Support Letter For Parole Withdrawal

Description

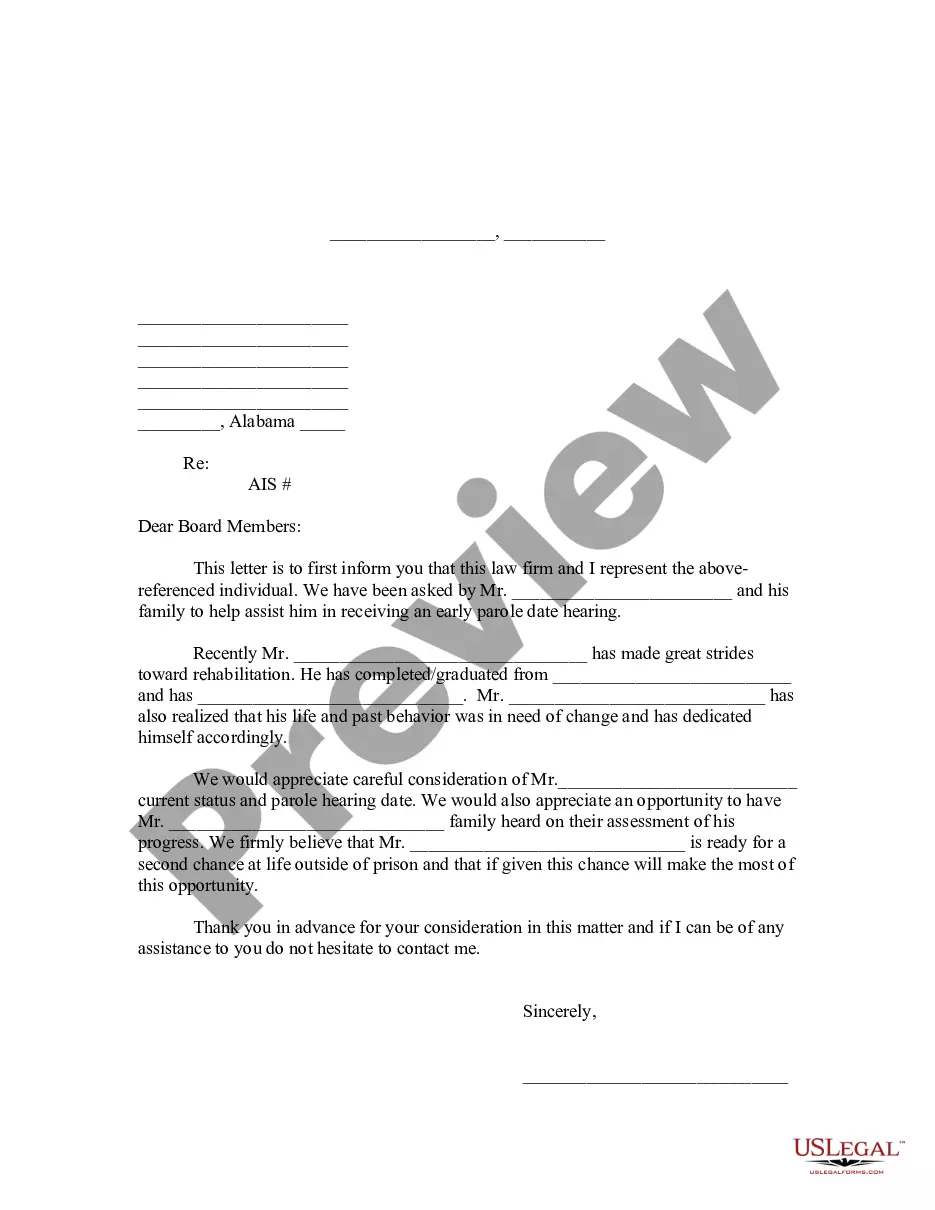

How to fill out Alabama Letter To Parol Board Members By Attorney Requesting Parol Of Inmate For Family?

The Parole Withdrawal Support Letter present on this page is a versatile formal template created by experienced attorneys in accordance with federal and state statutes and regulations.

For over 25 years, US Legal Forms has delivered individuals, organizations, and legal professionals with over 85,000 validated, state-specific documents for various business and personal needs. It’s the quickest, easiest, and most reliable method to acquire the necessary documents, as the service ensures the utmost level of data security and anti-malware safeguards.

Register for US Legal Forms to have verified legal templates for every aspect of life readily available.

- Search for the document you require and review it.

- Look through the file you've searched and view it or read the form description to confirm it meets your requirements. If it doesn’t, utilize the search feature to find the suitable one. Click Buy Now once you have found the necessary template.

- Enroll and Log In.

- Choose the payment plan that fits you and set up an account. Use PayPal or a credit card for a swift transaction. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the fillable template.

- Select the format you desire for your Parole Withdrawal Support Letter (PDF, DOCX, RTF) and download the example onto your device.

- Complete and sign the document.

- Print the template to fill it out by hand. Alternatively, employ an online versatile PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature.

- Re-download your documents as needed.

- Use the same template again whenever required. Access the My documents section in your profile to redownload any previously saved documents.

Form popularity

FAQ

Section 27-7-29, Mississippi Code of 1972, is brought forward as follows: 27-7-29. (a) Except as otherwise provided in subsection (b) of this section, all income received by the following organizations shall be exempt from taxation under this article: (1) Fraternal beneficiary societies, orders or associations.

Mississippi has a flat 5.00 percent individual income tax. Mississippi also has a 4.00 to 5.00 percent corporate income tax rate. Mississippi has a 7.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 7.07 percent.

The county assessor shall from time to time by personal inspection and examination, by himself or deputies, gather and record, in writing, any and all available data and information bearing upon the location, number, amount, kind and value of any and all property and persons which he is required by law to assess; and ...

Upon such payment to the chancery clerk as hereinabove provided, he shall execute to the person redeeming the land a release of all claim or title of the state or purchaser to such land, which said release shall be attested by the seal of the chancery clerk and shall be entitled to be recorded without acknowledgment, ...

Mississippi Business Taxes This tax is imposed on corporations or associations doing business in Mississippi. The Franchise tax is calculated at $2.50 per $1,000 of the value of the capital employed or the assessed property values in Mississippi, whichever is greater. The minimum franchise tax payment due is $25.

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

It shall be the duty of the collector to give notice, in writing, to the debtor of such taxpayer, which notice shall bind the debt in his hands and to the delinquent taxpayer, if he be a resident of the county, five (5) days before sale.

If the business income of the corporation is derived solely from property owned or business done in this state and the corporation is not taxable in another state, the entire business income shall be allocated to this state.