Child Custody With Restraining Order

Description

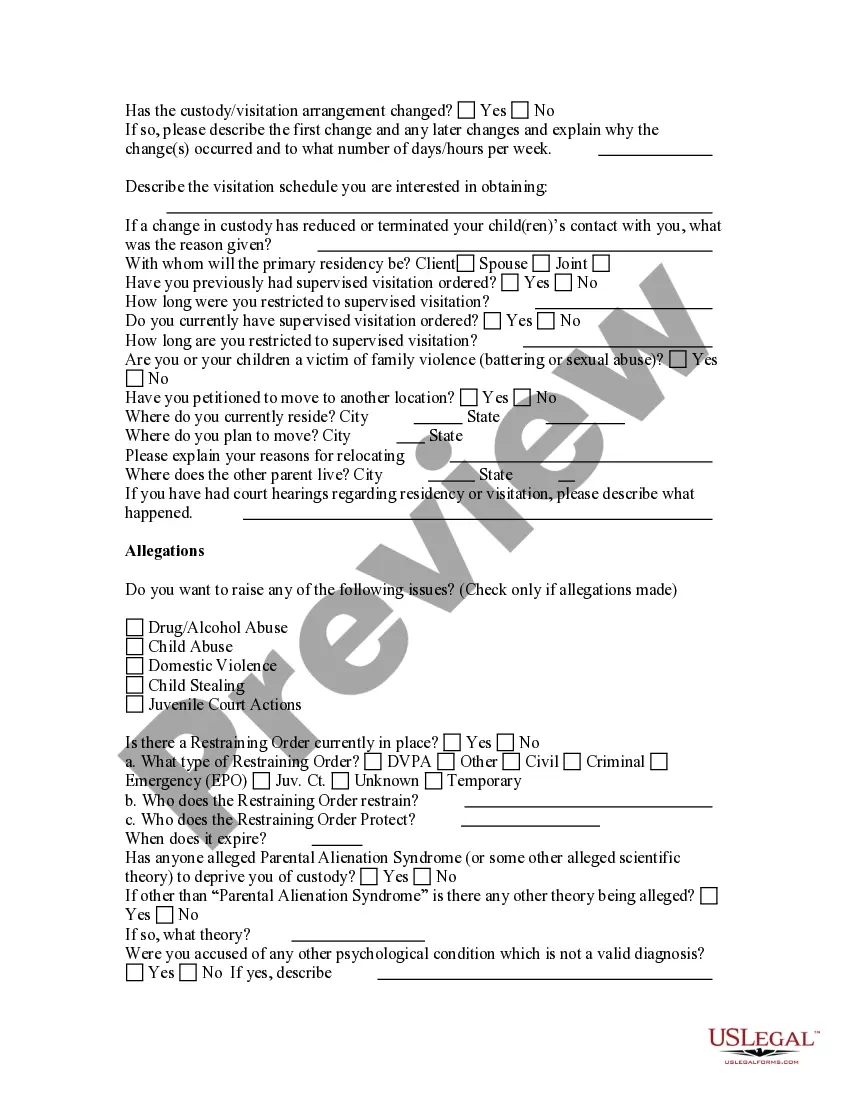

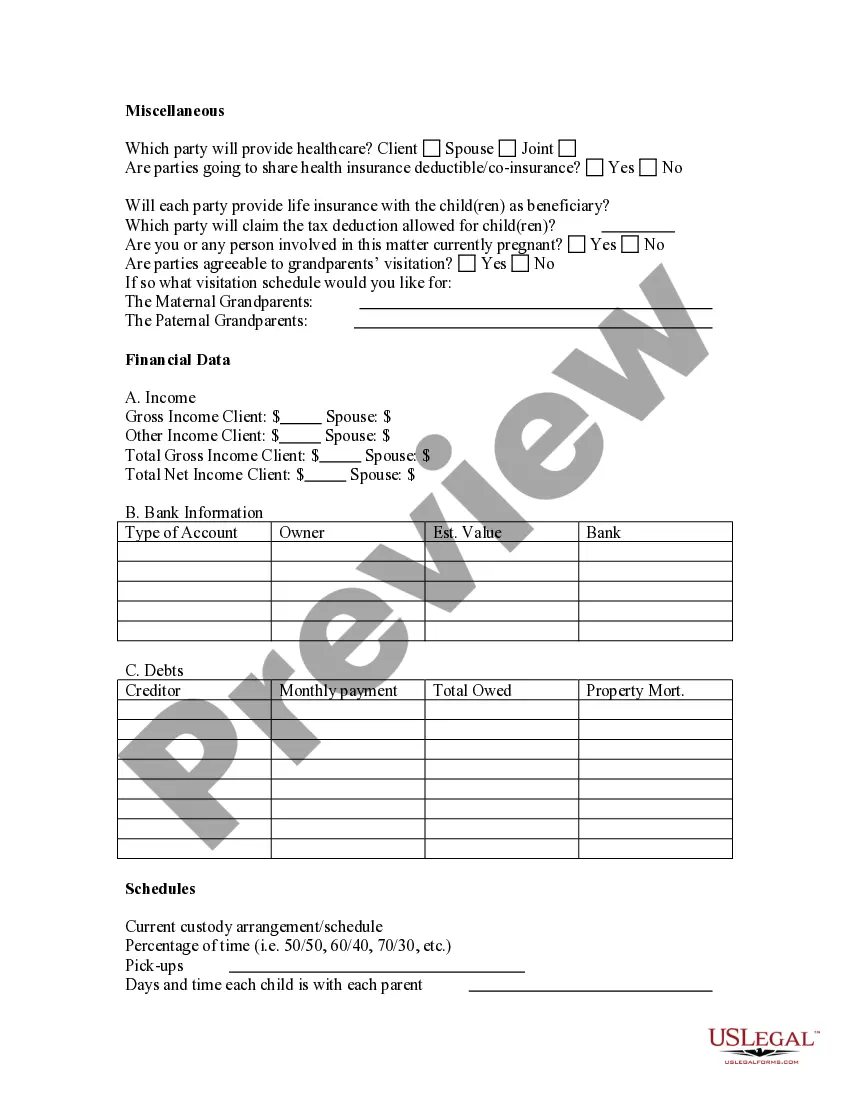

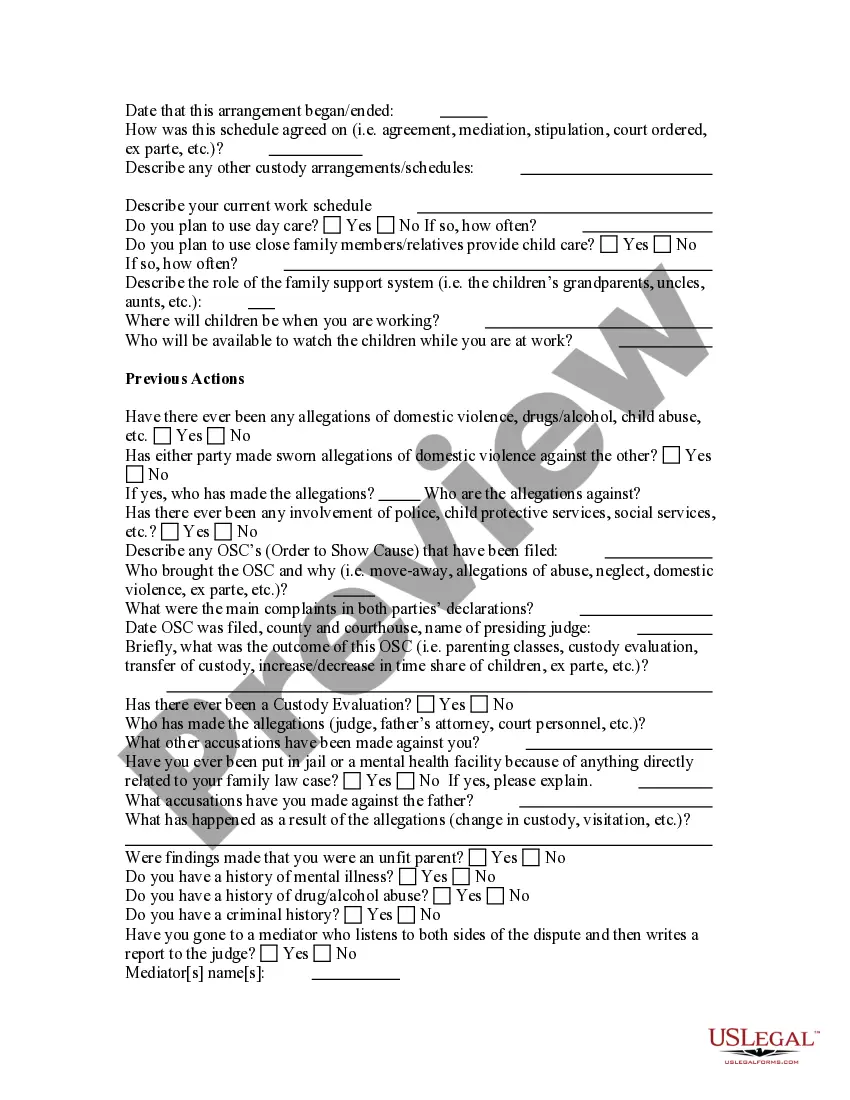

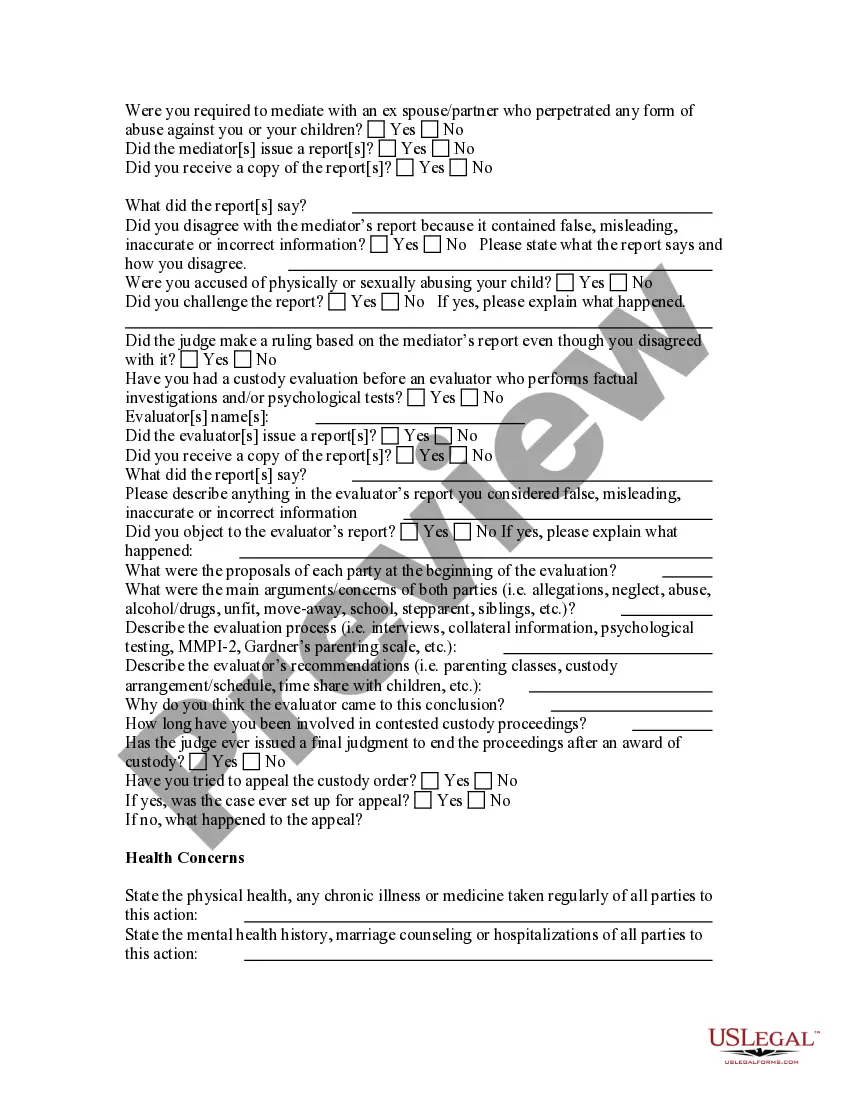

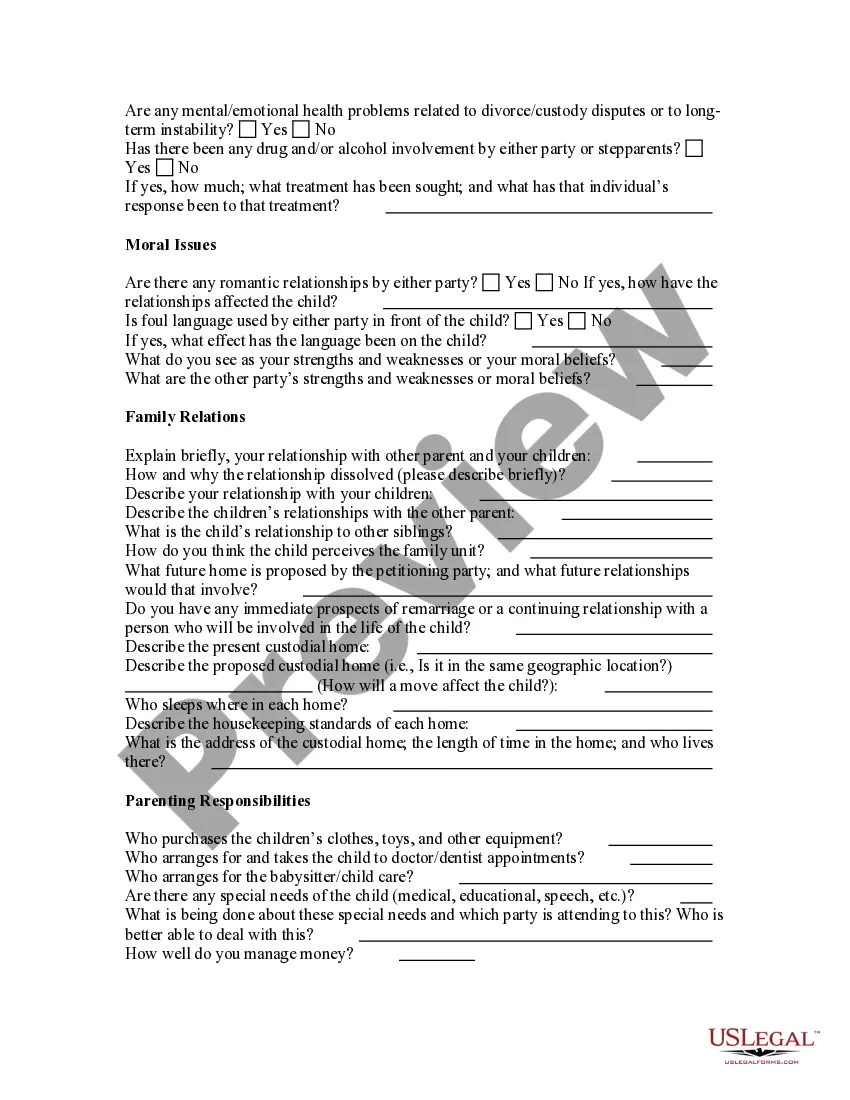

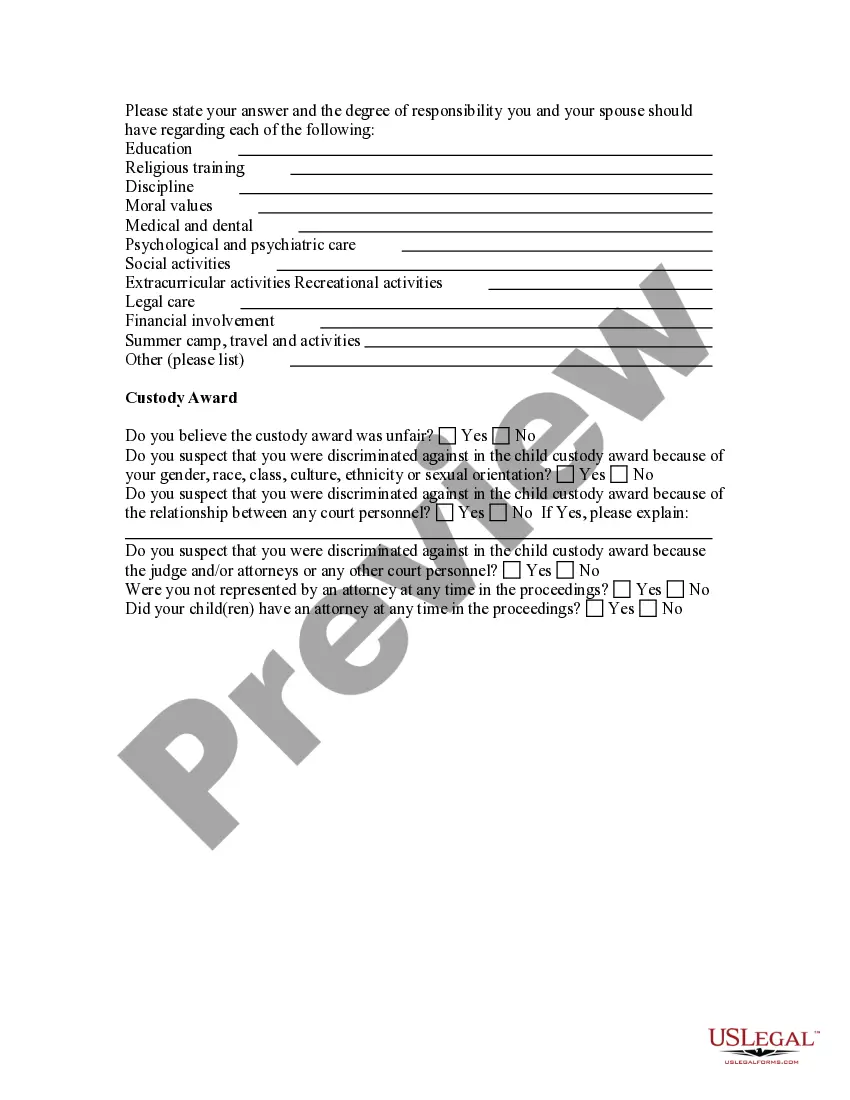

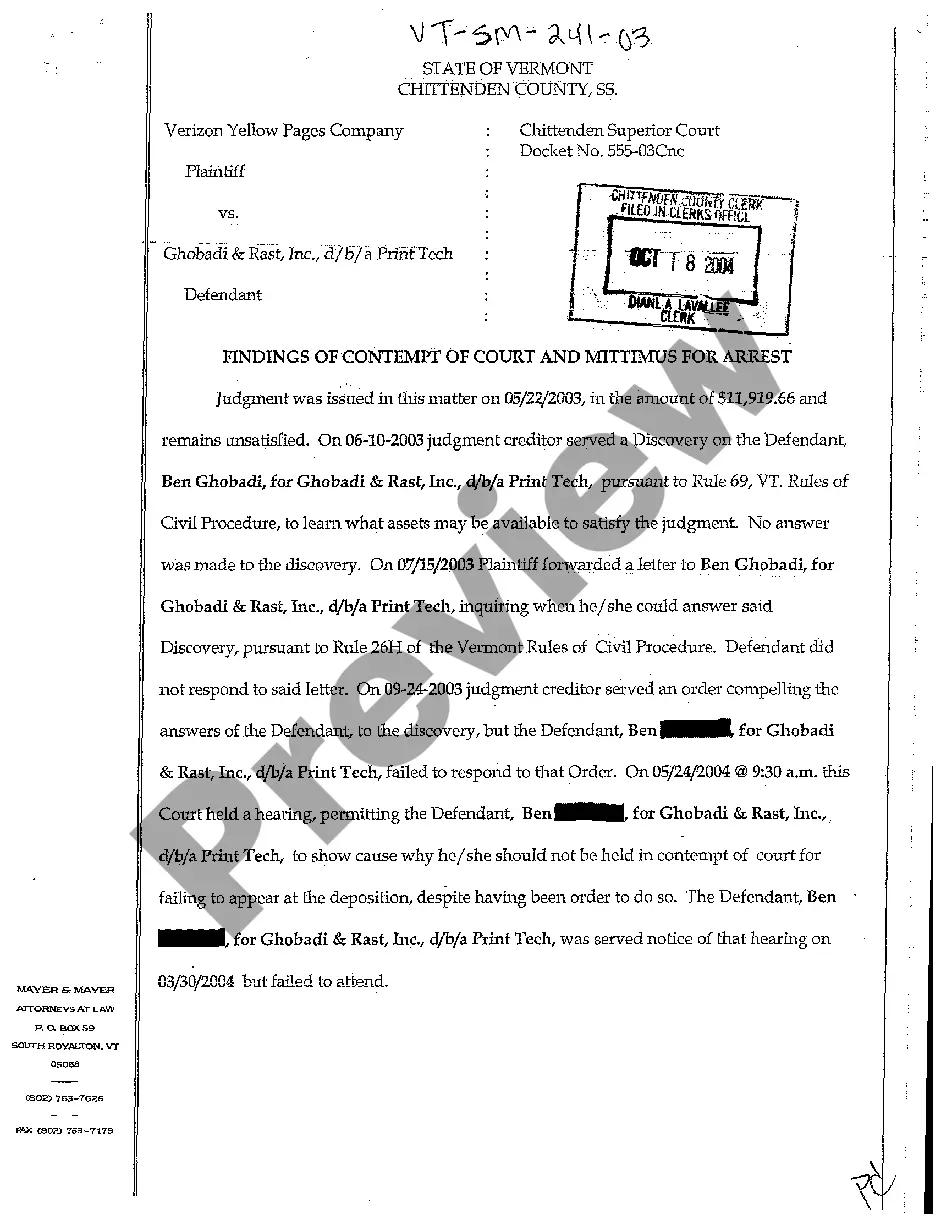

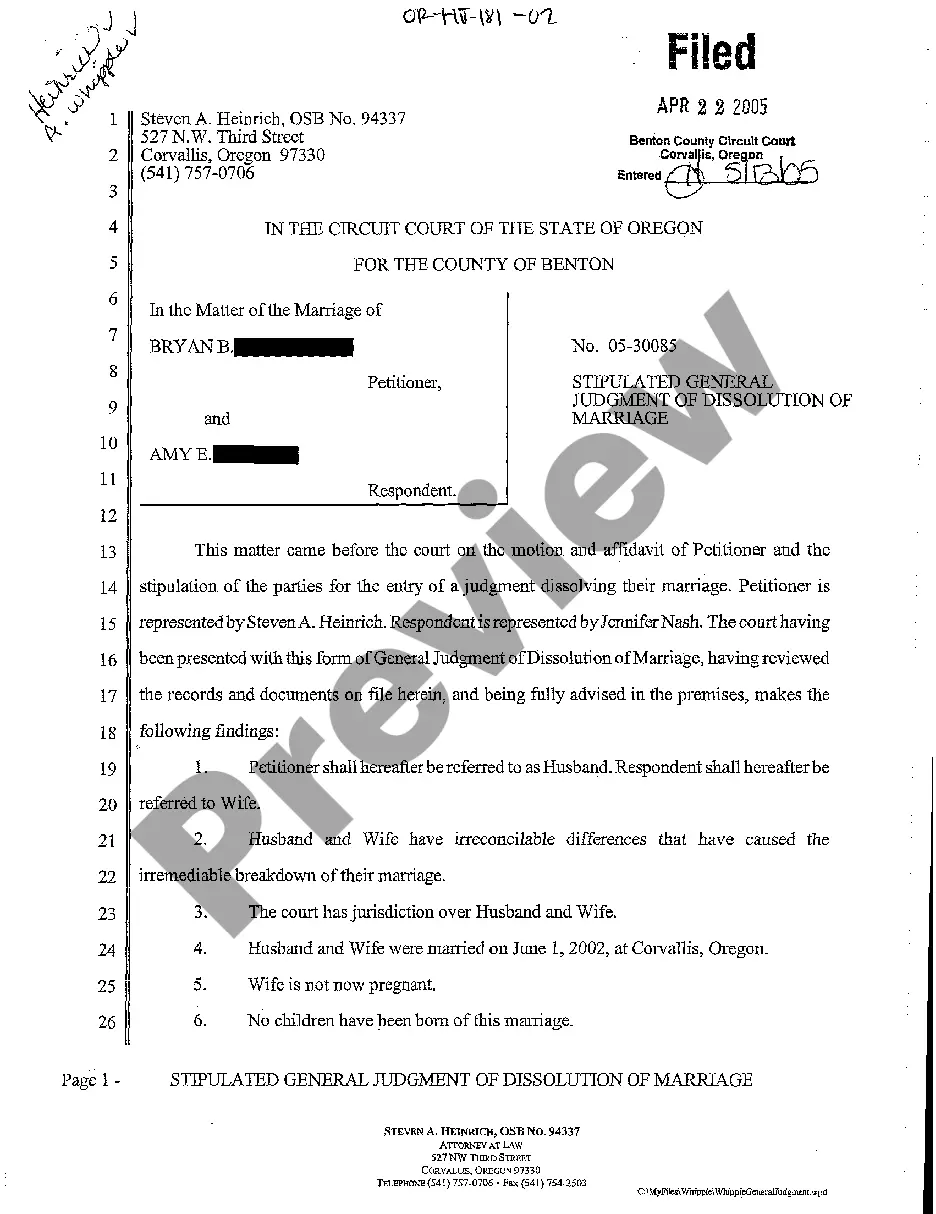

How to fill out Child Custody And Visitation Questionnaire?

It’s widely recognized that you can’t become a legal specialist instantly, nor