Cosigner Finder For Car

Description

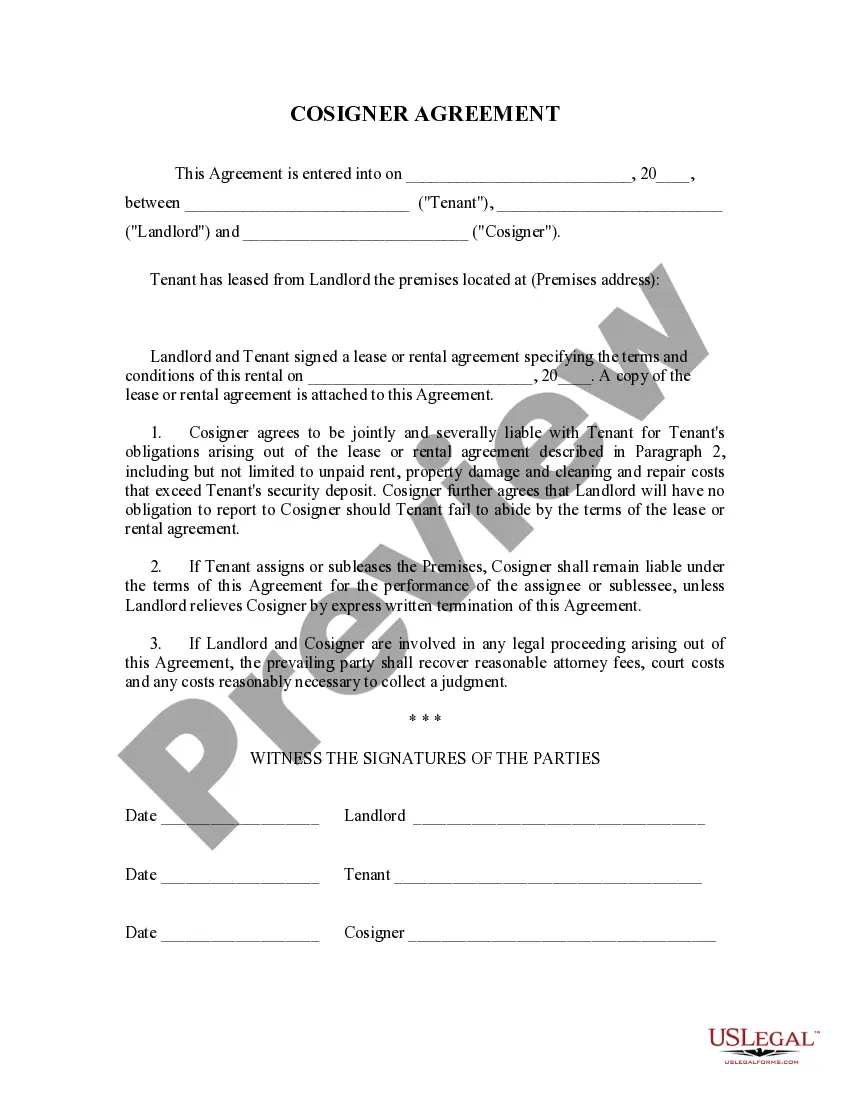

How to fill out Alabama Landlord Tenant Lease Co-Signer Agreement?

Individuals frequently link legal documentation with something intricate that only a specialist can handle.

In a sense, this is accurate, as creating a Cosigner Finder For Car necessitates considerable knowledge in subject matter criteria, such as state and local laws.

Nonetheless, with the US Legal Forms, the process has become more straightforward: ready-to-use legal templates for any life and business situation specific to state laws are compiled in a single online directory and are now accessible to everyone.

All templates in our collection are reusable: once purchased, they remain saved in your profile. You can access them whenever required via the My documents tab. Explore all advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current forms categorized by state and field of use, allowing you to search for a Cosigner Finder For Car or any other specific template in just minutes.

- Users who have previously registered with an active subscription need to Log In to their account and click Download to get the form.

- New users on the platform will first need to create an account and subscribe before they can save any documentation.

- Here is the step-by-step guide on how to obtain the Cosigner Finder For Car.

- Review the page content thoroughly to ensure it meets your requirements.

- Read the form description or confirm it through the Preview option.

- Look for another sample using the Search bar above if the previous one does not fit your needs.

- Press Buy Now when you locate the appropriate Cosigner Finder For Car.

- Select a subscription plan that meets your needs and financial plan.

- Create an account or Log In to move to the payment page.

- Make the payment for your subscription using PayPal or your credit card.

- Choose the format for your document and click Download.

- Print your form or upload it to an online editor for quicker completion.

Form popularity

FAQ

Being a cosigner carries financial risk since you are responsible for the debt if the primary borrower defaults. This means that any missed payments can adversely affect your credit score. Additionally, you might face difficulties obtaining new loans, as the debt may impact your overall debt-to-income ratio. Utilizing our cosigner finder for car, you can make informed decisions by understanding the responsibilities involved.

If you cannot find a cosigner, first evaluate your financial situation and budget. Consider using a cosigner finder for car that connects you with potential cosigners in your network, or look into credit-building options that may qualify you for loans independently. Furthermore, consider engaging platforms like uslegalforms, which can provide useful resources and guides that help you navigate your financing challenges.

To obtain a cosigner release form, contact your lender directly as they often provide the required documents. You'll need to meet specific criteria before the release is granted, such as making timely payments for a certain number of months. Once you have the document, follow the lender's instructions for completing and submitting it. Using a cosigner finder for car can help clarify the process and requirements.

To add a cosigner to a car, start by contacting your lender and expressing your intent. You will need to provide the cosigner's information, including credit history and income details, for evaluation. The lender will then assess the situation and inform you of the next steps to legally add the cosigner to your car financing agreement. Consider utilizing a cosigner finder for car services to expedite the process.

Yes, a cosigner can be added to the car title, depending on the lender's policies. It usually requires both the primary borrower and the cosigner to sign the title application. Additionally, some states may have specific regulations about changing the title. Using a cosigner finder for car can help you understand these requirements better.

To add a cosigner to your car, you typically need to contact your lender. Provide them with the necessary information about the cosigner, like their personal and financial details. Once the lender reviews and approves the cosigner, they will guide you through the paperwork. A cosigner finder for car tools may help you locate someone who fits the requirements for cosigning.