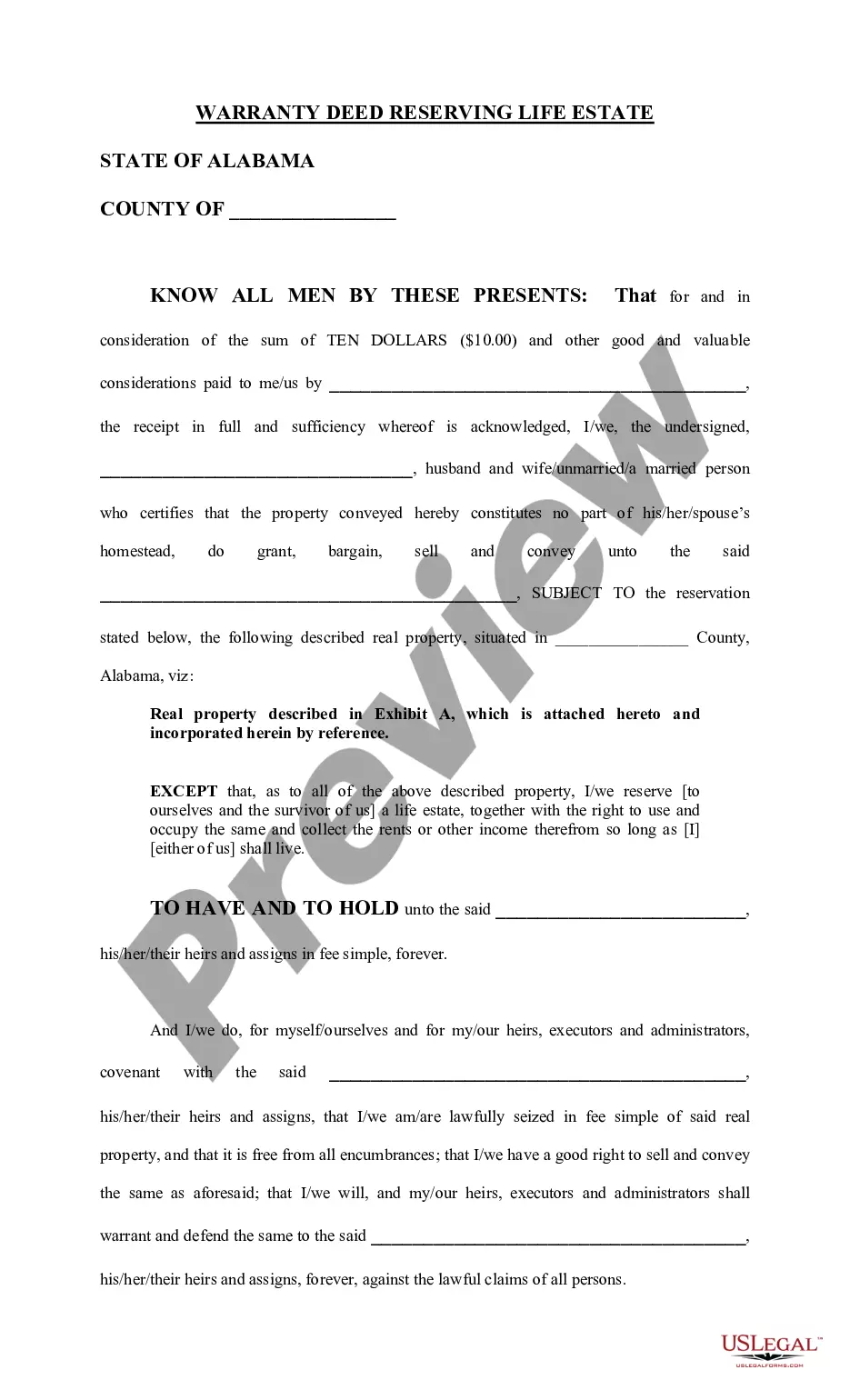

This deed warrants that the grantor is the lawful owner of the property at the time the deed is made and delivered and that the grantor has the right to convey the property. However, the grantor is reserving a life estate interest a life estate, together with the right to use and occupy the same and collect the rents or other income therefrom so long as he shall live. The form is available in both word and word perfect formats.

