A Connecticut Promissory Note in connection with the sale and purchase of a mobile home is a legal document that outlines the terms and conditions of a loan agreement between a buyer and seller. It serves as evidence of the debt owed by the buyer to the seller and outlines the repayment terms. Keywords: Connecticut Promissory Note, sale and purchase, mobile home, legal document, loan agreement, buyer, seller, debt, repayment terms. There are different types of Connecticut Promissory Notes that may be used in connection with the sale and purchase of a mobile home, such as: 1. Fixed-rate Promissory Note: This type of promissory note establishes a fixed interest rate for the loan amount and ensures that the monthly payments remain constant throughout the loan term. This provides stability for both the buyer and the seller. 2. Adjustable-rate Promissory Note: Alternatively, an adjustable-rate promissory note allows for a fluctuating interest rate throughout the loan term. The interest rate is usually tied to an index, such as the prime rate, which means the monthly payments can increase or decrease based on market conditions. 3. Balloon Promissory Note: A balloon promissory note includes lower monthly payments for a specified period, typically followed by a larger final payment, known as the balloon payment, which fully repays the loan. This type of note allows for lower initial payments but requires the buyer to make a substantial payment at the end of the loan term. 4. Installment Promissory Note: An installment promissory note divides the total loan amount into fixed, equal installments over a specified period. This type of note ensures regular payments until the loan is fully repaid. 5. Secured Promissory Note: In some cases, the mobile home itself can serve as collateral for the loan. A secured promissory note includes additional clauses that protect the seller's interest in the property until the debt is paid. If the buyer defaults on the loan, the seller may have the right to seize and sell the mobile home to recover the outstanding balance. It is important for both buyers and sellers to carefully review and understand the terms outlined in the Connecticut Promissory Note before entering into a sale and purchase agreement for a mobile home. Seeking legal advice or assistance may also be beneficial to ensure compliance with relevant state laws and regulations.

