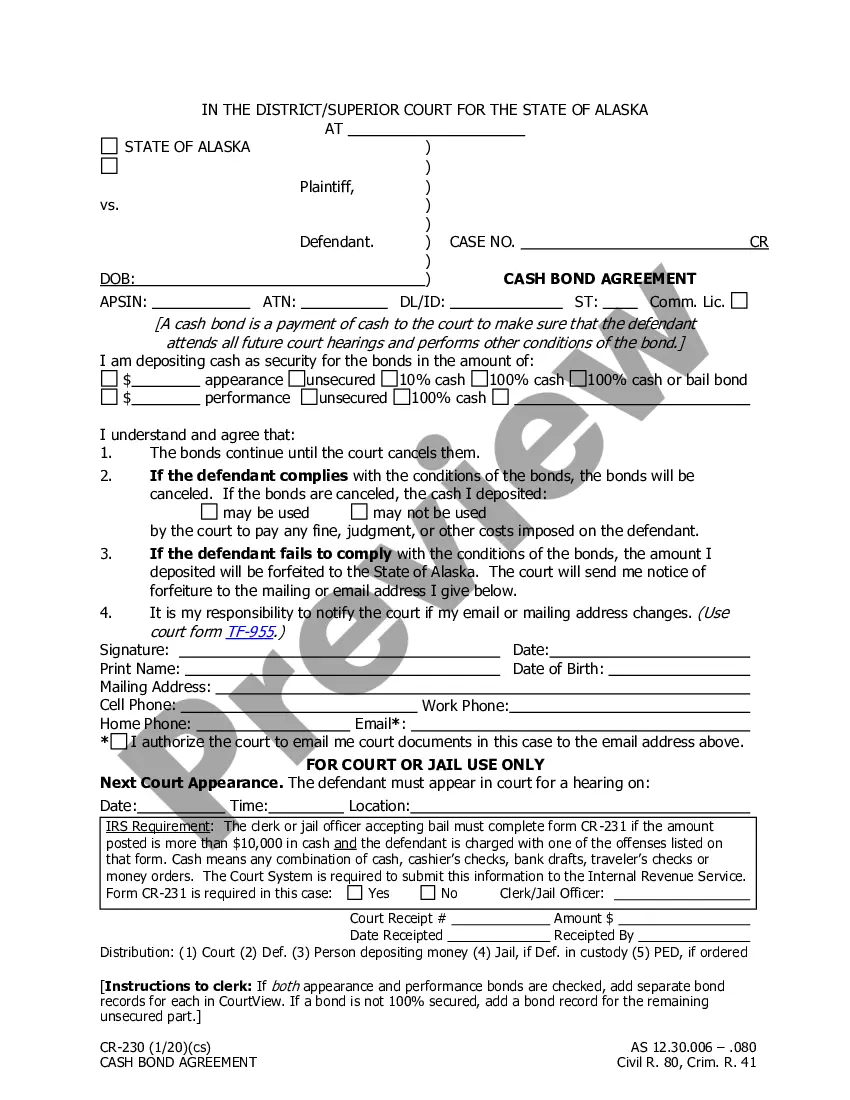

Surety Bond, is an official form from the Alaska Court System, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Alaska statutes and law.

Alaska Surety Bond With Conditions

Description

How to fill out Alaska Surety Bond?

It's clear that you cannot instantly become a legal authority, nor can you understand how to swiftly create an Alaska Surety Bond With Conditions without possessing specialized knowledge.

Drafting legal documents is a lengthy process necessitating particular training and expertise. So why not entrust the development of the Alaska Surety Bond With Conditions to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can discover anything from judicial paperwork to templates for internal corporate communication.

Click Buy now. After the payment is processed, you can access the Alaska Surety Bond With Conditions, complete it, print it out, and send it to the appropriate individuals or organizations.

You can access your documents from the My documents section anytime. If you are an existing user, you can simply Log In to find and download the template from the same section.

Regardless of the intent behind your forms, whether financial, legal, or personal, our site has you covered. Explore US Legal Forms now!

- Start by visiting our website and obtain the form you need in just a few minutes.

- Utilize the search feature at the top of the page to find the document you require.

- Preview it (if this option is available) and review the accompanying description to see if the Alaska Surety Bond With Conditions meets your needs.

- If you need a different template, initiate your search again.

- Create a free account and select a subscription plan to acquire the form.

Form popularity

FAQ

The $50,000 surety bond often refers to a common requirement in various industries, ensuring that the principal has the financial capacity to meet their obligations, typically required in Alaska. This bond acts as a security measure, providing a safety net for those expecting compliance from the bonded party. When considering an Alaska surety bond with conditions, remember that the amount signifies the level of financial responsibility needed.

The Demand Letter Your demand letter must request that you be paid the full amount of the check, any bank fees and the cost of mailing the demand. It also tells the person who gave you the bad check, that if they do not pay within 30 days of your mailing the demand letter, you can sue for the check plus damages.

Use these six ways to collect on a bad check without going to court. Contact the Bank First. ... Call Your Customer. ... Send a Certified Letter. ... Call Your Local District Attorney's Office. ... Use a Check Recovery Service. ... Contact a Collection Agency. ... Secure Your Cash Flow While You Collect on Bad Checks.

But whether you'll face criminal penalties can depend on the laws in your state and if you cashed a bad check intentionally. If you are the victim of a scam and deposited a bad check in good faith, you're unlikely to face criminal charges. But if you knowingly deposited a check, you might face fines and jail time.

If your bank credited your account for a check that was later returned unpaid for insufficient funds, the bank can reverse the funds and may charge a fee. As the payee, you must pursue the maker of the check if you wish to seek reimbursement.

If someone writes you a check that bounces after you deposit it, your bank can reverse the deposit and charge you an NSF fee or ?returned item? fee. If you want to retrieve the money from the writer of the check, it's up to you to take care of it.