Nevada Certificate of Trust by Individual

Description

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

Definition and meaning

The Nevada Certificate of Trust by Individual is a legal document that affirms the existence of a trust and provides essential details about its structure and governance. This certificate is particularly significant because it allows trustees to engage in transactions involving trust assets without needing to disclose the entirety of the trust document.

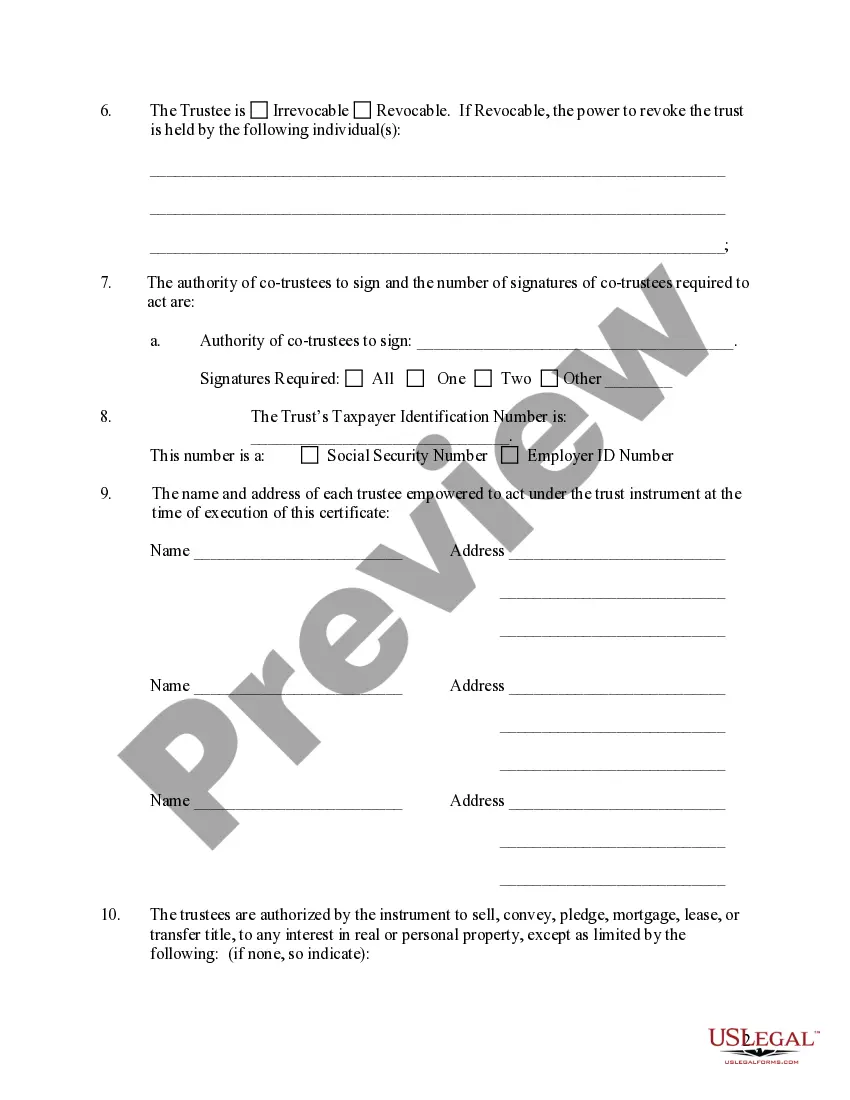

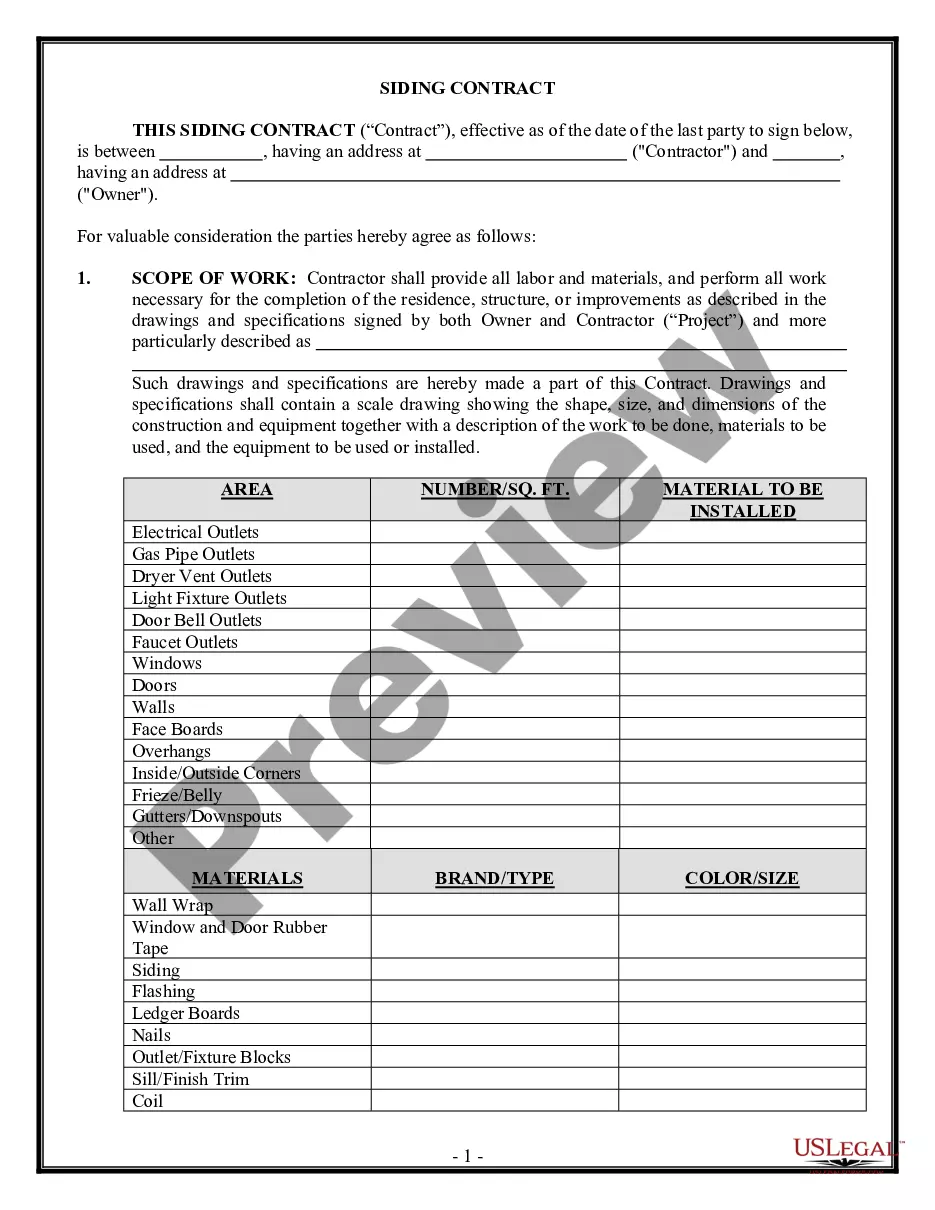

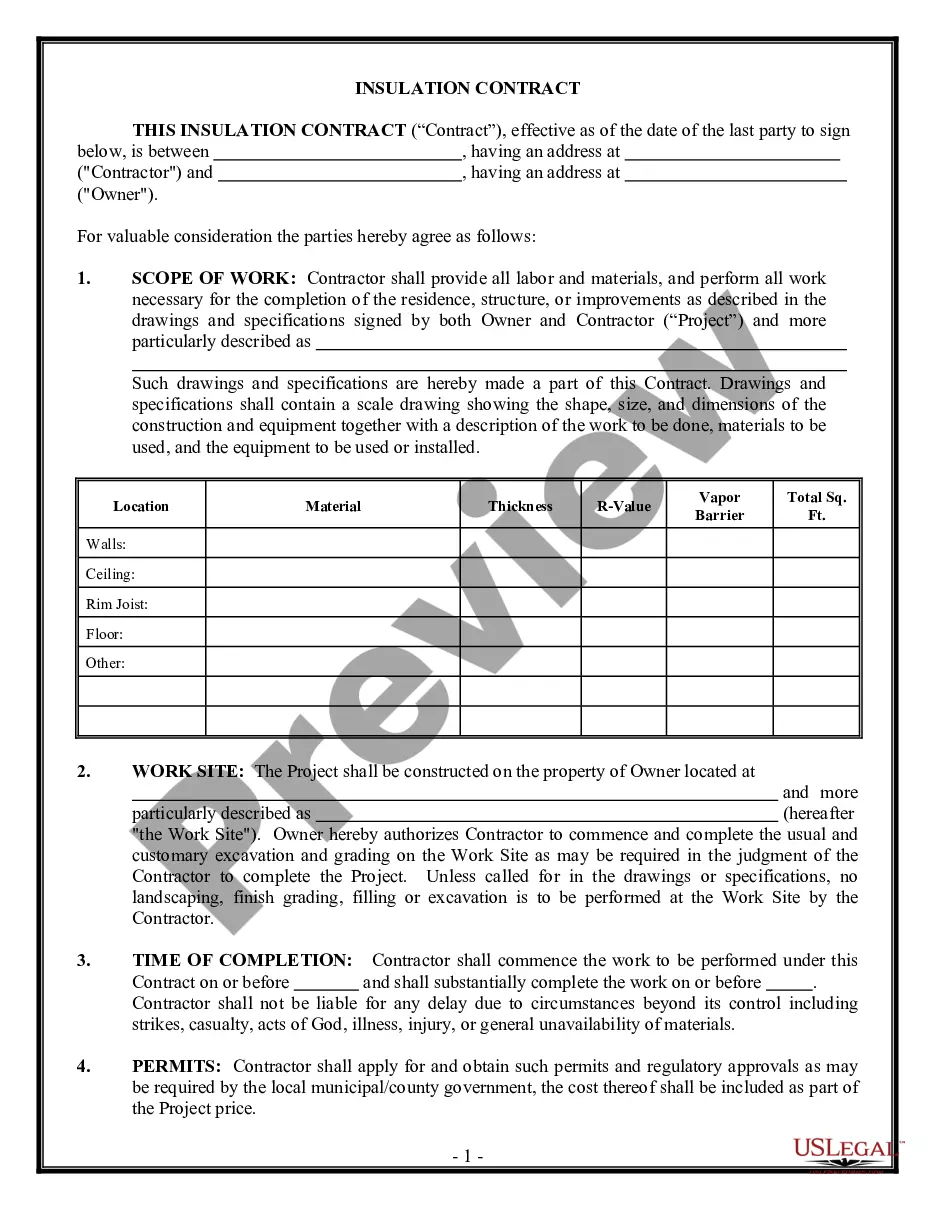

Key components of the form

This certificate includes critical information such as:

