Michigan LLC Operating Agreement for Married Couple

Description

How to fill out LLC Operating Agreement For Married Couple?

Are you currently in a situation where you require documents for either business or personal functions nearly every day.

There are numerous legal document templates available online, but finding ones you can trust isn't easy.

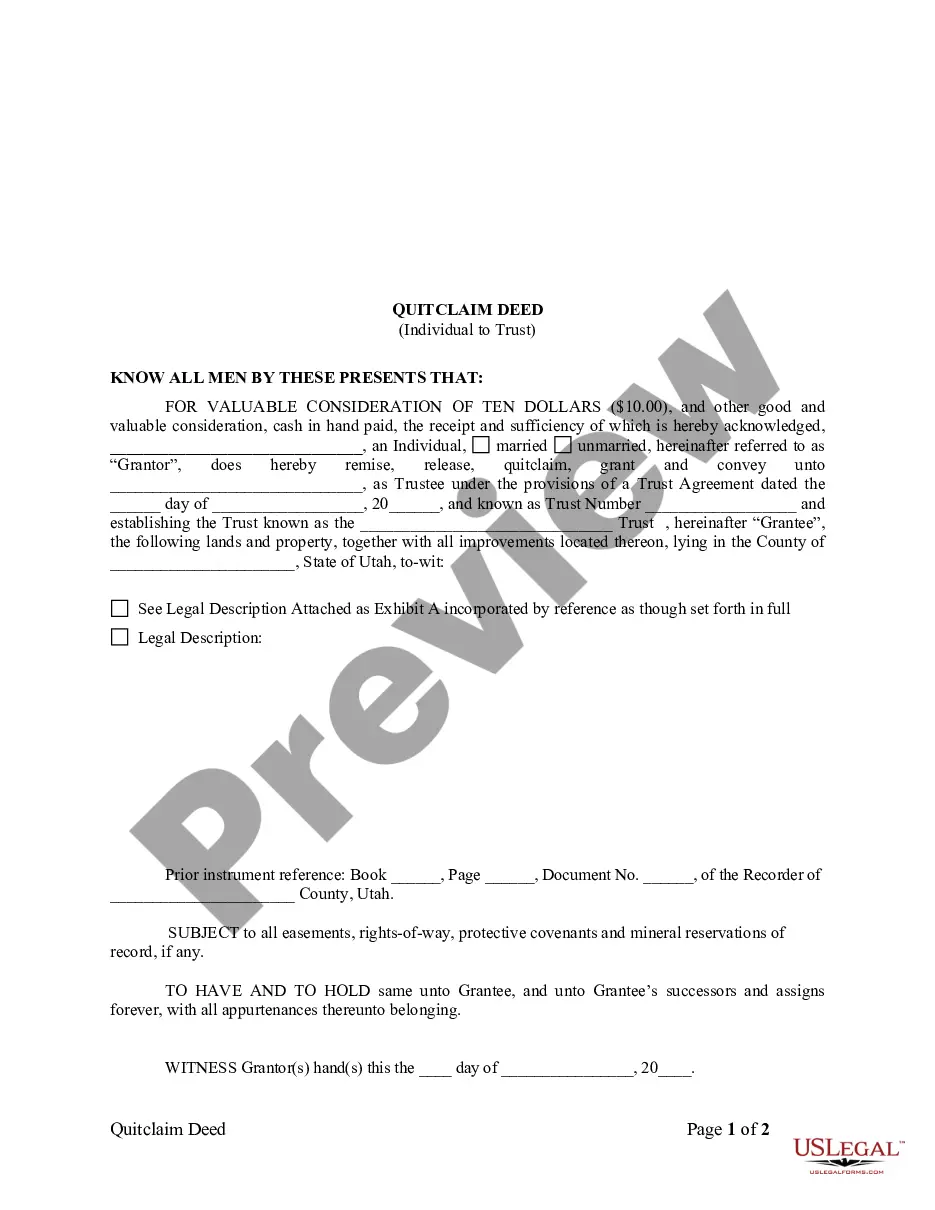

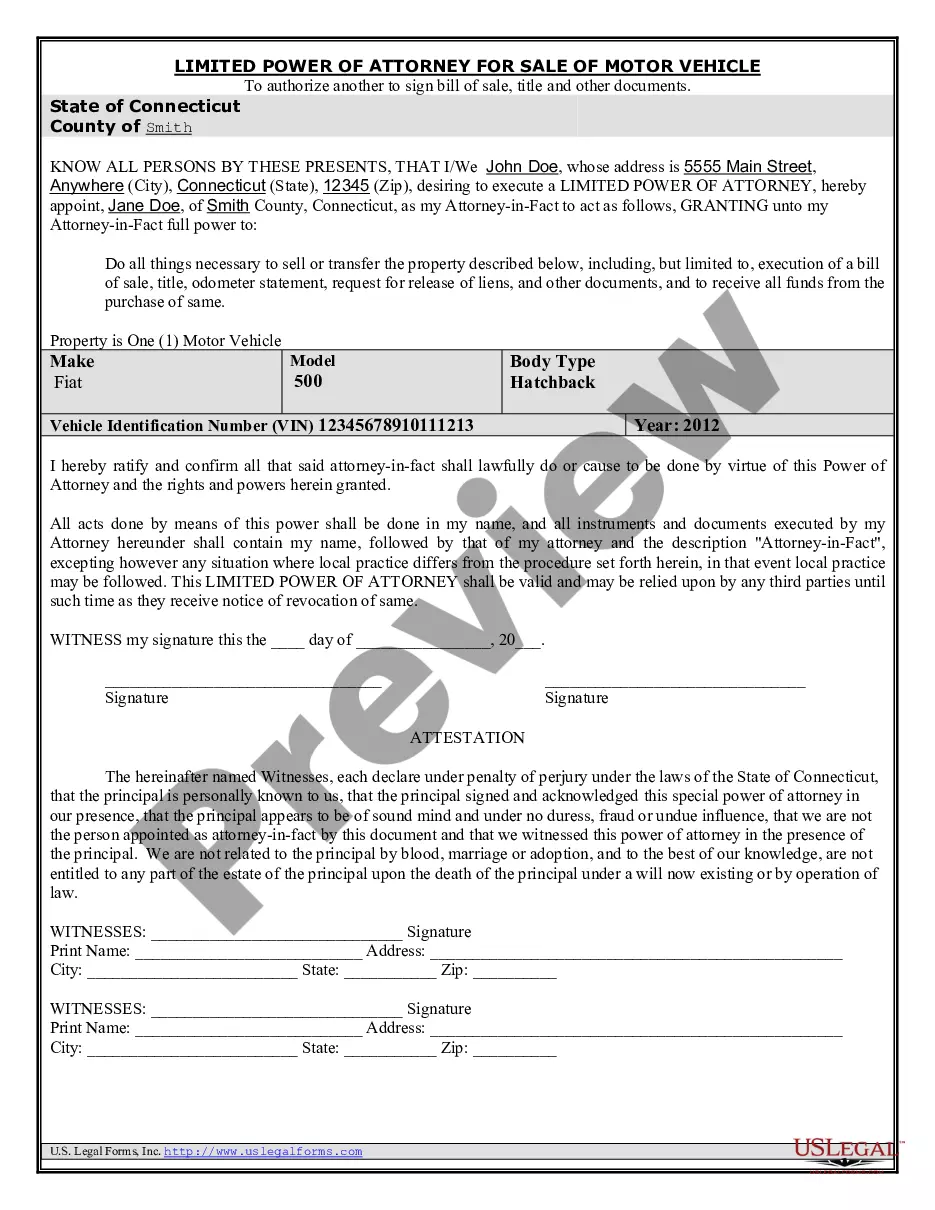

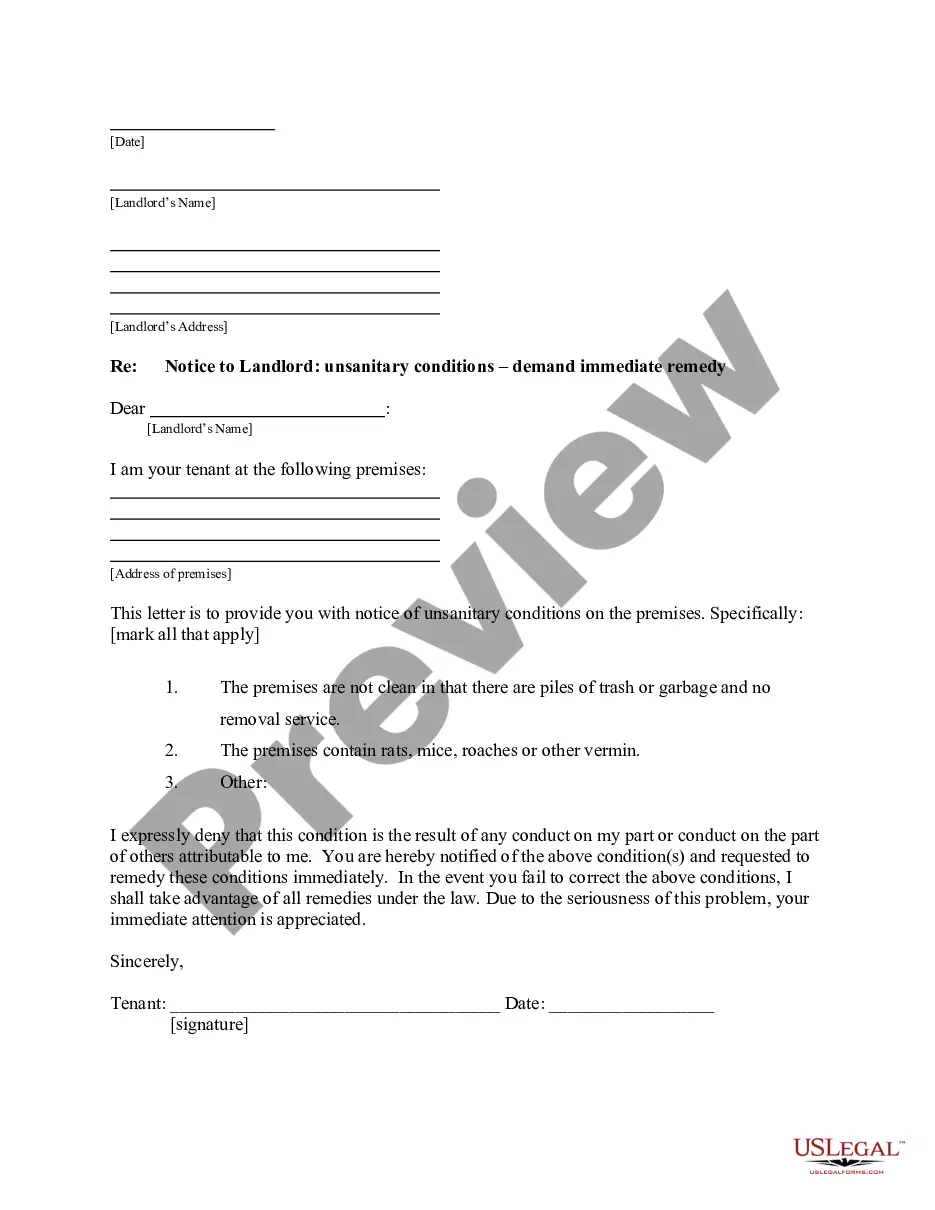

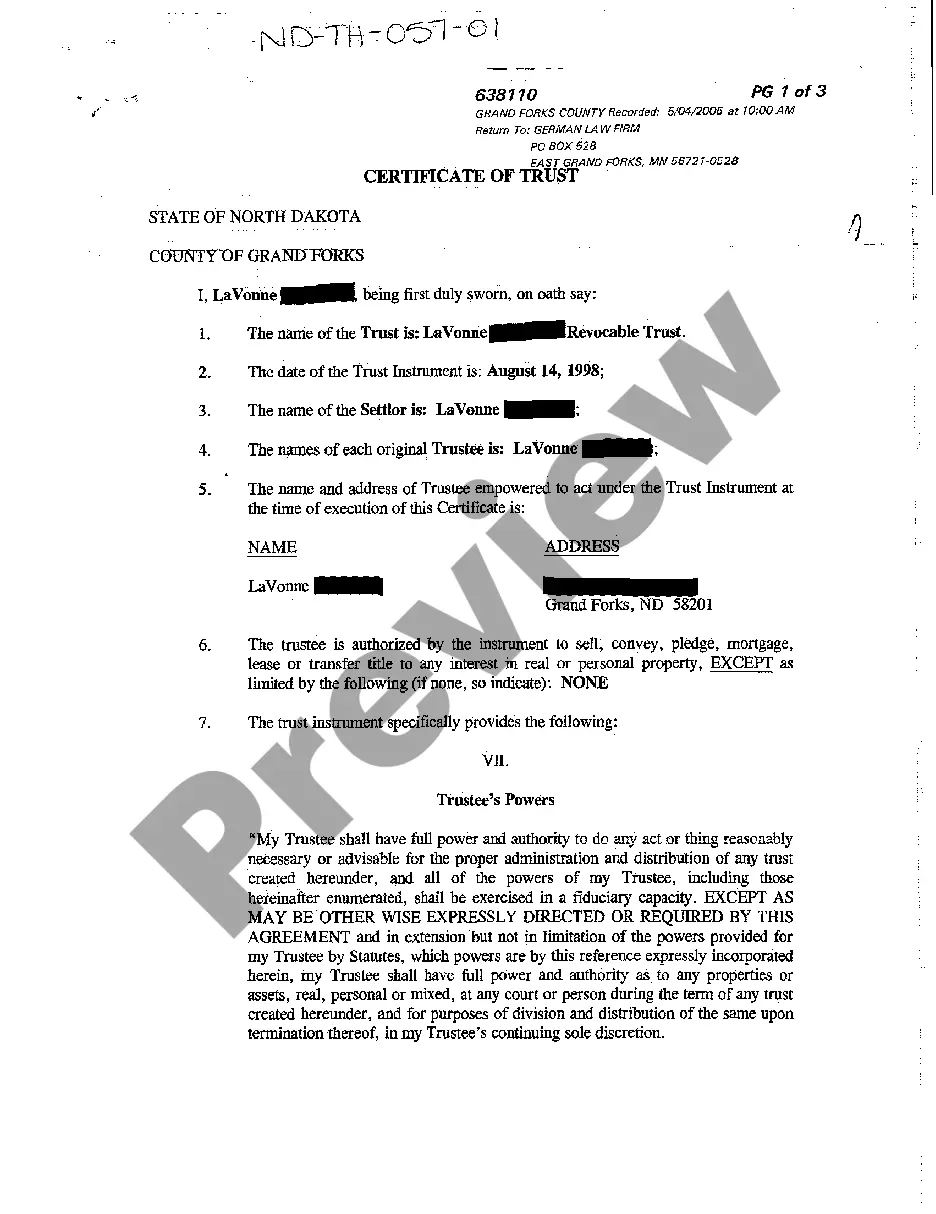

US Legal Forms offers thousands of template forms, such as the Michigan LLC Operating Agreement for Married Couples, that are crafted to meet state and federal requirements.

Once you find the right form, click Get now.

Choose the pricing plan you want, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are familiar with the US Legal Forms website and have an account, simply sign in.

