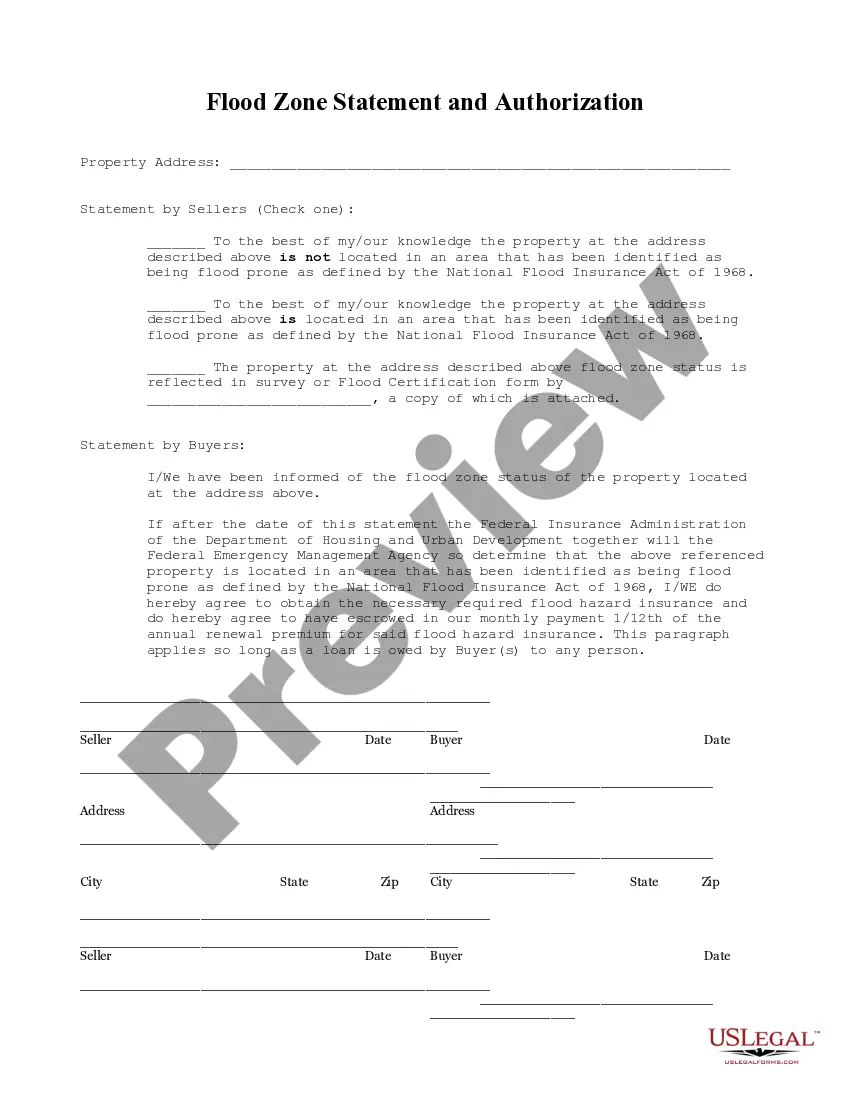

Florida Flood Zone Statement and Authorization

Description

How to fill out Florida Flood Zone Statement And Authorization?

Obtain the most comprehensive collection of legal documents.

US Legal Forms is essentially a platform to discover any state-specific paperwork in just a few clicks, such as Florida Flood Zone Statement and Authorization forms.

No need to squander several hours searching for a court-acceptable template.

Utilize the Preview feature if it's available to verify the document’s information. If everything appears to be correct, click Buy Now. After selecting a pricing plan, create your account. Pay using a card or PayPal. Download the document to your device by clicking the Download button. That's it! You should complete the Florida Flood Zone Statement and Authorization form and review it. To ensure that everything is accurate, consult your local legal advisor for assistance. Register and effortlessly explore 85,000 beneficial samples.

- Our certified experts guarantee that you receive updated documents each time.

- To utilize the forms library, choose a subscription and create your account.

- If you have done this, simply Log In and click Download.

- The Florida Flood Zone Statement and Authorization form will be promptly saved in the My documents section (a section for every document you save on US Legal Forms).

- To create a new profile, follow the simple steps below.

- If you're planning to use a state-specific template, ensure you specify the correct state.

- If feasible, review the description to comprehend all of the details of the document.

Form popularity

FAQ

Acceptable documentation for proof of flood insurance typically includes your flood insurance policy, a declarations page, and a letter from your insurer. It is important that these documents are recent and accurately reflect your coverage. If you are applying for a Florida Flood Zone Statement and Authorization, ensure that you have the proper documentation ready. Having everything organized will help you streamline the process.

Florida flood zone codes are designated letters used to identify the different types of flood risk areas, such as A, AE, V, and X zones. These codes help determine flood insurance requirements and the overall risk of a property. Understanding these codes is essential for homeowners, especially when dealing with the Florida Flood Zone Statement and Authorization. Familiarize yourself with the codes to better navigate insurance needs.

Satisfactory evidence of flood insurance consists of your current policy documents demonstrating valid coverage. This can include a declaration page or a letter from your insurance provider confirming coverage details. When you apply for a Florida Flood Zone Statement and Authorization, having this satisfactory evidence helps expedite the process. Ensure all documentation is clear and accurate.

Requirements for flood insurance usually include living in a flood-prone area and having a mortgage from a federally regulated lender. Understanding the specifics can help you secure the necessary Florida Flood Zone Statement and Authorization. Most policies also mandate that you provide essential information about the property and its flooding history. Review your local regulations to ensure compliance.

Acceptable evidence of flood insurance includes a copy of your insurance policy, declaration page, or any other formal documentation from your insurer. This evidence must clearly show your coverage period and the property it protects. For transactions requiring a Florida Flood Zone Statement and Authorization, having solid proof of flood insurance is crucial. Always keep updated copies in your records.

Proof of loss flood insurance is documentation that verifies the amount you have claimed for damage incurred due to flooding. This document typically includes details of the loss, repairs needed, and the insurance coverage applicable. Submitting this proof is crucial to ensuring you receive the compensation outlined in your policy. The Florida Flood Zone Statement and Authorization often requires this documentation for processing claims.

To fill out the FEMA application, start by gathering all required information related to your property and the flood event. Provide details such as the flood zone designation, which is critical for the Florida Flood Zone Statement and Authorization. Follow the instructions on the form carefully to ensure accurate submission. If you need assistance, consider using resources available on platforms like USLegalForms for guided support.

Obtaining a flood zone certificate involves a few key steps. First, you will need to contact a licensed surveyor who can assess your property and determine its flood zone designation. Once they complete the assessment, the surveyor will issue a certificate, which may include the Florida Flood Zone Statement and Authorization to help with future insurance needs. This certificate is vital when securing flood insurance and ensuring compliance with local regulations.

To file a flood insurance claim, start by documenting the damage with photographs and notes. Next, contact your insurance provider to report the loss and request a claim form. Remember to include your Florida Flood Zone Statement and Authorization with your submission to help expedite the process. By providing thorough information, you can improve the chances of receiving a timely payout.

Buying a house in an AE flood zone can be a smart choice, but it comes with certain risks and responsibilities. Properties in these zones often require flood insurance, which might increase your overall costs. However, if you're prepared to manage these aspects, the investment can be worthwhile. Always acquire a Florida Flood Zone Statement and Authorization to understand your property's flood risk fully. US Legal Forms offers helpful resources to assist you in this decision-making process.