Life Estate Deed Explained

Description

How to fill out Alabama Deed Reserving Life Estate?

Legal administration can be overwhelming, even for experienced professionals.

When you seek a Life Estate Deed Explained and lack the time to invest in finding the appropriate and current version, the processes may be arduous.

US Legal Forms addresses any needs you may have, from personal to business documents, all in one place.

Utilize advanced tools to complete and manage your Life Estate Deed Explained.

- Access a database of articles, guides, and resources pertinent to your circumstances and requirements.

- Save time and effort in searching for the documents you need, using US Legal Forms’ sophisticated search and Preview tool to find Life Estate Deed Explained and obtain it.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and acquire it.

- Check your My documents tab to review the documents you've previously downloaded and manage your folders accordingly.

- If this is your initial experience with US Legal Forms, create an account for unlimited access to the full benefits of the library.

- A comprehensive online form catalog could be a significant advantage for anyone wishing to navigate these matters effectively.

- US Legal Forms is a leader in the online legal form industry, featuring over 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you can access legal and organizational forms tailored to specific states or counties.

Form popularity

FAQ

The duration of a life estate is based on the life of the designated individual, known as the life tenant. Once the life tenant passes away, the estate transfers automatically to the remainderman. A life estate deed explained helps you understand these rights clearly, ensuring everyone knows what happens next. This straightforward transfer can simplify estate planning for you and your family.

Yes, you can create your own life estate deed, but it is essential to understand what this entails. A life estate deed explained clearly outlines the rights of the life tenant and the remainderman. While DIY options are available, using professional services or platforms like USLegalForms can ensure accuracy and compliance with state laws. This approach can help you avoid common pitfalls and create a valid life estate deed.

Yes, you can sell a house with a life estate deed, but the process can be a bit tricky. The life tenant must obtain permission from the remainderman to execute the sale. Furthermore, it’s essential to understand that the sale will not change the life estate; the new owner will step into the existing life estate arrangement. For insights on formulating a strategy, refer to USLegalForms.

A life estate deed explained is a legal document that allows one person to live in a property for their lifetime, while stating who will own the property after they pass away. In simple terms, it grants rights to the life tenant, yet also ensures that ownership transfers smoothly to the designated remainderman afterward. This arrangement can simplify estate planning. For easy-to-understand documents, check out USLegalForms.

Understanding the disadvantages of a life estate deed explained is crucial. One key drawback is that the life tenant cannot sell or modify the property without the consent of the remainderman. Additionally, if the life tenant incurs debt, creditors may have claims against the property. To navigate these complexities, you can consult resources available at USLegalForms.

A life estate deed explained retains control over the property during the owner’s lifetime. However, a will cannot directly override a life estate deed once it is in place. Instead, upon the death of the life tenant, the property passes to the remainderman as outlined in the deed. For more tailored legal assistance, consider using USLegalForms to explore your specific situation.

People create life estates primarily for efficient estate planning, to ensure smooth property transfer to heirs while avoiding probate. Additionally, a life estate can provide peace of mind, allowing individuals to retain lifetime use of their property while securing their desired beneficiaries. This arrangement also offers potential tax advantages. Understanding why people choose this option will help you grasp the life estate deed explained.

The negatives of a life estate include limited flexibility and complexities in managing property rights. The life tenant cannot freely sell or alter the property without involving the remainderman, leading to potential conflicts. Additionally, the arrangement may lead to unexpected tax implications or financial responsibilities. It's vital to fully grasp these negatives when exploring the life estate deed explained.

Yes, creditors can access a life estate under certain circumstances. If the life tenant has outstanding debts, creditors can make claims against the property. However, this typically depends on the specific debt and state laws. For those concerned about creditor claims, understanding the life estate deed explained, and seeking legal advice is advisable.

While life estates provide certain benefits, they also come with disadvantages. One significant drawback is that the life tenant has limited control when it comes to selling or mortgaging the property without the remainderman's consent. Furthermore, any liabilities such as property taxes or maintenance costs typically fall on the life tenant, which may become burdensome over time. It is crucial to weigh these disadvantages when considering the life estate deed explained.