New Jersey Bargain and Sale Deed with Covenant of General Warranty

Definition and meaning

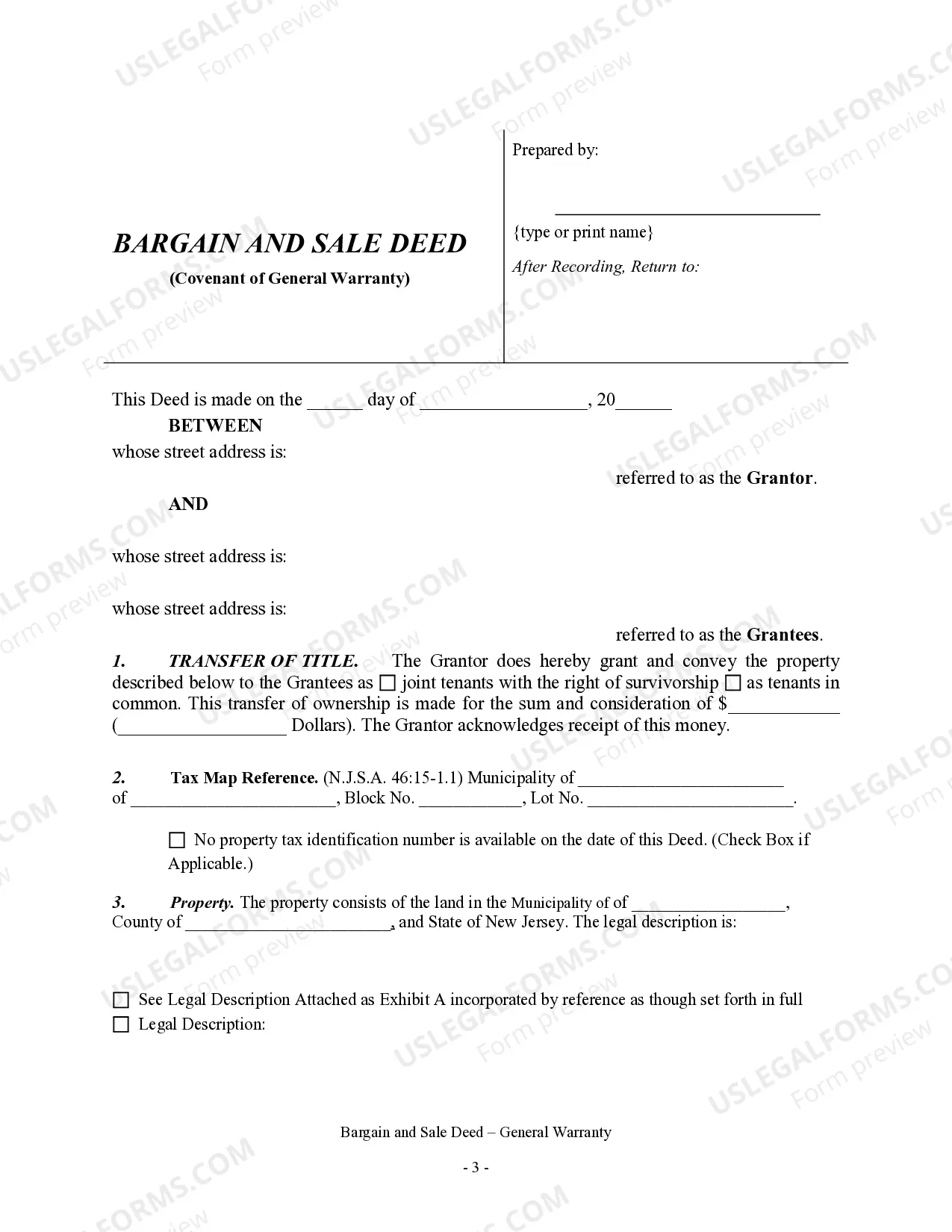

The New Jersey Bargain and Sale Deed with Covenant of General Warranty is a legal document used in property transactions in New Jersey. This deed facilitates the transfer of real estate from one party, the Grantor, to another party, the Grantees. The hallmark of this type of deed is the General Warranty Covenant, which assures the Grantees that the Grantor has the legal right to transfer the title and that the property is free of any liens or claims against it.

How to complete a form

Completing the New Jersey Bargain and Sale Deed requires careful attention to detail. Here's a step-by-step guide:

- Fill in the date: Write the date the deed is executed.

- Identify the Grantor: Clearly print the name and address of the Grantor.

- Identify the Grantees: List the names and addresses of the Grantees.

- Property description: Provide a detailed legal description of the property, which may include block and lot numbers.

- Consideration amount: Enter the sale price and acknowledge receipt of this amount.

