Florida Enhanced Life Estate or Lady Bird Deed - An Individual to Three Individuals

What this document covers

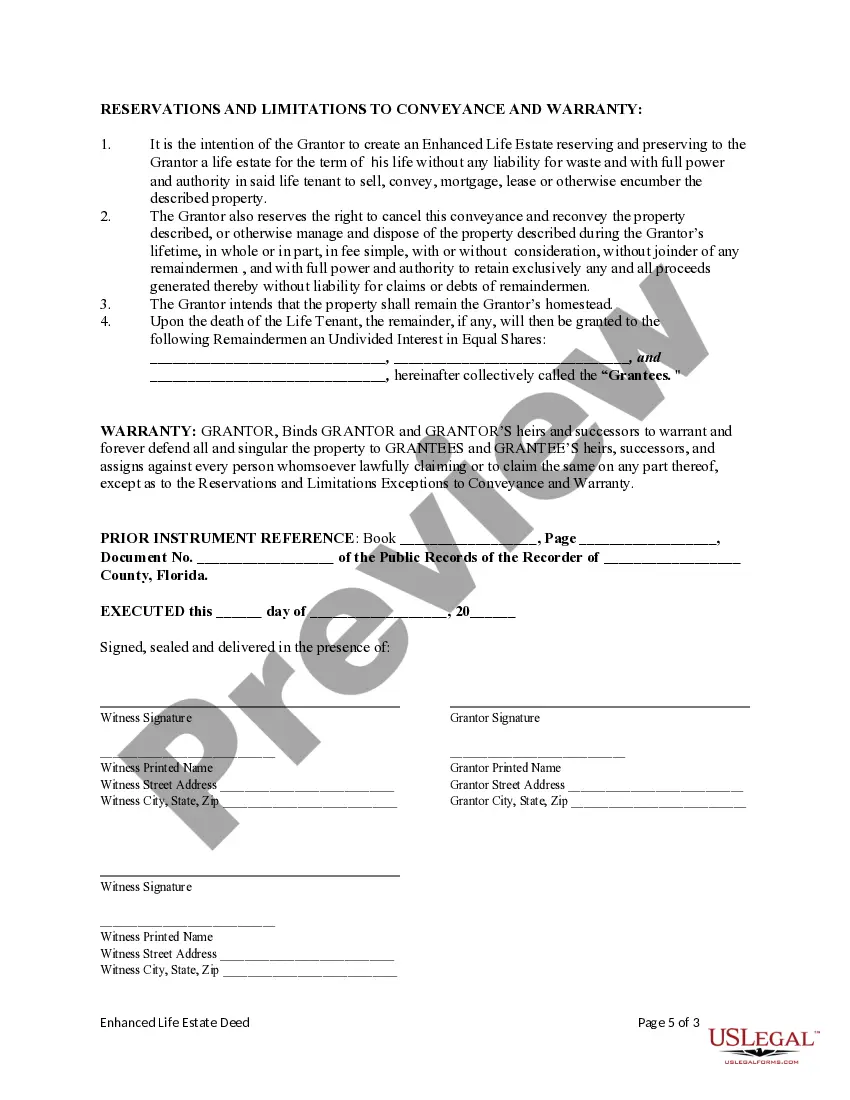

The Enhanced Life Estate or Lady Bird Deed is a legal document allowing an individual (the Grantor) to transfer property to three individuals (the Grantees) while retaining the right to use and manage the property during their lifetime. This type of deed provides the Grantor with flexibility, including the ability to sell or mortgage the property, but it also ensures that the Grantees will inherit the property automatically upon the Grantor's death, avoiding probate. Unlike standard life estate deeds, this enhanced version gives the Grantor more control over the property during their lifetime.

What’s included in this form

- Grantor and Grantees: Identifies the individuals involved in the transaction.

- Property Description: Clearly outlines the property being conveyed.

- Retained Life Estate: Describes the Grantor's rights to use and benefit from the property until death.

- Transfer Method: Specifies how the Grantees will hold the property, such as Tenants in Common or Joint Tenants with Right of Survivorship.

- Remaindermen Information: Details who will inherit the property after the Grantor's death.

