California Closing Statement

Overview of this form

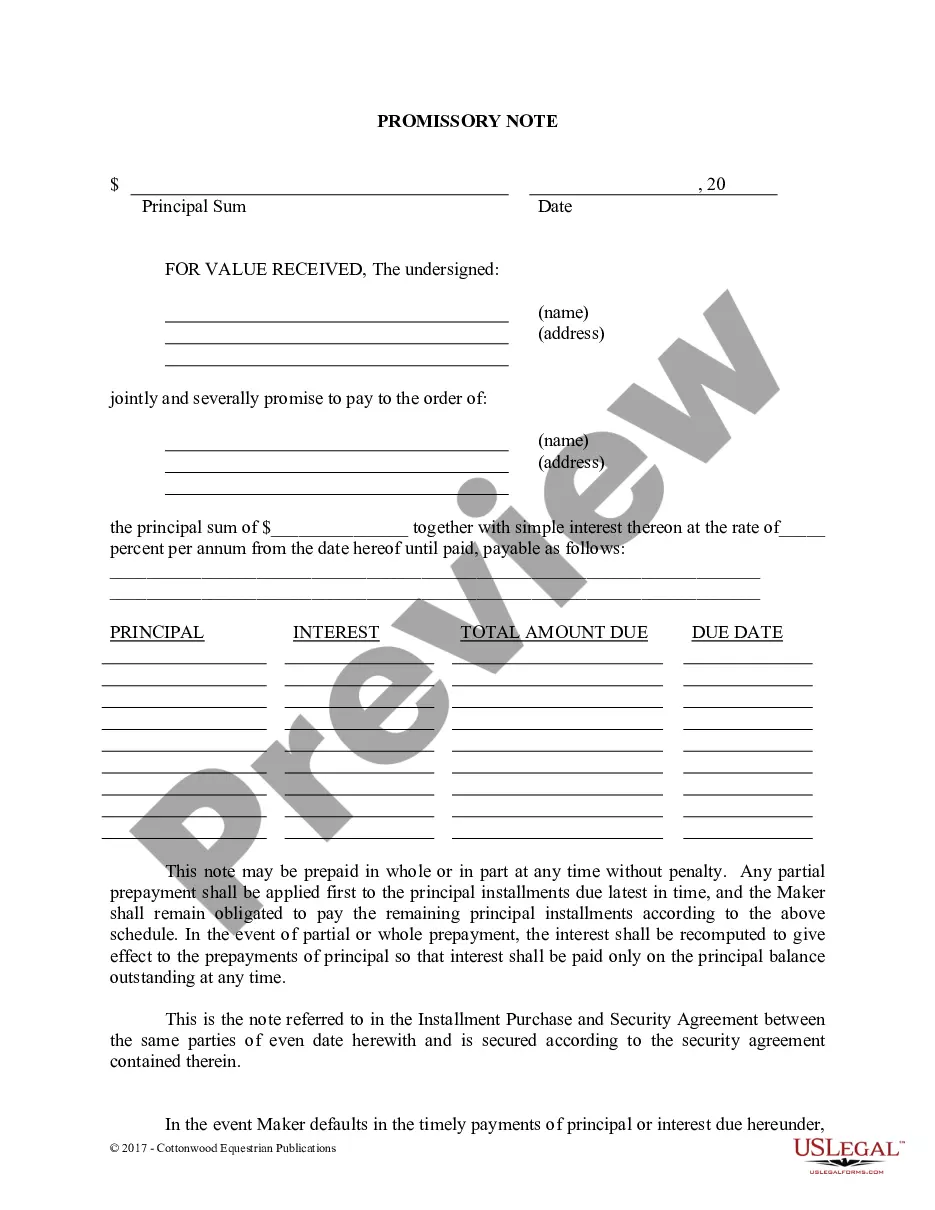

The Closing Statement is a crucial document in real estate transactions, specifically for cash sales or owner-financed deals. This form serves to summarize and itemize all the financial details related to the closing of a property sale, ensuring that both the buyer and seller are aware of the final amounts owed and received. It is verified and signed by both parties, confirming that all costs associated with the transaction are accounted for and agreed upon.

Form components explained

- Balance: Reflects the final amounts due to or from the buyer or seller.

- Expenses: Items such as title searches, recording fees, and attorney fees are detailed here.

- Title Insurance: Indicates costs related to protecting against title defects.

- Notary Fee: Documents any fees related to notary services required during the transaction.

- Adjustments: Includes prorations for taxes and any special assessments affecting the closing.

- Certification: Signatures confirming the truthfulness of the information presented by both parties.

When to use this form

This Closing Statement should be used during the finalization of a real estate transaction. It is particularly necessary when the sale is either a cash transaction or a case of owner financing. Use this form to clearly outline all costs and obligations involved in the transfer of property ownership to avoid misunderstandings between buyers and sellers.

Who this form is for

- Real estate buyers and sellers involved in cash transactions.

- Individuals entering into owner financing agreements.

- Real estate agents facilitating these transactions.

- Attorneys handling the legal aspects of property sales.

Steps to complete this form

- Identify the parties involved: Enter the names and contact details of the buyer and seller.

- Specify the property: Clearly describe the property being sold, including the address and any relevant details.

- List all expenses: Detail every cost associated with the transaction, including title insurance, fees, and prorations.

- Calculate balances: Ensure all amounts are accurately computed for both buyer and seller.

- Obtain signatures: Both parties should sign to certify the accuracy of the information provided.