- After that, you can download the Michigan LLC Operating Agreement for Married Couples template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for your correct locality.

- Use the Preview button to check the form.

- Review the details to ensure you have selected the correct template.

- If the form isn't what you're looking for, use the Search section to locate the form that suits your needs.

Form popularity

FAQ

member LLC is a limited liability company with a single owner, and LLCs refer to owners as members. Singlemember LLCs are disregarded entities. A disregarded entity is ignored by the IRS for tax purposes, and the IRS collects the business's taxes through the owner's personal tax return.

Since the default rule for multi-members LLCs is that the LLC is treated as a partnership, an LLC composed solely of a husband and wife will be a partnership for tax purposes unless the members choose to have it elect to be treated as a corporation. There is one exception to the general rule, however.

A business jointly owned and operated by a married couple is a partnership (and should file Form 1065, U.S. Return of Partnership Income) unless the spouses qualify and elect to have the business be treated as a qualified joint venture, or they operate their business in one of the nine community property states.

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC.

The straightforward answer is no: You are not required to name your spouse anywhere in the LLC documents, especially if they aren't directly involved in the business. However, there are some occasions where it may be helpful or necessary to include your spouse.

Since the default rule for multi-members LLCs is that the LLC is treated as a partnership, an LLC composed solely of a husband and wife will be a partnership for tax purposes unless the members choose to have it elect to be treated as a corporation. There is one exception to the general rule, however.

Note: If an LLC is owned by husband and wife in a non-community property state, the LLC should file as a partnership. LLCs owned by a husband and wife are not eligible to be "qualified joint ventures" (which can elect not be treated as partnerships) because they are state law entities.

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC.

The straightforward answer is no: You are not required to name your spouse anywhere in the LLC documents, especially if they aren't directly involved in the business.