The Idaho Agreement Adding Silent Partner to Existing Partnership is a legal document that outlines the process of introducing a silent partner to an already existing partnership in the state of Idaho. This agreement is essential for formalizing the arrangements, rights, and obligations of all parties involved. A silent partner, also known as a dormant or limited partner, is an individual or entity who invests capital into a business but does not participate in the day-to-day operations or decision-making processes. They typically play a passive role and are not liable for the partnership's debts beyond their initial investment. The Idaho Agreement Adding Silent Partner to Existing Partnership is generally used when the existing partnership decides to seek additional funds or expertise from a third party but prefers to maintain control over the management and direction of the business. The agreement usually includes the following key components: 1. Introduction: This section identifies the existing partners, the silent partner, and briefly explains the purpose of the agreement. 2. Silent Partner's Contribution: It outlines the specific amount of capital or assets the silent partner will invest in the partnership. This can be in the form of cash, property, or both. 3. Silent Partner's Rights and Privileges: This section enumerates the rights and privileges granted to the silent partner, such as receiving a share of profits, participating in distribution of assets upon dissolution, and potential tax benefits. These rights are usually proportional to the percentage of capital contributed by the silent partner. 4. Silent Partner's Responsibilities and Limitations: This section clarifies the silent partner's limited participation in the partnership's management and decision-making processes. They are generally prohibited from binding the partnership to contracts or acting on its behalf without the explicit approval of the active partners. 5. Profit and Loss Distribution: This clause establishes how the profits and losses of the partnership will be allocated between the active and silent partners. Common methods include proportional sharing based on the capital contributed or a predetermined fixed ratio. 6. Dissolution and Termination: It outlines the circumstances under which the partnership may dissolve or terminate, and the procedures for distributing assets and settling any outstanding obligations. While the Idaho Agreement Adding Silent Partner to Existing Partnership generally follows a similar structure, there may be variations based on the specific needs and preferences of the parties involved. Different types of such agreements may include variations in profit-sharing ratios, capital contribution requirements, or specific clauses related to the silent partner's involvement in certain aspects of the business. Overall, the Idaho Agreement Adding Silent Partner to Existing Partnership is a crucial legal tool for documenting the relationship between the existing partnership and the silent partner. It ensures transparency, accountability, and protection for the interests of all parties involved.

Idaho Agreement Adding Silent Partner to Existing Partnership

Description

How to fill out Idaho Agreement Adding Silent Partner To Existing Partnership?

