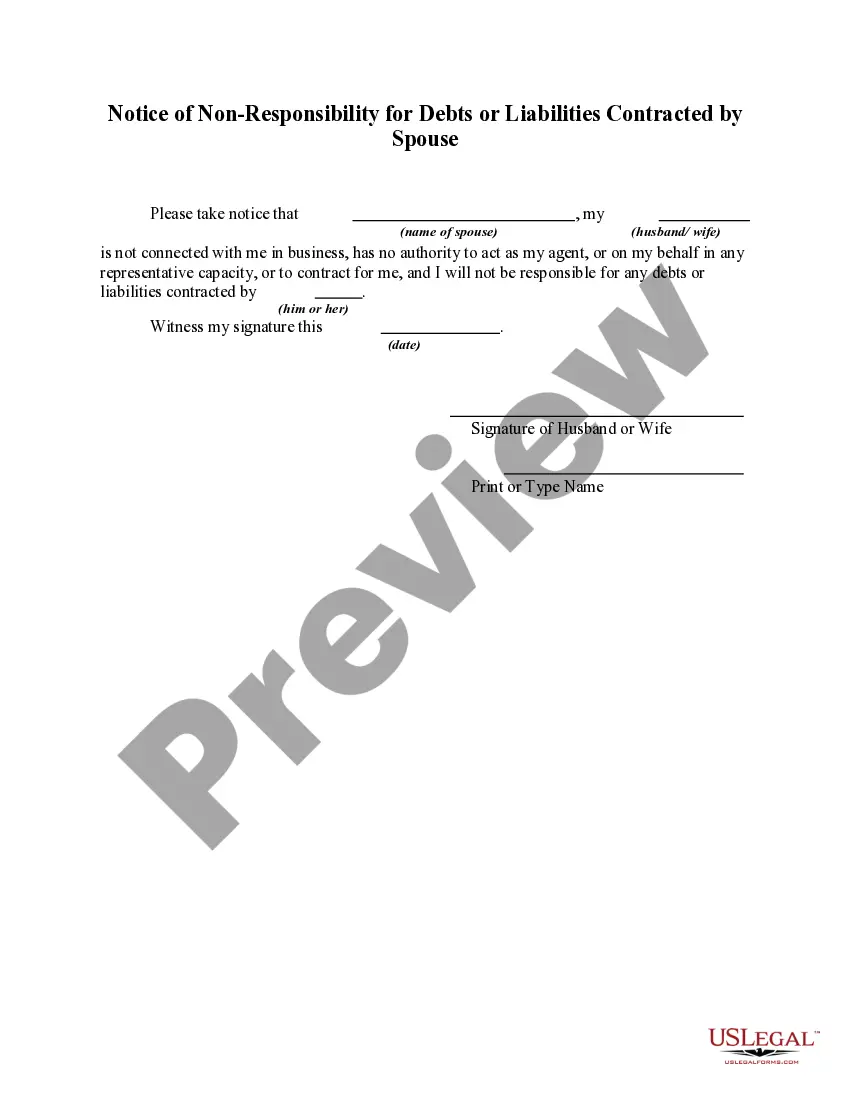

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Carolina Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse is a legally binding document that protects individuals from being held liable for their spouse's debts or liabilities. This contract is important for individuals who wish to establish their financial independence and safeguard their assets in South Carolina. When a couple is married in South Carolina, they usually share certain responsibilities and legal obligations. However, situations arise where one spouse may incur debts or liabilities without the knowledge or consent of the other spouse. In such cases, the innocent spouse can file a South Carolina Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse to ensure that they are not held accountable for their partner's financial obligations. Typically, there are two main types of South Carolina Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse: 1. General South Carolina Notice of Non-Responsibility: This contract applies to a broad range of debts or liabilities incurred by the spouse. It includes credit card debts, loans, mortgages, business debts, and any other financial obligations that the innocent spouse should not be held responsible for. 2. Specific South Carolina Notice of Non-Responsibility: As the name suggests, this contract applies to specific debts or liabilities contracted by the spouse. The innocent spouse specifies the particular debts or liabilities they wish to be exempt from, thereby allowing them to protect their assets from being used to pay off those specific obligations. In either case, the South Carolina Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse should clearly outline the responsibilities and liabilities of each spouse. It should state that the innocent spouse has no legal or financial obligation to repay the debts or liabilities incurred solely by their partner. To make the South Carolina Notice of Non-Responsibility legally valid, both spouses must sign it in the presence of a notary public. Additionally, it is crucial to ensure that the contract complies with all the legal requirements and regulations set forth by the state of South Carolina. By using a South Carolina Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, individuals can protect their financial interests and avoid potential legal complications. It offers an effective way to establish financial independence, safeguard assets, and prevent any unforeseen financial burdens that may arise from their spouse's debts or liabilities in South Carolina.