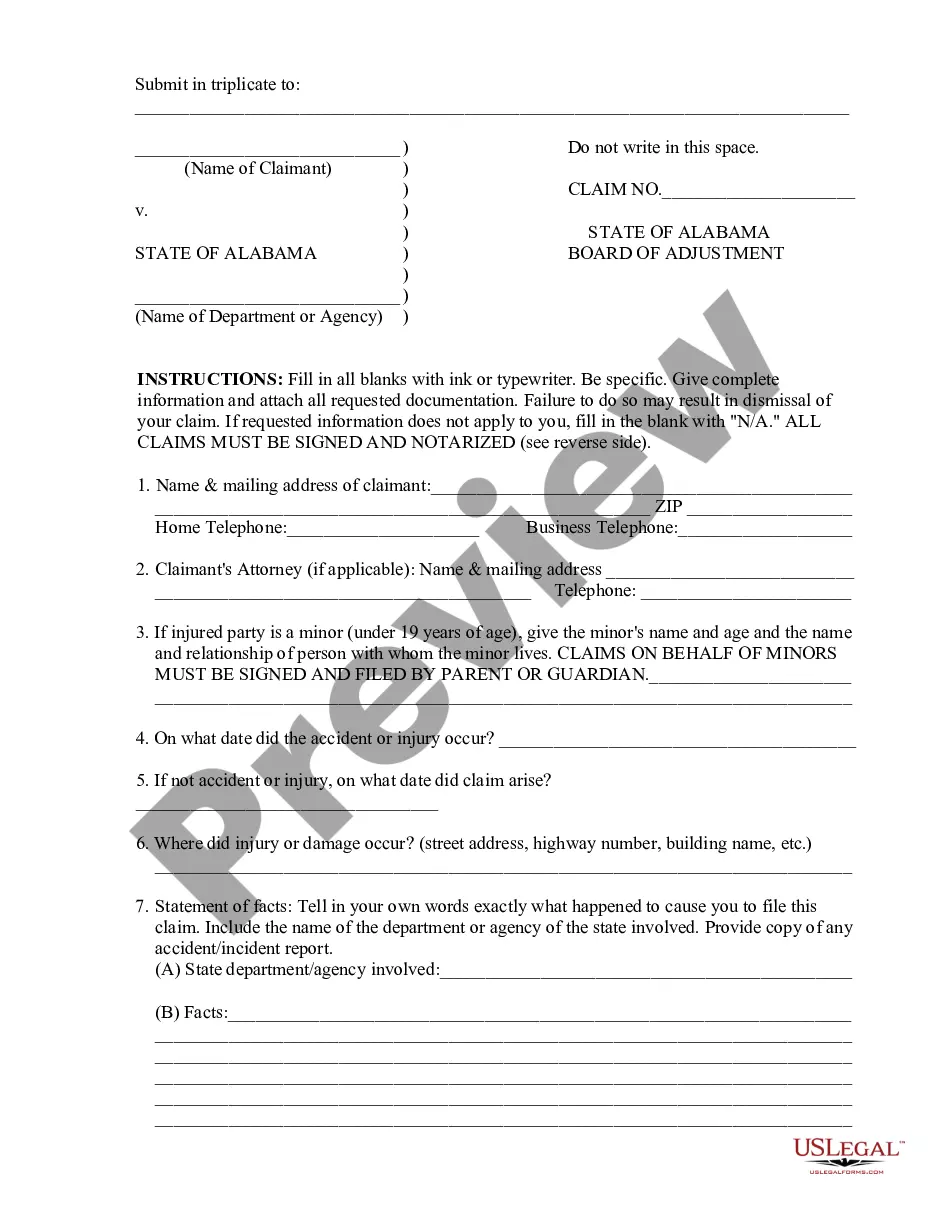

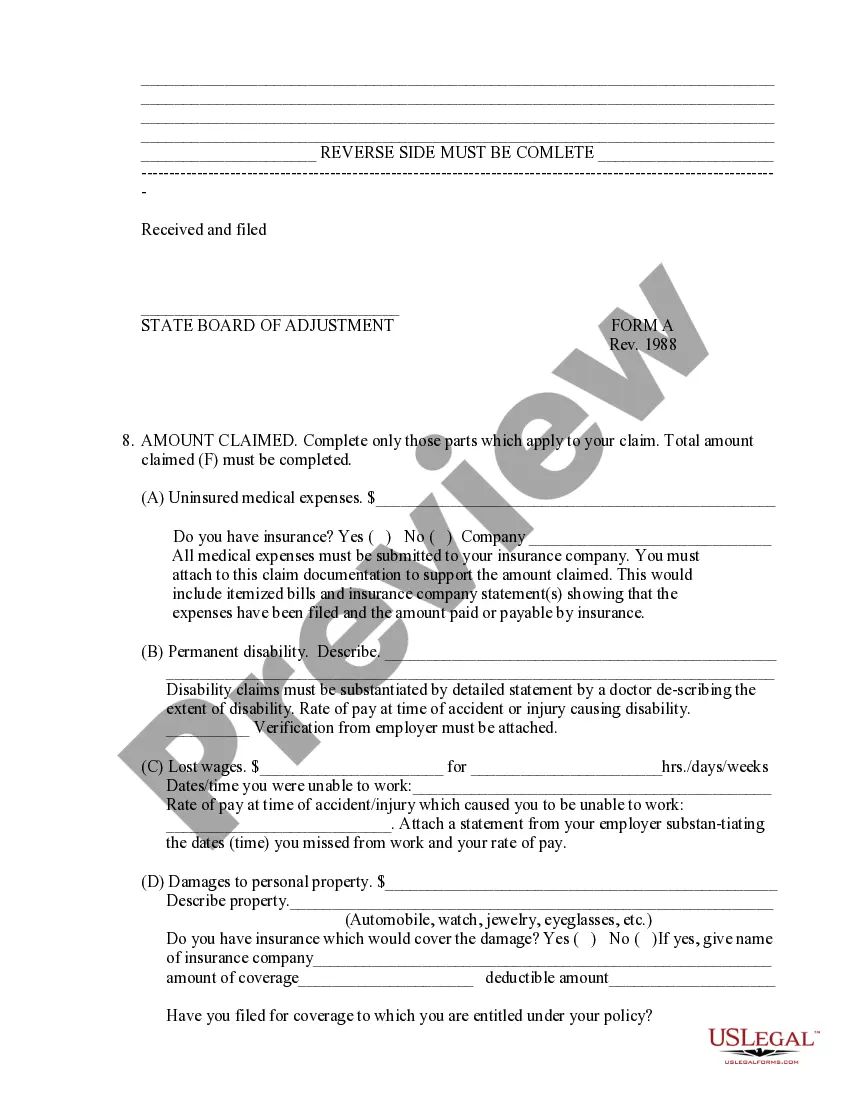

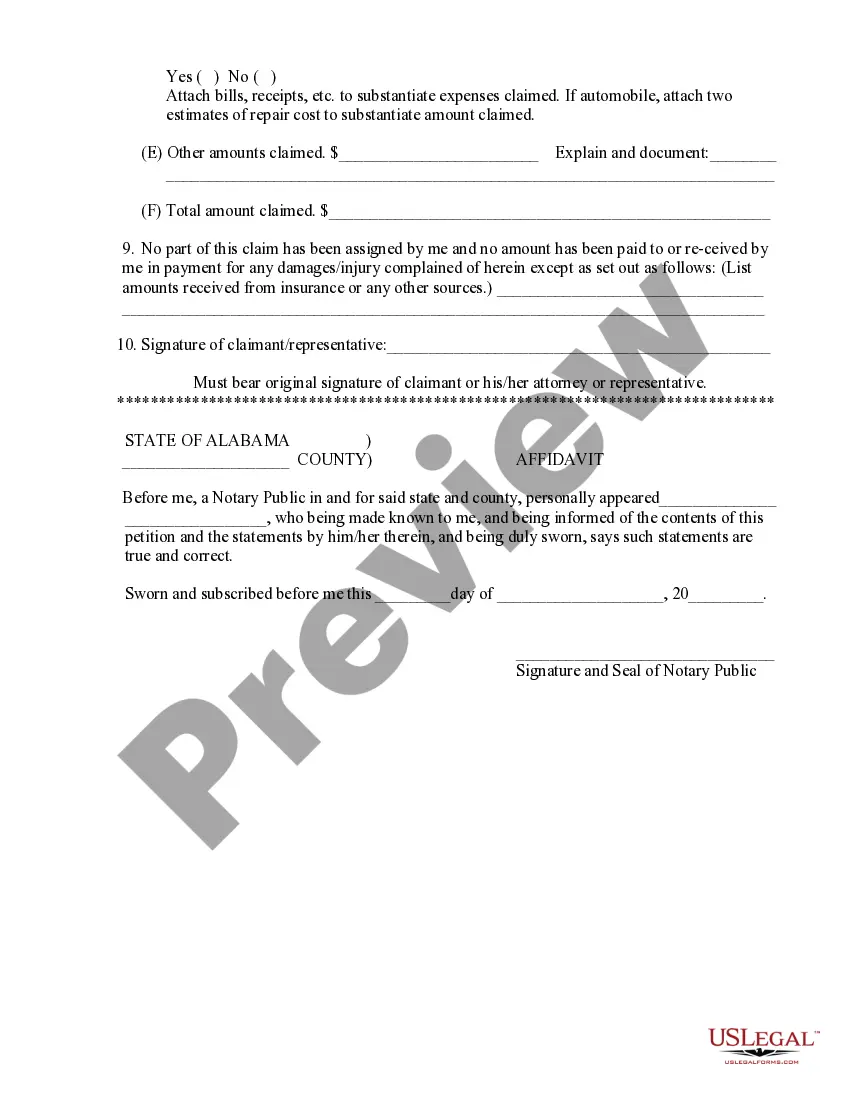

This is a sample claim form for filing with the State of Alabama Board of Adjustment for personal injury incurred on state property or caused by state agents, employees, etc.

Alabama Board Of Adjustment Rules

Description

How to fill out Claim Form To State Of Alabama Board Of Adjustment For Personal Injury?

Getting a go-to place to access the most recent and relevant legal samples is half the struggle of working with bureaucracy. Finding the right legal files needs accuracy and attention to detail, which is the reason it is vital to take samples of Alabama Board Of Adjustment Rules only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You may access and view all the information concerning the document’s use and relevance for your situation and in your state or region.

Consider the following steps to finish your Alabama Board Of Adjustment Rules:

- Utilize the catalog navigation or search field to find your template.

- View the form’s information to ascertain if it suits the requirements of your state and county.

- View the form preview, if available, to ensure the form is definitely the one you are searching for.

- Resume the search and locate the proper document if the Alabama Board Of Adjustment Rules does not fit your requirements.

