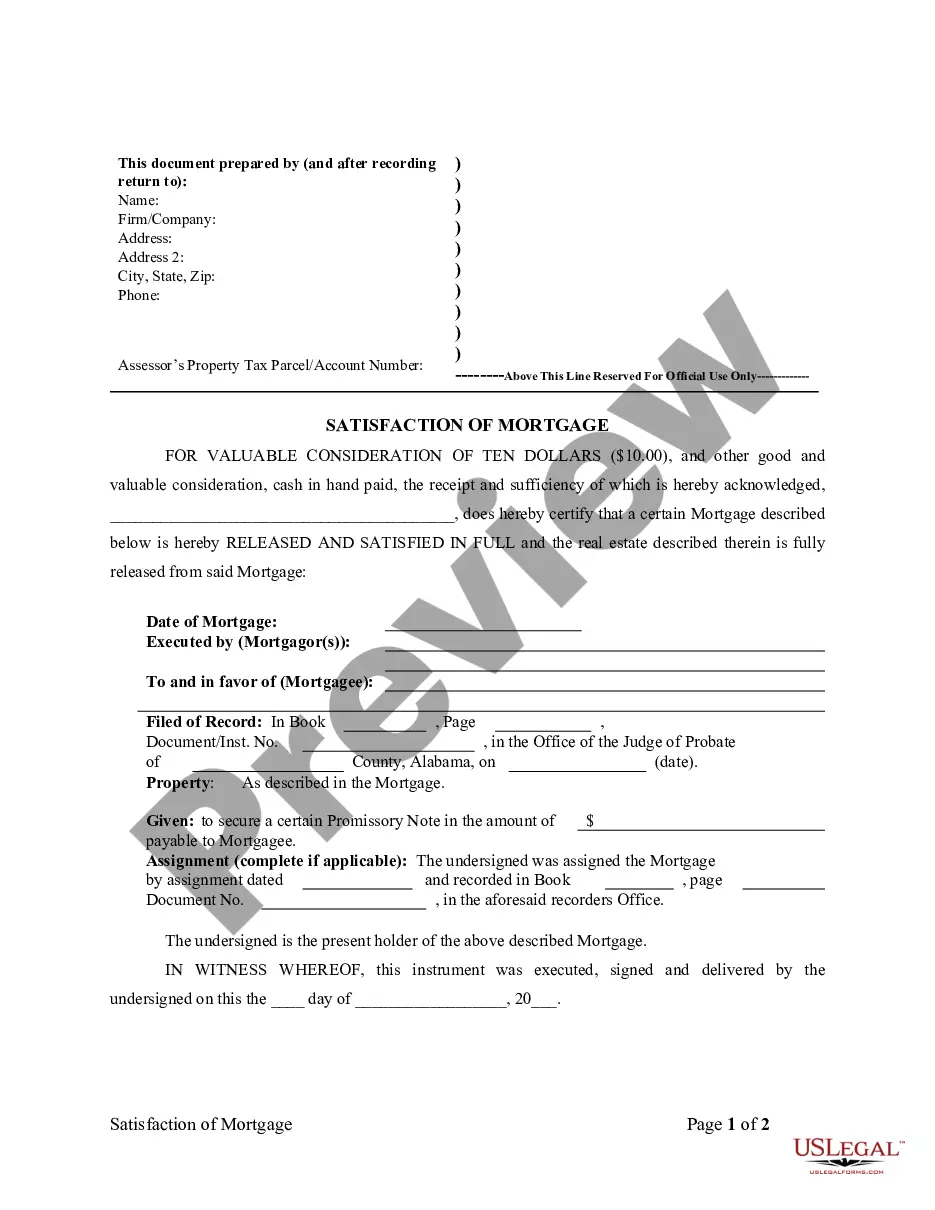

This is a satisfaction or release of a deed of trust or mortgage, for the state of Alabama, by an individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Alabama Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Alabama Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Utilizing Alabama Satisfaction, Release or Cancellation of Mortgage by Individual examples crafted by skilled lawyers offers you the chance to bypass complications when filing documents.

Simply download the form from our site, complete it, and ask a legal expert to validate it. This approach will conserve you considerably more time and expenses compared to hiring an attorney to draft a document tailored to your requirements.