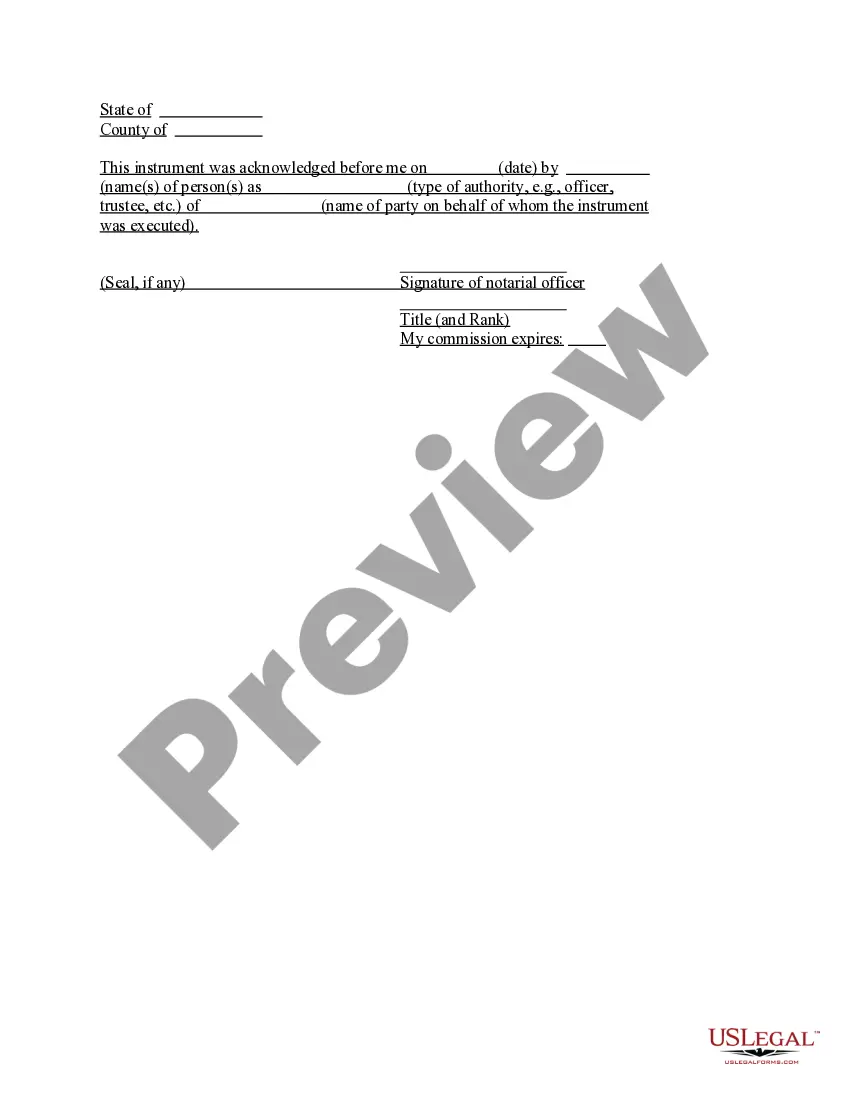

Is notarization required?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all expenses can lead to discrepancies.

- Not accurately calculating the final balances due to either party.

- Skipping signatures can invalidate the agreement.

- Using outdated versions of the form which may not comply with current laws.

Why use this form online

- Convenient access to a legally vetted template that saves time.

- Editability allows for customization to fit specific transaction needs.

- Online availability ensures that you can access the form anytime, from anywhere.

Looking for another form?

Form popularity

FAQ

California is a wet closing state, meaning that funds are typically disbursed at the close of escrow when all documents are signed. This process allows both parties to ensure everything is complete before finalization. Understanding this can give you peace of mind as you move through your transaction. Always refer to your California Closing Statement to keep track of your closing process.

Closing costs for a $600,000 dwelling in California usually range from $12,000 to $30,000. The exact amount can fluctuate based on a variety of variables, including your mortgage lender and specific property. Being aware of these costs ahead of time can ease anxiety during the home-buying process. Your California Closing Statement will provide a complete breakdown of these expenses.

A proper California Closing Statement should be organized, clear, and comprehensive. It should feature identifiable sections for income and expenses, with each item clearly labeled and totaled at the end. This format helps ensure transparency and makes it easy for both buyers and sellers to verify the financial details of the transaction.

To prepare a real estate closing statement in California, compile all relevant expenses and credits associated with the sale. Use a systematic approach to categorize each item, ensuring that nothing is overlooked. Utilizing resources like those from USLegalForms can simplify this process and help you create an accurate closing statement.

At the closing in California, both the buyer and the seller must typically be present along with their respective agents. It is also common for the escrow officer to attend to facilitate the signing of documents. This group ensures that all aspects of the California Closing Statement are agreed upon and executed properly.

To write an effective California Closing Statement, start by gathering all relevant financial information related to the transaction. Organize this information into categories like fees, credits, and debits, ensuring clarity and accuracy. Always double-check your figures and consider using a template from a reliable source, such as USLegalForms, to streamline the process.

A good California Closing Statement clearly outlines all the financial details related to the sale of a property. It should provide an itemized list of credits and debits for all parties involved. This transparency helps both buyers and sellers understand the costs associated with the transaction and ensures everyone is on the same page.

To get a copy of your California Closing Statement, reach out directly to your title company or the real estate agent who handled your transaction. They usually have these records readily available and can provide them promptly. Alternatively, check your email for any digital copies you may have received during the closing process.

In California, closing documents such as the California Closing Statement may become part of public records once recorded. However, access to these documents can vary based on local laws and the specific details of your transaction. If you need further assistance with public records, consider contacting your local recorder's office.

Typically, you should receive your California Closing Statement a few days before your closing date. It's essential to review this document carefully, as it outlines all the financial details of your transaction. If you haven’t received it by then, contact your lender or title company for clarity.