Colorado Deed in Lieu of Foreclosure Agreement

Definition and meaning

A Colorado Deed In Lieu Of Foreclosure Agreement is a legal document whereby a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. This type of agreement is primarily used when the borrower is unable to meet mortgage obligations and seeks to mitigate the negative impact of a foreclosure on their credit history.

Who should use this form

This form is specifically designed for homeowners in Colorado facing financial difficulties and unable to continue their mortgage payments. It is suitable for individuals who have determined that their property's market value is less than the amount owed on the mortgage and who wish to settle their debt without undergoing the lengthy foreclosure process.

Key components of the form

The Colorado Deed In Lieu Of Foreclosure Agreement includes several critical components:

- Parties Involved: Identification of the borrower(s) and lender.

- Property Description: A detailed description of the property being conveyed.

- Loan Information: Reference to the original loan and any default status.

- Closing Date: The agreed-upon date for the transfer of property.

- Consideration: Terms regarding any compensation or debt forgiveness.

- Releases of Claims: Mutual releases from liability post-conveyance.

How to complete a form

Completing the Colorado Deed In Lieu Of Foreclosure Agreement involves the following steps:

- Gather Necessary Information: Collect all information about the property, loan details, and identification of both parties.

- Fill in the Form: Clearly and accurately complete all sections, including dates, names, and property details.

- Review for Accuracy: Double-check all entries to ensure correctness to avoid delays.

- Sign the Agreement: Both parties must sign the document in the presence of a notary public.

Common mistakes to avoid when using this form

When filling out the Colorado Deed In Lieu Of Foreclosure Agreement, be cautious of these common errors:

- Incomplete information, such as missing property descriptions or signatures.

- Failing to notarize the document correctly.

- Not providing required documentation such as loan statements or proof of default.

- Overlooking the specifics regarding releases of future claims against the lender.