- The name of the trust

- The date when the trust was created

- The names of the original trustees and grantors

- The powers assigned to the trustees

- The trust's taxpayer identification number

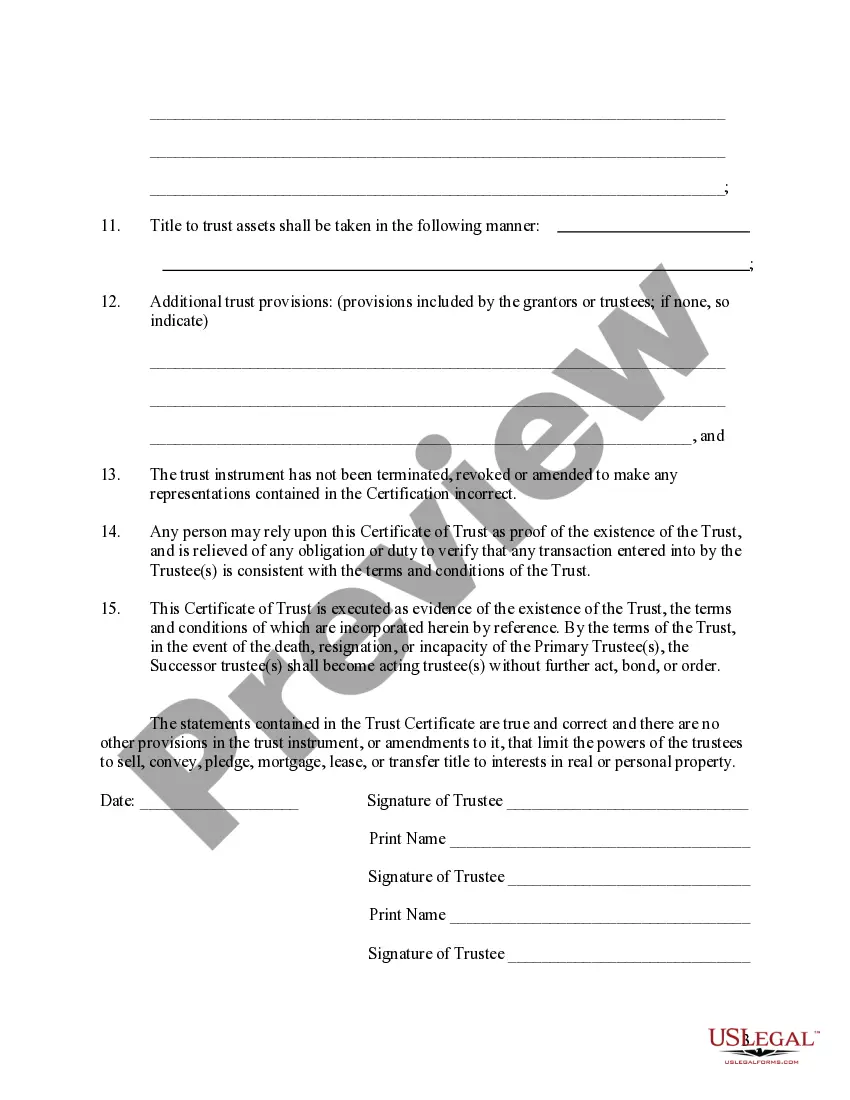

- Any additional provisions included in the trust

These components ensure that relevant parties understand the authority and limitations of the trustees in managing the trust's assets.

How to complete a form

To properly complete the Nevada Certificate of Trust by Individual, follow these steps:

- Begin by entering the name of the trust as it appears in the trust instrument.

- Record the date of the trust instrument.

- List all grantors' names, ensuring accuracy.

- Identify each original trustee by name.

- Detail the powers granted to the trustees as per the trust document.

- Indicate whether the trust is revocable or irrevocable, along with any individual(s) holding the power to revoke.

- Provide information regarding the required signatures for co-trustees.

- Include the taxpayer identification number.

- Complete the sections for the names and addresses of the trustees.

- Sign and date the certificate before a notary public.

Completing these steps ensures that the certificate accurately reflects the trust's intentions and is valid for legal use.

Who should use this form

The Nevada Certificate of Trust by Individual is designed for individuals who act as trustees in a trust. It is beneficial for any trustee looking to establish their authority, particularly when dealing with financial institutions or legal entities that require proof of trust existence.

Additionally, grantors of the trust who want to provide clarity about the trust's structure can also use this form to communicate essential information about the trust effectively.

Common mistakes to avoid when using this form

When completing the Nevada Certificate of Trust by Individual, be aware of these common pitfalls:

- Failing to accurately list all trustees and grantors, leading to potential disputes.

- Not providing a correct or current taxpayer identification number, which could complicate tax matters.

- Leaving sections incomplete or unclear, which might affect the document's validity.

- Overlooking the requirement for notarization, which is essential for legal acceptance.

By avoiding these mistakes, you can ensure the validity and functionality of the certificate.

