Transfer On Death Deed Form Alabama With Iowa

Description

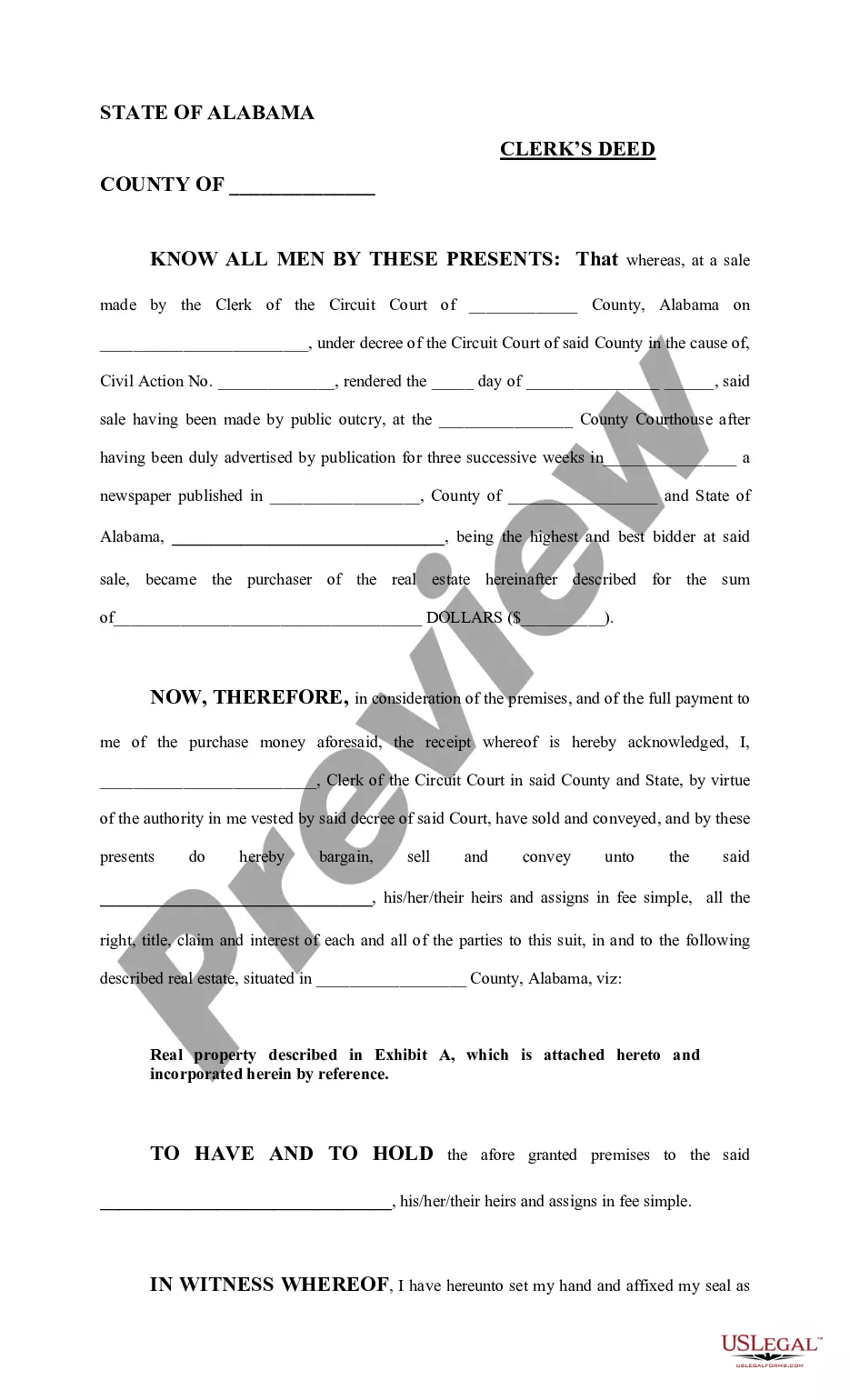

How to fill out Alabama Clerk's Deed?

Whether for business purposes or for personal matters, everyone has to handle legal situations sooner or later in their life. Filling out legal documents requires careful attention, starting with selecting the appropriate form sample. For example, if you choose a wrong edition of the Transfer On Death Deed Form Alabama With Iowa, it will be declined when you send it. It is therefore important to have a trustworthy source of legal papers like US Legal Forms.

If you need to get a Transfer On Death Deed Form Alabama With Iowa sample, follow these simple steps:

- Get the sample you need by using the search field or catalog navigation.

- Examine the form’s description to make sure it fits your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the wrong document, go back to the search function to locate the Transfer On Death Deed Form Alabama With Iowa sample you need.

- Get the file if it matches your needs.

- If you have a US Legal Forms profile, click Log in to access previously saved templates in My Forms.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the profile registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Choose the document format you want and download the Transfer On Death Deed Form Alabama With Iowa.

- Once it is downloaded, you are able to complete the form with the help of editing software or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time seeking for the appropriate sample across the web. Utilize the library’s easy navigation to get the correct template for any occasion.

Form popularity

FAQ

Signing Requirements for Alabama Deeds An Alabama deed is not valid unless it is signed as required by law. The deed should be signed by the current owner or owners, with each signature notarized using Alabama's statutorily approved acknowledgments. There is no need for the new owners (grantees) to sign the deed.

Transfer-on-death real estate, vehicles in Iowa In Iowa, transfer-on-death deeds or registration is not allowed for real estate or vehicles.

50 per $500 or $1.00 per $1000 on value of property conveyed - charged in increments of $500. The amount of value conveyed is always rounded to the nearest $500. A $1.00 ?no-tax? fee is charged on deeds that are tax exempt.

To transfer ownership from the deceased owner, the surviving owner must bring in the original title and original death certificate of deceased owner for transfer of title. If the names are joined on the title with ?and? or nothing separating the names, it is presumed by the state to be ?AND?.

Unlike some states, Alabama does not currently allow the use of TOD deeds for real estate. Instead, other instruments such as joint tenancy or revocable living trusts are typically used to avoid probate when transferring real estate upon death.