Arizona Escrow Instructions in Short Form

About this form

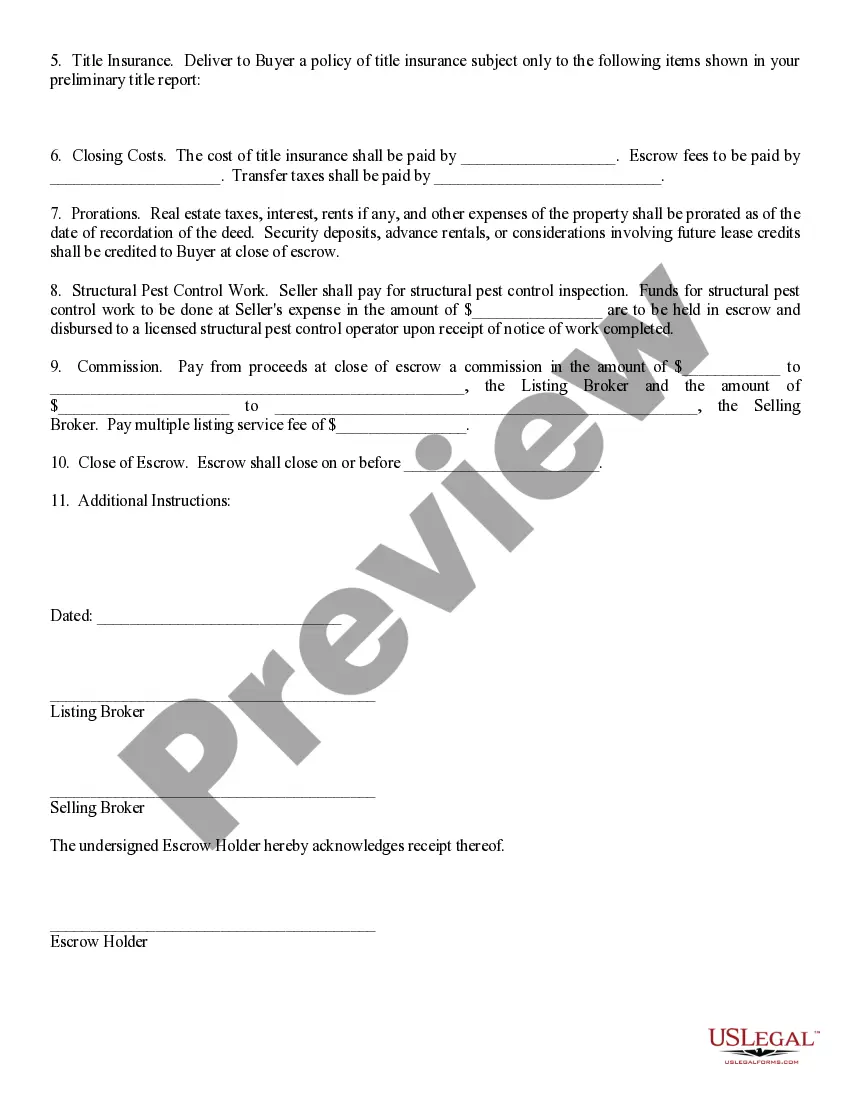

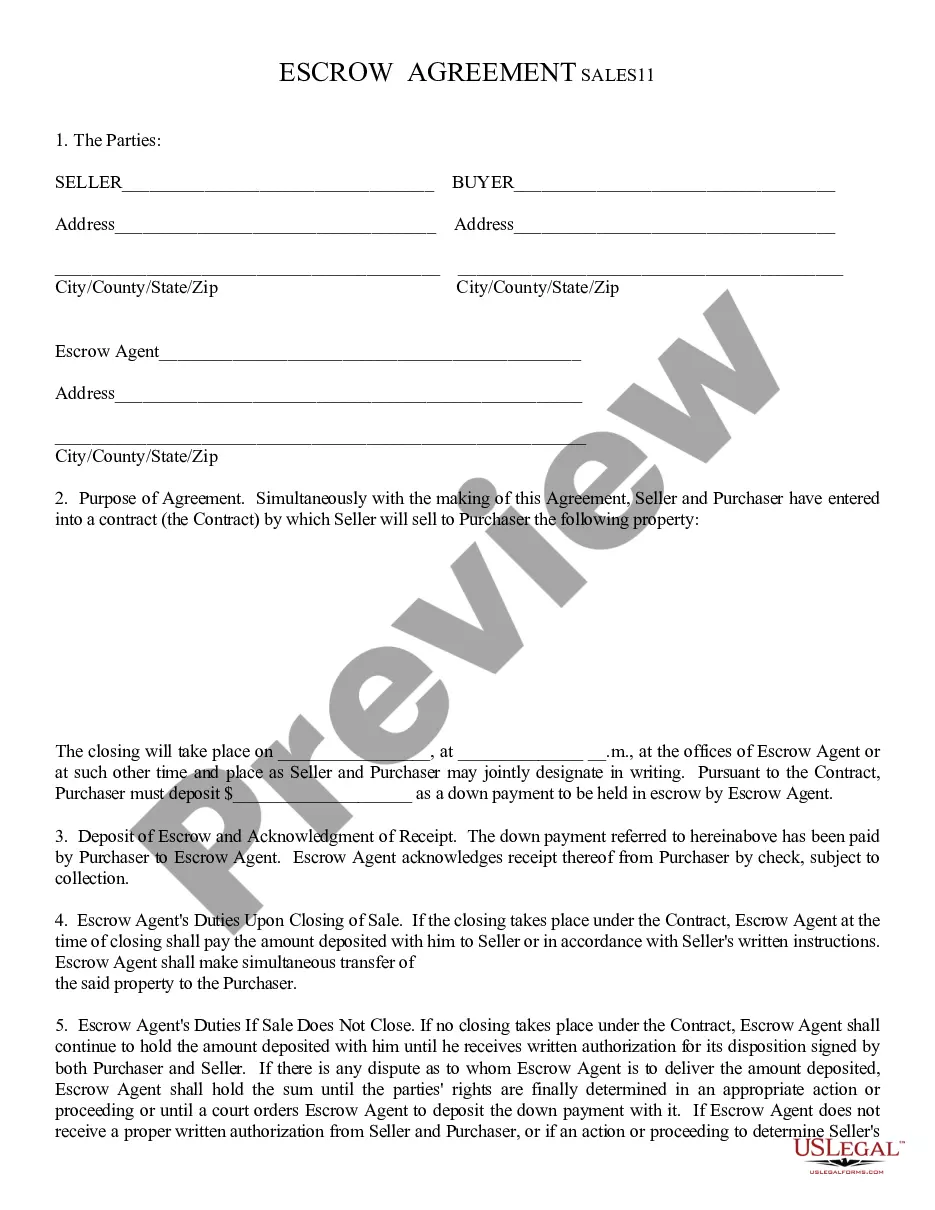

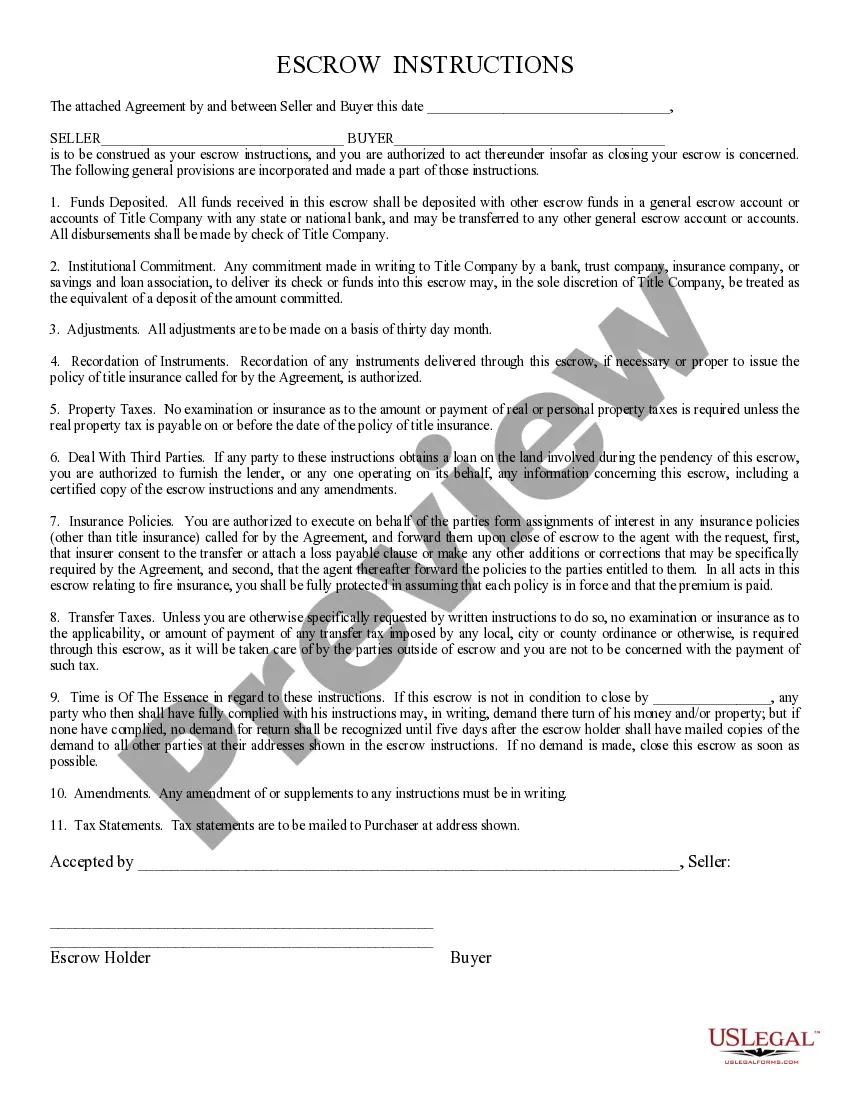

The Escrow Instructions in Short Form is a legal document that outlines the responsibilities and procedures associated with an escrow account during a real estate transaction. This form provides essential guidance for the Buyer, Seller, and Escrow Agent, ensuring that all parties understand their duties in the buying or selling process of property. It differs from other escrow forms by presenting a concise version suitable for simple transactions, while still covering all necessary aspects for a smooth escrow process.

