Alabama Property Code

Description

How to fill out Alabama Postnuptial Property Agreement?

Obtaining legal documents that comply with federal and local regulations is crucial, and the web provides countless alternatives to select from.

However, what is the benefit of squandering time searching for the suitable Alabama Property Code example online when the US Legal Forms digital library already has these documents compiled in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 customizable documents created by lawyers for various professional and personal situations. They are straightforward to navigate with all forms categorized by state and intended use. Our experts stay updated with legislative amendments, ensuring that your form is always current and adheres to regulations when acquiring an Alabama Property Code from our site.

All documents you discover through US Legal Forms are reusable. To download and complete previously acquired forms, access the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal documentation service!

- Acquiring an Alabama Property Code is quick and easy for both existing and new members.

- If you already possess an account with an active subscription, Log In and retrieve the document sample you need in the correct format.

- If you are unfamiliar with our website, follow the instructions below.

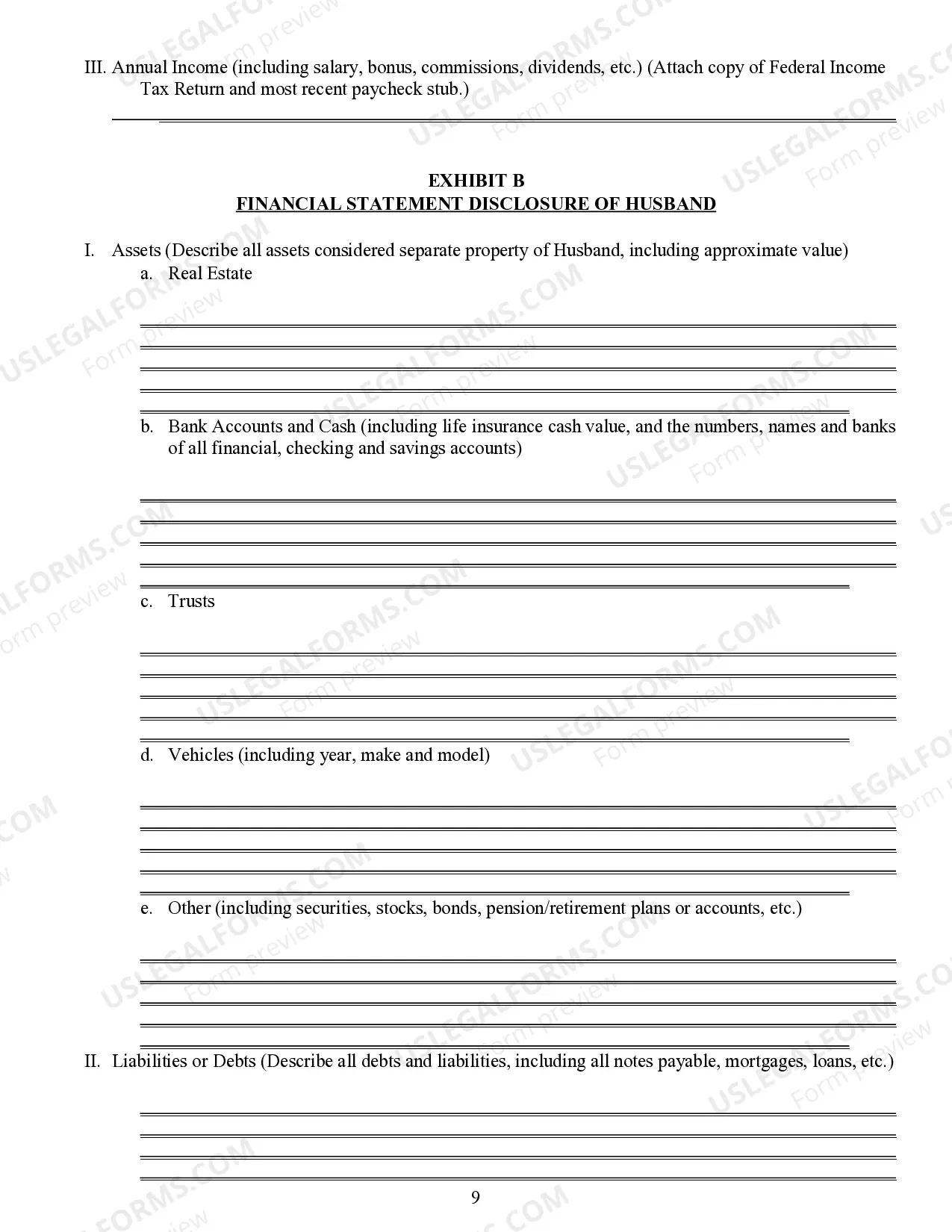

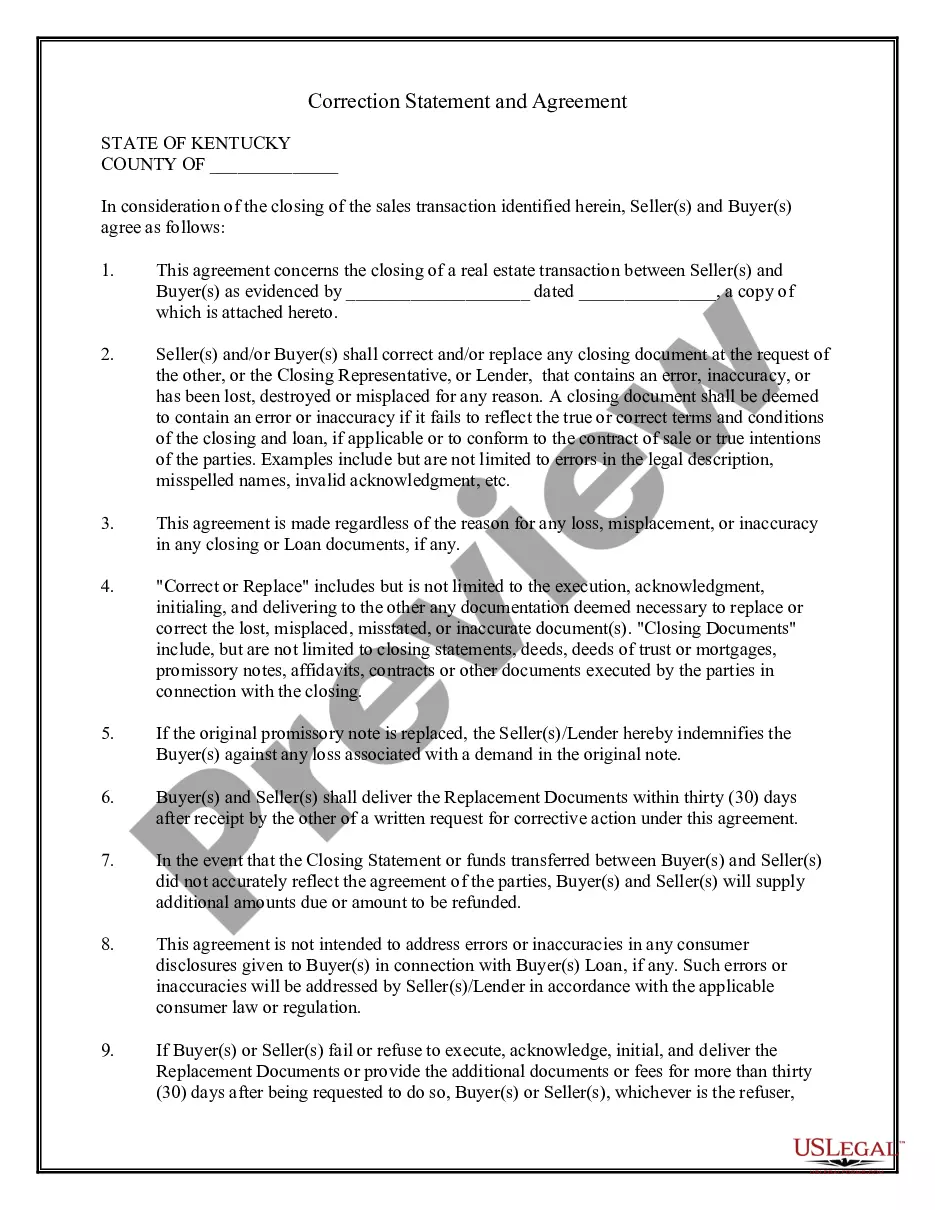

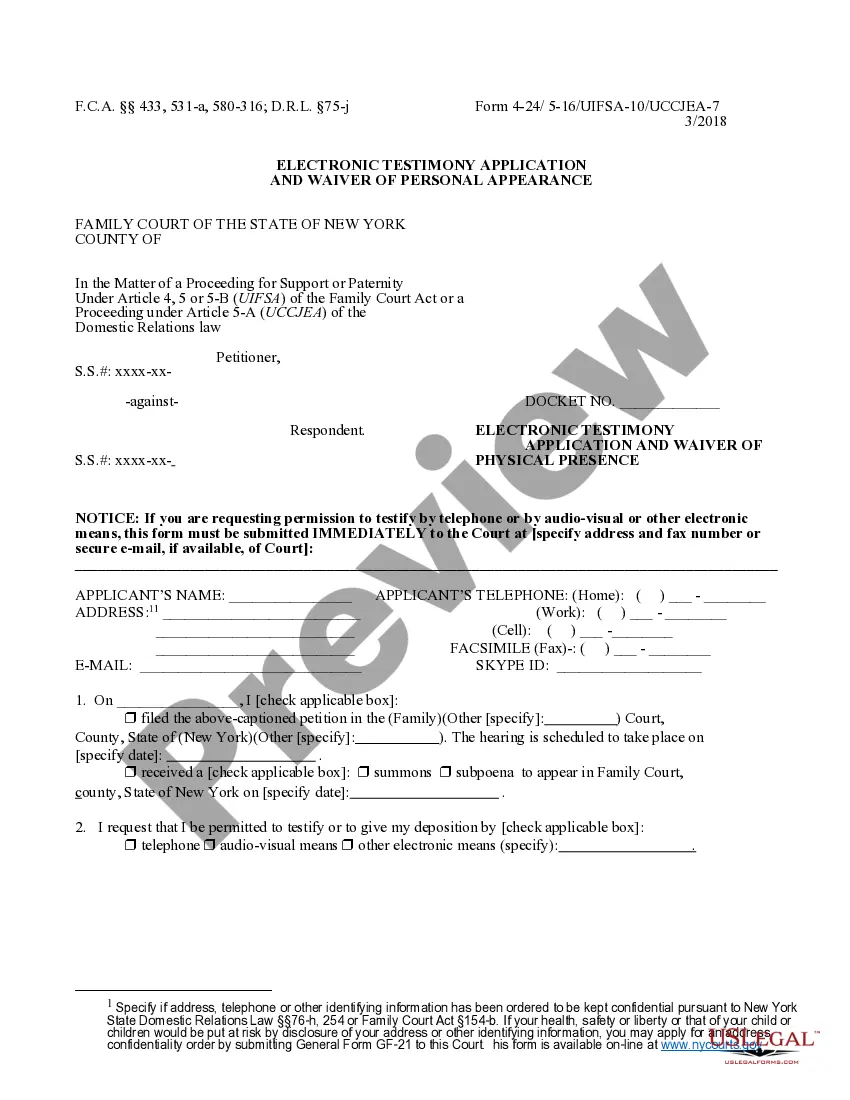

- Examine the template using the Preview option or through the text description to ensure it satisfies your requirements.

- Search for another example using the search bar at the top of the page if necessary.

- Press Buy Now when you've found the right form and select a subscription package.

- Create an account or sign in and process payment via PayPal or credit card.

- Choose the most suitable format for your Alabama Property Code and download it.

Form popularity

FAQ

'10-4' conveys the message of acknowledgment among law enforcement. It signals that a transmission has been received and understood clearly. This code remains widely recognizable and is often used in everyday conversation, but its origin lies within communication protocols. Understanding codes like '10-4' can enhance your knowledge of the Alabama property code context.

Hear this out loud PauseIf you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. County taxes may still be due. Please contact your local taxing official to claim your homestead exemption.

Hear this out loud PauseYour Alabama taxes are calculated using your property's assessed value. This is determined by multiplying the appraised value by the corresponding property classification, which is also known as the assessment rate.

Hear this out loud PauseUnder Alabama State Tax Law, only one Homestead Exemption is granted regardless of how much property is owned in the state. This exemption does not require annual renewal however, the exemption is non-transferrable. New owner application is required.

Hear this out loud PauseYou may redeem your property within 3 years of sale by paying all taxes, interest, fees, and penalties at the rate of 12% per annum. Yes. You may redeem your property within 3 years of sale by paying all taxes, interest, fees, and penalties at the rate of 12% per annum.

If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. County taxes may still be due.