment opportunities.

A deed of assignment allows a property owner to transfer their rights to receive rental income to another party. This document helps secure financing or manage properties effectively. By incorporating a trust deed with assignment of rents, property owners can ensure lenders have priority access to rental income, enhancing financial stability.

Lenders typically benefit the most from the assignment of rent clause in a trust deed, as it provides them with enhanced security. This clause ensures they can access rental income directly in case of borrower default. Consequently, a trust deed with assignment of rents adds a layer of protection that supports the lender's investment.