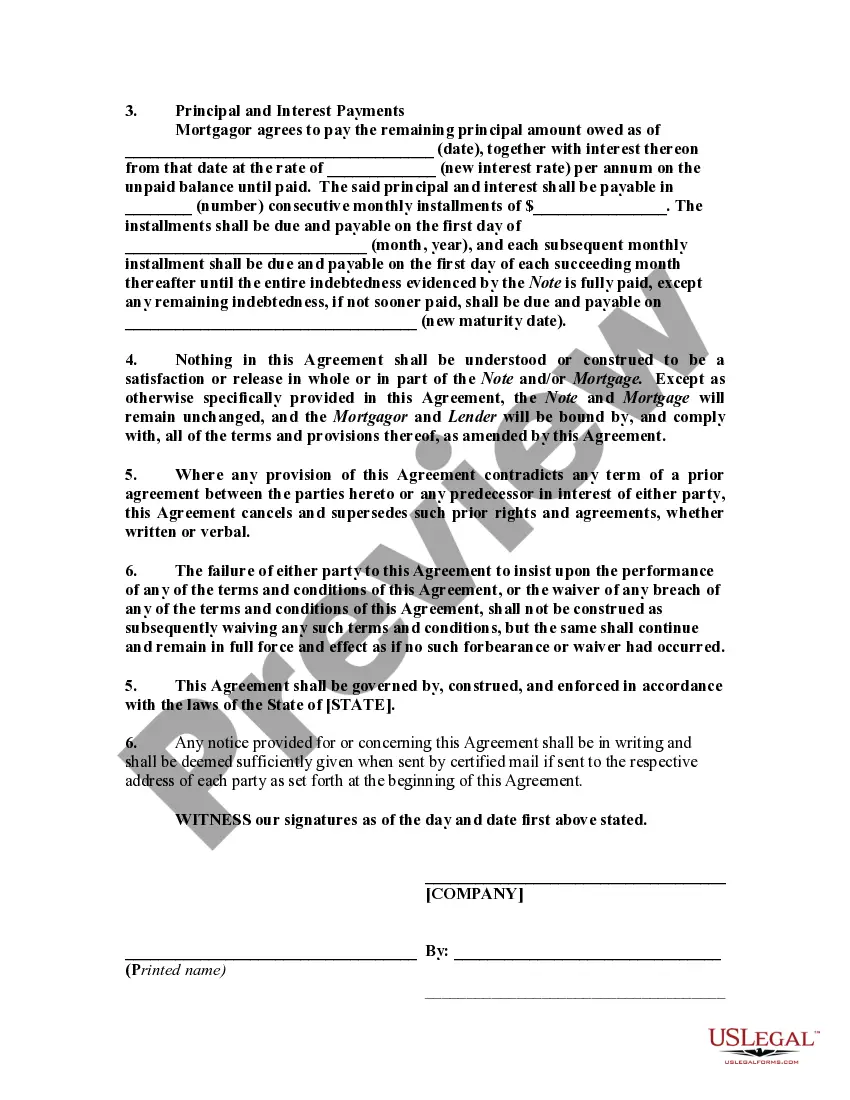

An Agreement to Modify Promissory Note Secured by a Mortgage is a document used to modify the terms of a promissory note that is secured by a mortgage. This agreement allows the borrower to modify the terms of the promissory note, including altering the interest rate, loan amount, maturity date, and other details of the loan. This agreement is typically used when a borrower is unable to keep up with the original terms of the loan agreement and wants to modify the promissory note to make it more affordable. There are two types of Agreement to Modify Promissory Note Secured by a Mortgage: a standard agreement, which is used for generic modifications, and a secured agreement, which is used when the loan is secured by collateral. In the secured agreement, the lender may require the borrower to provide additional collateral to secure the loan.

Agreement to Modify Promissory Note Secured by a Mortgage

Description

How to fill out Agreement To Modify Promissory Note Secured By A Mortgage?

Dealing with official documentation requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Agreement to Modify Promissory Note Secured by a Mortgage template from our service, you can be sure it meets federal and state laws.

Working with our service is straightforward and quick. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your Agreement to Modify Promissory Note Secured by a Mortgage within minutes:

- Remember to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for another formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Agreement to Modify Promissory Note Secured by a Mortgage in the format you prefer. If it’s your first time with our service, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the Agreement to Modify Promissory Note Secured by a Mortgage you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

The mortgage modification agreement is a legal document between a lender and borrower to change an existing loan's terms. A typical modification may include reducing the interest rate, extending the repayment term, lowering monthly payments, or even forgiving part of the debt.

