Entry of Default - B 260

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

The term 'entry of default B 260' pertains to a procedural element in the United States legal system, particularly in bankruptcy proceedings. An 'entry of default' is a court's formal record of a party's failure to respond to a legal action or comply with a court order. Form B 260 specifically relates to the bankruptcy process, indicating that a debtor has not met the necessary obligations under the bankruptcy filing requirements.

Step-by-Step Guide on Handling Entry of Default in Bankruptcy

- Receive Notification: The debtor is notified of the potential entry of default through a court document or a communication from a creditor.

- Consult Legal Advice: It is paramount to seek legal counsel to understand the implications of the entry of default and potential next steps.

- Response Preparation: Work with your lawyer to prepare a response to the notice of default, which may include contesting the entry or rectifying the default.

- Submission of Response: Submit the prepared document to the court by the specified deadline to avoid further legal actions.

- Follow-up: Regularly follow up with the court and involved parties to stay updated on your case status.

Risk Analysis

- Financial Risks: An entry of default can result in increased financial strain because of accruing interests and penalties.

- Legal Risks: Non-response to a default notice can lead to adverse legal judgments, including the potential loss of assets or increased debt responsibility.

- Reputational Risks: An entry of default impacts personal and business reputations, potentially altering future credit and business opportunities.

Common Mistakes & How to Avoid Them

- Ignoring Notices: Never ignore legal notices related to defaults. Always respond in a timely and appropriate manner.

- Handling Without Legal Help: Attempting to handle default notices without professional legal help can increase the risk of unfavorable outcomes.

- Lack of Documentation: Always maintain thorough records of all communications and filings related to your bankruptcy case to support your positions.

Key Takeaways

Understanding the implications of an 'entry of default B 260' and responding appropriately are crucial to managing bankruptcy effectively. Always seek professional legal advice and act in a timely manner to mitigate risks associated with defaults in bankruptcy proceedings.

