Missouri Loan Modification Agreement

Form popularity

FAQ

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

Generally, the simplest way to calculate a debt to income ratio for loan modification is simply to take total monthly debt obligations and divide it by total monthly gross household income. Anything over about 60-70% is pretty good for loan modification purposes.

Be at least one regular mortgage payment behind or show that missing a payment is imminent. Provide evidence of significant financial hardship, for reasons such as:

The loan modification underwriter will analyze and review the particular circumstances which justify a loan modification. The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay.

Yes, probably. In California, a law called the Homeowner Bill of Rights (HBOR) generally gives borrowers the right to appeal a modification denial. Under HBOR, in most cases, if the servicer denies a borrower's application to modify a first lien loan, the borrower can appeal.

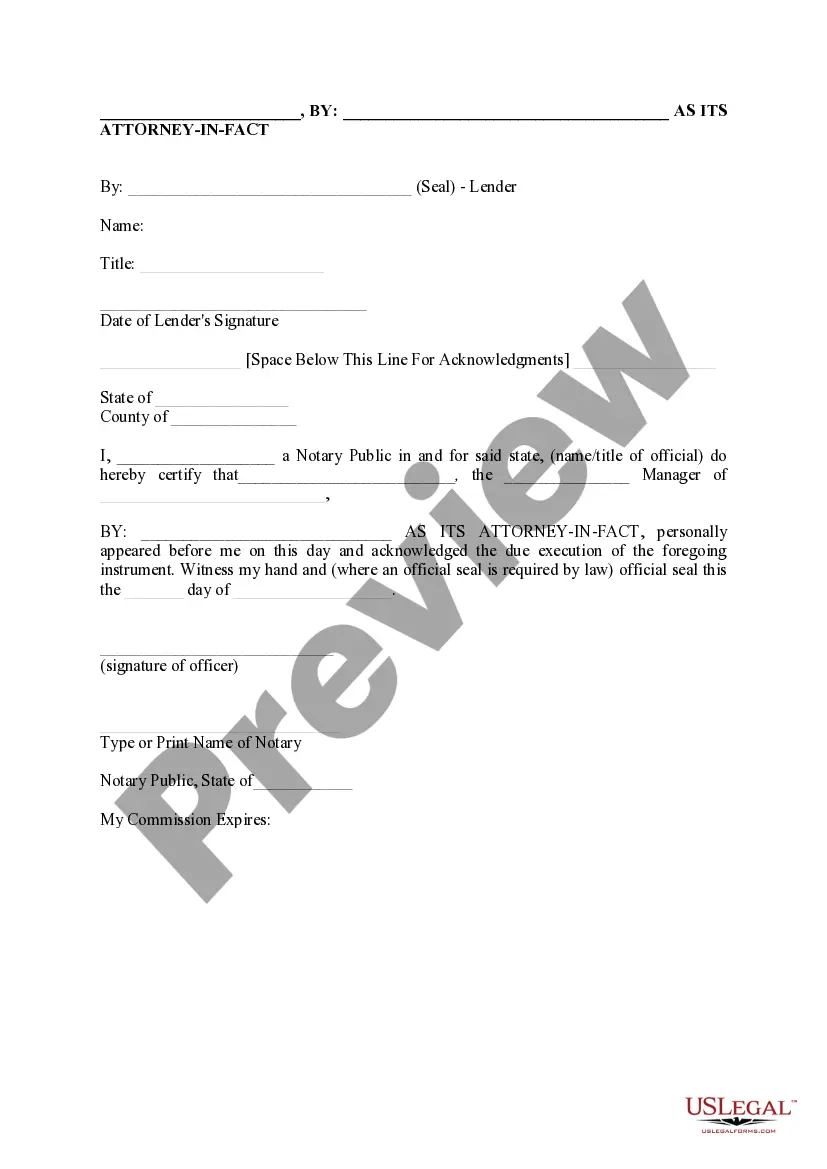

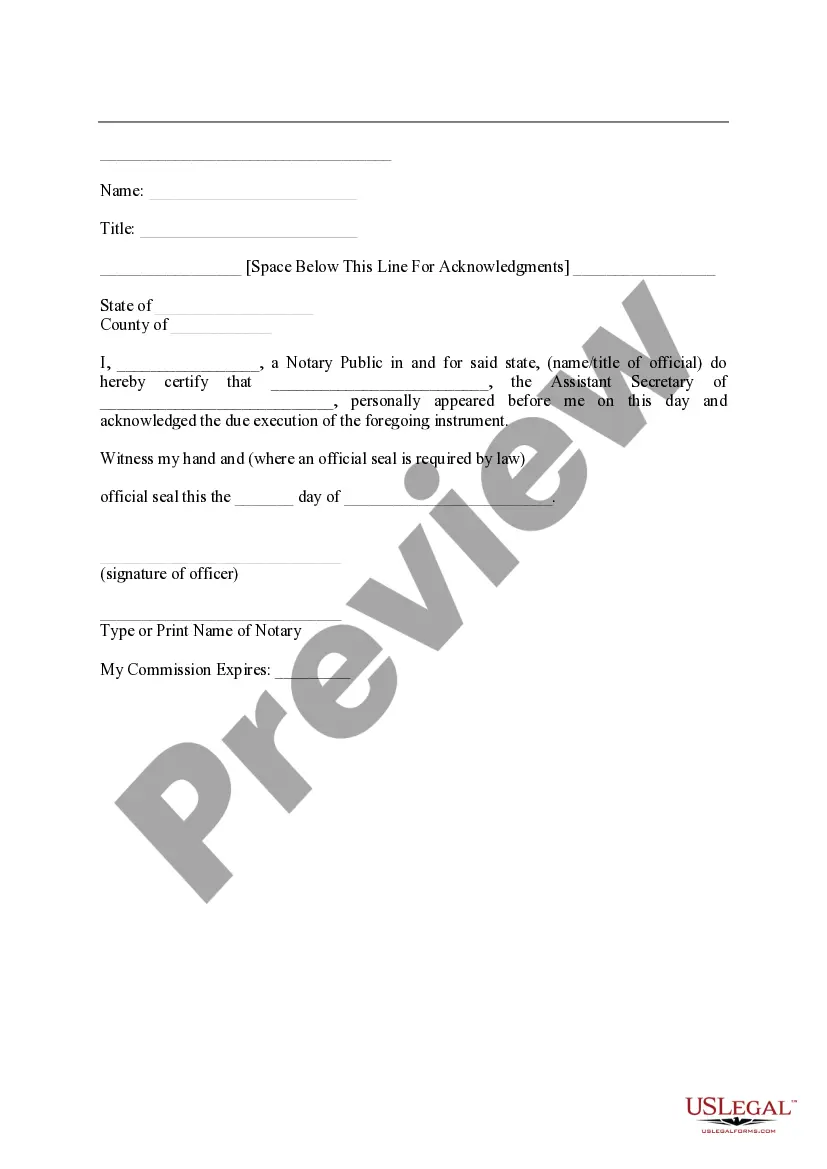

When you've successfully completed your trial modification payments, your mortgage loan servicer will send you a loan modification agreement. That agreement needs to be signed by you, stamped and signed by a notary, and sent back to your servicer.Some banks even offer a notary who will come to your home.

A lender may agree to a loan modification during a settlement procedure or in the case of a potential foreclosure.A loan modification agreement is a long-term solution. A loan modification may involve a reduced interest rate, a longer period to repay, a different type of loan, or any combination of these.

Suspend past due amounts. Bring your account current. Adjust your interest rate. Lower your minimum payments. Modify your loan. Agree to a short sale of a home. Consider a settlement option.