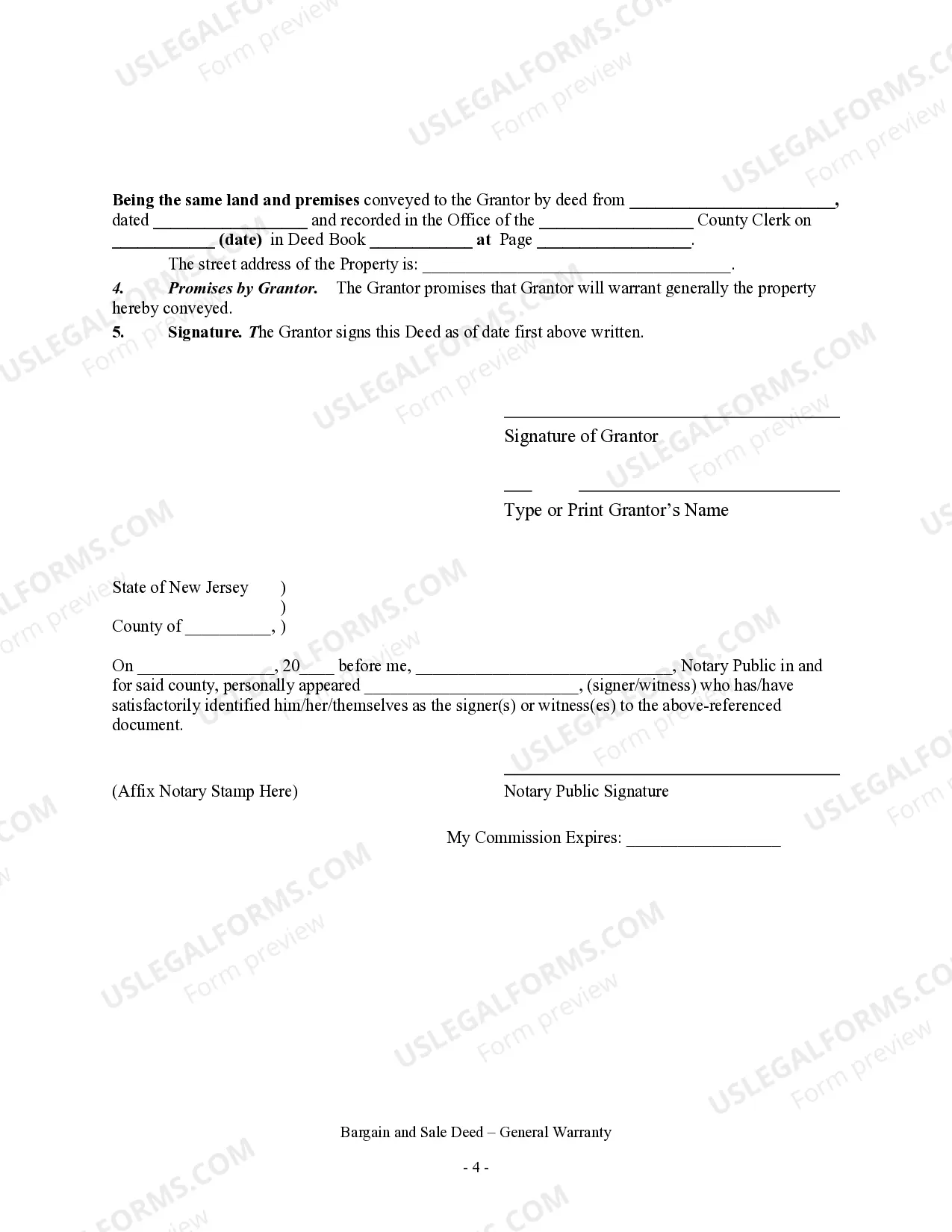

- Sign and date: The Grantor must sign the deed and include the date.

Who should use this form

This form is ideal for individuals or entities looking to transfer property ownership in New Jersey. It is commonly used by sellers and buyers who seek a formalized record of the property transfer. Additionally, real estate agents and attorneys may use this form on behalf of their clients to ensure compliance with state laws.

Key components of the form

The New Jersey Bargain and Sale Deed consists of several key components:

- Grantor and Grantee Information: Details for both parties involved in the transaction.

- Property Description: The exact location and legal description of the property being transferred.

- Consideration Amount: The monetary value exchanged for the property.

- General Warranty: A promise that the Grantor will defend the title against any claims.

- Notary Acknowledgment: A section for notarization to validate the deed.

What to expect during notarization or witnessing

When finalizing the New Jersey Bargain and Sale Deed, notarization is a crucial step. Expect the following:

- The Grantor must appear before a notary public.

- Identification is required, so bring a valid ID.

- The notary will witness the signing of the deed and may require that the Grantor affirm the accuracy of the information.

- Once notarized, the document is then ready for filing with the appropriate county office.

Form popularity

FAQ

In order to make the Warranty Deed legally binding, the Seller needs to sign it front of a notary public. Then signed and notarized deed must be filed at the city or county office for recording property documents. Before filing with this office all previously billed property taxes must be paid in full.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

Bargain and sale deeds are generally used to transfer the grantor's entire interest in the property at the time of conveyance without any warranties of title.Unlike quitclaim deeds, bargain and sale deeds imply that the grantor holds an actual interest in the property being conveyed.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

In its most basic form, a bargain and sale deed includes a warranty that the grantor has title to the property but does not guarantee that the property is free of claims.In contrast, a grantee would prefer a general warranty deed because it gives them the most protection possible.

Be in English or include an English translation (N.J.S.A. Identify the grantor / grantee (N.J.S.A. Be signed by the grantor with the name printed underneath (N.J.S.A. Include the name and mailing address of the grantee (N.J.S.A. Be notarized (N.J.S.A.

Let's start with the definition of a deed: DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.

Buying property with this type of deed is not necessarily a bad idea, but it is advisable to take some precautions. If possible, a title search should be conducted to look for any clouds on the title and to see how difficult it would be to release them.