Sample Letter for Collection Efforts

Understanding this form

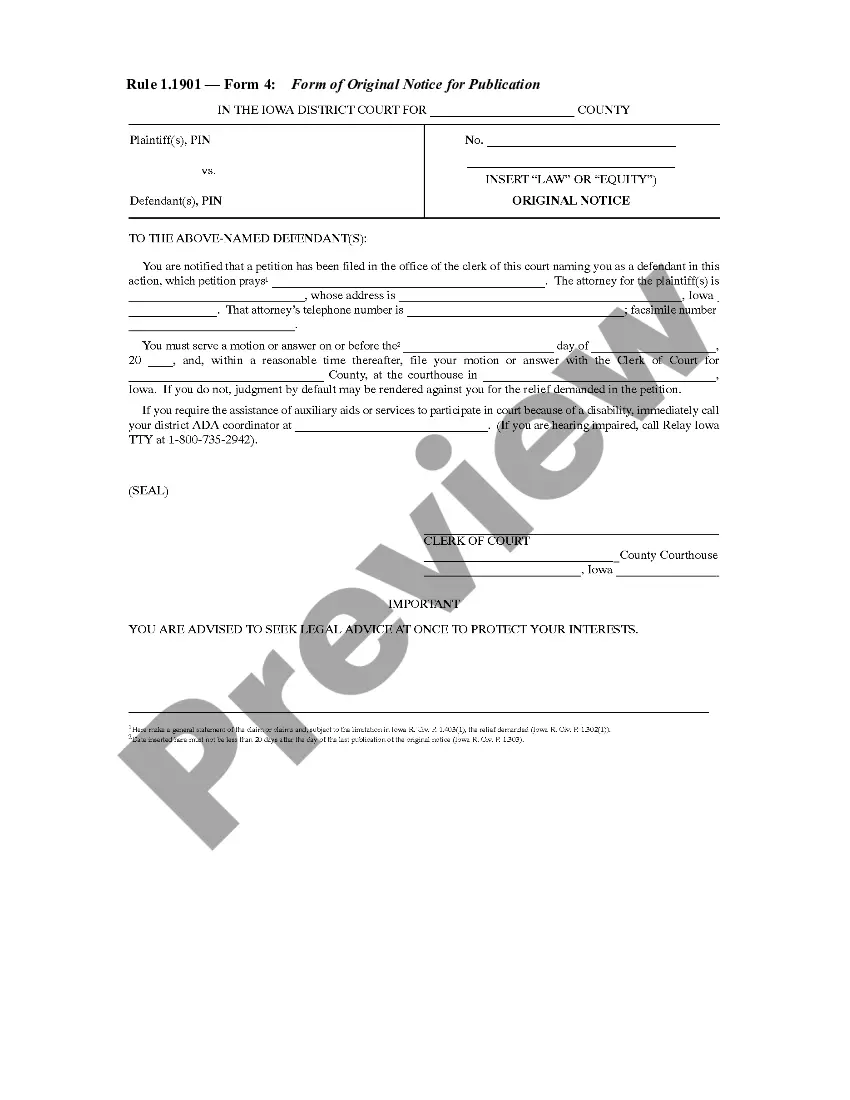

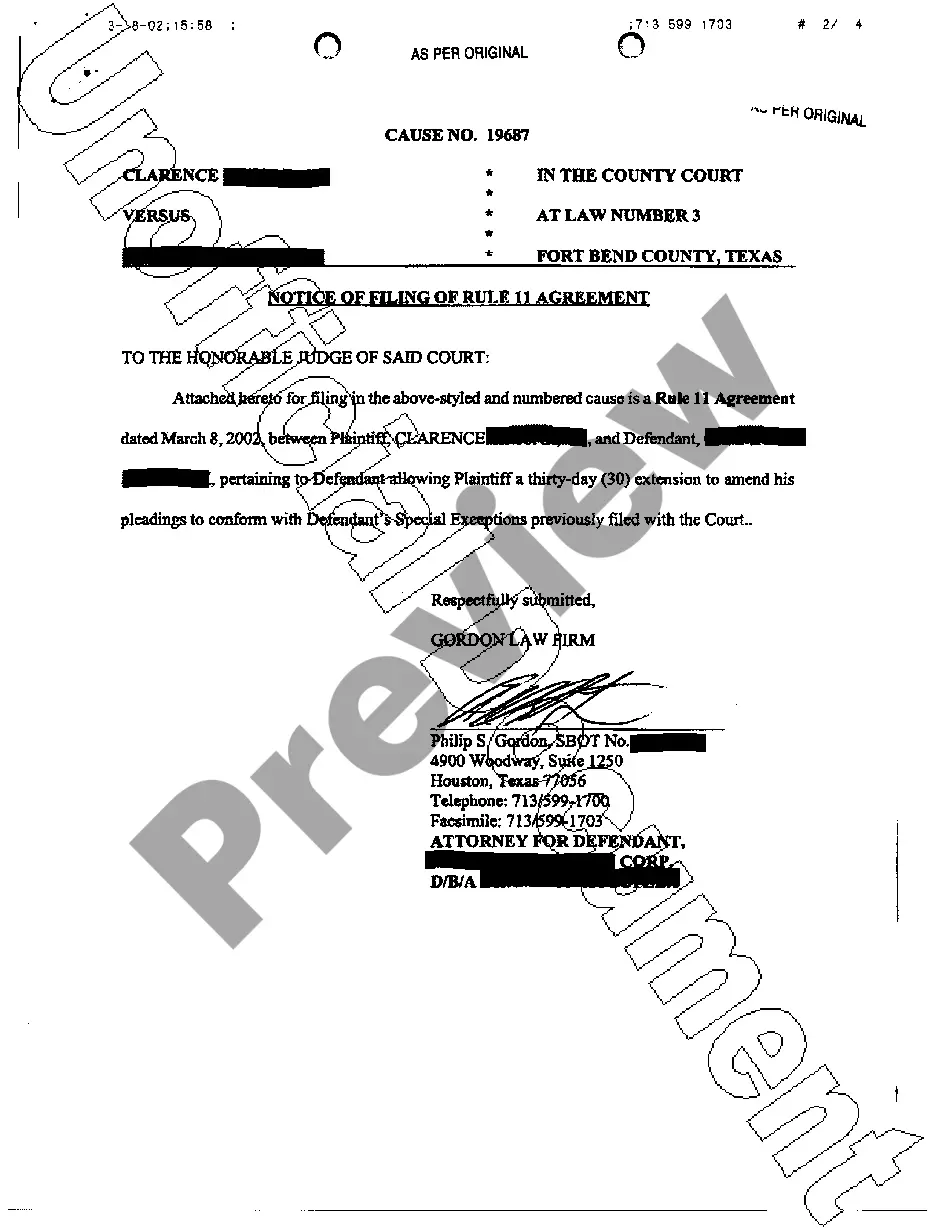

The Sample Letter for Collection Efforts is a template designed to assist individuals and businesses in formally requesting payment for outstanding debts. This letter serves as a crucial step in the debt collection process, allowing you to communicate your intentions clearly and professionally. It differs from other collection forms by specifically providing a structure for correspondence that outlines legal claims and requests for resolution.

Form components explained

- Date â The date the letter is created.

- Recipient's name and address â Information about the person or entity being contacted.

- Subject line â A clear indication of the purpose of the letter.

- Identification of the legal issue â Details outlining the nature of the debt and potential liability.

- Request for a discussion â Encouraging dialogue regarding payment and resolution options.

- Signature â A formal closure to the letter.

When this form is needed

This form is ideal for situations where you have made previous attempts to collect a debt and need to escalate your efforts. If you are facing challenges in resolving payment disputes or require a documented approach to address unpaid invoices, this letter can serve as an effective communication tool, prompting the debtor to respond to your request for payment.

Intended users of this form

- Business owners seeking to collect overdue payments from clients or customers.

- Individuals needing to reclaim funds owed to them for services rendered or products sold.

- Collecting agencies looking for a professional template to enhance their communication efforts.

- Anyone involved in a dispute regarding personal or corporate debts.

Steps to complete this form

- Enter the date at the top of the letter.

- Fill in the recipient's name and complete address accurately.

- Clearly state the subject of your letter to indicate its purpose.

- Detail the nature of the debt and outline any relevant legal concerns.

- Request a follow-up call or meeting to discuss next steps.

- Sign the letter to formally close the communication.

Is notarization required?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include accurate contact information for both parties.

- Using vague language that does not specify the nature of the debt.

