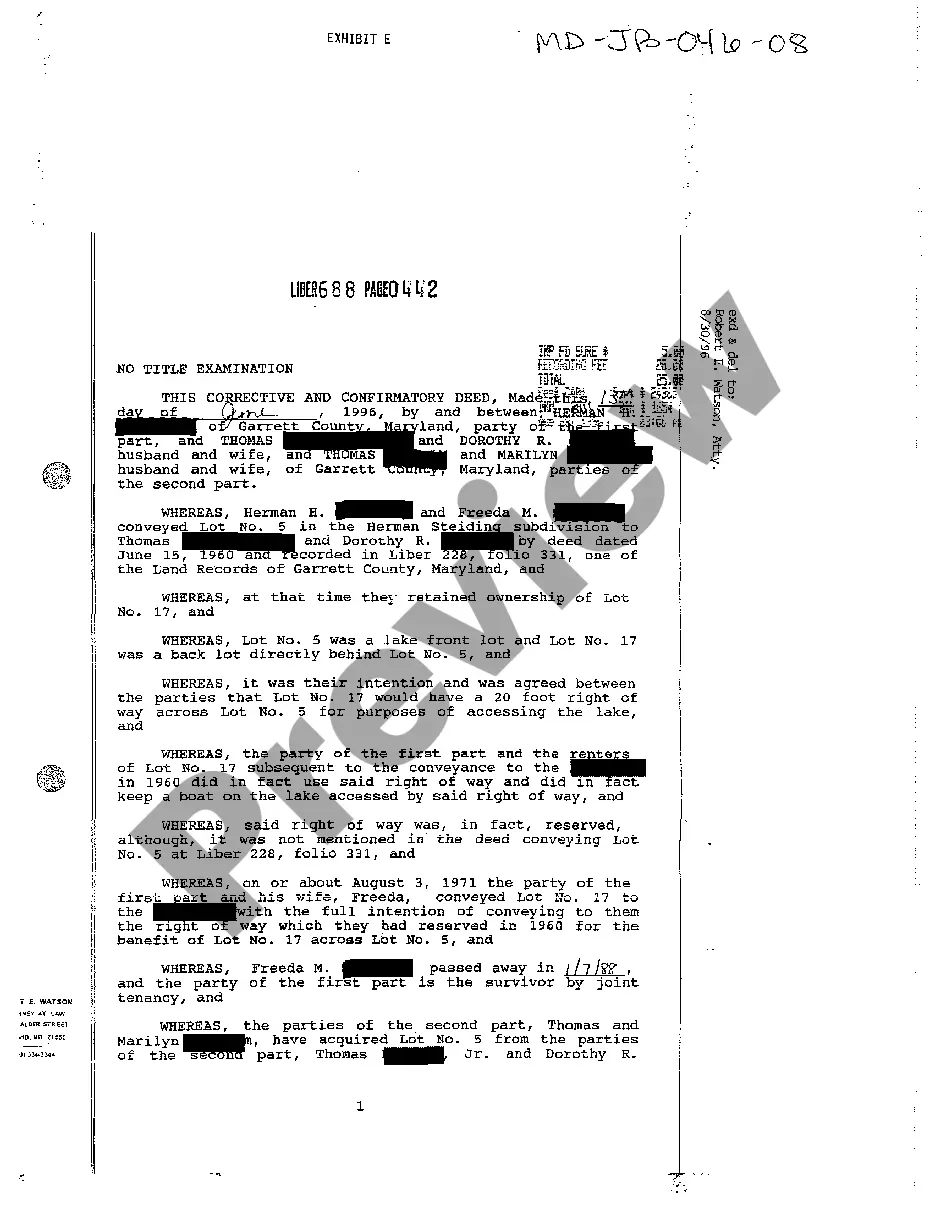

Maryland Exhibit E Corrective and Confirmatory Deed - Husband and Wife to Married Couple

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Exhibit E Corrective And Confirmatory Deed - Husband And Wife To Married Couple?

Greetings to the finest legal documents library, US Legal Forms. Here, you can obtain any template such as Maryland Exhibit E Corrective and Confirmatory Deed - Husband and Wife to Married Couple forms and archive them (as many as you desire/require). Create official documents in just a few hours, rather than days or weeks, without spending a fortune on a lawyer. Acquire the state-specific template in a few clicks and feel assured knowing it was crafted by our skilled legal experts.

If you are an existing user, simply Log In to your account and click Download next to the Maryland Exhibit E Corrective and Confirmatory Deed - Husband and Wife to Married Couple you wish to obtain. Since US Legal Forms is a web-based solution, you will typically have access to your saved documents, no matter the device you’re using. Access them under the My documents section.

If you haven't created an account yet, what’s holding you back? Refer to our instructions below to begin.

Once you have filled out the Maryland Exhibit E Corrective and Confirmatory Deed - Husband and Wife to Married Couple, submit it to your attorney for review. It’s an additional step but a crucial one to ensure you’re fully protected. Join US Legal Forms today and gain access to a vast array of reusable templates.

- If this is a state-specific template, verify its validity in your state.

- Read the description (if available) to ensure it’s the correct template.

- Explore more details using the Preview feature.

