Foreclosure With Fha

Description

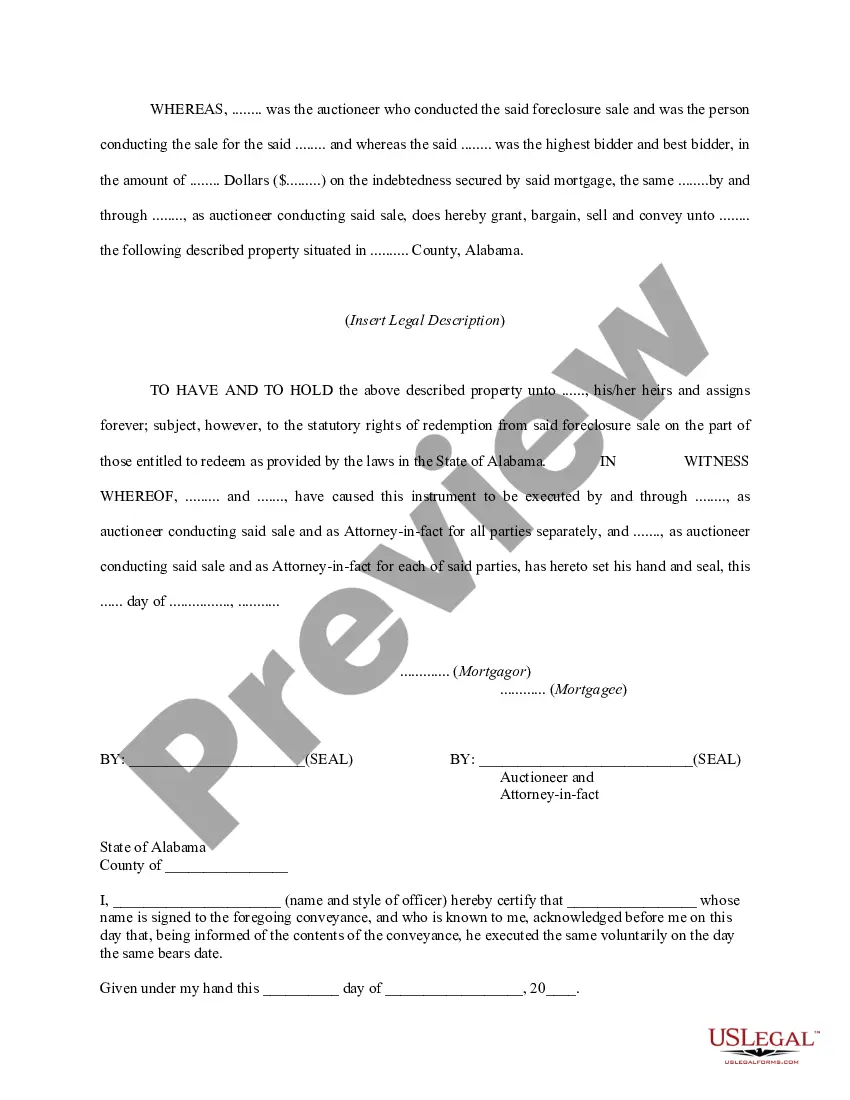

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- If you are a returning user, click here to log into your account and download your required form template by hitting the Download button. Verify your subscription's active status and renew it if necessary.

- For first-time users, start by previewing the form options available. Make sure to read the form descriptions carefully to select the correct one that fits your needs and adheres to your jurisdiction requirements.

- If you need a different template, use the Search tab to locate the right one. Find the form that matches your requirements before proceeding.

- To purchase the selected document, click the Buy Now button and choose your desired subscription plan. You will need to create an account to access the document library.

- Complete the payment by entering your credit card information or utilizing your PayPal account to finalize the subscription.

- Once the purchase is confirmed, download your form. Save it on your device for completion later, and access your documents anytime via the My Forms section in your profile.

Utilizing the services of US Legal Forms ensures you have access to a comprehensive library of over 85,000 fillable legal forms, allowing you to execute necessary paperwork swiftly and accurately.

For expert assistance and to ensure your forms are completed correctly, reach out to their premium services. Start simplifying your legal document process today!

Form popularity

FAQ

For a home to qualify as FHA approved, it must meet specific safety, security, and soundness standards set by the FHA. This includes adequate functionality of plumbing, electrical systems, and overall structural integrity. The home must also be appraised by an FHA-approved appraiser to confirm that it meets the agency's guidelines. If you're considering a foreclosure with FHA, it's crucial to ensure that the property meets these qualifications.

For a foreclosed home financed with FHA, the down payment generally starts at 3.5%. This option is attractive for many first-time homebuyers looking to enter the market. It's important to assess your financial situation and ensure you're prepared for the ongoing costs of homeownership.

Buying a foreclosure with FHA financing can involve several disadvantages, such as potential property repairs and hidden costs. Foreclosed homes may have been neglected and could require considerable renovations. Additionally, competition can be fierce, leading to multiple offers, which may drive prices higher.

The 37-day foreclosure rule refers to a timeline in which certain legal notices must be sent before foreclosure proceedings can officially start. After providing a notice of default, the lender must typically wait a minimum of 37 days before proceeding with the sale. Understanding this process helps homeowners know their rights and prepare accordingly.

Typically, a lender may begin foreclosure proceedings after a borrower misses three to six payments. However, this process can vary based on state laws and lender policies. It's crucial to communicate with your lender early on if you face financial difficulties to explore helpful options.

You can often make an offer that is 10% to 30% lower than the market value when considering a foreclosure with FHA financing. The specific amount depends on the property’s condition and how long it has been on the market. A skilled real estate agent familiar with foreclosures can provide guidance on making a competitive offer.

Sellers often prefer conventional loans over FHA due to perceived speed and simplicity in transactions. Conventional loans typically have fewer restrictions, allowing for quicker closings without extensive requirements. Additionally, some sellers believe that conventional offers indicate stronger buyers, which can ease worry about potential stumbling blocks. Nevertheless, opting for a foreclosure with FHA can provide significant financial advantages for the right buyer.

On forums like Reddit, realtors sometimes express their frustrations with FHA loans due to the associated challenges. Realtors may point out that FHA loans often require more paperwork and have stringent guidelines, which can complicate transactions. This sentiment can lead to a general bias against FHA in favor of more straightforward financing options. However, purchasing a foreclosure with FHA can still be a viable and beneficial path for buyers.

Many sellers may avoid FHA loans due to perceived complications that come with them. Sellers often believe that FHA loans involve stricter appraisal and inspection requirements which could delay closing. Additionally, some sellers fear that potential buyers cannot fulfill the conditions associated with these loans. Understanding this concern can help you navigate the real estate market when considering a foreclosure with FHA.

The FHA 85% rule is a guideline that relates to mortgage insurance for loans backed by the Federal Housing Administration. Essentially, it allows homeowners to obtain refinancing options even when their home value falls below what they owe. This rule can be vital during tough financial times, especially during a foreclosure with FHA. By understanding this rule, you can explore your refinancing options effectively and avoid potential foreclosure.