- Not providing a clear call to action regarding payment or discussion.

- Neglecting to proofread for errors, which can undermine professionalism.

Benefits of using this form online

- Convenience â Access and download the template anytime, anywhere.

- Editability â Customize the letter to fit your specific situation easily.

- Professional appearance â Use an attorney-drafted document to enhance credibility.

- Time-saving â Quickly generate a formal letter without needing legal expertise.

Looking for another form?

Form popularity

FAQ

Your full name and address. The collections agency's name and address. A request for the amount of the debt claimed to be owed. A request for the name of the original creditor. A request for the judgment information (if applicable) A request for proof of the company's license.

Mention of all previous attempts to collect. Invoice number and amount. Original invoice due date. Current days past due. Instructions on what they should do next. A warning of the impending consequences.

I am responding to your contact about a debt you are attempting to collect. You contacted me by phone/mail, on date. You identified the debt as any information they gave you about the debt. Please stop all communication with me and with this address about this debt.

Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not in the next 7 business days as this can be vauge.

Reference the products or services that were purchased. Make it very clear what you did for your client and how much it costs. Maintain a friendly but firm tone. Remind the payee of their contract or agreement with you. Offer multiple ways the payee can take action. Add a personal touch. Give them a new deadline.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request that the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

Creditors do not have to respond to every debt verification letter sent to them. Under the FDCPA, if a collector contacts you about a debt, you have 30 days to request validation. If you send a verification request within that time, the creditor is legally obligated to respond to you.

This is not a good time. Please call back at 6. I don't believe I owe this debt. Can you send information on it? I prefer to pay the original creditor. Give me your address so I can send you a cease and desist letter. My employer does not allow me to take these calls at work.