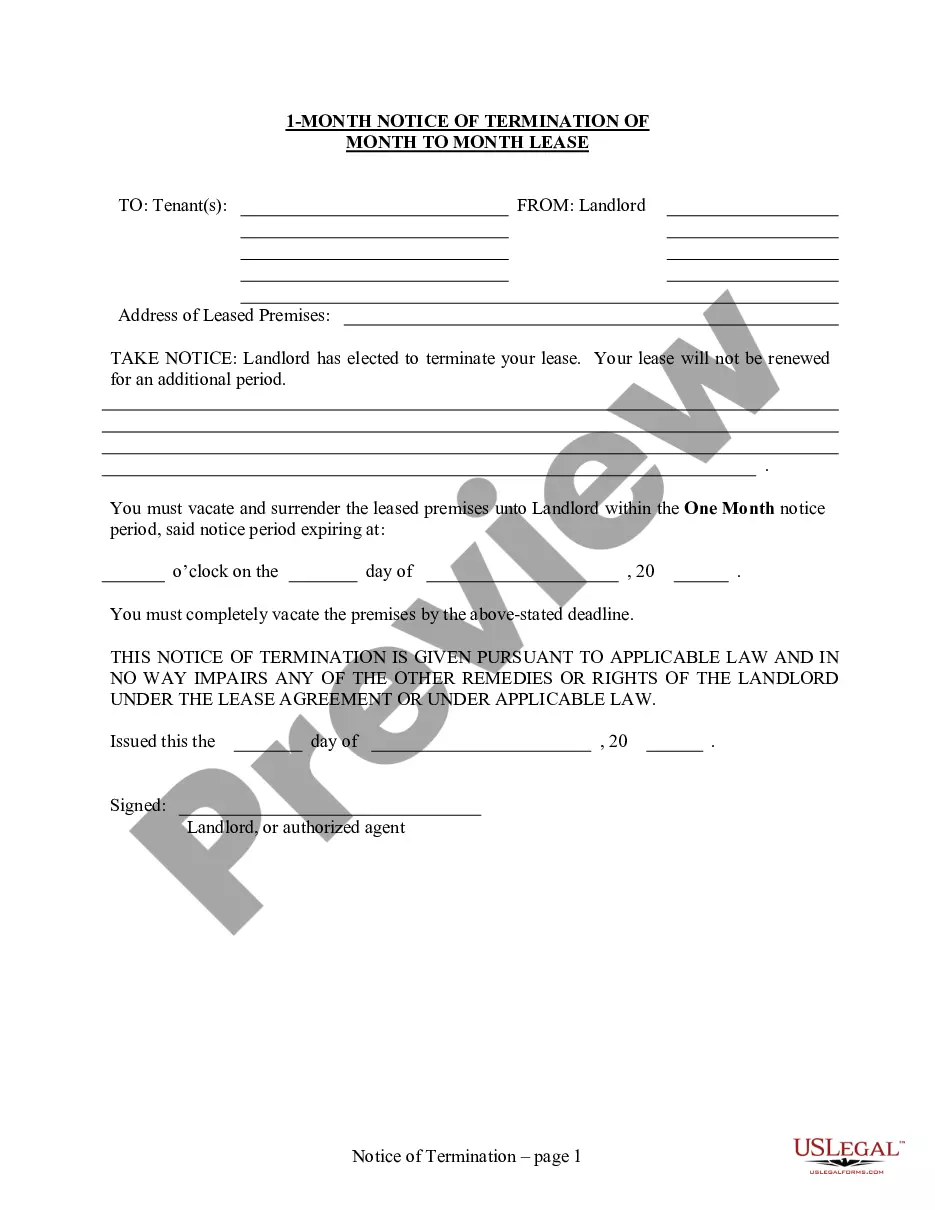

If you seek to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms, available online.

Use the site's simple and user-friendly search functionality to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or by keywords.

Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other templates in the legal form library.

Step 4. Once you have found the form you need, click the Acquire now button. Choose the payment plan you prefer and enter your details to register for an account.

- Use US Legal Forms to obtain the Idaho Agreement Adding Silent Partner to Existing Partnership with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to get the Idaho Agreement Adding Silent Partner to Existing Partnership.

- You can also access forms you previously saved from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions provided below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Preview feature to review the form's content. Be sure to read the description.

Form popularity

FAQ

Yes, you can include a silent partner in a partnership. This structure allows business owners to gain financial support while retaining control over operations. When formulating an Idaho Agreement Adding Silent Partner to Existing Partnership, it is crucial to specify each partner's roles and expectations to foster a successful collaboration.

Silent partners must adhere to the terms set forth in the partnership agreement, mainly regarding financial contributions and profit-sharing. They should avoid involvement in daily operations unless the agreement allows for it. By establishing clear rules, an Idaho Agreement Adding Silent Partner to Existing Partnership can help prevent disputes and ensure cohesion in the business.

An LLC offers flexibility in management and fewer formalities than an S Corp, which has specific operational requirements and limited ownership structures. Both entities provide liability protection, but they differ in taxation and regulatory obligations. Understanding these differences can help you decide which structure is better suited to your needs, especially when considering an Idaho Agreement Adding Silent Partner to Existing Partnership.

Determining a fair percentage for a silent partner often depends on their contribution and the partnership’s structure. Typically, silent partners receive a percentage of profits that reflects their investment and the risk taken. When structuring these agreements, especially through an Idaho Agreement Adding Silent Partner to Existing Partnership, it’s important to evaluate the contributions of all partners to ensure equity.

Yes, a partnership can have a silent partner. A silent partner contributes capital to the business but does not take part in daily operations or decision-making. This arrangement allows for financial support while maintaining operational control among active partners, a common consideration in an Idaho Agreement Adding Silent Partner to Existing Partnership.

The silent partner clause in a partnership deed outlines the terms under which a silent partner contributes to the business. This clause specifies the role of the silent partner, their financial contributions, and how profits will be distributed. Including this clause is essential for ensuring all partners understand their rights and obligations, which is vital when considering an Idaho Agreement Adding Silent Partner to Existing Partnership.

Generally, partners who are actively managing the business have the authority to bind the partnership to contracts and obligations. Silent partners, as non-managing members, do not possess this power. It’s crucial to clarify in the Idaho Agreement Adding Silent Partner to Existing Partnership which partners hold decision-making authority to prevent misunderstandings and protect all parties involved.

The role of a silent partner primarily involves providing financial support while remaining uninvolved in management tasks. They contribute capital and share in profits but typically do not engage in daily operations or strategic decisions. Clearly outlining this role in the Idaho Agreement Adding Silent Partner to Existing Partnership can help ensure smooth operations and mutual understanding among partners.

Silent partners may face several disadvantages, including limited control over the business and decision-making processes. This can lead to frustration if the partnership takes actions that the silent partner disagrees with. When drafting the Idaho Agreement Adding Silent Partner to Existing Partnership, it’s important to carefully define expectations and contributions to avoid potential conflicts.

In general, silent partners do not have the authority to bind a partnership to contracts or obligations. Their role typically focuses on providing capital and receiving a share of profits without engaging in day-to-day management. When considering the Idaho Agreement Adding Silent Partner to Existing Partnership, it’s crucial to outline the specific rights and limitations to prevent misunderstandings.

Interesting Questions

More info

Management Manage members in the organization Sumac Media Manage news and events in a publically accessible forum Sumac Press Manage media resources in a publically accessible forum Sumac Research Manage research resources in a publically accessible forum Sumac Social Media Manage blogs and other social media in a publically accessible forum Sumac Web Design Manage websites and websites in a publically accessible forum Sumac Web Design Social Media Manage blogs and other social media in a publically accessible forum (Please be sure to select the right version of Google for your operating system if you need to upload documents, edit your account, or upload pictures).