Credit Add Report With Data

Description

How to fill out Statement To Add To Credit Report?

Acquiring legal templates that comply with federal and local laws is essential, and the internet provides numerous options to choose from.

However, what’s the benefit of spending time searching for the suitable Credit Add Report With Data sample online when the US Legal Forms digital library already contains such templates collected in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable templates created by attorneys for any business and personal circumstance. They are simple to navigate with all documents organized by state and intended use. Our experts keep up with legal updates, so you can always be assured your form is current and compliant when obtaining a Credit Add Report With Data from our site.

Click Buy Now when you've located the appropriate form and choose a subscription plan. Create an account or Log In and complete the payment using PayPal or a credit card. Select the appropriate format for your Credit Add Report With Data and download it. All documents you discover through US Legal Forms are reusable. To re-download and complete previously saved forms, access the My documents tab in your account. Take advantage of the most comprehensive and user-friendly legal paperwork service!

- Getting a Credit Add Report With Data is straightforward and fast for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you need in the correct format.

- If you are a newcomer to our site, follow the steps below.

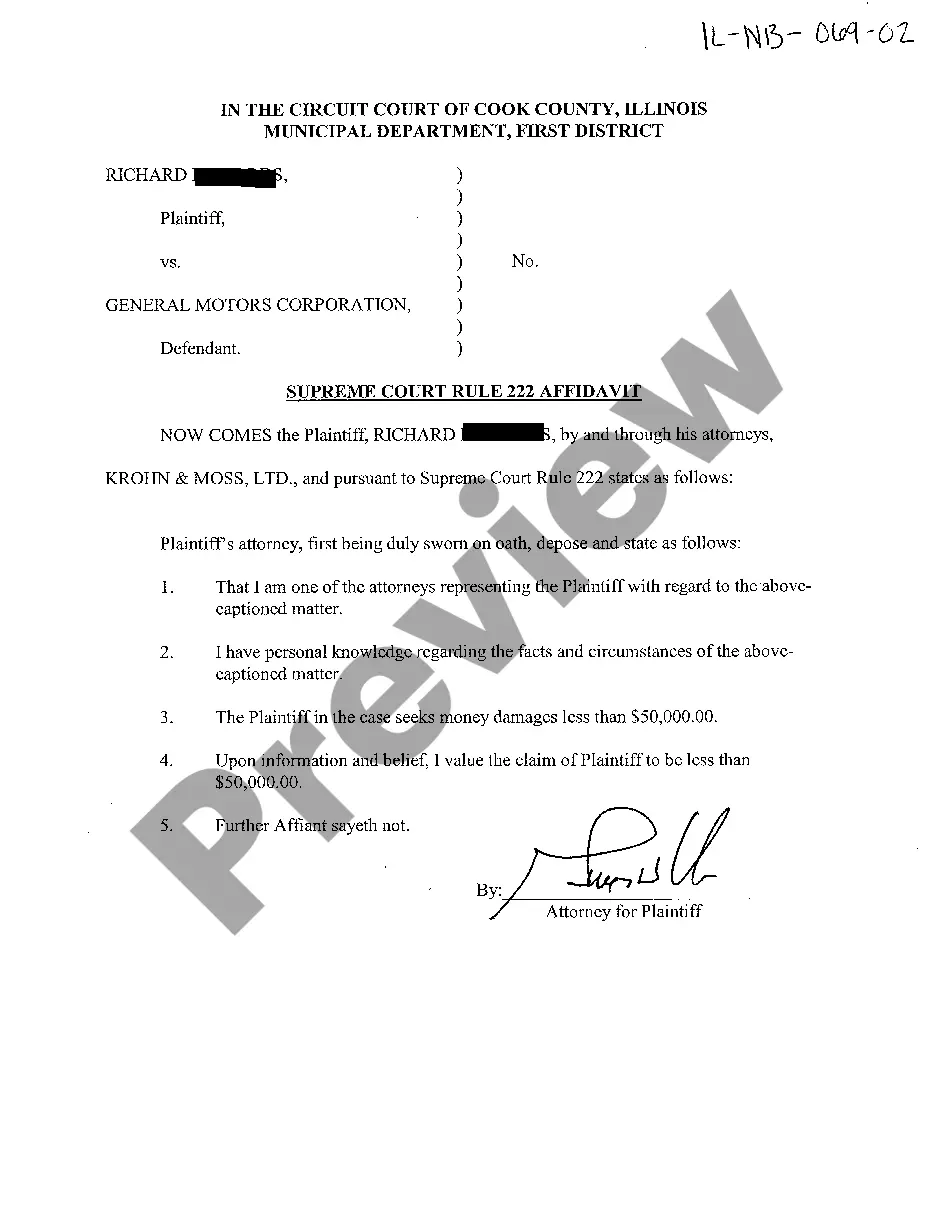

- Examine the template using the Preview feature or through the text description to ensure it fulfills your requirements.

- If necessary, search for another sample using the search tool at the top of the page.

Form popularity

FAQ

A credit data furnisher is an institution that reports consumer credit information to one or more of the major credit bureaus.

How do you improve your credit score? Review your credit reports. ... Pay on time. ... Keep your credit utilization rate low. ... Limit applying for new accounts. ... Keep old accounts open.

Ask the CRA to Add the Information Send a copy of a recent account statement and copies of canceled checks (never originals) or other proof of payment showing your payment history. Then, ask the credit reporting agencies to add the information to your file.

In order to report your consumer account data to Equifax, you must meet the following minimun requirements: Data providers must send data electronically in Metro 2® format-requires Metro2 Sofware for formatting. ... The entire portfolio must be reported every month (e.g., all current, delinquent and charged-off accounts).

A credit report is a summary of your credit history, including the types of credit accounts you've had, your payment history and certain other information such as your credit limits.