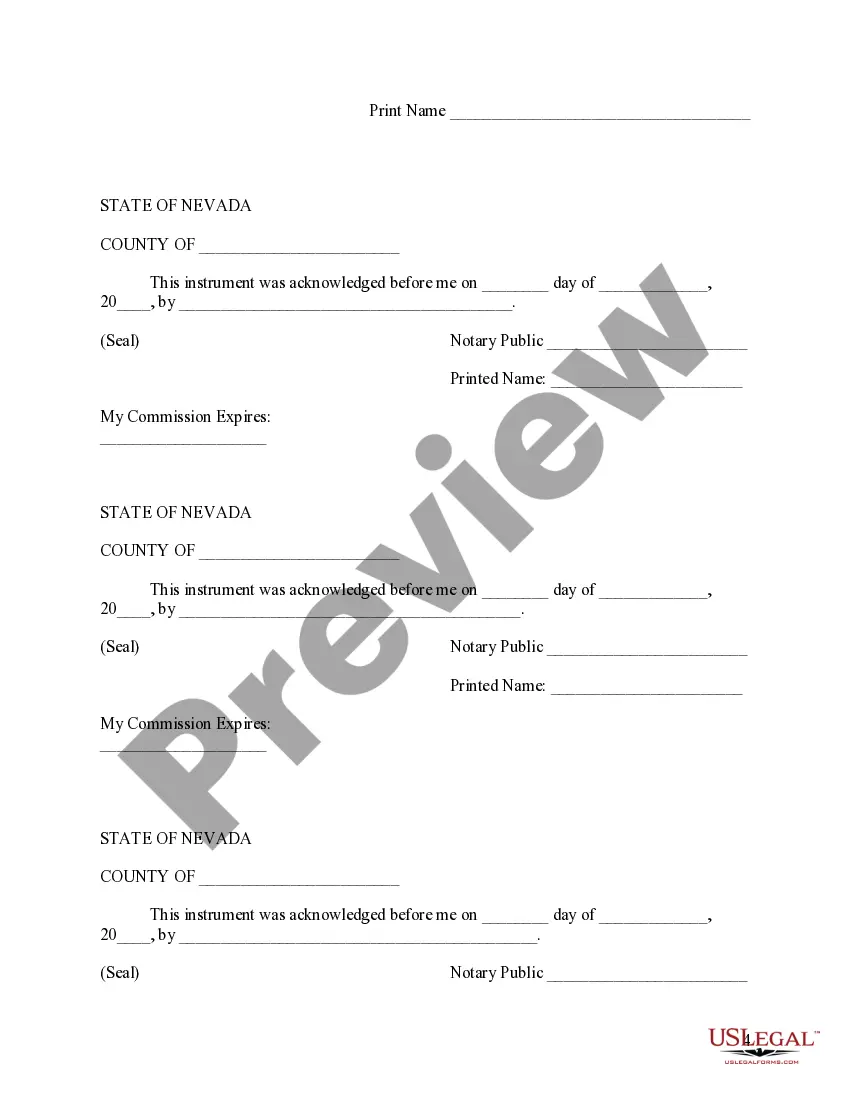

What to expect during notarization or witnessing

During the notarization process for the Nevada Certificate of Trust by Individual, the notary public will verify the identities of the trustees signing the document. They will confirm that all parties understand the certificate's contents and sign voluntarily. It is important that you bring valid identification and any other necessary documents to affirm the authenticity of the signatures.

The notary will then sign and seal the certificate, providing it with legal validation. This process may incur a small fee, and it's advisable to call ahead or check the notary's requirements before visiting.

How to fill out Nevada Certificate Of Trust By Individual?

US Legal Forms is actually a unique platform to find any legal or tax template for filling out, including Nevada Certificate of Trust by Individual. If you’re fed up with wasting time searching for suitable samples and paying money on document preparation/attorney charges, then US Legal Forms is precisely what you’re trying to find.

To enjoy all of the service’s advantages, you don't have to download any application but simply pick a subscription plan and sign up your account. If you already have one, just log in and look for an appropriate sample, download it, and fill it out. Downloaded documents are kept in the My Forms folder.

If you don't have a subscription but need to have Nevada Certificate of Trust by Individual, take a look at the instructions below:

- check out the form you’re considering applies in the state you need it in.

- Preview the form and read its description.

- Click Buy Now to reach the register webpage.

- Pick a pricing plan and continue registering by entering some information.

- Choose a payment method to complete the registration.

- Download the document by choosing your preferred format (.docx or .pdf)

Now, submit the document online or print out it. If you feel uncertain concerning your Nevada Certificate of Trust by Individual form, speak to a attorney to examine it before you decide to send out or file it. Start hassle-free!

Form popularity

FAQ

A trust document isn't required to be filed. If you are transferring real estate into a trust, a deed will need oo be filed at the county recorder's office.The declaration will detail the terms and conditions of the living trust, including who will serve as the Trustee.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.

The declaration of trust is your trust. The certificate of trust is not needed but can help keep things private and provide a easier way to open bank or stock accounts...

If you have a trust in Michigan, state law provides that you can register the trust. Registering a Michigan trust is not required (except for certain charitable trusts, as discussed below). Even for non-charitable trusts, there are good reasons that a trust should be registered.

Normally a Nevada trust only requires a notary public affirmation; that is, witnesses are not required. If however the trust is likely to be administered in a state that requires witnesses, sound discretion would mandate that witnesses and a notary public be used in executing the trust.

A Certificate of Trust is recorded in the Official Records of the county in which any trust real property is located. It aids in clearing title to the property. Generally, where the trust owns no real property, there is no need to record a Certificate...

Once a declaration of trust has been executed, subsequent declarations can be issued to confirm current terms or amend the existing agreement. Depending on the jurisdiction, the declaration of trust can also be referred to as a trust agreement or a trust document.

A: An affidavit of trust and a certificate of trust are essentially the same thing. At least they serve the same functions. Simply put, an affidavit of trust is an abbreviated version of the trust agreement that provides general information about the terms of the trust.

A certification of trust (or "trust certificate") is a short document signed by the trustee that simply states the trust's essential terms and certifies the trust's authority without revealing private details of the trust that aren't relevant to the pending transaction.