California Deed in Lieu of Foreclosure - Individual to a Trust

What this document covers

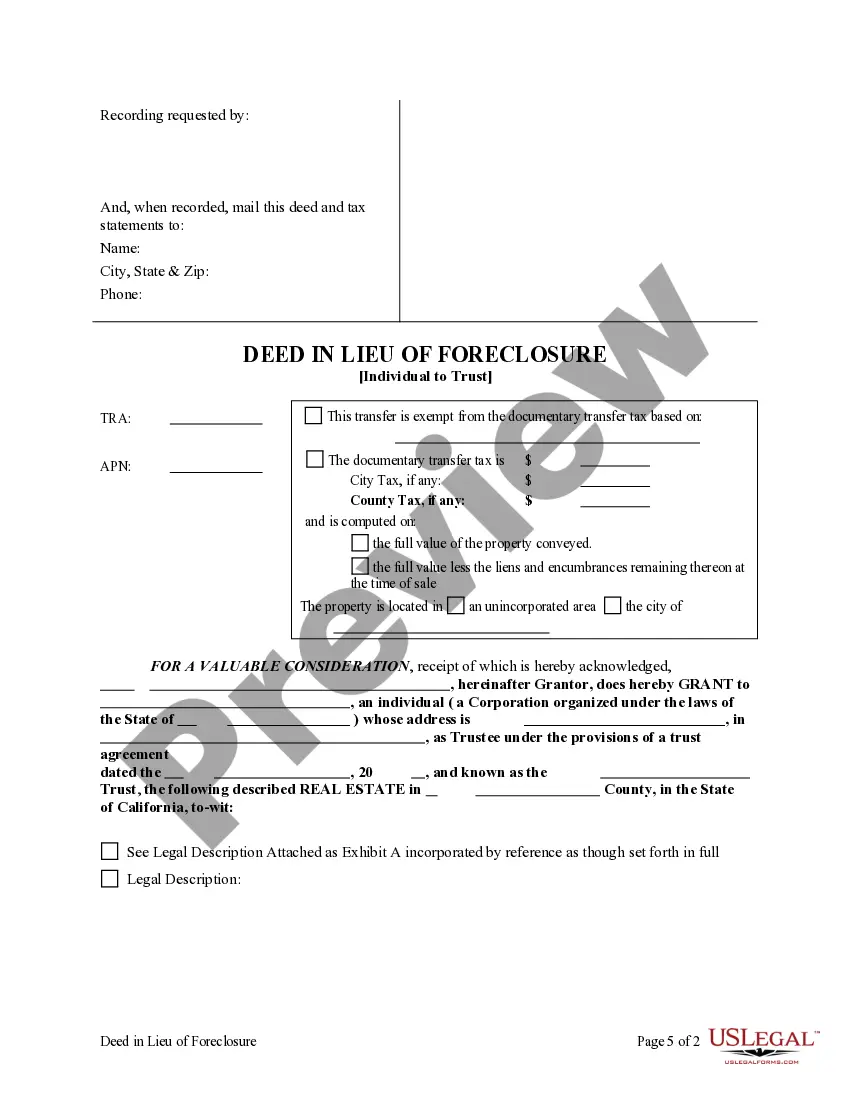

The Deed in Lieu of Foreclosure - Individual to a Trust is a legal document that allows a property owner (the Grantor) to transfer their property to a trust (the Grantee) instead of going through the foreclosure process. This type of deed serves as a means to settle debts secured by a deed of trust and a promissory note, thereby simplifying the transfer of ownership and avoiding the complexities of foreclosure. It is important to differentiate this form from standard deeds, as it specifically addresses situations involving a trust and is utilized to effectively manage property ownership under financial distress.

Key parts of this document

- Identification of the Grantor and Grantee.

- Description of the property being transferred.

- Statement confirming transfer as satisfaction of the prior deed of trust.