Amendments to a promissory note may only be made with consent from the lender and will be considered binding by all parties involved. Amendments can be made for significant changes and should be done in a formal manner to minimize liability and confusion with the contract moving forward.

Secured promissory notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

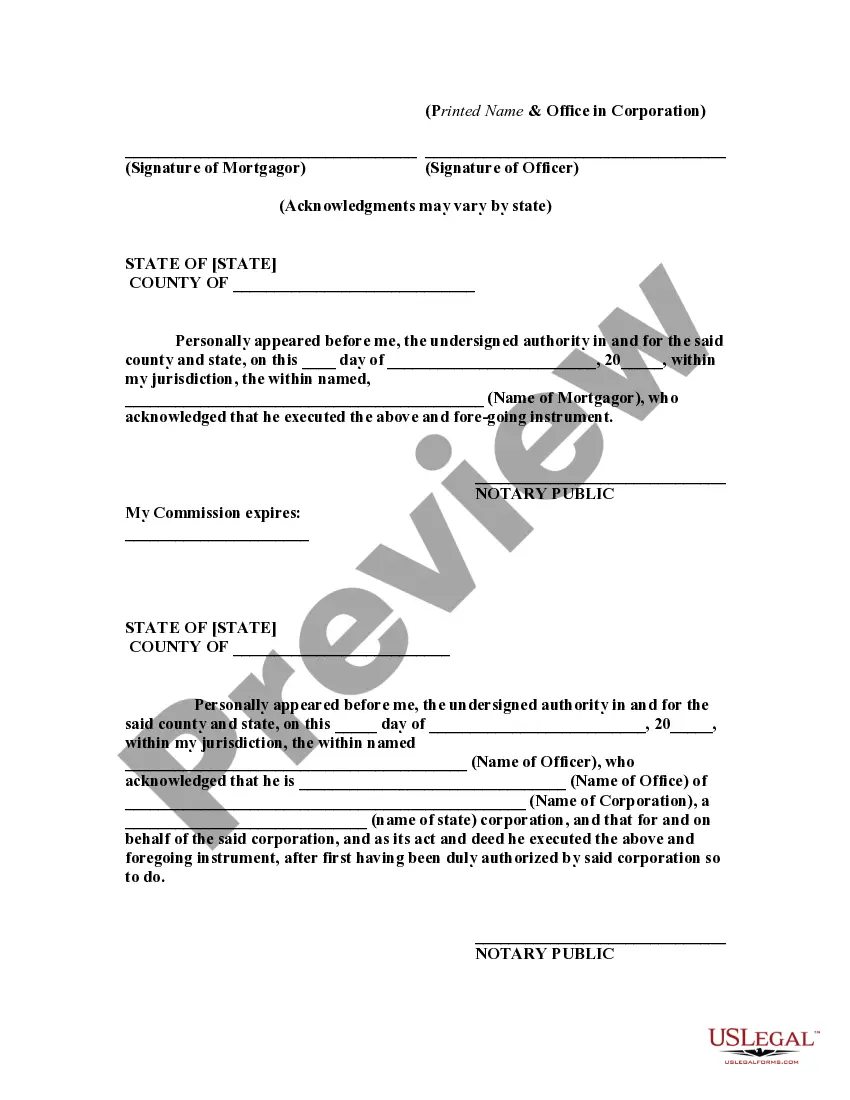

True, The borrower signs a promissory note pledging to repay the debt and gives the lender a mortgage, which is security for the property. When a property is mortgaged, the owner must execute both a promissory note and a security instrument.

A home mortgage secures a promissory note with the title to the property as collateral. This is done in case the lender ever needs to foreclose and sell the property because the homeowner did not make loan payments. Your lender will keep the original promissory note until your loan is paid off.

A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

A home mortgage secures a promissory note with the title to the property as collateral. This is done in case the lender ever needs to foreclose and sell the property because the homeowner did not make loan payments. Your lender will keep the original promissory note until your loan is paid off.

Promissory notes can be secured using a financing statement, deed of trust, or a mortgage. If a promissory note includes these terms, then it is a secured promissory note. So, the inclusion of collateral is the only real difference between secured promissory notes and unsecured promissory notes.