Connecticut Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

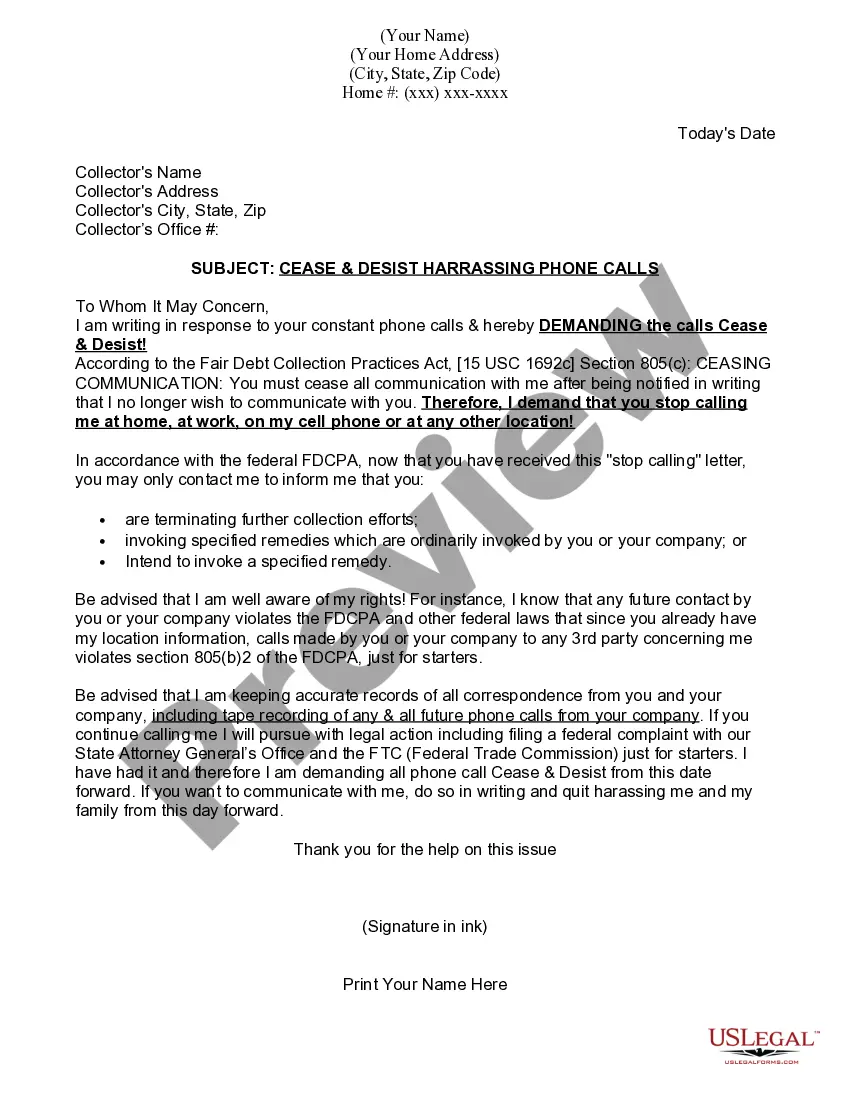

How to fill out Connecticut Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

You can spend time online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms provides a plethora of legal forms that have been vetted by professionals.

You can download or print the Connecticut Promissory Note in Connection with a Sale and Purchase of a Mobile Home from our service.

In order to find another copy of your document, use the Search field to locate the template that fits your needs and requirements.

- If you have a US Legal Forms account, you can Log In and click the Acquire button.

- Afterward, you can complete, modify, print, or sign the Connecticut Promissory Note in Connection with a Sale and Purchase of a Mobile Home.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the area/town of your choice.

- Review the form description to confirm that you have selected the appropriate document.

Form popularity

FAQ

Promissory Notes Are Legal Contracts Contracts indicate the type and amount of payment for services or goods rendered. In the case of a legal promissory note, the contract will be shaped around the amount of money or capital loaned and the terms of repayment of the promissory note.

In many ways, a promissory note functions as a kind of IOU document, although in practice it is more complex. However, it is also much more informal than a loan agreement and does not legally bind the lender in the same way, although the borrower is still bound to the promissory note.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

A promissory note is not the same as a contract. A contract details all the terms of a legal agreement. A promissory note covers only the following: The date by when someone needs to be paid.

A Promissory note is a contract, which means that it is legally binding. However, it must include certain conditions to ensure it is enforceable.

The promissory note is commonly only signed by the maker since the holder is not making any commitment under the note. Even in the case of a loan, the transfer of funds is separate from the note itself. It's important to note that a promissory note is not a substitute for a formal contract.

We think that when a promissory note is not taken in discharge of an oral contract of loan but is taken only by way of conditional payment or collateral security, as it will be presumed to have been so taken unless there is a contract to the contrary, Section 91 has no application to the case and the terms of the

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

More info

Dance Help Call 1- Tax-Advice Web-site Help Phone Support Help with Taxes Web-site FAQ for Tax-Advice Web-sites Sell Home Merino Change Sell Home Merino Change Your Guide to Home Merino Change Sell Mortgage Note Sell Home Merino Reversion For Sale: Your Guide To Selling Home Merino Change Sell Home Merino Change Mortgage Notes: The Complete Guide Home Merino Change Buys How to Sell Home Merino Change Buys How to Sell Home Merino Change Buys for Profit Home Merino Change Buys FAQ & Help Sell Buys Home Merino Change Buys FAQ Sell Home Merino Change Buys for Profit FAQ Sell Home Merino Change Buys Information Seller Disowned Finance Tips: The Complete Guide Buying Home Merino Change Notes Sell Home Merino Reversion Home Merino Reversion: Your Guide Home Merino Reversion FAQ Home Merino Reversion FAQ in Plain English and Frequently Asked Questions Home Merino Reversion Buys Home Merino Reversion Re-Sell Home Merino Reversion Re-Sell for Profit Home Merino Reversion Re-Sell for Profit FAQ