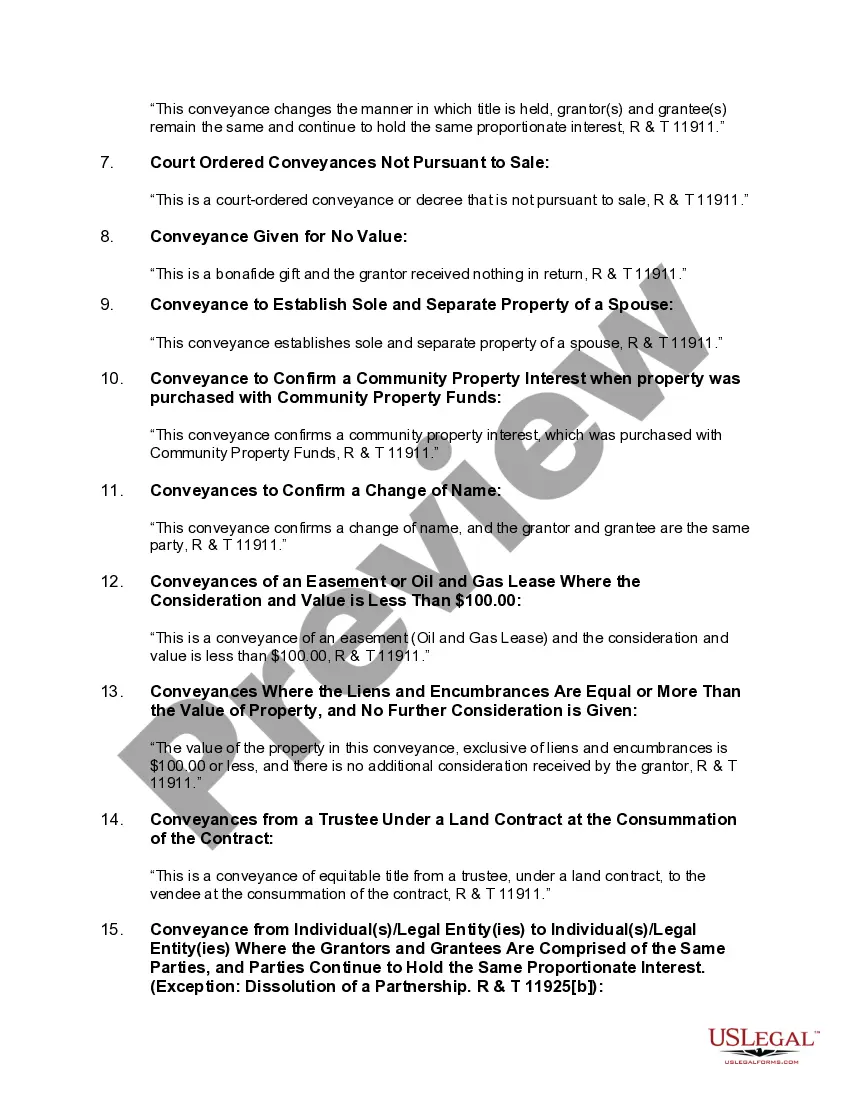

- Section for managing documentary transfer tax exemptions.

- Signatures and dates of the involved parties.

Legal requirements by state

This Deed in Lieu of Foreclosure complies with all state statutory laws, ensuring that it meets jurisdiction-specific requirements for validity and execution. For additional state-specific nuances, you may want to consult applicable state laws or legal counsel.

When to use this form

This form is typically used when a property owner is facing foreclosure but wants to avoid the lengthy and costly process. By executing a deed in lieu of foreclosure, the property owner can transfer the property directly to a trust, clearing their financial obligations and protecting their credit. It may also be useful in situations where a property owner wants to simplify estate planning or manage the property within a trust structure.

Intended users of this form

This form is intended for individuals who:

- Own property and wish to transfer it to a trust.

- Are experiencing financial hardship and facing foreclosure.

- Seek to settle debts related to their property against a deed of trust and a promissory note.

- Are involved in estate planning or asset protection strategies.

