Kentucky Sample Transmittal Letter

Understanding this form

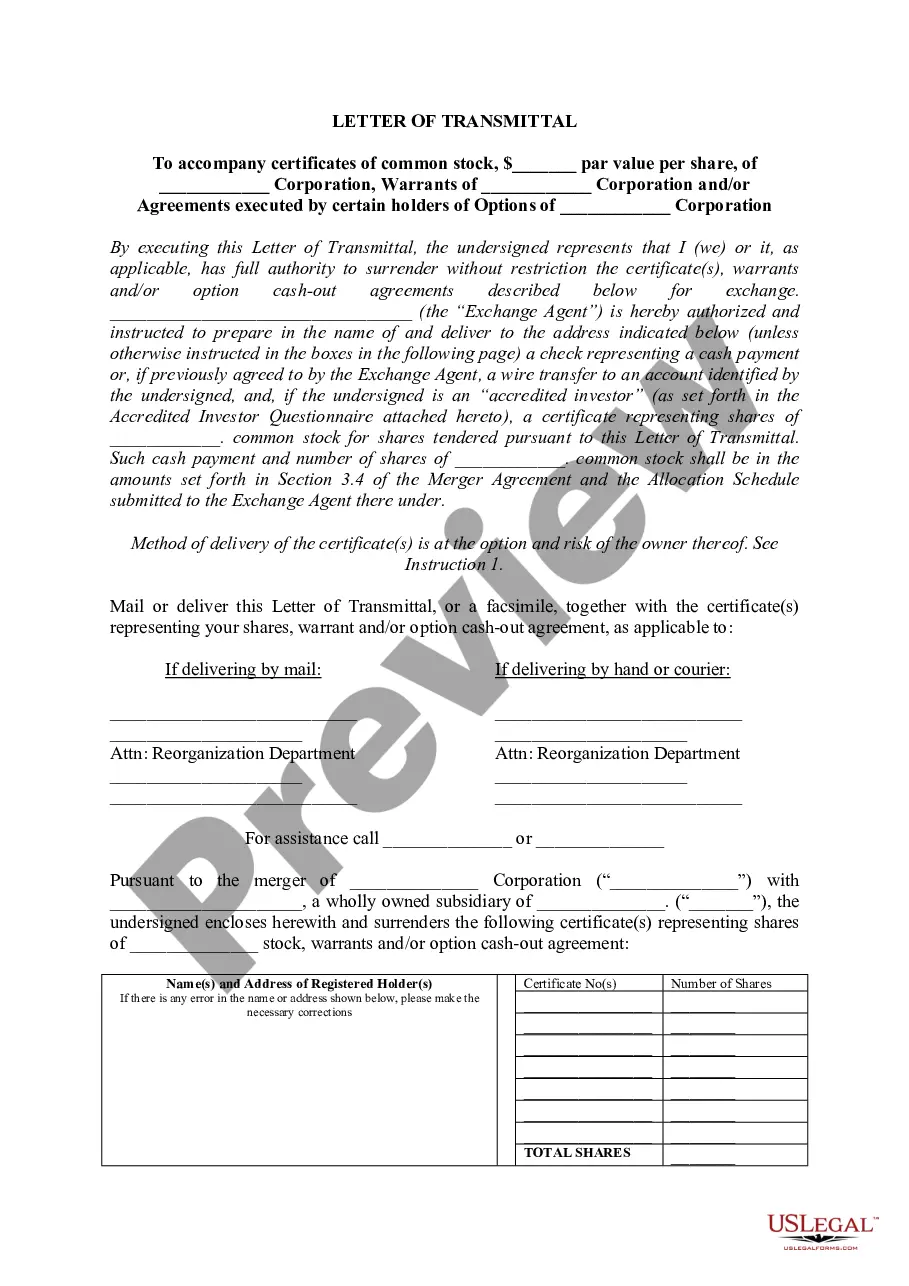

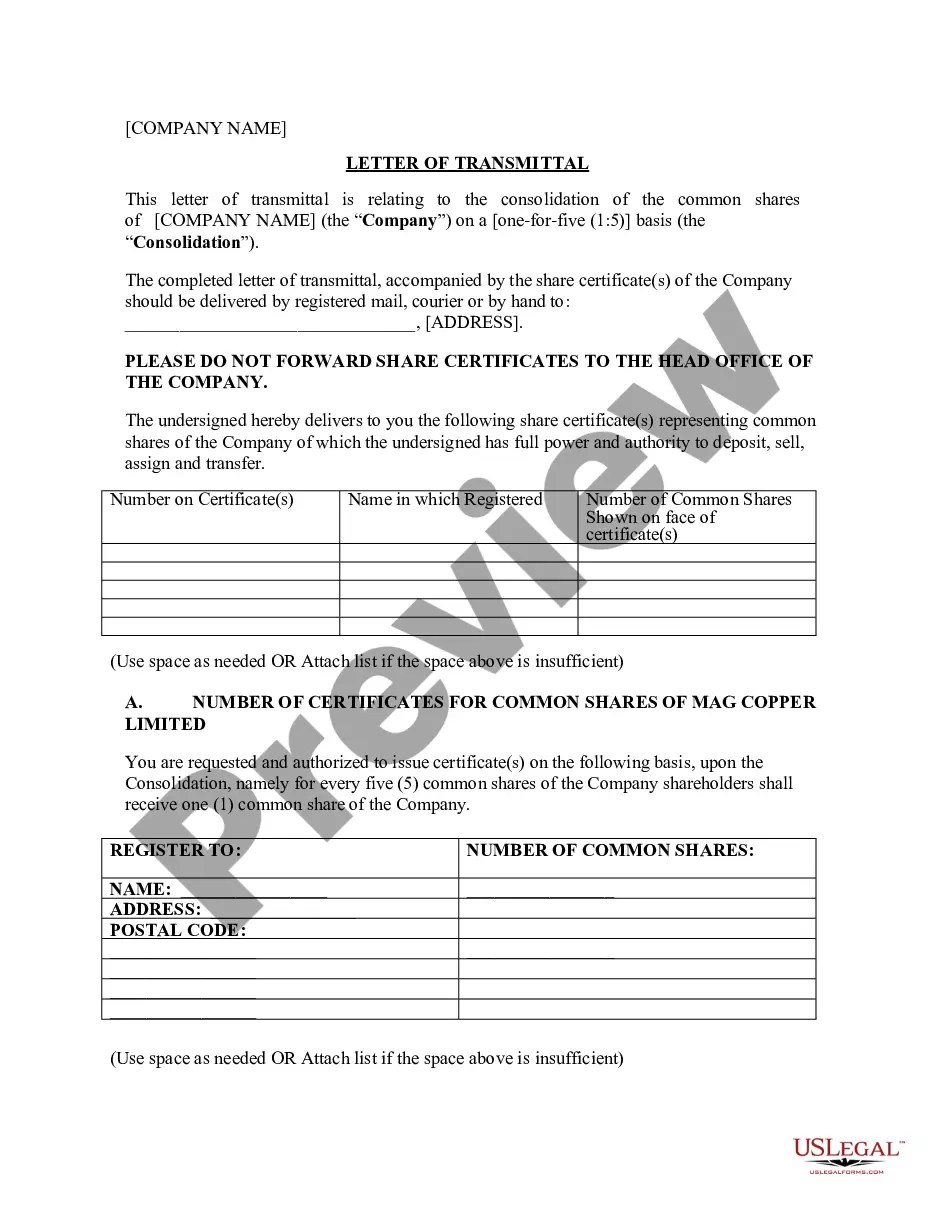

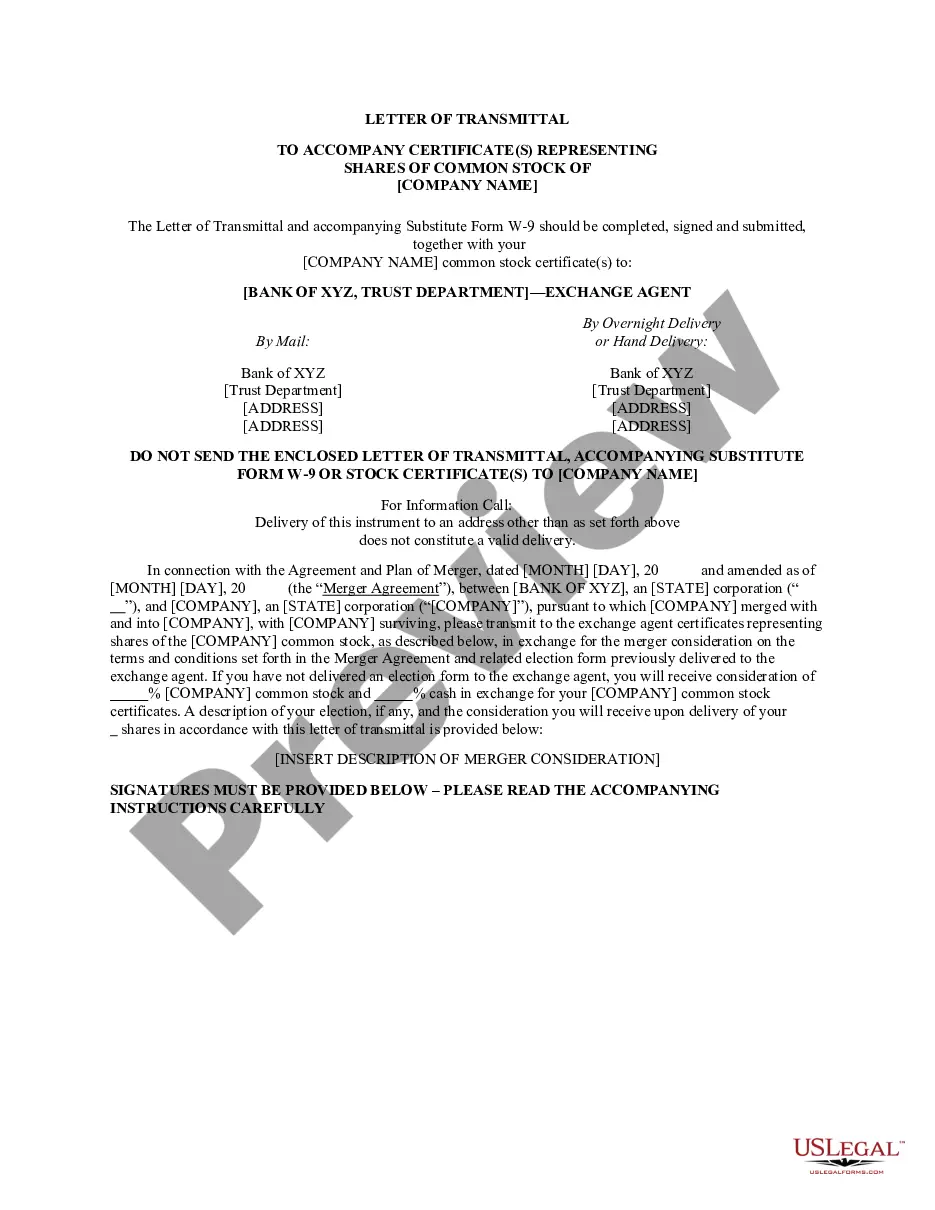

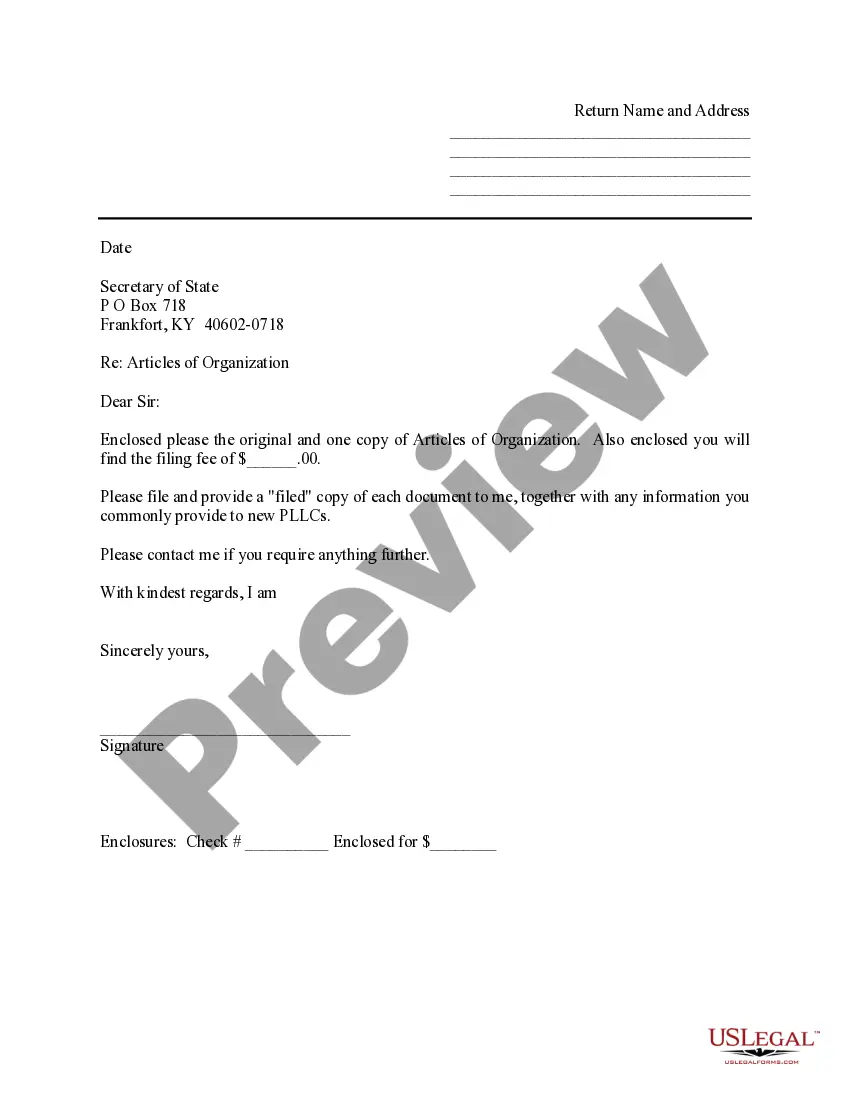

The Sample Transmittal Letter is a formal document sent to the Secretary of State when submitting Articles of Organization for filing. This letter includes the necessary documents and filing fees required to establish a new business entity. It differs from other business formation documents by serving as a cover letter that ensures all relevant paperwork is properly submitted and acknowledged.

Main sections of this form

- Date of submission to the Secretary of State.

- Address of the Secretary of State.

- Reference to the Articles of Organization.

- Inclusion of filing fee amount.

- Request for confirmation of filing and additional information for new PLLCs.

- Signature of the sender and any necessary enclosures.

When to use this form

This form should be used when you are ready to file Articles of Organization for your new business. It is necessary when submitting the required documents and fees to the Secretary of State. An accurate and complete transmittal letter can facilitate the filing process and ensure timely processing of your business formation.

