Quit Claim Deed With Survivorship

Description

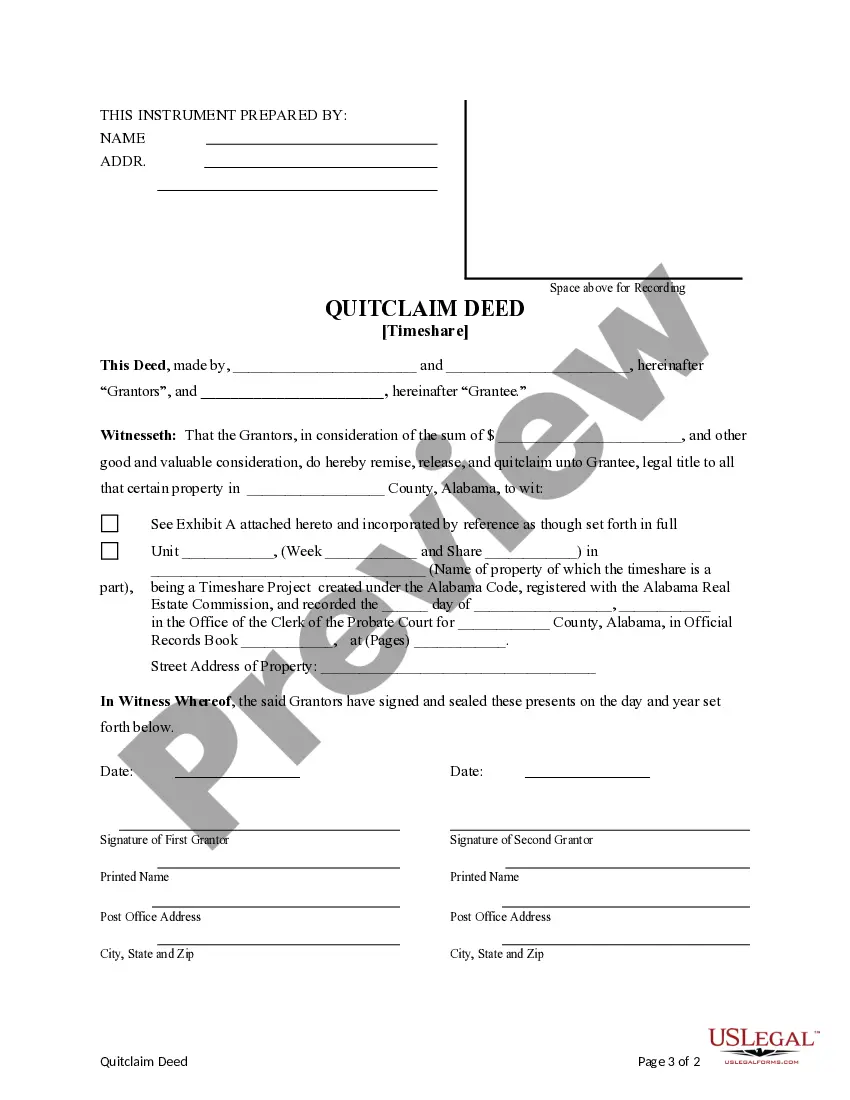

How to fill out Alabama Quitclaim Deed For A Timeshare - Two Individuals To One Individual?

- If you're a returning user, log in to your account and verify your subscription status. Download the required form by clicking the Download button.

- For first-time users, begin by reviewing the form descriptions and Preview mode. Ensure the selected template aligns with your local jurisdiction requirements.

- Should you find discrepancies or if the current form doesn't meet your needs, utilize the Search tab to find alternatives.

- Once you've located the appropriate document, click on the Buy Now button. Choose a subscription plan that works best for you and create an account to access all resources.

- Complete your purchase by entering your payment details. You can use either a credit card or your PayPal account.

- Finally, download the completed form to your device, allowing you to access it anytime through the My Forms section.

US Legal Forms stands out by providing an extensive collection of over 85,000 fillable legal forms, surpassing competitors in both variety and affordability. Users also benefit from expert assistance, ensuring all documents are completed accurately and conform to legal standards.

In conclusion, securing a Quit claim deed with survivorship has never been easier with US Legal Forms. Follow these simple steps to obtain your document efficiently. Get started today and empower yourself to manage your legal documents with confidence!

Form popularity

FAQ

The purpose of a survivorship deed, particularly a quit claim deed with survivorship, is to streamline property transfers and avoid the probate process. It allows co-owners to manage property together, ensuring that upon one owner’s death, the remaining owner retains full rights. This arrangement simplifies estate management and provides clarity and security for joint property ownership.

While the right of survivorship in a quit claim deed with survivorship has many benefits, it also has downsides. One major drawback is that the deceased owner's share bypasses the estate, which may not align with their wishes if they intended to distribute assets differently in their will. This automatic transfer can lead to unexpected outcomes, especially if family dynamics change over time.

Survivorship on a deed refers to a legal arrangement where co-owners jointly possess a property and ensures that upon death, the property automatically transfers to the surviving owner. In the context of a quit claim deed with survivorship, this creates a clear path of ownership transfer without intervention from the courts. It enhances the security for all owners involved, ensuring smooth transitions in case of mortality.

Yes, a survivorship deed with survivorship typically overrides a will regarding the property transferred. If you have designated co-owners on the deed, their interest in the property takes precedence over instructions in a will. Hence, it’s crucial to understand how a survivorship deed interacts with your overall estate plan.

The right of survivorship on a quit claim deed with survivorship ensures that when one owner dies, the deceased's share automatically transfers to the surviving owner. This legal arrangement avoids the lengthy probate process, allowing for immediate control over the property. Essentially, it provides peace of mind, knowing that ownership will seamlessly pass to the remaining owner.

Individuals who want to transfer property ownership quickly and without complications benefit the most from a quit claim deed with survivorship. This type of deed is especially useful among family members or close friends, as it simplifies the transfer process. Additionally, it allows for shared ownership, ensuring that if one owner passes away, the other receives full ownership without needing probate.

To obtain a survivorship deed, you can start by drafting a quit claim deed with survivorship language. It's often advisable to consult with a lawyer to ensure you meet all legal requirements. Additionally, using platforms like USLegalForms can simplify the process by providing customizable templates and guidance for your specific situation.

A quit claim deed with survivorship allows co-owners of a property to automatically transfer their interest to the surviving owner upon death. This arrangement avoids the lengthy process of probate, providing a smoother transition of ownership. Essentially, it offers peace of mind for those planning for future property ownership situations.

One main disadvantage of a quit claim deed with survivorship is the lack of warranties. This means that the grantor does not guarantee clear title or ownership. Additionally, if there are existing liens against the property, the grantee may become liable for them. It's important to carefully consider these factors before proceeding with such a deed.

Deeds, including a quit claim deed with survivorship, generally take priority over wills when it comes to property transfer. This means that if a deed is established with survival rights, it will control the disposition of the property upon death, not the will. Understanding how deeds intersect with wills can help in estate planning and ensuring that your wishes are executed as intended. Consider using uslegalforms to navigate these complexities and create the necessary documents accurately.