What’s included in this form

- Payment terms, including amounts and interest rates for financing.

- Title information for the property and any outstanding liens or assessments.

- Details regarding title insurance obligations and closing costs.

- Instructions for prorating property expenses and handling security deposits.

- Requirements for structural pest control services and associated costs.

- Commission details for listing and selling brokers, including applicable fees.

- The date by which the escrow should close.

When to use this document

This form is typically utilized when a Buyer and Seller agree to enter an escrow process during the purchase or sale of real estate. It is particularly useful when both parties want to clearly define the terms of the escrow arrangement, including financial obligations, property conditions, and responsibilities concerning any inspections or commissions. Utilizing this form can help prevent disputes and misunderstandings among all parties involved.

Who this form is for

- Home Buyers entering an agreement to purchase property.

- Home Sellers seeking to outline conditions for assisting the sale.

- Escrow Agents managing the transaction to ensure compliance with set terms.

- Real Estate Brokers involved in facilitating the sale or purchase.

Steps to complete this form

- Identify all parties involved: Buyer, Seller, Listing Broker, and Selling Broker.

- Specify the property details, including address and title ownership information.

- Enter financial terms such as payment amounts, interest rates, and closing costs.

- Provide instructions regarding structural pest control and allocation of related funds.

- Detail the closing date and ensure signatures from all required parties.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include all party names and signatures.

- Not specifying payment details or missing key financial terms.

- Omitting the closing date which can delay the transaction.

- Neglecting to clarify responsibilities for commissions and fees.

- Overlooking property details such as liens or assessments that may affect transaction.

Advantages of online completion

- Convenience of accessing and completing the form at any time.

- Editability allows for easy updates and adjustments as needed.

- Reliable source of legally vetted templates crafted by licensed attorneys.

- Streamlined process that saves time compared to traditional methods.

Looking for another form?

Form popularity

FAQ

Escrow companies in Arizona are regulated by the Arizona Department of Financial Institutions. This agency ensures that escrow companies operate within the legal frameworks and adhere to industry standards. By following the Arizona Escrow Instructions in Short Form, you can be confident that your chosen escrow company complies with all necessary regulations, providing you with peace of mind during your transaction.

Yes, Arizona is considered an escrow state. This means that real estate transactions in Arizona typically involve a neutral third party who manages the escrow process. Utilizing Arizona Escrow Instructions in Short Form can simplify these transactions, ensuring both buyers and sellers understand their roles and responsibilities.

Setting up escrow involves selecting a reputable escrow service and providing them with the necessary details about your transaction. You will need relevant documents and funds to secure the escrow. Using platforms like US Legal Forms can simplify the process by providing the required forms and information for Arizona escrow instructions in short form.

Yes, escrow officers must hold a valid license in Arizona to perform their duties legally. Licensing ensures that they are adequately trained and knowledgeable about escrow practices and regulations. To become licensed, individuals must meet specific educational and experience requirements set by the state.

Escrow instructions are detailed guidelines provided to the escrow agent by the parties involved in a transaction. These instructions outline how to handle funds, documents, and other responsibilities during the escrow process. Understanding Arizona escrow instructions in short form helps ensure that all parties comply with legal requirements.

The salary of an escrow officer in Arizona can vary based on experience and location. On average, an escrow officer can earn a competitive salary, often ranging from $50,000 to $75,000 annually. This figure can increase with experience, making escrow a lucrative career option over time.

Escrow can be a rewarding career choice for those interested in finance and real estate. It offers opportunities for growth, continuous learning, and the chance to assist clients in significant transactions. If you enjoy working with people and ensuring smooth processes, then exploring a career in escrow might be a great fit.

Yes, Arizona has well-defined escrow instructions. These instructions guide the escrow process, ensuring that all parties understand their requirements and obligations. They play a vital role in real estate transactions to safeguard buyers' and sellers' interests.

The escrow process in Arizona involves several key steps, starting with the signing of an escrow agreement, followed by the execution of written escrow instructions. The escrow agent then holds the funds and documents until all contractual obligations are met. Utilizing Arizona Escrow Instructions in Short Form can help you navigate this process effectively, ensuring compliance and efficiency.

Escrow procedures refer to the step-by-step process that the escrow agent follows from the initiation of the agreement to the completion of the transaction. This includes receiving funds, holding documents securely, and conducting necessary verifications. With Arizona Escrow Instructions in Short Form, individuals can simplify these procedures, making transactions smoother and less stressful.