Situations where this form applies

This form is ideal for individuals who wish to transfer property to multiple heirs while retaining control over the property during their lifetime. It is commonly used in estate planning to ensure that property is passed on without going through the lengthy probate process. You may consider this form if you are looking to secure your heirs' future and maintain the ability to change your mind about the property management.

Who should use this form

- Individuals planning their estate who want to transfer property to multiple heirs

- Estate planners seeking a flexible way to manage property during their lifetime

- Homeowners looking to bypass probate for their heirs

- Couples, whether married or not, wishing to jointly manage property while ensuring a defined inheritance path

How to prepare this document

- Identify the parties: Fill in the names and addresses of the Grantor and the Grantees.

- Specify the property: Enter a detailed description of the property being transferred.

- Indicate the retained rights: Describe the Grantor's retained rights, including the ability to manage the property during their lifetime.

- Choose the form of property ownership: Indicate how the Grantees will hold the property (e.g., Tenants in Common, Joint Tenants with Right of Survivorship).

- Sign and date: Ensure that the Grantor signs and dates the deed as required.

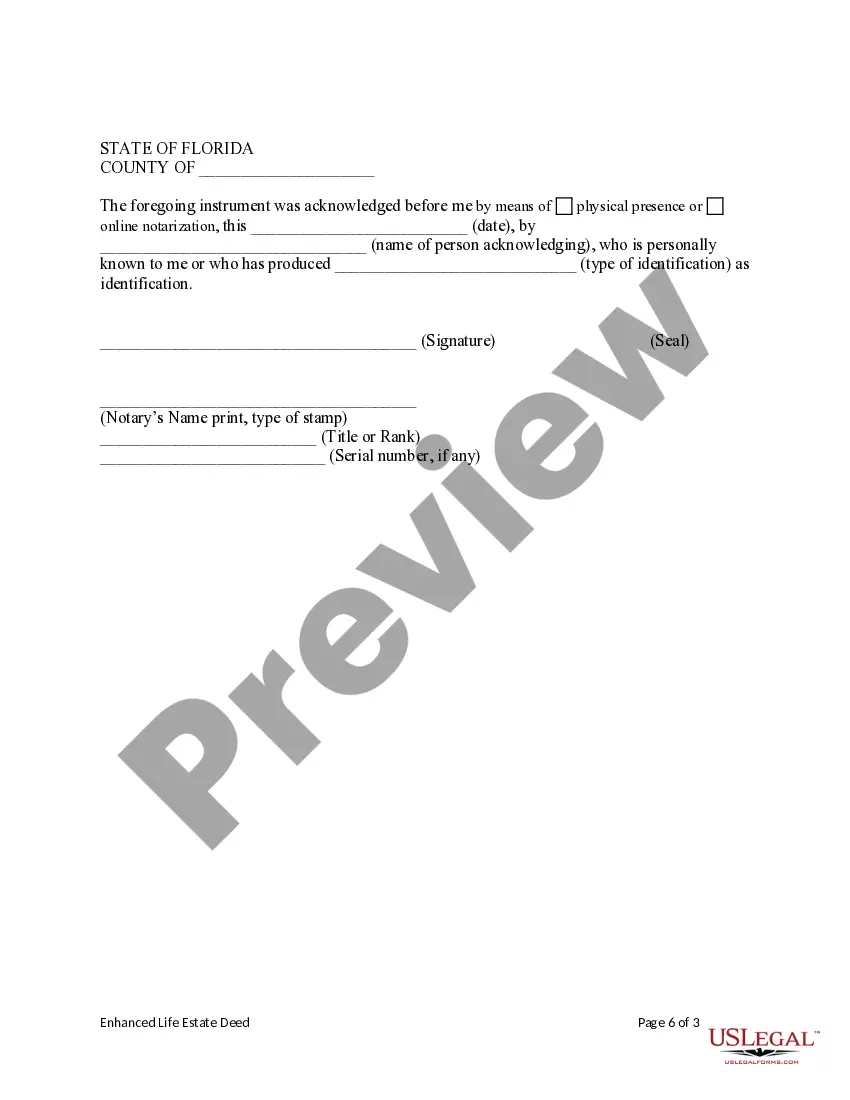

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide a clear and complete property description.