can you master how to swiftly formulate Child Custody With Restraining Order without a certain set of expertise.

Drafting legal documents is a lengthy process that demands specialized training and competencies.

So why not entrust the formulation of the Child Custody With Restraining Order to the experts.

Select Buy now. Once the transaction is finalized, you can receive the Child Custody With Restraining Order, complete it, print it, and send or deliver it to the relevant parties or organizations.

You can access your documents again from the My documents section at any time. If you are a returning client, you can simply Log In, and locate and download the template from the same section.

- Begin with our platform and obtain the document you require in just minutes.

- Utilize the search bar at the top of the page to find the form you need.

- If available, preview it and review the accompanying description to verify if Child Custody With Restraining Order is what you are looking for.

- If you need another form, restart your search.

- Sign up for a free account and select a subscription plan to acquire the form.

Form popularity

FAQ

Disadvantages. Personal liability is unlimited. A partner's personal property can be seized to pay partnership debts. With shared liability, partners must deal with the financial and legal consequences of each other's (and employees') actions.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

To have a general partnership, two conditions must be true: The company must have two or more owners. All partners must agree to have unlimited personal responsibility for any debts or legal liabilities the partnership might incur.

General partners are two or more persons engaged in a business for the purpose of joint profit, thereby creating a general partnership. General partners assume unlimited joint and several personal liability; as such, a general partner may be personally liable for the actions of other general partners.

A general partner (known as a "GP") is a manager of a venture fund. GPs analyze potential deals and make the final decision on how a fund's capital will be allocated. General partners get paid through management fees, carried interest, and distributions from the fund.

For example, let's say that Dottie and Dave decide to open a clothing store. They decide to name the store D.D.'s Duds. Dottie and Dave don't need to do anything special in order to form a general partnership. Once Dottie and Dave agree to form the business, it's automatically considered to be a general partnership.

How do I create a Partnership Agreement? Provide partnership details. Start by specifying the industry you're in and what type of business you'll run. ... Detail the capital contributions of each partner. ... Outline management responsibilities. ... Prepare for accounting. ... Add final details.

A general partner is a part-owner of a partnership business and is involved with its operations and shares in its profits. A general partner is often a doctor, lawyer, or another professional who has joined a partnership in order to remain independent while being part of a larger business.