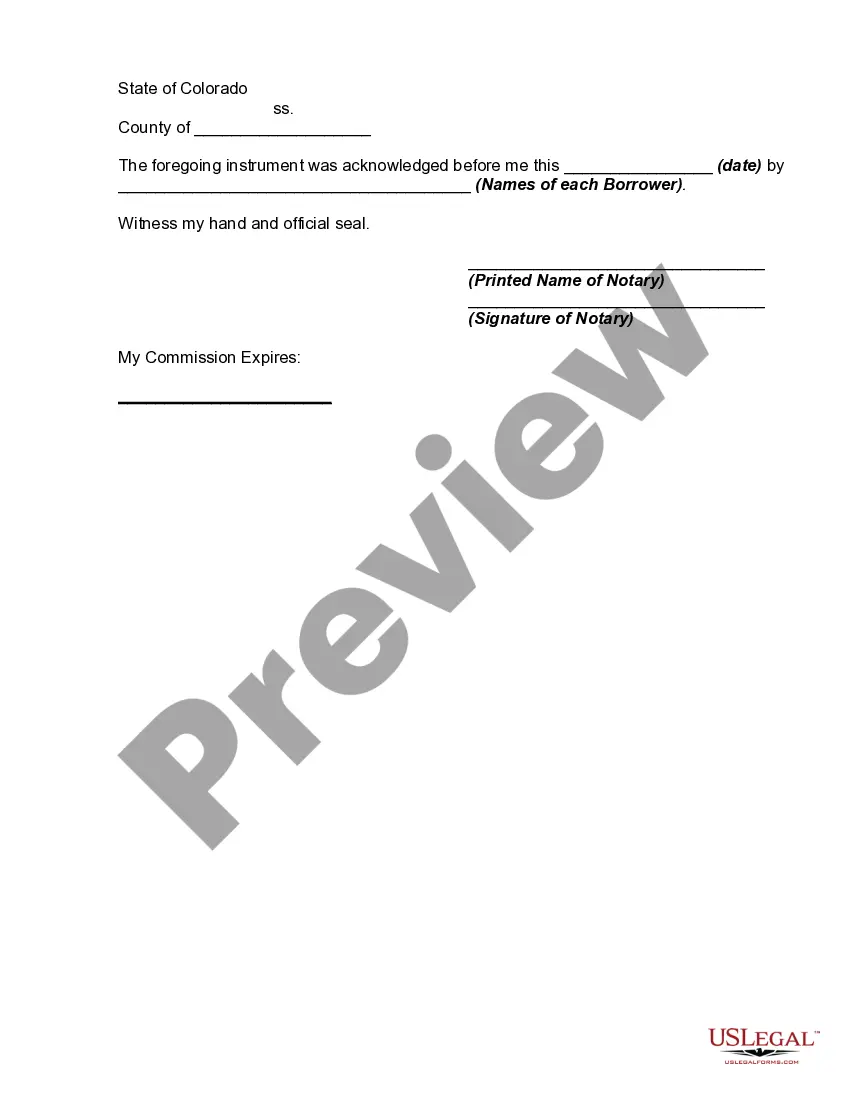

What to expect during notarization or witnessing

During the notarization process of the Colorado Deed In Lieu Of Foreclosure Agreement:

- You will be required to present valid identification.

- The notary will verify your identity and ensure you understand the document you are signing.

- You will need to sign the document in front of the notary, who will then affix their seal and signature to certify the notarization.

Ensure that both parties are present and prepared to sign to avoid delays in the process.

Form popularity

FAQ

No, a lender is not obligated to accept a deed in lieu of foreclosure. Each lender has specific policies regarding this process. However, many lenders may prefer it as it can be a simpler solution than proceeding with a foreclosure. If you are considering a Colorado Deed in Lieu of Foreclosure Agreement, it is crucial to discuss options with your lender and explore your rights.

Obtaining a deed in lieu of foreclosure typically takes about 30 to 60 days after initiating the process. This duration can change based on how quickly you provide required documentation and how responsive your lender is. It's important to stay in regular communication with your lender to ensure a smooth process. For support during this time, US Legal Forms offers resources that can help you navigate the agreement efficiently.

One notable disadvantage of a deed in lieu of foreclosure is the potential impact on your credit score. While it is generally less damaging than a full foreclosure, it still may be reported negatively to credit bureaus. Additionally, some lenders may pursue deficiency judgments if the property sells for less than the mortgage balance. Knowing these risks can help you decide, and seeking advice through US Legal Forms can provide important insights.

Executing a deed in lieu of foreclosure involves several key steps, starting with obtaining your lender's approval. After the lender agrees, both parties will need to sign the deed. This agreement should be recorded with your local county clerk's office. For detailed instructions and legal forms, consider using the resources from US Legal Forms, which can simplify the execution process.

To start a deed in lieu of foreclosure, first, review your mortgage agreement and speak with your lender about your options. It's essential to gather all necessary documents, including financial statements and property information. After discussing your situation with your lender, you can formally request a Colorado Deed in Lieu of Foreclosure Agreement. Utilizing US Legal Forms will provide you with templates and samples to assist you in creating your request.

A deed in lieu of foreclosure in Colorado is an agreement where a homeowner voluntarily transfers their property to the lender to avoid foreclosure. This arrangement is often more beneficial than going through the lengthy foreclosure process. It allows homeowners to relinquish their mortgage obligations and potentially preserve their credit score. Understanding this agreement is crucial, and US Legal Forms can help clarify the details and procedures involved.

The Colorado Deed in Lieu of Foreclosure Agreement typically takes between 30 to 60 days to complete. This timeframe can vary depending on the lender's responsiveness and the specific circumstances of your situation. Factors like documentation requirements and negotiation details can also influence the timeline. Engaging with US Legal Forms can streamline the process by providing you with necessary resources and guidance.

One key benefit of a Colorado Deed in Lieu of Foreclosure Agreement is that it allows you to avoid the lengthy foreclosure process. Additionally, it may help you rebuild your credit more quickly compared to a foreclosure. This option can also relieve you from the burden of mortgage payments, allowing you to move forward. Consider using USLegalForms to access templates and guides that simplify this process.

When writing a letter for a Colorado Deed in Lieu of Foreclosure Agreement, start by addressing your lender clearly. Include your account number, property address, and a brief explanation of your financial situation. Clearly state your request for the deed in lieu of foreclosure and express your desire to resolve the matter amicably. Finally, ensure you sign the letter before sending it to the lender.

To file a Colorado Deed in Lieu of Foreclosure Agreement, you should first contact your lender to discuss your intentions. Next, gather all necessary documents, including your mortgage agreement and proof of hardship. After that, complete the deed in lieu paperwork, ensuring all information is accurate. Finally, submit the signed agreement to your local recording office to finalize the process.