- Not indicating how the Grantees should hold the property.

- Inadequately identifying all parties involved in the transaction.

- Overlooking the need for witnesses or notarization as required in certain states.

Why complete this form online

- Convenience: Download and fill out the form from anywhere, anytime.

- Editability: Easily adjust the details before final submission.

- Compliance: Forms are prepared to meet current legal standards and requirements.

- No travel required: Save time and costs by completing the form online.

Looking for another form?

Form popularity

FAQ

Filling out a Florida Enhanced Life Estate or Lady Bird Deed - An Individual to Three Individuals involves several straightforward steps. First, you need to gather essential information about the property, the current owner, and the intended beneficiaries. Next, utilize a reliable platform, like US Legal Forms, to access a template that ensures compliance with Florida laws. Finally, review the completed form carefully, sign it, and ensure it is recorded with your local county property office to make it legally binding.

Choosing between a trust and the Florida Enhanced Life Estate or Lady Bird Deed - An Individual to Three Individuals depends on individual needs. A trust may provide more control and flexibility in managing the property after death, while a Lady Bird deed simplifies the transfer process and avoids probate. Each option has its benefits, so it's essential to evaluate your circumstances carefully. Seeking help from uslegalforms can ensure you make the best choice for your situation.

In Florida, the Florida Enhanced Life Estate or Lady Bird Deed - An Individual to Three Individuals does not trigger immediate tax consequences. The property typically receives a step-up in basis at the time of death, which can minimize capital gains taxes for beneficiaries. However, it is vital to consult a tax professional to understand specific implications based on individual circumstances. Utilizing services from uslegalforms can also help clarify tax responsibilities associated with this deed.

A significant disadvantage of the Florida Enhanced Life Estate or Lady Bird Deed - An Individual to Three Individuals lies in the limitation on control over the property after the owner's death. Once the owner passes away, the designated beneficiaries automatically receive the property, which could complicate matters if the owner wishes to change beneficiaries later. Furthermore, this deed does not provide protection from certain legal claims, which could endanger the assets.

The Florida Enhanced Life Estate or Lady Bird Deed - An Individual to Three Individuals can include one owner and up to three additional beneficiaries. This flexibility allows property owners to choose multiple individuals for optimal estate planning. However, it is essential to ensure that all parties understand their roles and responsibilities regarding the property. Using an established platform like uslegalforms can streamline this process.

One drawback of the Florida Enhanced Life Estate or Lady Bird Deed - An Individual to Three Individuals is the potential for loss of control over the property. Once the deed is established, the property is transferred to the designated beneficiaries upon the owner's death, which may not align with the owner’s later wishes. Additionally, if one of the beneficiaries faces financial issues, creditors may claim the property. Understanding these risks is crucial for making an informed decision.

While a Florida Enhanced Life Estate or Lady Bird Deed - An Individual to Three Individuals offers significant benefits, some drawbacks exist. For instance, the deed does not protect against creditors, which could affect your beneficiaries in the future. Additionally, if an individual named in the deed cannot manage their share, it could lead to disputes among heirs. Therefore, understanding these potential downsides is essential when deciding on your estate planning strategy.

A Florida Enhanced Life Estate or Lady Bird Deed - An Individual to Three Individuals can include multiple names, and typically, you can designate up to three individuals as beneficiaries. This flexibility allows homeowners to pass their property seamlessly to trusted family members or friends. Additionally, naming several individuals can facilitate more personal estate management and shared responsibilities. Always consult with a legal expert to ensure proper execution.

A Florida Enhanced Life Estate or Lady Bird Deed - An Individual to Three Individuals does not override a will; rather, it works alongside it. The deed transfers property outside of probate, ensuring a smooth transition to beneficiaries upon death. However, if conflicts arise, the will may take precedence regarding other assets. Thus, it is crucial to plan your estate carefully, considering both avenues.

The Florida Enhanced Life Estate or Lady Bird Deed - An Individual to Three Individuals is widely regarded as one of the best options for avoiding probate. This deed allows property owners to transfer their interests directly to beneficiaries upon death, bypassing the lengthy probate process. As a result, your loved ones can inherit the property quickly and efficiently, saving both time and resources.