Virginia Rental Application With No Credit

Description

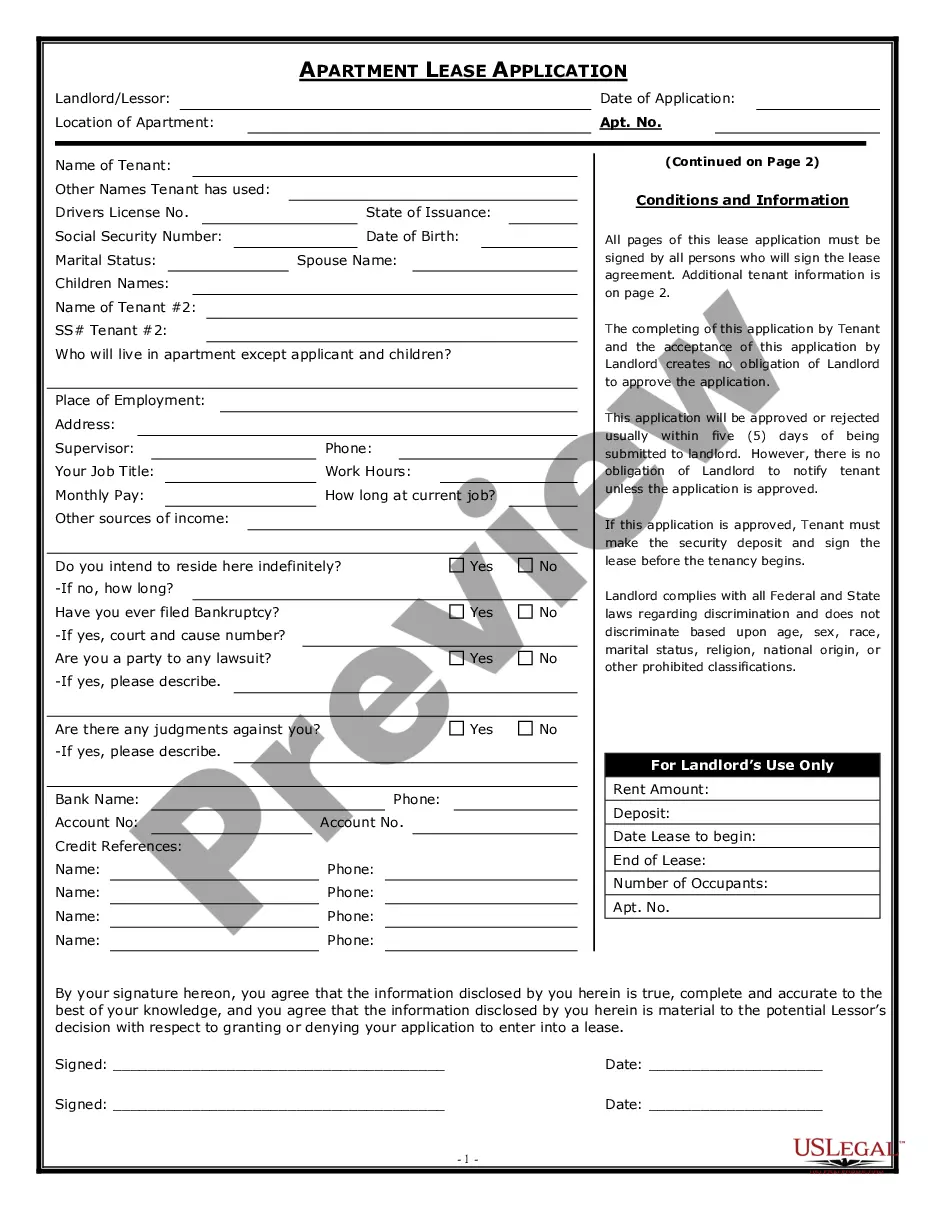

How to fill out Virginia Apartment Lease Rental Application Questionnaire?

Finding a go-to place to access the most recent and appropriate legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal files needs precision and attention to detail, which explains why it is very important to take samples of Virginia Rental Application With No Credit only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and check all the information about the document’s use and relevance for the situation and in your state or region.

Consider the following steps to complete your Virginia Rental Application With No Credit:

- Utilize the catalog navigation or search field to locate your sample.

- Open the form’s description to ascertain if it matches the requirements of your state and area.

- Open the form preview, if there is one, to make sure the form is definitely the one you are interested in.