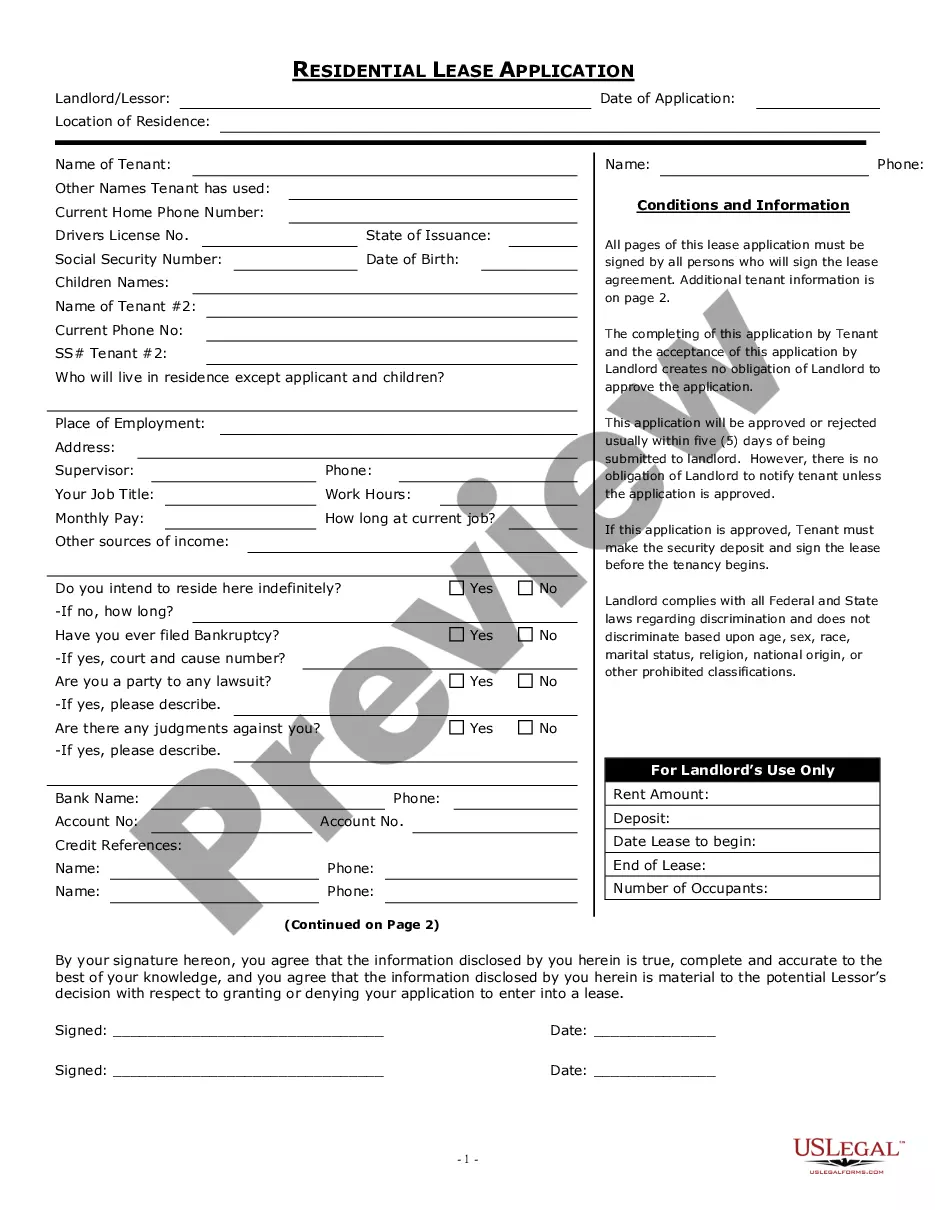

How to fill out Entry Of Default - B 260?

Employ the most comprehensive legal catalogue of forms. US Legal Forms is the perfect platform for finding updated Entry of Default - B 260 templates. Our platform provides a huge number of legal documents drafted by licensed lawyers and sorted by state.

To obtain a template from US Legal Forms, users only need to sign up for an account first. If you’re already registered on our service, log in and choose the template you are looking for and purchase it. Right after purchasing templates, users can find them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines below:

- Find out if the Form name you have found is state-specific and suits your needs.

- When the form has a Preview function, utilize it to review the sample.

- In case the template doesn’t suit you, utilize the search bar to find a better one.

- Hit Buy Now if the template corresponds to your expections.

- Choose a pricing plan.

- Create your account.

- Pay via PayPal or with the debit/visa or mastercard.

- Choose a document format and download the template.

- When it’s downloaded, print it and fill it out.

Save your effort and time with the platform to find, download, and complete the Form name. Join a large number of delighted clients who’re already using US Legal Forms!

Form popularity

FAQ

A default judgment is granted by the trial court when a defendant hasn't filed a timely response. This means that a defendant did not respond to the lawsuit by 10 a.m. on the Monday after 20 days has elapsed from the date of service as dictated by Rule 83 of the Texas Rules of Civil Procedure.

Once a judge enters a default judgment against you in your divorce case, you may be able to fight the default and get a second chance to respond to the case.The court may reverse the default judgment if you petition them and support your request with proof of mistake or another issue.

State and local rules may vary, but generally, if your spouse failed to respond to your divorce petition within 30 days, you may file a request to enter a default along with a proposed judgment.By failing to respond or appear, your spouse gives up the right to have any say in the divorce proceeding or court judgment.

Default judgments happen when you don't respond to a lawsuit often from a debt collector and a judge resolves the case without hearing your side.Next up could be wage garnishment or a bank account levy, which allows a creditor to remove money from your bank accounts to repay the debt.

The danger of allowing a default judgment against you is once this occurs the debt buyer can garnish your wages and your bank accounts.If you don't submit a written answer to the lawsuit the court can enter a default judgment giving the debt buyer everything they are asking for.

When a default is entered, the party who requested the entry of default must obtain a default judgment against the defaulting party within 45 days after the default was entered, unless the court has granted an extension of time.

How long does a divorce take in the state of California? A divorce in California always takes a minimum of six months. This is called a waiting period. The waiting period is to make sure you and your spouse do not change your mind about going through with the divorce.

A default divorce is one in which the courts pass judgment on the divorce after the respondent fails to respond. In other words, if a spouse ignores notices regarding a desired divorce, that spouse could find him/herself divorced anyway.