Who this form is for

- Business owners forming a new Limited Liability Company (LLC).

- Individuals or partners wishing to register a Professional Limited Liability Company (PLLC).

- Legal representatives handling the formation process for clients.

Completing this form step by step

- Enter the date at the top of the letter.

- Fill in the address for the Secretary of State in Kentucky.

- Reference the Articles of Organization clearly in the body of the letter.

- Indicate the filing fee that you are enclosing.

- Sign the letter and include any required enclosures.

Does this form need to be notarized?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Mistakes to watch out for

- Neglecting to include the filing fee amount or check.

- Failing to sign the transmittal letter.

- Omitting important reference details, such as the Articles of Organization.

- Not using the correct address for the Secretary of State.

Benefits of completing this form online

- Immediate access to the transmittal letter template, making it easy to complete.

- Ability to edit and customize the form to fit your specific needs.

- Reliability of using attorney-drafted templates, ensuring legal compliance.

What to keep in mind

- The Sample Transmittal Letter is essential for registering a new LLC or PLLC in Kentucky.

- Ensure all components are complete and accurate to avoid processing delays.

- Review state-specific rules to confirm compliance with local filing requirements.

Form popularity

FAQ

Register online with the KY Dept of Revenue to receive a Withholding Account Number. Registration may also be completed via the Kentucky Registration Application (10A100). Please visit the Kentucky DOR Tax Registration Information page or additional resources or call the KY DOR at (502) 564-4581.

Annual wages minus the Kentucky standard deduction equals annual Kentucky wages. Compute tax on wages using the 5% Kentucky flat tax rate to determine gross annual Kentucky tax. Divide the gross annual Kentucky tax by the number of annual pay periods to determine the Kentucky withholding tax for the pay period.

A withholding tax takes a set amount of money out of an employee's paycheck and pays it to the government. The money taken is a credit against the employee's annual income tax. If too much money is withheld, an employee will receive a tax refund; if not enough is withheld, an employee will have an additional tax bill.

Employers and payers who issue Kentucky withholding statements W-2, W-2G, or 1099 must report the statements to the DOR in an electronic file or file Form K-5. Those who issue 26 or more Kentucky withholding statements are required to submit an electronic file or file Form K-5 online.

Withholding tax applies to income earned through wages, pensions, bonuses, commissions, and gambling winnings. Dividends and capital gains, for example, are not subject to withholding tax. Self-employed people generally don't pay withholding taxes; they typically make quarterly estimated payments instead.

Form K4Kentucky Withholding CertificateKentucky recently enacted a new flat 5% income tax rate. Due to this change all Kentucky wage earners will be taxed at 5% with an allowance for the standard deduction.

Those who issue 26 or more Kentucky withholding statements are required to submit an electronic file or file Form K-5 online. The completed Form K-5 may be submitted online or printed and mailed to the DOR. The option to print and mail is only available for those reporting fewer than 26 withholding statements.

Commonwealth Business Identifier (CBI): A unique, ten-digit, number assigned to all Kentucky businesses. The CBI allows the business to be easily identified by all state agencies that utilize the Kentucky OneStop Portal.