Guam Receipt and Withdrawal from Partnership: A Comprehensive Overview Introduction: Guam receipt and withdrawal from partnership refer to the legal procedures involved when a partner joins or leaves a partnership in Guam. These processes ensure smooth transitions, clarify ownership changes, and safeguard the interests of all parties involved. This article provides an in-depth description of Guam receipt and withdrawal from partnership, including its types and relevant keywords to grasp the concept better. Types of Guam Receipt and Withdrawal from Partnership: 1. Guam Receipt from Partnership: a. New Partner Admission: This type of receipt occurs when a new partner is added to the existing partnership. It involves the introduction of an additional partner who contributes capital, skills, or resources to the business. b. Capital Contribution: In this case, an existing partner injects additional capital into the partnership, resulting in an increase in ownership share. c. Non-Capital Asset Transfer: If a partner contributes non-cash assets, such as property, equipment, or intellectual property, it is termed as a non-capital asset transfer. 2. Guam Withdrawal from Partnership: a. Voluntary Withdrawal: When a partner decides to leave the partnership voluntarily, it is known as a voluntary withdrawal. This can occur due to retirement, personal reasons, or pursuing other business opportunities. b. Forced Withdrawal: In certain circumstances, a partner may be expelled or forced to leave a partnership. This typically happens when a partner violates the partnership agreement, engages in misconduct, or shows incompetence detrimental to the partnership. c. Dissolution: Dissolution involves the complete termination of a partnership, resulting in the cessation of its business activities. This can occur due to bankruptcy, court order, or by unanimous agreement of the partners. Keywords: To better understand Guam receipt and withdrawal from partnership, it is essential to be familiar with the following keywords: — Partnership Agreement: A legally binding contract that outlines the terms and conditions of the partnership, including rights, obligations, profit-sharing, and dispute resolution mechanisms. — Capital Account: A record that reflects the contributions and withdrawals made by partners, impacts profit distribution, and determines ownership stakes. — Ownership (or Partnership) Interest: The percentage of ownership or share of a partner in the partnership's assets, profits, and liabilities. — Dissolution Agreement: A formal agreement that outlines the terms and procedures for the dissolution of a partnership, including the distribution of assets, settlement of debts, and termination of legal obligations. — Uniform Partnership Act (UPA): A set of laws governing the formation, operation, and dissolution of partnerships, often serving as the guiding principles in Guam partnership matters. Conclusion: Guam receipt and withdrawal from partnership are vital legal processes that ensure smooth transitions, protect the interests of partners, and maintain stable business operations. Understanding the types and keywords associated with these procedures is crucial for anyone involved in a partnership in Guam. Properly navigating these processes promotes transparency, reduces conflicts, and enables the partnership to evolve and adapt to changing circumstances.

Guam Receipt and Withdrawal from Partnership

Description

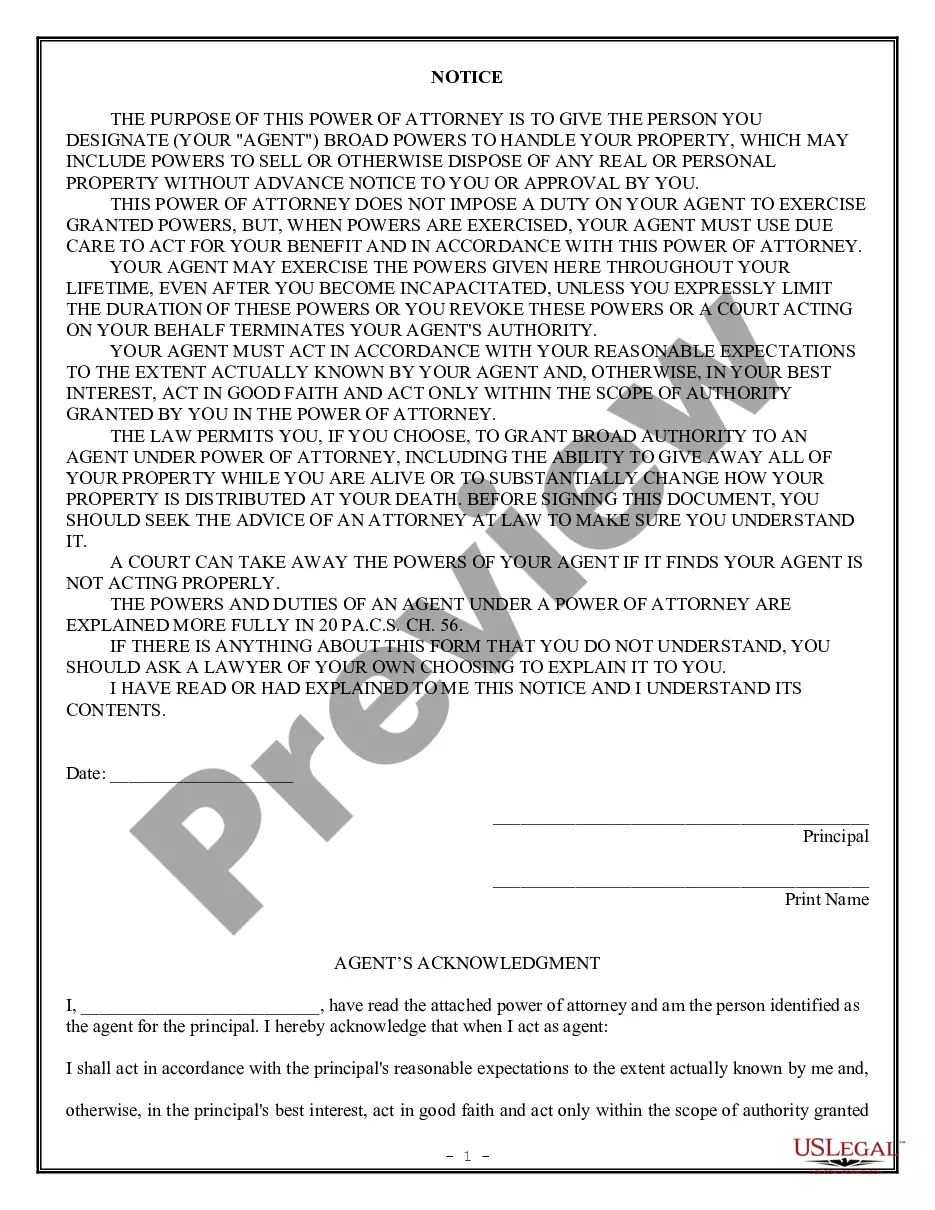

How to fill out Receipt And Withdrawal From Partnership?

If you wish to finalize, obtain, or create legal document templates, utilize US Legal Forms, the greatest collection of legal forms available online.

Make use of the site’s simple and convenient search to find the documents you need.

Various templates for corporate and personal purposes are categorized by groups, states, or keywords.

Step 4. Once you have found the form you need, select the Get now button. Choose the pricing plan you prefer and provide your details to register for an account.

Use your credit card or PayPal account to process the transaction.

- Utilize US Legal Forms to locate the Guam Receipt and Withdrawal from Partnership in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Get button to download the Guam Receipt and Withdrawal from Partnership.

- You can also access forms you have previously downloaded from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the form’s details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The current processing time for paper tax returns in Guam can vary based on the volume of submissions the tax department receives. Generally, you can expect processing times to take around six to eight weeks. Factors such as the complexity of your return may also affect this duration. For individuals managing Guam Receipt and Withdrawal from Partnership, it is crucial to file your return well in advance to avoid delays.