- Get back to the search and look for the proper document if the Virginia Rental Application With No Credit does not suit your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Choose the pricing plan that fits your requirements.

- Proceed to the registration to complete your purchase.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Virginia Rental Application With No Credit.

- Once you have the form on your device, you can change it with the editor or print it and finish it manually.

Eliminate the hassle that accompanies your legal paperwork. Check out the extensive US Legal Forms library where you can find legal templates, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

Prove your financially stable You should aim for a minimum credit score of at least 620 before you apply for a rental home. If you don't meet the credit criteria, a high income and proof of finances can show the landlord you're stable and can afford the rent.

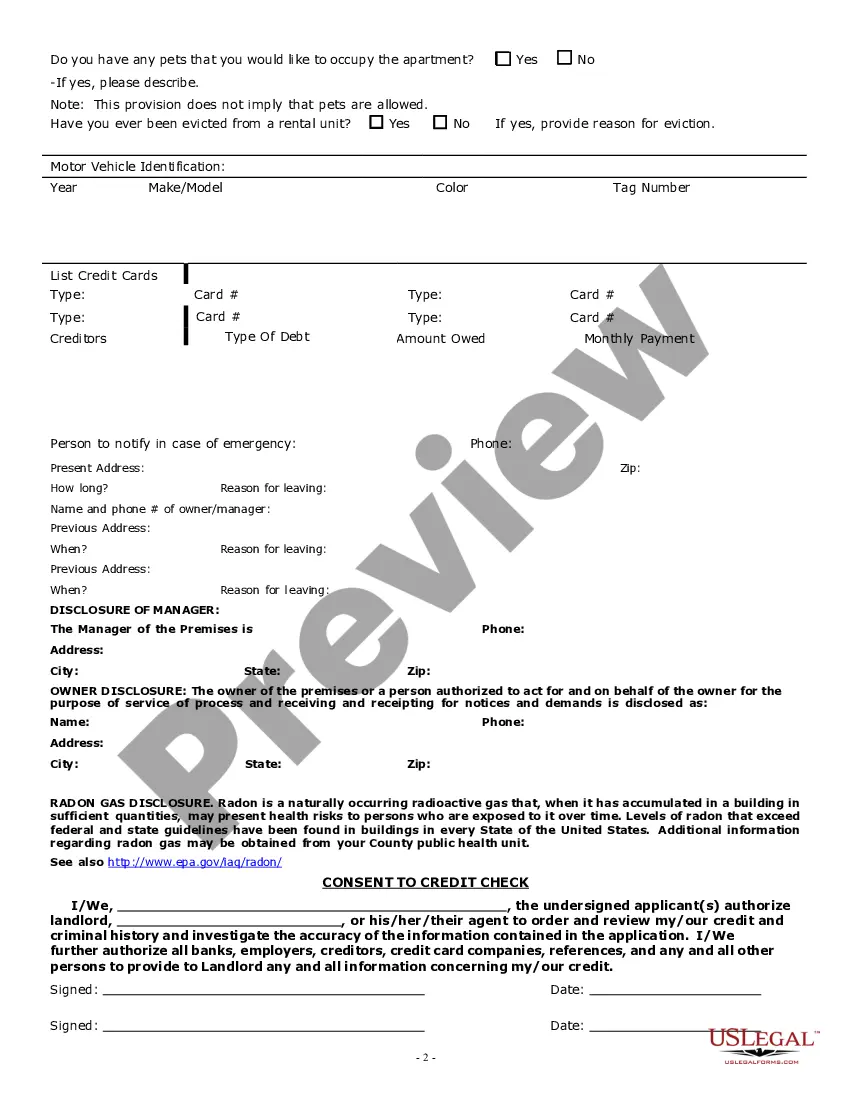

11 Documents Needed to Rent an Apartment Paystubs. Bank Statements. Offer Letter. ID. Proof of Renter's Insurance. SSN. Credit Report. Landlord References.

You'll want to shoot for having a good credit score ? generally in the range of 570-739 ? to get an apartment. While you may be able to still get an apartment if you don't have solid credit, it will make it more challenging with the competition you're likely to face.

A Virginia rental application is a form used to verify information about a prospective tenant before signing a lease. The document will include the applicant's personal information and consent to the verification. The landlord will commonly run a credit report and verify the references of the applicant.

If an applicant doesn't have an ideal credit score, landlords have options and can still rent to them. Landlords can ask applicants to provide context about their low score, have a guarantor for the lease, show proof of income, pay a larger security deposit, and have a shorter lease term.