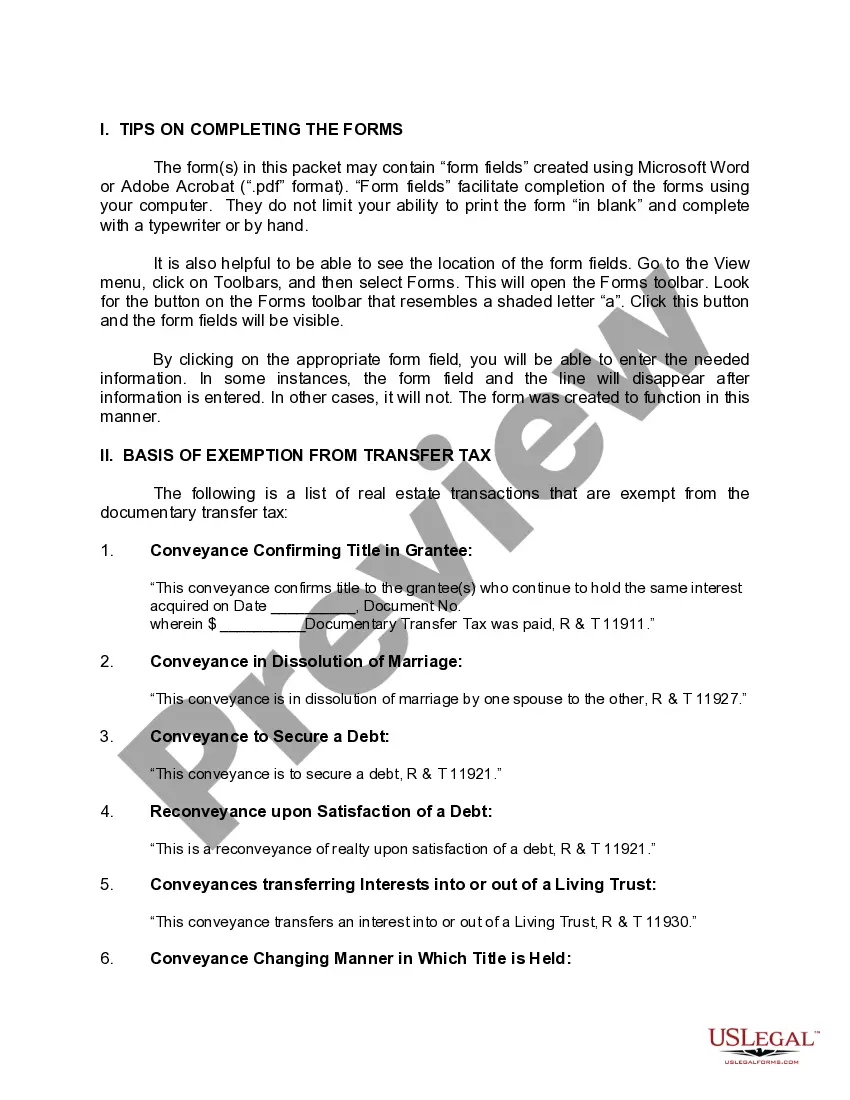

Completing this form step by step

- Identify the parties involved by entering the names of the Grantor and the Grantee.

- Clearly describe the property being transferred, including its address or legal description.

- Specify the date of the prior deed of trust and the documentary transfer tax, if applicable.

- Both parties should sign the document in the designated sections, including any required witness signatures.

- Ensure all field entries are complete before finalizing the document.

Notarization guidance

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Common mistakes

- Failing to accurately describe the property being transferred.

- Inadequate or missing signatures from involved parties.

- Leaving sections blank that are required for legal compliance.

- Not checking for state-specific requirements that may affect use.

Why use this form online

- Convenience of downloading the form when needed.

- Editability to customize the form according to specific circumstances.

- Access to professionally drafted templates ensuring legal compliance.

- Speed in obtaining necessary documents without the need for a lawyer's office visit.

Form popularity

FAQ

Processing a California Deed in Lieu of Foreclosure - Individual to a Trust starts with reaching out to your lender. You'll need to discuss your financial situation and express your intent to explore this option. Once you agree on the terms, you both must complete the necessary paperwork, including a deed, and finalize the process at your local county office.

To file a deed in lieu of foreclosure, begin by drafting the deed detailing your intent to transfer ownership back to the lender. After both parties sign the document, ensure you have the appropriate certification and any required attachments. Finally, file it with the county recorder's office to make the transfer official and protect your rights.

To put your property in a trust in California, start by setting up a legally recognized trust document. This document details the terms, conditions, and beneficiaries of the trust. After creating the document, execute a grant deed that transfers ownership to the trust, and file this deed at your county recorder's office for proper documentation.

Transferring a deed to a trust in California involves drafting a grant deed that conveys your property from your name to the trust. It's important to make sure that all legal requirements are met and that the deed includes accurate property descriptions. Once you finalize the document, file it with the local county office to ensure proper registration.

To transfer a deed to a living trust in California, you need to create a trust document that outlines the trust's terms and beneficiaries. Then, prepare a grant deed, which should include the trust's name and the current property owner's signature. Finally, file the grant deed with the county recorder's office to ensure the changes are officially recorded.

Lenders often accept a California Deed in Lieu of Foreclosure - Individual to a Trust because it provides a more straightforward resolution to defaulted loans. Accepting a deed in lieu avoids the lengthy and costly foreclosure process. It also allows lenders to minimize their losses and recover their investments more efficiently, making it a win-win for both parties.

One significant disadvantage of a California Deed in Lieu of Foreclosure - Individual to a Trust is the potential impact on your credit score. A deed in lieu may not be as damaging as a foreclosure, but it still reflects negatively on your credit history. Additionally, lenders often require you to be in default on your mortgage, which can lead to additional financial strain before the process can start.

There are several factors that can render a deed of trust invalid in California. For instance, if the document is not signed by the borrower, lacks proper notarization, or fails to meet legal requirements, it may be deemed unenforceable. Understanding these aspects is crucial, especially if you consider a California Deed in Lieu of Foreclosure - Individual to a Trust, as validity impacts the transaction's legitimacy.

Recently, California has updated its foreclosure laws to assist homeowners facing financial difficulties. Specifically, these laws aim to provide better options for individuals to avoid traditional foreclosure through alternatives like the California Deed in Lieu of Foreclosure - Individual to a Trust. This allows homeowners to transfer property ownership directly to the lender, simplifying the process and reducing negative impacts on credit.

To transfer a deed to a trust in California, you must first create a trust document that outlines the terms of the trust. After that, you will execute a new deed that transfers the property title from your name to the trust. This deed must be properly signed and notarized, and then recorded at your local county recorder's office. Utilizing the services provided by USLegalForms can simplify this process, ensuring your California Deed in Lieu of Foreclosure - Individual to a Trust is handled correctly and efficiently.