- When you are positive regarding the form’s relevance, download it.

- If you are an authorized customer, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the template.

- Choose the pricing plan that suits your needs.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by picking a transaction method (credit card or PayPal).

- Choose the document format for downloading Alabama Board Of Adjustment Rules.

- When you have the form on your gadget, you may change it using the editor or print it and finish it manually.

Get rid of the inconvenience that comes with your legal paperwork. Check out the extensive US Legal Forms collection where you can find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

As mentioned above, in Maryland, you should have your POA notarized and witnessed. The notary public can act as one of the two required witnesses.

Steps for Making a Financial Power of Attorney in Maryland Create the POA Using a Statutory Form, Software, or Attorney. ... Sign the POA in the Presence of a Notary Public and Witnesses. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Circuit Court Clerk's Office.

Use Form 548, Power of Attorney and Declaration of Representative, for this purpose if you choose. You may use Form 548 Power of Attorney to appoint one or more individuals to represent you in tax matters before the Comptroller of Maryland.

You are entitled to claim qualified exemptions on your Maryland return. The amount of your Maryland exemption may be limited by the amount of your federal adjusted gross income. See chart below. The personal exemption is $3,200.

Section 4-107 - Powers of attorney (a) Every power of attorney executed by any person authorizing an agent or attorney to sell and grant any property shall be executed in the same manner as a deed and recorded: (1) Before the day on which the deed executed pursuant to the power of attorney is recorded; (2) On the same ...

For most people, the best option is to have a general durable power of attorney because it gives your agent broad powers that will remain in effect if you lose the ability to handle your own finances. An attorney can customize a general POA to limit powers even more?or add powers, Berkley says.

The discovery rule suspends the statute of limitations until an injury is or should have been discovered. In the state of Alabama, the discovery rule is 1 year.

It was established by §41-9-60, Code of Alabama, 1975, to provide for the adjustment of claims against the State of Alabama or any of its agencies, commissions, boards, institutions or departments to persons for injuries, damages to property, death or payments due on contract.