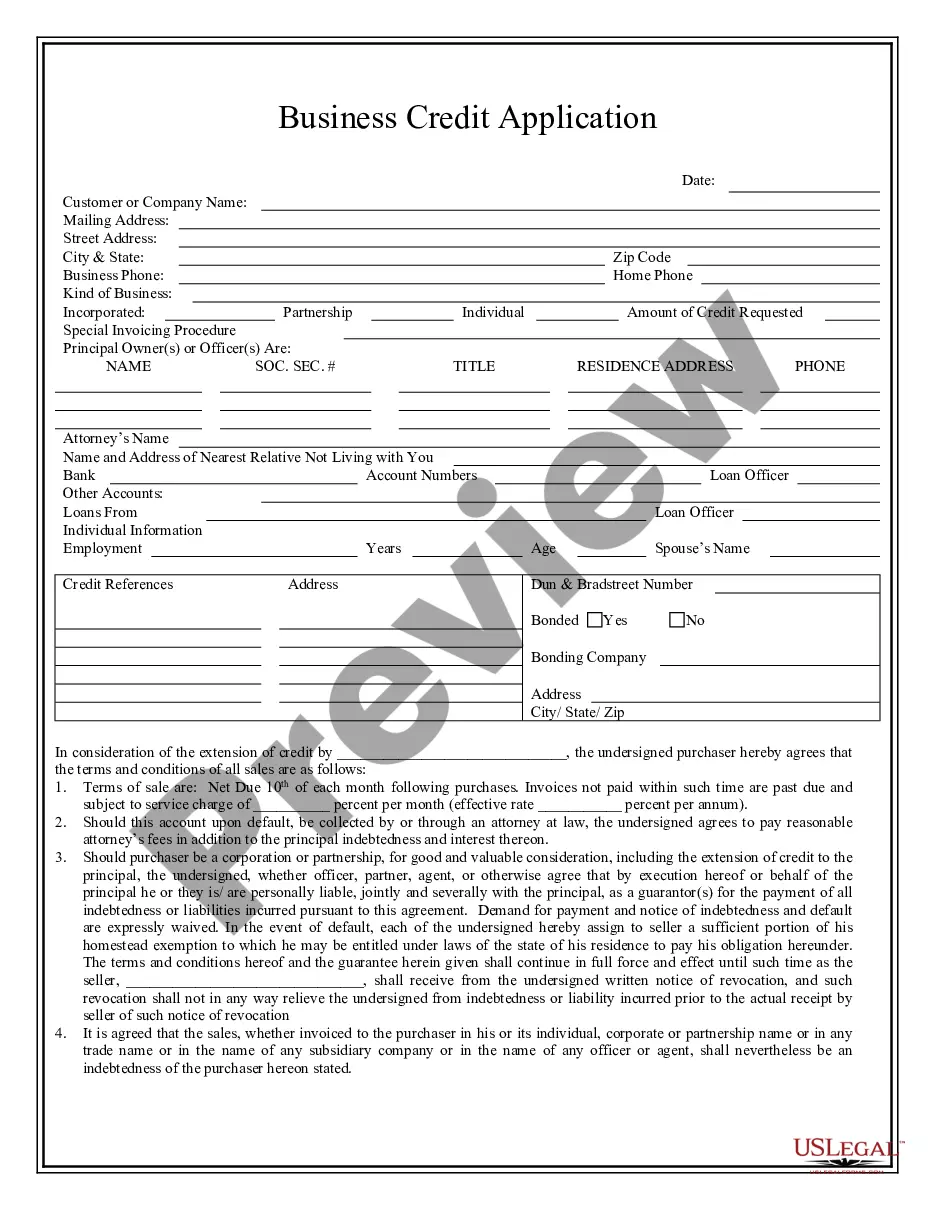

Business Credit Applications

Description

How to fill out Alabama Business Credit Application?