- If the template satisfies your needs, click Buy Now.

- To create an account, choose a pricing plan.

- Utilize a card or PayPal account to register.

- Download the template in the format you need (Word or PDF).

- Print the document and complete it with your/your business’s information.

Form popularity

FAQ

To change the names on a real estate deed, you will need to file a new deed with the Division of Land Records in the Circuit Court for the county where the property is located. The clerk will record the new deed.

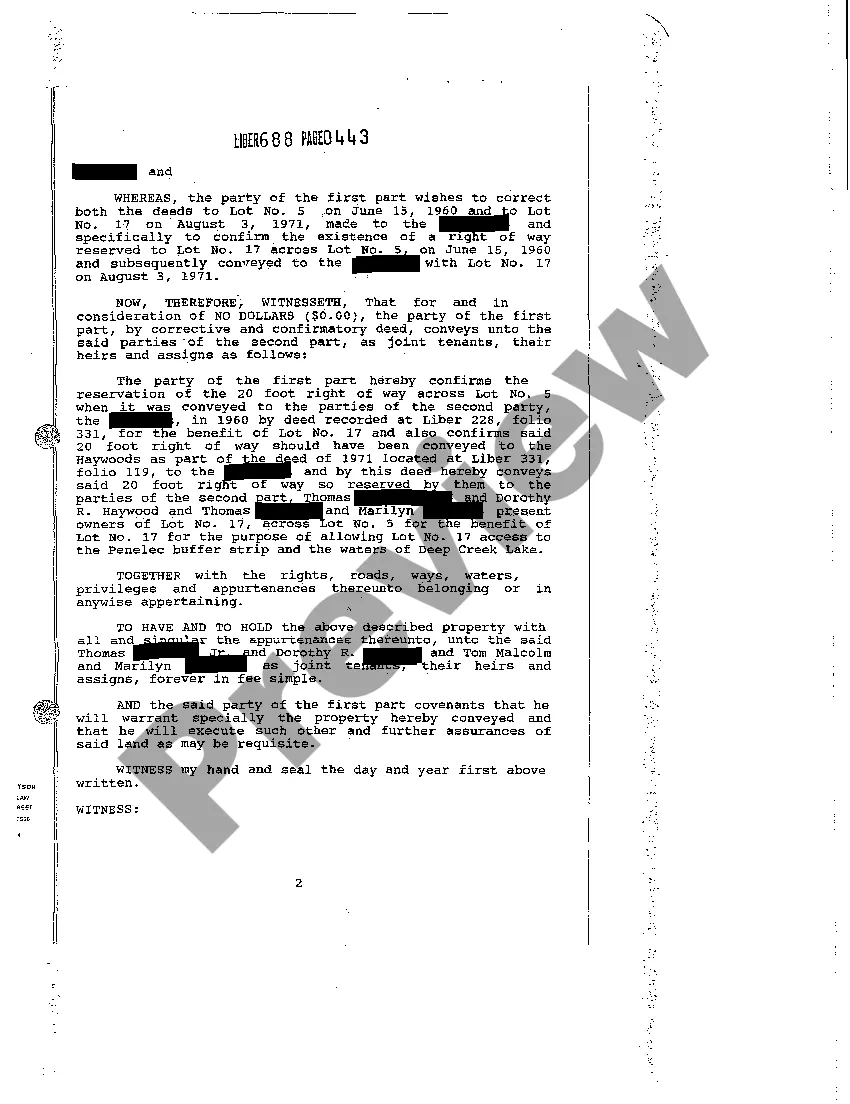

A confirmatory deed is used to correct one or more "defects" in a property owner's title. Should a real estate sale or other transfer of ownership occur and a defect in the current or previous title appear, a confirmatory deed can correct the prior problem as well as the present issue.

Presently, Maryland law permits individuals to transfer personal property to a named beneficiary outside of probate.The owner may sell the property, transfer it to someone other than the beneficiary named in the transfer-on-death deed, or place a mortgage on the property.

A corrective deed is an instrument filed in the public record in addition to the incorrect deed. It's known as a confirmatory instrument since it perfects an existing title by removing any defects, but it doesn't pass title on its own.

Correct common errors in a deed, such as typographical mistakes or omissions in various sections of the original deed, by using a corrective deed, which must be signed by the grantor and witnesses and re-acknowledged. They recommend against correcting deeds that are valid in spite of an error.

A correction deed is a new deed signed and acknowledged by the grantor. A correction affidavit can be signed by either party but is used in limited situations. This press release was authorized by Mark W. Bidwell, an attorney licensed in California.

Presently, Maryland law permits individuals to transfer personal property to a named beneficiary outside of probate.The owner may sell the property, transfer it to someone other than the beneficiary named in the transfer-on-death deed, or place a mortgage on the property.

Correction Deed - Correcting A Recorded Deed.A corrective deed is most often used for minor mistakes, such as misspelled or incomplete names, missing or wrong middle initials, and omission of marital status or vesting information. It can also be used for obvious errors in the property description.

Re-recording of the original document. With corrections made in the body of the original document. A cover sheet detailing the changes. Must be re-signed and re-acknowledged. Correction Deed. A new deed reflecting the corrections/changes. Must meet all recording requirements of a deed.