If you already possess a US Legal Forms membership, just Log In to your account and navigate back to the form page. Locate the Download button adjacent to the templates you are reviewing. Once you download a document, all your saved examples will be accessible in the My documents section.

After you have completed all the above steps, you will have the capability to fill out, print, and sign the Alabama Satisfaction, Release or Cancellation of Mortgage by Individual template. Ensure to double-check all entered information for accuracy before submitting it or sending it out. Minimize the time spent on document creation with US Legal Forms!

- If you do not have a subscription, it’s not an issue.

- Just adhere to the instructions below to register for your online account, obtain, and finalize your Alabama Satisfaction, Release or Cancellation of Mortgage by Individual template.

- Confirm that you’re downloading the appropriate form specific to your state.

- Use the Preview feature and read the description (if provided) to ascertain if you require this particular template and if so, click Buy Now.

- If needed, find another document using the Search field.

- Select a subscription that fits your requirements.

- Initiate the process with your credit card or PayPal.

- Select a file format and download your document.

Form popularity

FAQ

To fill out a satisfaction of mortgage, start by obtaining the correct form, which is often available through local court offices or online platforms like uslegalforms. Ensure you enter your details, including the lender’s information and the property's legal description. After completing the form, it should be signed by the mortgage holder, notarized, and then filed with the appropriate authority, facilitating the Alabama Satisfaction, Release or Cancellation of Mortgage by Individual.

Alabama Code 35 property 35 9a 201 outlines specific provisions related to mortgages and their satisfaction in the state. This legislation provides clarity on how mortgages operate and the process for releasing them. For individuals seeking to navigate the mortgage satisfaction process, understanding this code is important. It can empower you to effectively manage your financial responsibilities regarding your property.

Alabama Code 35 10 20 specifies the legal requirements for a mortgage satisfaction, including how it should be executed and recorded. This code ensures that laws regarding mortgage releases are followed, protecting both lenders and borrowers. Being familiar with this code helps individuals understand their rights as property owners, facilitating the release of financial obligations tied to their homes. Compliance with these regulations is key to effective property management.

Disorderly conduct in Alabama refers to behavior that disrupts public peace or safety, including fighting, using obscene language, or creating a hazardous environment. Such behavior might result in fines or even jail time, depending on the severity of the act. It's essential to understand Alabama's laws regarding conduct to avoid legal troubles. If you find yourself in a situation related to this, consulting a legal expert can provide guidance.

In Alabama, the destruction of state property by an inmate refers to any act where an inmate willfully damages or destroys property owned by the state. This can include anything from physical structures to equipment. Such actions are taken seriously and may result in additional charges and penalties. Understanding the implications of such actions is important, especially when considering legal rights and procedures associated with property laws.

Filing a discharge for a mortgage involves visiting your local county recorder's office. You’ll need to submit the discharge document along with any required fees. Using a platform like uslegalforms can simplify this process by providing the correct forms and guidance tailored for Alabama Satisfaction, Release or Cancellation of Mortgage by Individual.

To obtain a mortgage lien release in Alabama, you need to follow a few steps after paying off your mortgage. First, contact your lender to request the release documentation. Once you have it, ensure it is recorded with the local county office to officially remove the lien from your property. For added convenience, you can use US Legal Forms to access templates and advice throughout this process.

In Alabama, most mortgage documents require notarization to be considered valid and enforceable. This requirement ensures that all parties are properly identified and that the signing process is legitimate. Notarization is an important step in protecting your rights as a homeowner. US Legal Forms can guide you through the notarization process with ease.

Yes, a satisfaction of mortgage in Alabama must be notarized to ensure its validity. Notarization adds an extra layer of authentication and confirms that the document is genuine. This step is crucial for protecting both the borrower and the lender. You can find helpful notarization services through platforms like US Legal Forms to facilitate this requirement.

In Alabama, a satisfaction of mortgage typically requires notarization to be legally enforceable. This means that the document must be signed in the presence of a notary public. Notarization helps to verify the authenticity of the document and protects all parties involved. Having a proper notarized satisfaction document is essential for ensuring clear property title.