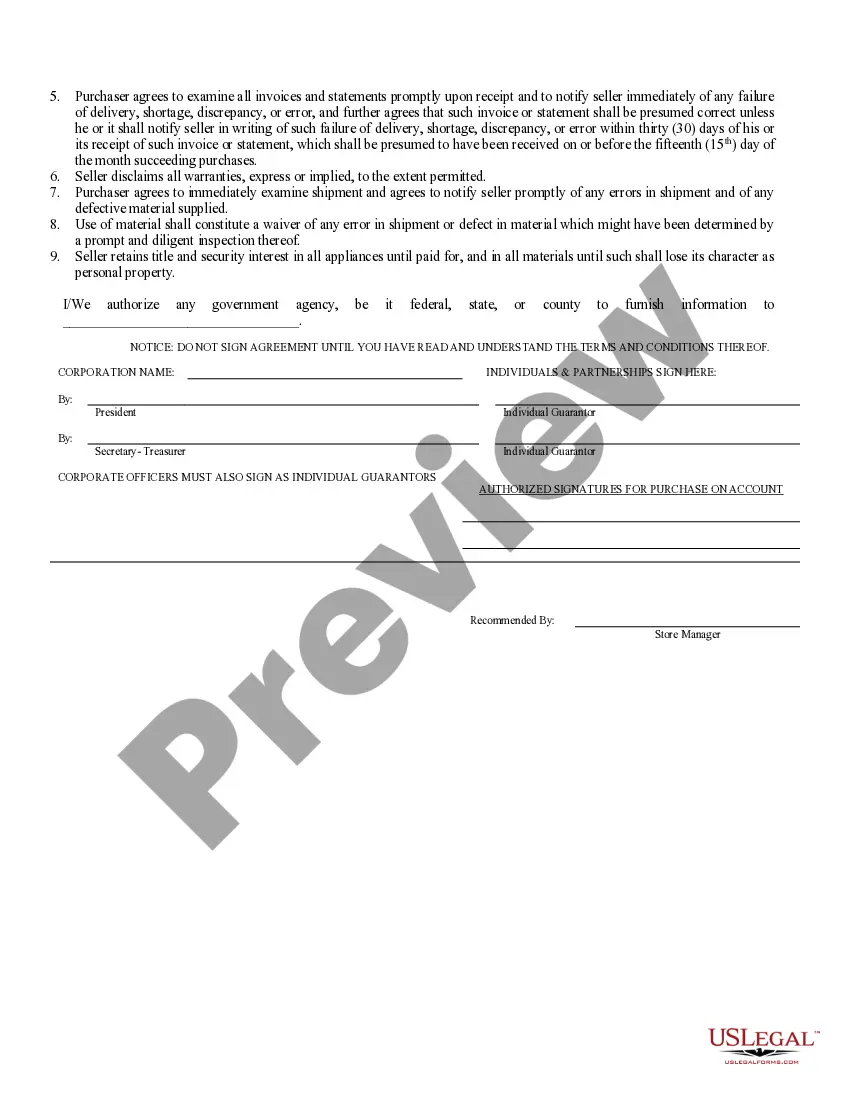

- If you are a returning user, log in to your account and click the Download button for your desired template. Ensure your subscription is active; renew if necessary.

- For first-time users, start by checking the Preview mode and form description to confirm you've selected the appropriate template that meets your specific needs.

- If the selected form doesn’t meet your requirements, utilize the Search tab to find another option that aligns with local jurisdiction standards.

- Once you select a suitable document, click the Buy Now button and choose your preferred subscription plan. You will need to create an account for full library access.

- Proceed to make your payment by entering your credit card information or using PayPal to finalize your subscription.

- After your purchase, download the form to your device, and you'll find it in the My Forms section of your profile for future reference.

US Legal Forms significantly streamlines the business credit application process by offering an extensive array of legal documents that are easy to use and edit. With access to premium expert support, users can ensure their documents are accurate and compliant.

Don't let the paperwork slow you down. Leverage US Legal Forms today to simplify your business credit applications and ensure you have the right documents at your fingertips.

Form popularity

FAQ

When applying for new business credit, you should be realistic and honest about your annual business revenue. If your business is new and has no revenue, you can estimate based on your business plan or projected sales. Maintain transparency, as mismatched figures can lead to complications with your business credit applications. Remember, presenting a clear financial outlook contributes positively to your application’s credibility.

Filling out a business credit card application involves providing accurate and comprehensive information about your business. Start by gathering necessary documentation such as financial statements and your EIN. Carefully fill in required fields, ensuring correct spelling and numbers to avoid delays in processing. Using resources from platforms like USLegalForms can streamline this process, making sure you don’t miss any critical details.

Yes, you can use your Employer Identification Number (EIN) instead of your Social Security Number (SSN) when applying for business credit. This option is particularly useful for LLCs and corporations, as it helps separate personal and business finances. Always check if the lender accepts EINs for business credit applications, as requirements can vary. Properly utilizing your EIN can enhance your business's credibility.

When completing a business credit card application, include key information such as your business legal name, EIN, revenue, and time in business. You should also provide personal information if you are personally guaranteeing the card. Accurately and honestly detailing your business operations will lead to successful business credit applications. Ensuring all details are correct can help speed up the approval process.

Getting approved for a business credit card often depends on your business's credit history and financial condition. Lenders typically look for a strong credit profile, steady revenue, and a solid business plan. If you carefully prepare and submit your business credit applications, chances of approval can increase. Using a reputable service like USLegalForms can guide you through the application process.

Obtaining a business credit card with your LLC is not overly challenging, especially if your business has established a good credit history. Lenders typically look at your business’s financial activity and credit score when processing business credit applications. By ensuring that your LLC meets all qualifications and organizes its finances, you increase your chances of approval.

Yes, you can apply for business credit with your LLC. Lenders often favor LLCs because they signify a legitimate business structure, which can enhance credibility. To successfully complete business credit applications, ensure your LLC is properly registered and that you have established a credit history.

You can create a business credit file by registering your LLC with credit reporting agencies, such as Dun & Bradstreet, Experian, and Equifax. Start by applying for a D-U-N-S Number through Dun & Bradstreet, then begin establishing credit accounts in your business’s name. Making consistent, timely payments on these accounts will strengthen your profile and enhance your business credit applications.

To obtain business credit with your LLC, start by establishing a separate business bank account. Next, ensure your LLC is registered with the appropriate state and obtain an Employer Identification Number (EIN) from the IRS. By making timely payments and maintaining good credit practices, you will build a solid credit profile linked to your business credit applications.

You can typically get business credit within a few weeks to a couple of months, depending on how quickly you complete your business credit applications and the lenders’ processing times. If you provide accurate and complete information, it speeds up the application process. By using platforms like uslegalforms, you can streamline your application and potentially reduce the wait time.